Profil perusahaan

| Nissan Securities Ringkasan Ulasan | |

| Didirikan | 1948 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | Diatur oleh FSA |

| Instrumen Pasar | Derivatif, Komoditas, FX |

| Akun Demo | ❌ |

| Dukungan Pelanggan | Formulir kontak |

| 6-10-1, Ginza, Chuo-ku, Tokyo 104-0061, Jepang (Kantor Pusat) | |

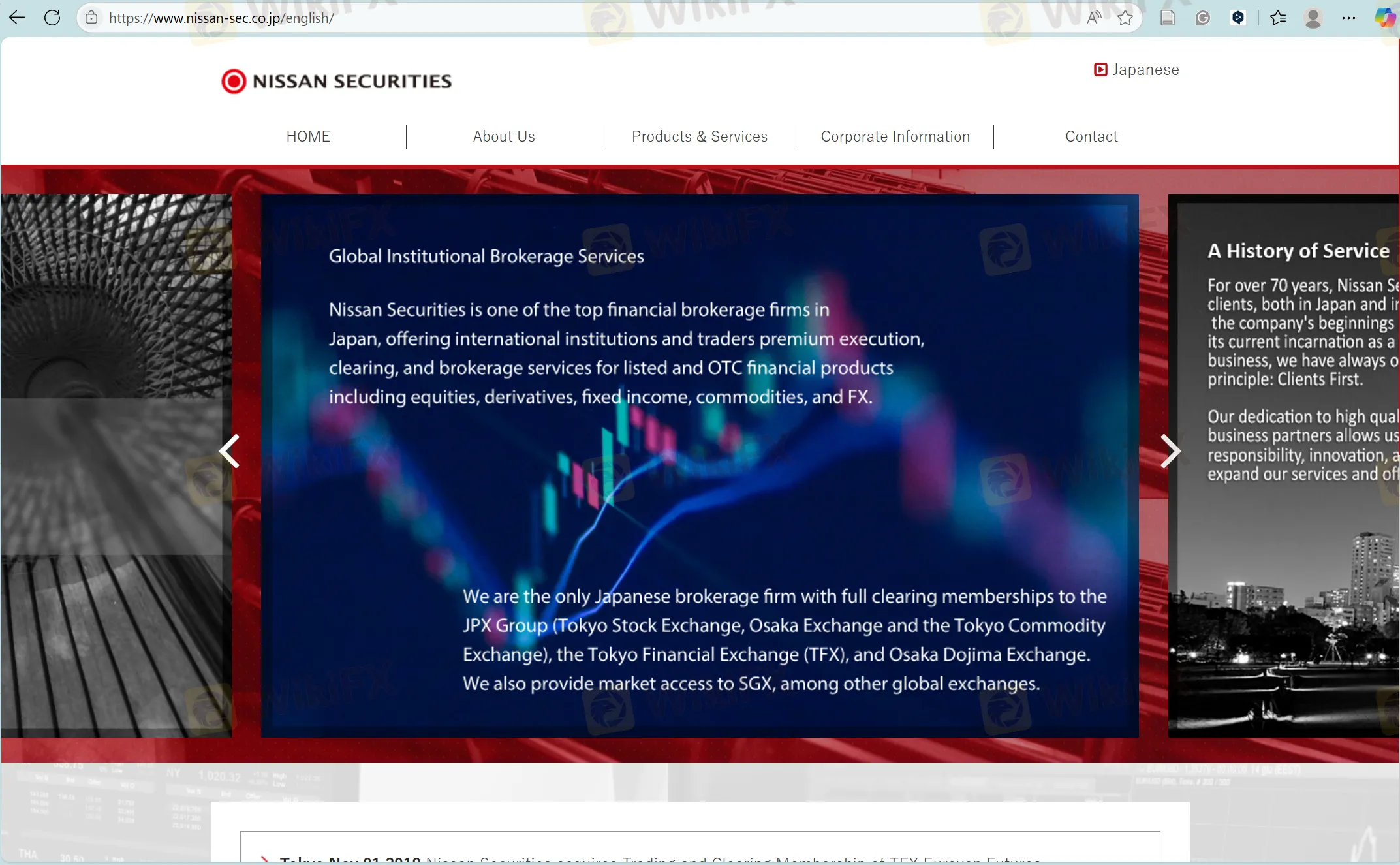

NISSAN SECURITIES adalah perusahaan keuangan yang berbasis di Jepang. Didirikan pada bulan Januari 1948 dan menyediakan termasuk derivatif, komoditas, dan FX melalui Platform Perdagangan ISV. Saat ini di bawah FSA.

