회사 소개

| LME 리뷰 요약 | |

| 설립 연도 | 1996 |

| 등록 국가/지역 | 영국 |

| 규제 | 규제 없음 |

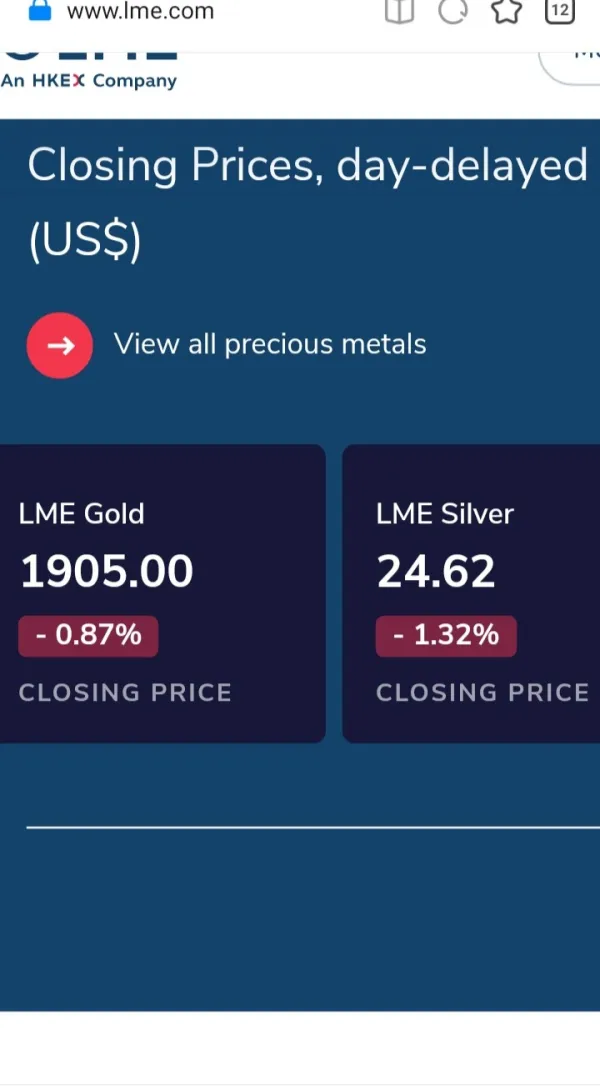

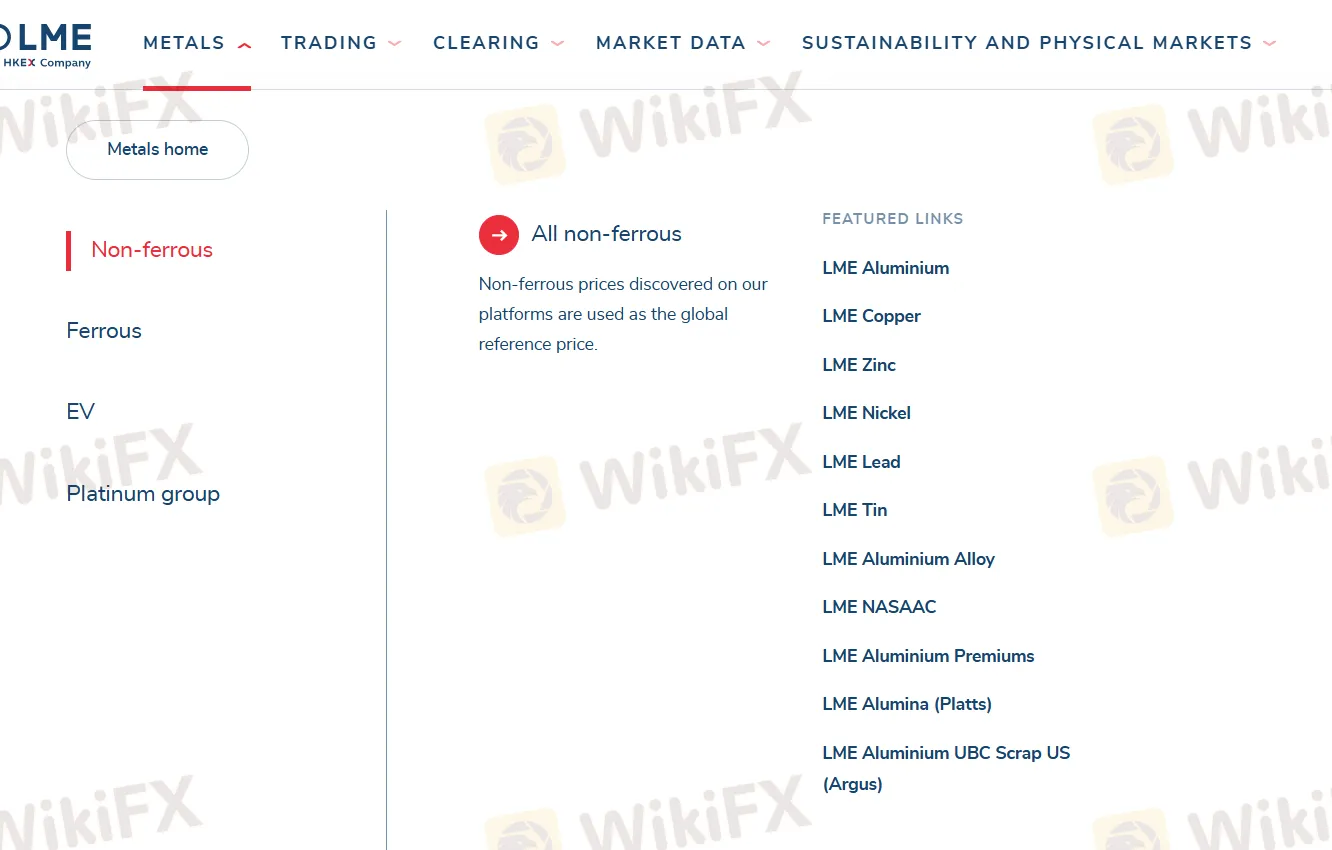

| 시장 상품 | 비철금속, 철금속, 전기차 금속, 귀금속 |

| 거래 플랫폼 | LMEselect (전자), 더 링 (공개 입찰), 24시간 전화 시장 |

| 고객 지원 | 전화: +44 (0) 20 7113 8888 |

| 이메일: chinateamdg@lme.com | |

| 주소: 10 Finsbury Square, London, EC2A 1AJ | |

| Vimeo, X, WeChat, LinkedIn | |

LME 정보

LME은 1996년 영국에서 설립된 비규제 금속 및 금융 서비스 제공업체입니다. 비철금속, 철금속, 전기차 금속 및 귀금속에 대한 제품 및 서비스를 제공합니다.

장단점

| 장점 | 단점 |

| 운영 시간이 길다 | 한정된 거래 상품 |

