Profil perusahaan

| Grand Capital Ringkasan Ulasan | |

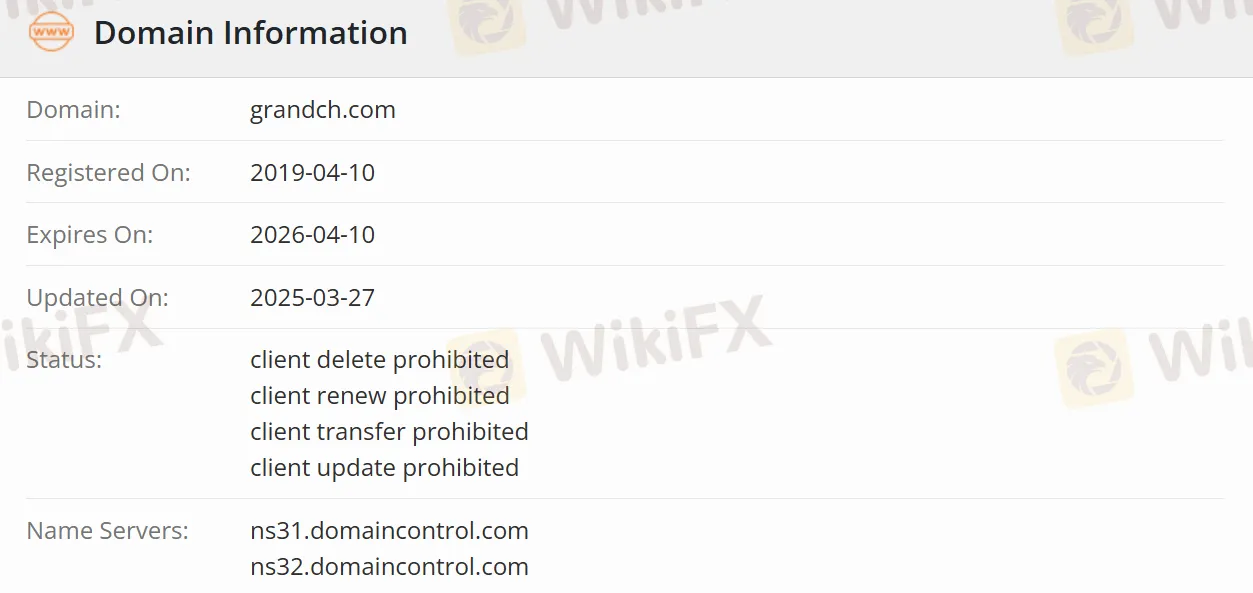

| Dibentuk | 2019-04-10 |

| Negara/Daerah Terdaftar | Inggris Raya |

| Regulasi | Klon yang Mencurigakan |

| Instrumen Pasar | Produk Sekuritas dan Pendapatan Tetap |

| Platform Perdagangan | Berbagai jenis platform perdagangan (Desktop dan Mobile) |

| Dukungan Pelanggan | Tel: +852 3891 9888 |

| Fax: +852 2529 2899 | |

| Email: cs@grandch.com | |

Informasi Grand Capital

Grand Capital Holdings Limited adalah perusahaan jasa keuangan yang berkantor pusat di Hong Kong. Anak perusahaannya yang sepenuhnya dimiliki, Grand Capital Securities Limited, menyediakan layanan eksekusi dan konsultasi bagi individu, perusahaan, dan lembaga melalui departemen perantara, manajemen kekayaan, manajemen aset, dan bisnis institusionalnya. Investor dapat dengan mudah mengakses 23 pasar perdagangan di seluruh dunia melalui platform perdagangan desktop, mobile, dan berbasis web.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Akses ke pasar global | Klon yang Mencurigakan |

| Kenyamanan perdagangan multi-platform | Informasi biaya yang tidak jelas |

| Diversifikasi bisnis |

Apakah Grand Capital Legal?

Keabsahan Grand Capital dipertanyakan. Meskipun mengklaim diatur oleh Otoritas Regulasi Hong Kong dan menyatakan bahwa memiliki lisensi yang relevan yang dikeluarkan oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC), dicurigai sebagai perusahaan kloning, dan tidak ada bukti nyata yang mendukung klaimnya memiliki lisensi yang sah.

Apa yang Dapat Saya Perdagangkan di Grand Capital?

Grand Capital menawarkan produk sekuritas, memungkinkan perdagangan saham terdaftar di lebih dari 20 negara di seluruh dunia. Juga mencakup produk seperti ETF (Exchange-Traded Funds), REIT (Real Estate Investment Trust), waran derivatif, dan CBBC (Callable Bull-Bear Contracts). Layanan perdagangan untuk produk pendapatan tetap, seperti obligasi pemerintah dan perusahaan yang beragam, obligasi dengan peringkat investasi dan tingkat pengembalian tinggi, serta obligasi multi-mata uang, juga dapat direalisasikan.

| Produk yang Dapat Diperdagangkan | Didukung |

| Sekuritas | ✔ |

| Pendapatan Tetap | ✔ |

Jenis Akun

Diklasifikasikan berdasarkan entitas pemegang akun, Grand Capital menawarkan akun individu, akun bersama, dan akun korporat. Diklasifikasikan berdasarkan jenis bisnis, akun sekuritas Grand Capital dibagi menjadi akun tunai dan akun margin. Dalam akun tunai, transaksi dilakukan menggunakan dana pemegang akun. Sementara itu, akun margin memungkinkan perdagangan dengan dana pinjaman, yang meningkatkan daya ungkit investasi tetapi juga memiliki risiko yang lebih tinggi.

Selain itu, ada akun pengelolaan aset yang fokus pada pengelolaan aset profesional, serta akun perbankan pribadi yang menyediakan layanan keuangan yang disesuaikan untuk klien berkekayaan tinggi.

Daya Ungkit

Grand Capital menawarkan perdagangan margin, yang berarti investor dapat melakukan perdagangan dengan leverage. Leverage dapat memperbesar pengembalian investasi, tetapi pada saat yang sama, juga akan memperbesar risiko. Namun, Grand Capital belum menentukan rincian leverage tersebut.

Platform Perdagangan

Perusahaan ini menyediakan berbagai jenis platform perdagangan, termasuk versi desktop, versi mobile (yang dapat diperoleh dari Play Store dan App Store), serta versi berbasis web. Platform-platform ini dilengkapi dengan fungsi-fungsi seperti memeriksa saldo akun dan informasi posisi, memungkinkan investor untuk memantau status investasi mereka kapan saja.