회사 소개

| Grand Capital 리뷰 요약 | |

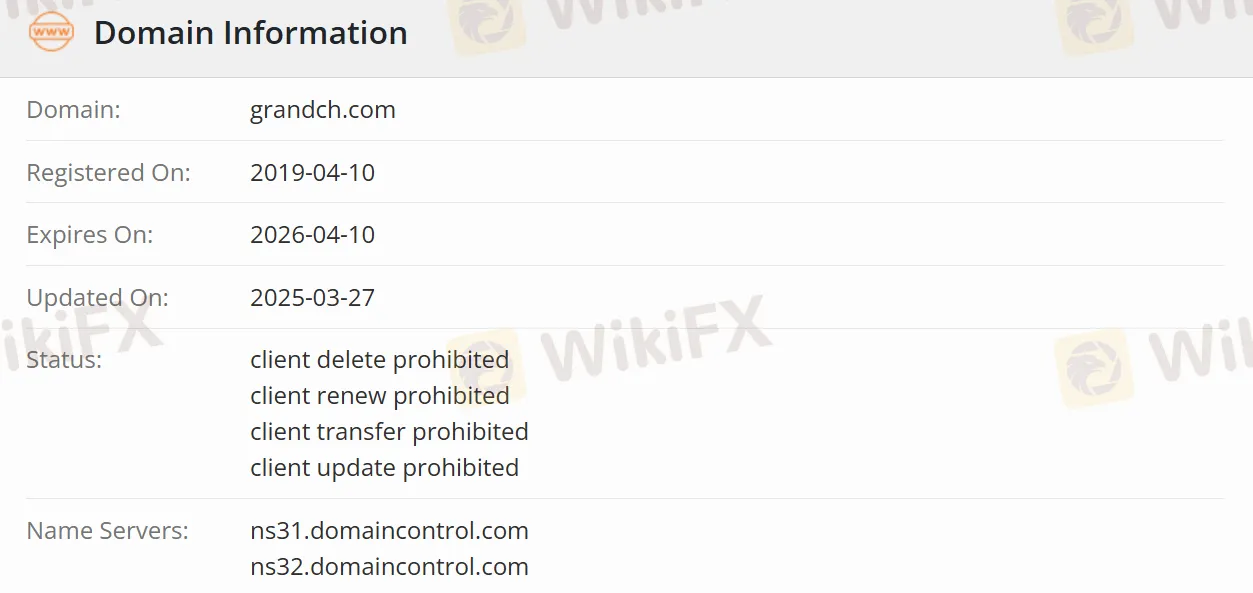

| 설립일 | 2019-04-10 |

| 등록 국가/지역 | 영국 |

| 규제 | 의심스러운 클론 |

| 시장 상품 | 증권 및 고정 수익 상품 |

| 거래 플랫폼 | 다양한 종류의 거래 플랫폼 (데스크톱 및 모바일) |

| 고객 지원 | 전화: +852 3891 9888 |

| 팩스: +852 2529 2899 | |

| 이메일: cs@grandch.com | |

Grand Capital 정보

Grand Capital Holdings Limited는 홍콩에 본사를 둔 금융 서비스 회사입니다. 자회사인 Grand Capital Securities Limited는 중개, 자산 관리 및 기관 사업부를 통해 개인, 기업 및 기관을 대상으로 실행 및 컨설팅 서비스를 제공합니다. 투자자는 데스크톱, 모바일 및 웹 기반 거래 플랫폼을 통해 전 세계 23개 거래 시장에 편리하게 접근할 수 있습니다.

장단점

| 장점 | 단점 |

| 글로벌 시장 접근 | 의심스러운 클론 |

| 다중 플랫폼 거래의 편리함 | 수수료 정보 불명확 |

| 다양한 사업 영역 |

Grand Capital의 신뢰성

Grand Capital의 신뢰성이 의심스럽습니다. 홍콩 규제 기관에 의해 규제되고 홍콩증권선물위원회(SFC)에서 발급한 관련 라이선스를 보유하고 있다고 주장하지만, 클론 회사로 의심되며, 합법적인 라이선스를 가지고 있다는 주장을 뒷받침할 실제적인 증거가 없습니다.

Grand Capital에서 무엇을 거래할 수 있나요?

Grand Capital은 증권 상품을 제공하여 전 세계 20개국 이상의 상장 주식 거래를 할 수 있습니다. 또한 ETF(상장지수펀드), REIT(부동산투자신탁), 파생상품증권 및 CBBC(콜러블 불-베어 계약)와 같은 상품도 포함되어 있습니다. 다양한 정부 및 기업 채권, 투자 등급 및 고수익 채권, 다중 통화 채권과 같은 고정 수익 상품에 대한 거래 서비스도 이용할 수 있습니다.

| 거래 가능한 상품 | 지원 |

| 증권 | ✔ |

| 고정 수익 상품 | ✔ |

계정 유형

계정 소유자 기준으로 분류하면, Grand Capital은 개인 계정, 공동 계정 및 법인 계정을 제공합니다. 업무 유형별로 분류하면, Grand Capital의 증권 계정은 현금 계정과 마진 계정으로 나뉩니다. 현금 계정에서는 계정 소유자의 자금을 사용하여 거래가 이루어집니다. 반면, 마진 계정은 대출 자금을 사용하여 거래할 수 있으며, 투자 레버리지를 높이지만 더 높은 리스크를 가지고 있습니다.

또한, 전문 자산 관리에 중점을 둔 자산 관리 계정과 고순자금 고객을 위한 맞춤형 금융 서비스를 제공하는 사설 은행 계정도 있습니다.

레버리지

Grand Capital은 마진 트레이딩을 제공하며, 이는 투자자가 레버리지로 거래할 수 있음을 의미합니다. 레버리지는 투자 수익을 증폭시킬 수 있지만, 동시에 리스크도 증폭시킬 수 있습니다. 그러나 Grand Capital은 레버리지의 세부 사항을 명시하지 않았습니다.

거래 플랫폼

회사는 데스크톱 버전, 모바일 버전(Play 스토어 및 App Store에서 얻을 수 있음) 및 웹 기반 버전을 포함한 다양한 유형의 거래 플랫폼을 제공합니다. 이러한 플랫폼은 계좌 잔액 및 포지션 정보 확인과 같은 기능을 갖추고 있어 투자자가 언제든지 투자 상태를 추적할 수 있습니다.