Buod ng kumpanya

| Grand Capital Buod ng Pagsusuri | |

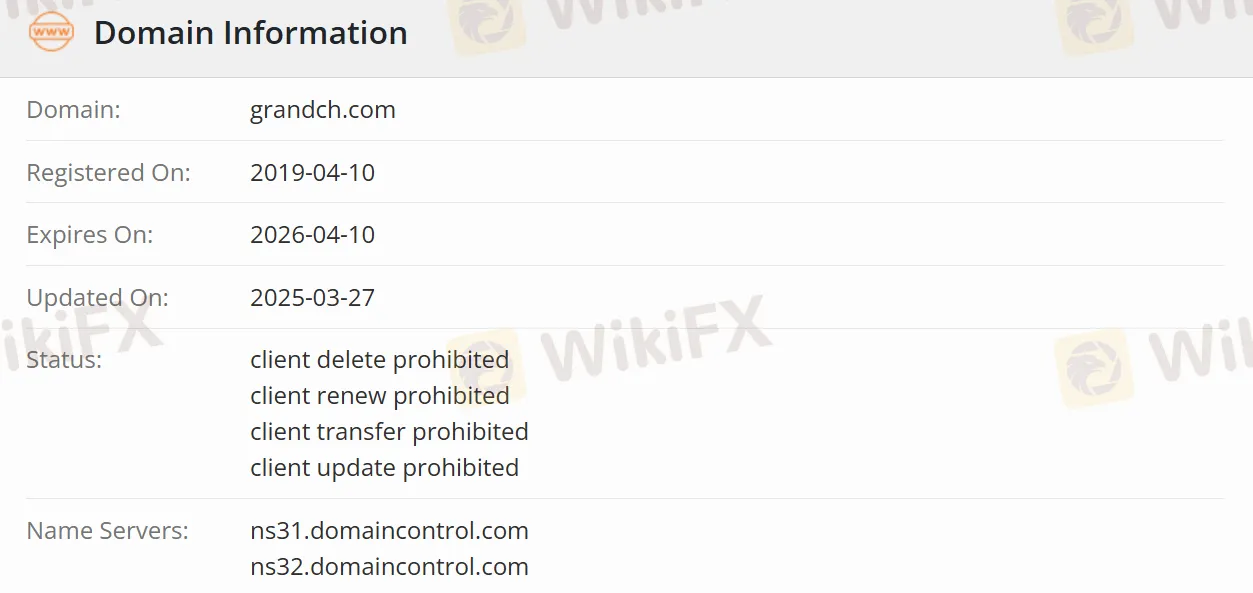

| Itinatag | 2019-04-10 |

| Rehistradong Bansa/Rehiyon | United Kingdom |

| Regulasyon | Suspicious Clone |

| Mga Instrumento sa Merkado | Mga Securities at Fixed-income na mga produkto |

| Plataforma ng Pagkalakalan | Mga iba't ibang uri ng mga plataporma ng pagkalakalan (Desktop at Mobile) |

| Suporta sa Customer | Tel: +852 3891 9888 |

| Fax: +852 2529 2899 | |

| Email: cs@grandch.com | |

Grand Capital Impormasyon

Ang Grand Capital Holdings Limited ay isang kumpanya ng serbisyong pinansyal na may punong tanggapan sa Hong Kong. Ang kanyang buong pag-aari na subsidiary, ang Grand Capital Securities Limited, ay nagbibigay ng mga serbisyo sa pagpapatupad at pag-aadvice para sa mga indibidwal, mga negosyo, at mga institusyon sa pamamagitan ng kanyang mga departamento sa brokerage, wealth management, asset management, at institutional business. Ang mga mamumuhunan ay maaaring madaling mag-access sa 23 mga merkado sa buong mundo sa pamamagitan ng mga desktop, mobile, at web-based na mga plataporma ng pagkalakalan nito.

Mga Kalamangan Mga Disadvantages Access sa global na mga merkado Suspicious Clone Kaginhawahan ng multi-platform na pagkalakalan Hindi malinaw na impormasyon sa bayad Diversified na negosyo Totoo ba ang Grand Capital?

Ang pagiging totoo ng Grand Capital ay nasa alanganin. Bagaman ito ay nagpapahayag na ito ay regulado ng Hong Kong Regulatory Authority at nagtatangkang patunayan na mayroon itong mga lisensiyang ibinigay ng Hong Kong Securities and Futures Commission (SFC), ito ay pinaghihinalaang isang cloned firm, at walang tunay na patunay upang suportahan ang mga pahayag nito na may lehitimong mga lisensya.

Ano ang Maaari Kong Ikalakal sa Grand Capital?

Ang Grand Capital ay nag-aalok ng mga produkto sa mga securities, na nagpapahintulot ng pagkalakal ng mga naka-listang stocks sa higit sa 20 mga bansa sa buong mundo. Ito rin ay sumasaklaw sa mga produkto tulad ng ETFs (Exchange-Traded Funds), REITs (Real Estate Investment Trusts), derivative warrants, at CBBCs (Callable Bull-Bear Contracts). Ang mga serbisyo sa pagkalakal para sa mga fixed-income na mga produkto, tulad ng iba't ibang mga pamahalaang bonds at korporasyon bonds, investment-grade at high-yield bonds, pati na rin ang mga multi-currency bonds, ay maaari ring maisakatuparan.

| Mga Ikalakal na Produkto | Supported |

| Securities | ✔ |

| Fixed-income | ✔ |

Uri ng Account

Nakabahagi ayon sa entidad ng may-ari ng account, ang Grand Capital ay nag-aalok ng mga indibidwal na mga account, joint accounts, at mga korporasyon na mga account. Nakabahagi ayon sa uri ng negosyo, ang mga securities accounts ng Grand Capital ay nahahati sa cash accounts at margin accounts. Sa cash accounts, ang mga transaksyon ay isinasagawa gamit ang pondo ng may-ari ng account. Sa kabilang banda, ang margin accounts ay nagbibigay-daan sa pagkalakal gamit ang hiniram na pondo, na nagpapataas sa leverage ng pamumuhunan ngunit may mas mataas na panganib.

Bukod pa rito, mayroong mga asset management accounts na nakatuon sa propesyonal na asset management, pati na rin ang mga pribadong banking accounts na nagbibigay ng pasadyang mga serbisyo sa pinansyal para sa mga kliyenteng may mataas na net worth.

Leverage

Grand Capital nag-aalok ng margin trading, ibig sabihin ay maaaring mag-trade ang mga mamumuhunan gamit ang leverage. Ang leverage ay maaaring palakihin ang mga kita sa pamumuhunan, ngunit sa parehong pagkakataon, ito rin ay magpapalaki ng mga panganib. Gayunpaman, hindi nagtukoy ang Grand Capital ng mga detalye ng leverage.

Plataforma ng Pagkalakalan

Ang kumpanya ay nagbibigay ng iba't ibang uri ng mga plataporma ng pagkalakalan, kasama ang mga desktop na bersyon, mga mobile na bersyon (na maaaring makuha mula sa Play Store at App Store), pati na rin ang mga bersyong batay sa web. Ang mga platapormang ito ay may mga function tulad ng pag-check ng mga balanse ng account at impormasyon sa posisyon, na nagbibigay-daan sa mga mamumuhunan na ma-monitor ang kanilang kalagayan sa pamumuhunan sa anumang oras.