Berikut adalah halaman utama situs resmi broker ini:

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh FSA | Opsi dukungan pelanggan terbatas |

| Pengalaman industri bertahun-tahun | Tidak ada metode pendanaan yang disebutkan |

| Platform Perdagangan ISV disediakan |

Apakah Nissan Securities Legal?

Nissan Securities diatur oleh Otoritas Jasa Keuangan (FSA). Ini memiliki Lisensi Forex Ritel, dengan 関東財務局長(金商)第131号.

| Status Regulasi | Diatur |

| Diatur oleh | Jepang |

| Institusi Berlisensi | Nissan Securities株式会社 |

| Tipe Lisensi | Lisensi Forex Ritel |

| Nomor Lisensi | 関東財務局長(金商)第131号 |

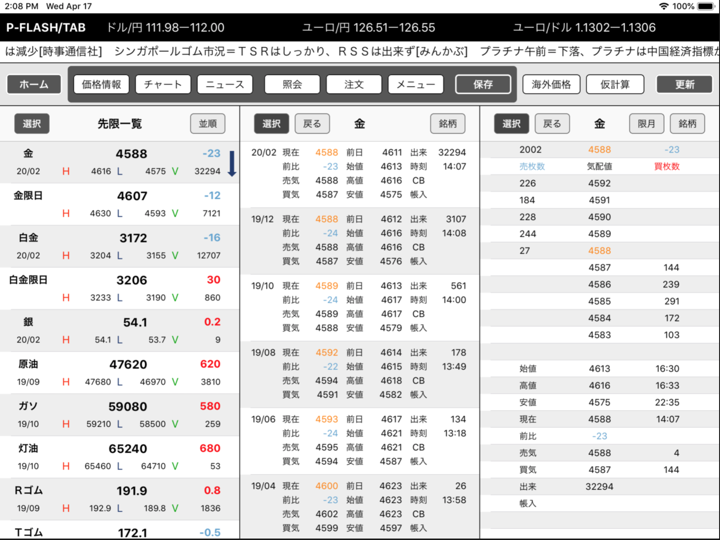

Apa yang Dapat Saya Perdagangkan di Nissan Securities?

Nissan Securities menawarkan derivatif, komoditas, dan FX. Produk mereka memberikan akses ke pasar Jepang dan global, dan mencakup layanan kliring, eksekusi, dan pialang.

