회사 소개

| NetDania리뷰 요약 | |

| 설립 | 1998 |

| 등록 국가/지역 | 덴마크 |

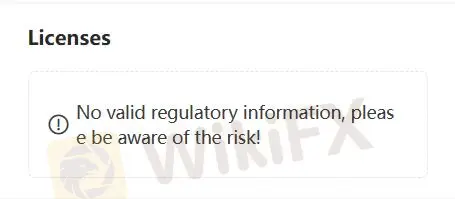

| 규제 | 규제되지 않음 |

| 거래 플랫폼 | NetDania 모바일 및 NetDania 넷스테이션 |

| 고객 지원 | 전화: +44 (0) 207 558 8405 |

| 문의 양식 | |

| 회사 주소: Holmens Kanal 71060 Copenhagen Denmark | |

NetDania은 덴마크에 기반을 둔 규제되지 않은 거래 플랫폼입니다. 이 회사는 1급 은행, 중개인 및 분석가들을 위한 스트리밍 가격 기술에 특화되어 있습니다. 데스크톱, 모바일 및 웹 애플리케이션을 포함한 다양한 금융 솔루션을 제공합니다.

장점 및 단점

| 장점 | 단점 |

| 없음 | 규제 부족 |

| 비투명한 거래 조건 | |

| 시장 기기에 대한 정보 부족 |

NetDania의 신뢰성

NetDania은 어떠한 규제 기관에도 규제되지 않았습니다. 이 플랫폼에서 거래를 운영하는 것은 매우 위험할 수 있습니다.

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 기기 | 적합한 대상 |

| NetDania 모바일 및 NetDania 넷스테이션 | ✔ | 데스크톱, 모바일, 웹 | / |

| MT5 | ❌ | 데스크톱, 모바일, 웹 | 경험 있는 트레이더 |

| MT4 | ❌ | 데스크톱, 모바일, 웹 | 초보자 |

| Trading View | ❌ | 데스크톱, 모바일, 태블릿, 웹 | 초보자 |

고객 서비스

| 연락 옵션 | 상세 정보 |

| 전화 | +44 (0) 207 558 8405 |

| 문의 양식 | ✔ |

| 웹사이트 언어 | 영어 |

| 실제 주소 | Holmens Kanal 71060 Copenhagen Denmark |

FAQs

NetDania은 신뢰할 수 있습니까?

아니요. NetDania은 여전히 규제되지 않은 플랫폼입니다.

NetDania은 안전한가요?

아니요. NetDania은 제대로 규제되지 않았기 때문에 안전하지 않습니다.

NetDania은 초보자에게 좋은가요?

아니요. NetDania은 초보자에게 좋지 않습니다.