Buod ng kumpanya

| NetDania Buod ng Pagsusuri | |

| Itinatag | 1998 |

| Rehistradong Bansa/Rehiyon | Denmark |

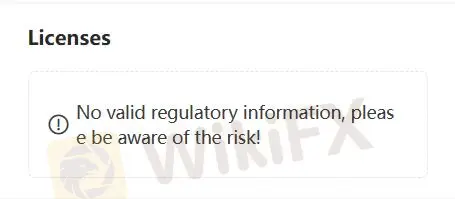

| Regulasyon | Hindi Regulado |

| Plataforma ng Pagkalakalan | NetDania Mobile & NetDania NetStation |

| Suporta sa Customer | Tel: +44 (0) 207 558 8405 |

| Form ng Pakikipag-ugnayan | |

| Address ng Kumpanya: Holmens Kanal 71060 Copenhagen Denmark | |

Ang NetDania ay isang hindi reguladong plataporma ng pagkalakalan na nakabase sa Denmark. Ito ay espesyalista sa teknolohiyang nagbibigay ng mga presyo ng streaming para sa mga Tier-1 bangko, mga broker, at mga analyst. Nag-aalok ang kumpanya ng iba't ibang mga solusyon sa pinansyal, kasama ang mga desktop, mobile, at web na aplikasyon.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Wala | Kawalan ng regulasyon |

| Hindi malinaw na mga kondisyon sa pagkalakalan | |

| Kawalan ng impormasyon tungkol sa mga instrumento ng merkado |

Legit ba ang NetDania?

Ang NetDania ay hindi regulado ng anumang mga awtoridad. Ang pagpapatakbo ng pagkalakalan sa platapormang ito ay maaaring lubhang mapanganib.

Plataforma ng Pagkalakalan

| Plataforma ng Pagkalakalan | Supported | Available Devices | Suitable for |

| NetDania Mobile & NetDania NetStation | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | Desktop, Mobile, Web | Mga karanasan na mga mangangalakal |

| MT4 | ❌ | Desktop, Mobile, Web | Mga nagsisimula |

| Trading View | ❌ | Desktop, Mobile, Tablets, Web | Mga nagsisimula |

Serbisyo sa Customer

| Mga Pagpipilian sa Pakikipag-ugnayan | Mga Detalye |

| Telepono | +44 (0) 207 558 8405 |

| Form ng Pakikipag-ugnayan | ✔ |

| Wika ng Website | Ingles |

| Physical Address | Holmens Kanal 71060 Copenhagen Denmark |

Mga Madalas Itanong

Legit ba ang NetDania?

Hindi. Nanatiling hindi regulado ang NetDania.

Ligtas ba ang NetDania?

Hindi. Hindi ligtas ang NetDania dahil hindi ito maayos na regulado.

Ang NetDania ba ay mabuti para sa mga nagsisimula?

Hindi. Hindi maganda ang NetDania para sa mga nagsisimula.