公司簡介

| 大唐资本 評論摘要 | |

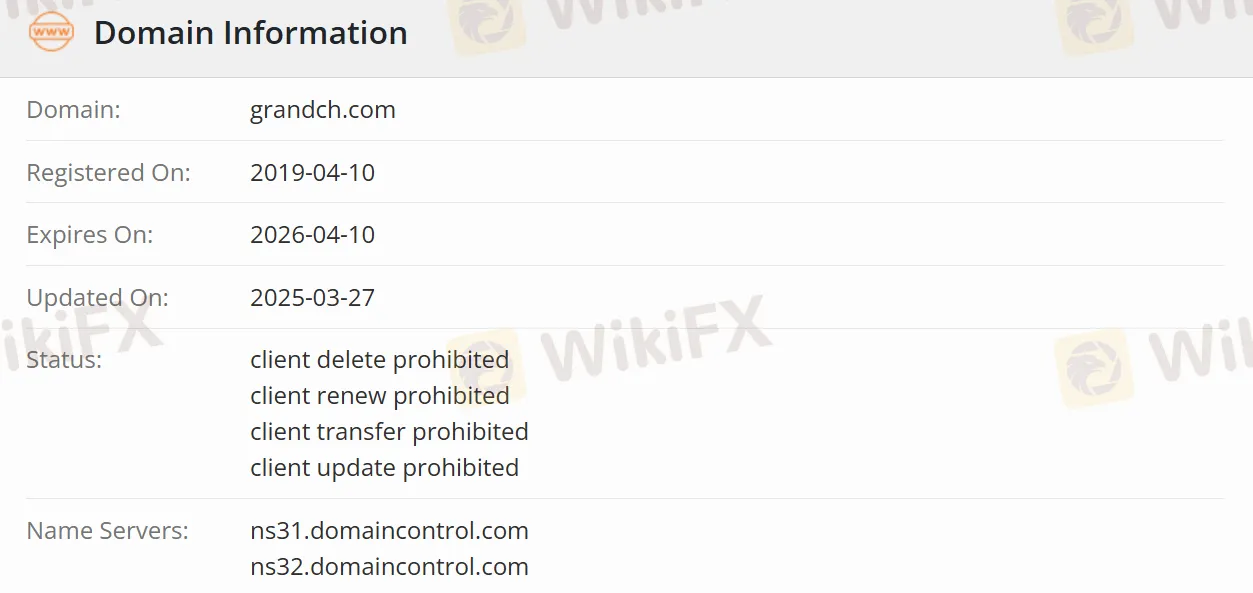

| 成立日期 | 2019-04-10 |

| 註冊國家/地區 | 英國 |

| 監管機構 | 可疑克隆 |

| 市場工具 | 證券和固定收益產品 |

| 交易平台 | 多種類型的交易平台(桌面和移動) |

| 客戶支援 | 電話:+852 3891 9888 |

| 傳真:+852 2529 2899 | |

| 電郵:cs@grandch.com | |

大唐资本 資訊

大唐资本 Holdings Limited 是一家總部位於香港的金融服務公司。其全資子公司 大唐资本 Securities Limited 通過其券商、財富管理、資產管理和機構業務部門為個人、企業和機構提供執行和諮詢服務。投資者可以通過其桌面、移動和基於網絡的交易平台方便地訪問全球23個交易市場。

優點和缺點

| 優點 | 缺點 |

| 全球市場接入 | 可疑克隆 |

| 多平台交易便利 | 費用信息不明確 |

| 多元化業務 |

大唐资本 是否合法?

大唐资本 的合法性存在疑問。雖然它聲稱受香港監管機構監管,並聲明持有香港證券及期貨事務監察委員會(SFC)發出的相關許可證,但據懷疑它是一家克隆公司,並沒有實際證據支持其擁有合法許可證的主張。

大唐资本 可以交易什麼?

大唐资本 提供證券產品,允許交易全球20多個國家的上市股票。它還涵蓋了 ETF(交易所交易基金)、REITs(房地產投資信託)、衍生權證和CBBCs(可調用牛熊合約)。還可以提供固定收益產品的交易服務,例如各種政府和企業債券、投資級和高收益債券,以及多幣種債券。

| 可交易產品 | 支援 |

| 證券 | ✔ |

| 固定收益 | ✔ |

帳戶類型

按帳戶持有人實體分類,大唐资本 提供個人帳戶、聯名帳戶和公司帳戶。按業務類型分類,大唐资本 的證券帳戶分為現金帳戶和保證金帳戶。在現金帳戶中,交易使用帳戶持有人的資金進行。另一方面,保證金帳戶允許使用借入的資金進行交易,這增加了投資槓桿,但也帶來了更高的風險。

此外,還有專注於專業資產管理的資產管理帳戶,以及為高資產淨值客戶提供定制金融服務的私人銀行帳戶。

槓桿

大唐资本 提供保證金交易,這意味著投資者可以透過槓桿進行交易。槓桿可以放大投資回報,但同時也會放大風險。然而,大唐资本 尚未具體說明槓桿的詳細內容。

交易平台

該公司提供多種類型的交易平台,包括桌面版本、移動版本(可從 Play Store 和 App Store 獲取),以及基於網頁的版本。這些平台配備了查詢賬戶餘額和持倉信息等功能,使投資者能夠隨時掌握其投資狀態。