회사 소개

| DALU 리뷰 요약 | |

| 설립 연도 | 2002 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFEX에 의해 규제됨 |

| 시장 상품 | 선물 |

| 데모 계정 | / |

| 거래 플랫폼 | Yisheng Polestar 9.5, Boyi Cloud, Continental Futures Infinity Pro, China Futures Express Online Trading, Wenhua Yingshun Cloud Market Software |

| 최소 입금액 | / |

| 고객 지원 | Wechat, Weibo, 24/5 고객 서비스 |

| 전화: 021-54071888 (거래), 021-54071111 (Demat) | |

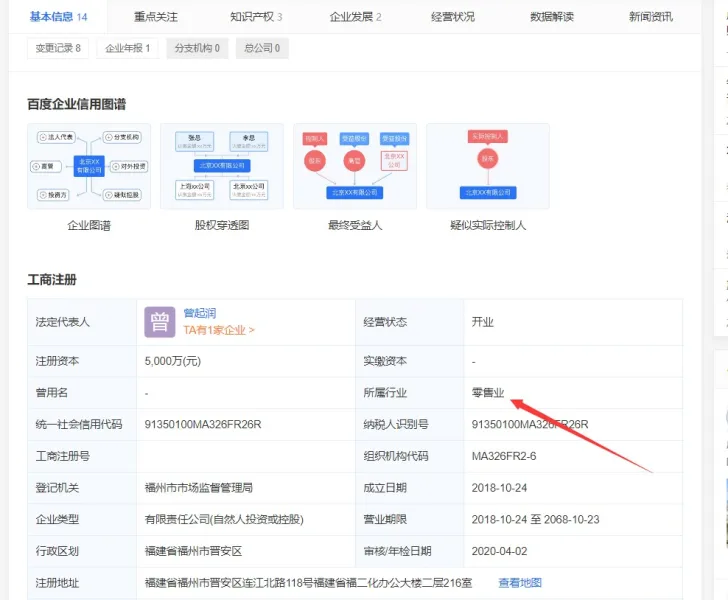

DALU 정보

DALU는 중국에서 2002년에 설립된 규제된 브로커로, 선물 거래에 주로 초점을 맞추며 다양한 종류의 선물 거래 서비스를 제공합니다. 또한 중국의 CFFEX에 의해 규제를 받고 있습니다.

장단점

| 장점 | 단점 |

| 잘 규제됨 | 최소 입금액에 대한 정보 없음 |

| 운영 시간이 길다 | |

| 고객 지원을 위한 다양한 채널 |

DALU 합법적인가요?

예. DALU은(는) 서비스를 제공하기 위해 CFFEX에서 라이센스 번호 0188을 받았습니다.

| 규제기관 | 현재 상태 | 규제 국가 | 규제 업체 | 라이센스 유형 | 라이센스 번호 |

| 중국금융선물거래소 (CFFEX) | 규제됨 | 중국 | 上海大陆期货有限公司 | 선물 라이센스 | 0188 |

DALU에서 무엇을 거래할 수 있나요?

| 거래 자산 | 지원됨 |

| 선물 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

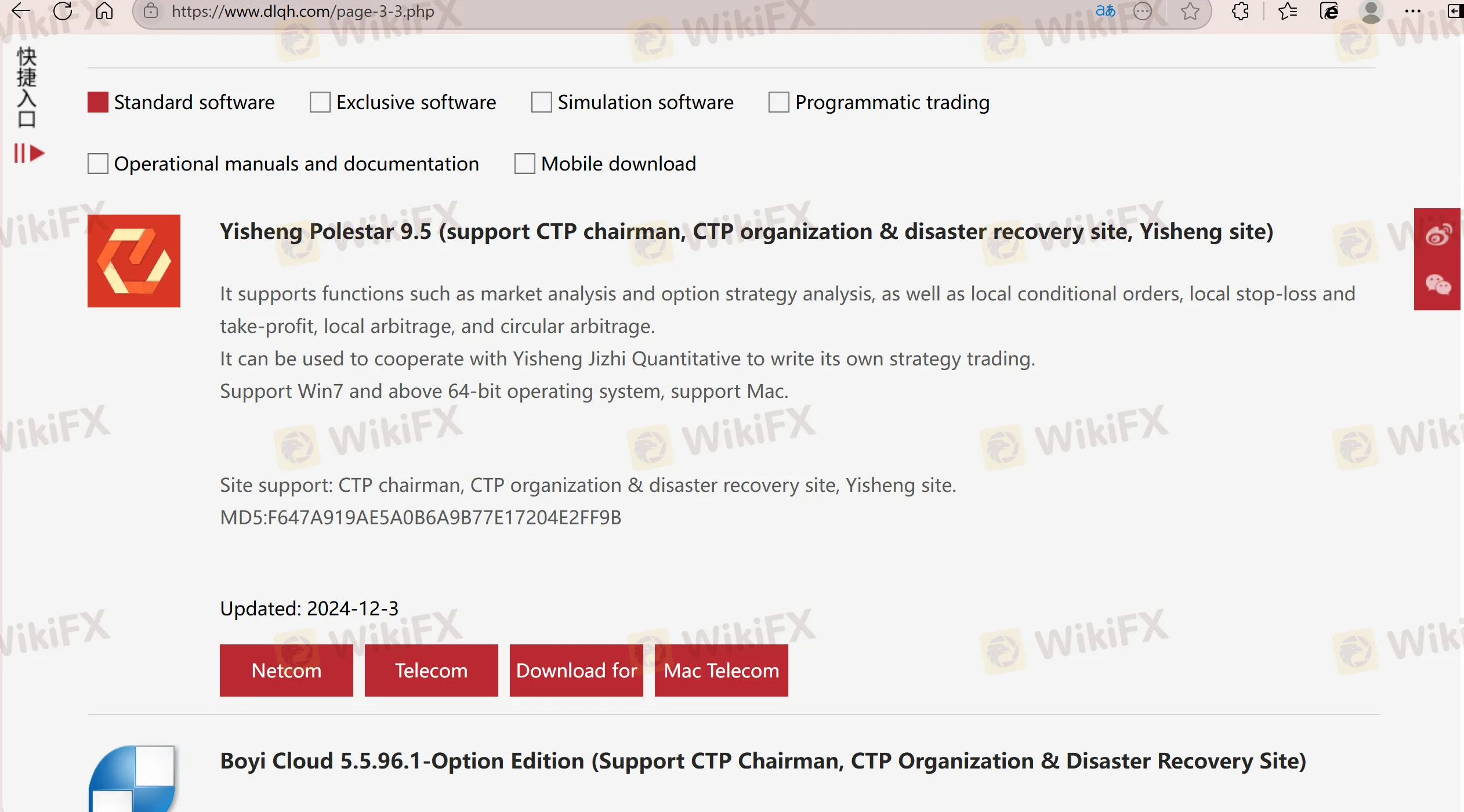

거래 플랫폼

| 거래 플랫폼 | 지원됨 | 사용 가능한 장치 |

| 이승 폴스타 9.5 | ✔ | 모바일 |

| 보이 클라우드 | ✔ | 모바일 |

| 컨티넨탈 선물 인피니티 프로 | ✔ | 모바일 |

| 중국 선물 익스프레스 온라인 거래 | ✔ | 모바일 |

| 문화 영순 클라우드 마켓 소프트웨어 | ✔ | 모바일 |