| 다양한 연락 채널 | 규제 부족 |

| MT4/MT5 플랫폼 없음 |

LME 합법적인가요?

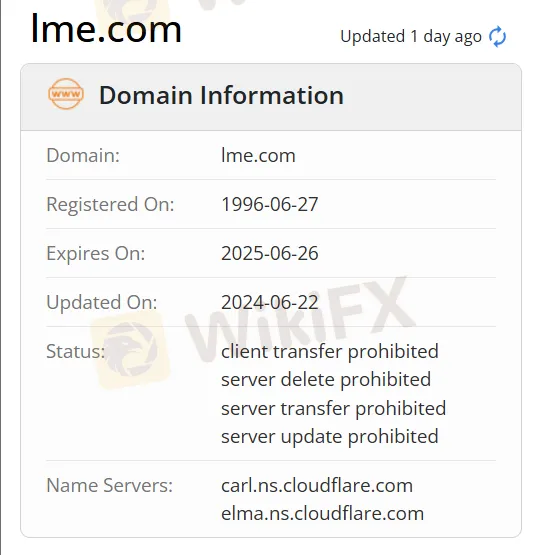

No. LME 현재 유효한 규정이 없습니다. 위험에 유의하십시오! 또한, 도메인 상태에서는 고객 이전 및 업데이트가 금지되어 있음을 보여줍니다.

LME에서 무엇을 거래할 수 있나요?

| 거래 상품 | 지원됨 |

| 비철금속 | ✔ |

| 철금속 | ✔ |

| 전기차 금속 | ✔ |

| 귀금속 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

거래 플랫폼

| 거래 플랫폼 | 지원됨 | 사용 가능한 장치 | 적합 대상 |

| LMEselect (전자) | ✔ | PC, 노트북, 태블릿 | / |

| the Ring (공개 입찰) | ✔ | PC, 노트북, 태블릿 | / |

| 24시간 전화 시장 | ✔ | 모바일 | / |

| MT4 | ❌ | / | 초보자 |

| MT5 | ❌ | / | 경험있는 트레이더 |