| Instrumen yang Dapat Ditransaksikan | Didukung |

| Forex | ✔ |

| Komoditas | ✔ |

| Derivatif | ✔ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

| Dana Investasi | ❌ |

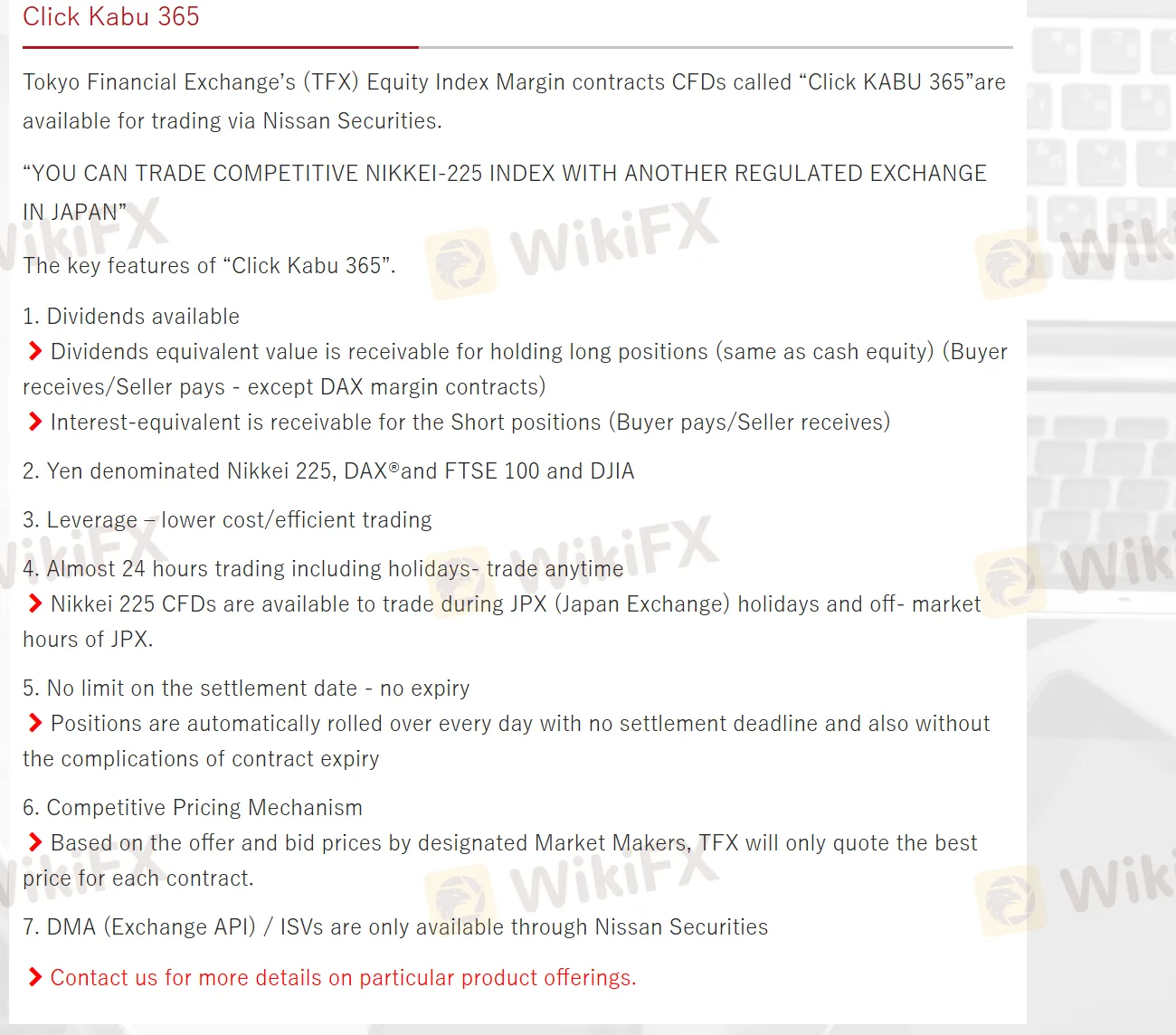

Klik KABU 365

Nissan Securities menawarkan peluang perdagangan untuk kontrak Margin Indeks Ekuitas CFD yang dikenal sebagai “Klik KABU 365,” yang disediakan oleh Bursa Keuangan Tokyo. Ini menyediakan perdagangan pada CFD TFX. Untuk posisi long, nilai setara dividen dapat diterima (kecuali kontrak margin DAX), dan untuk posisi short, setara bunga dapat diterima. Ada opsi leverage untuk perdagangan yang efisien biaya, dan menawarkan perdagangan hampir 24 jam termasuk hari libur. CFD Nikkei 225 dapat diperdagangkan selama libur JPX dan di luar jam pasar.

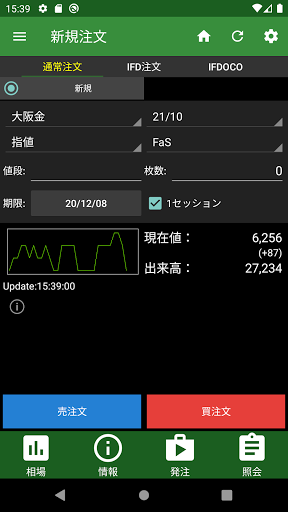

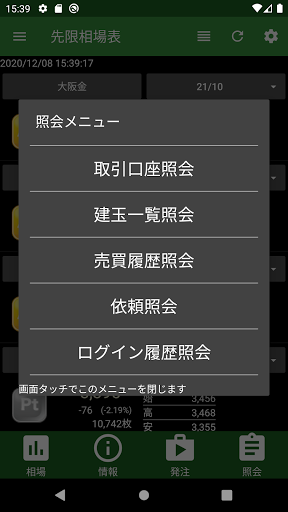

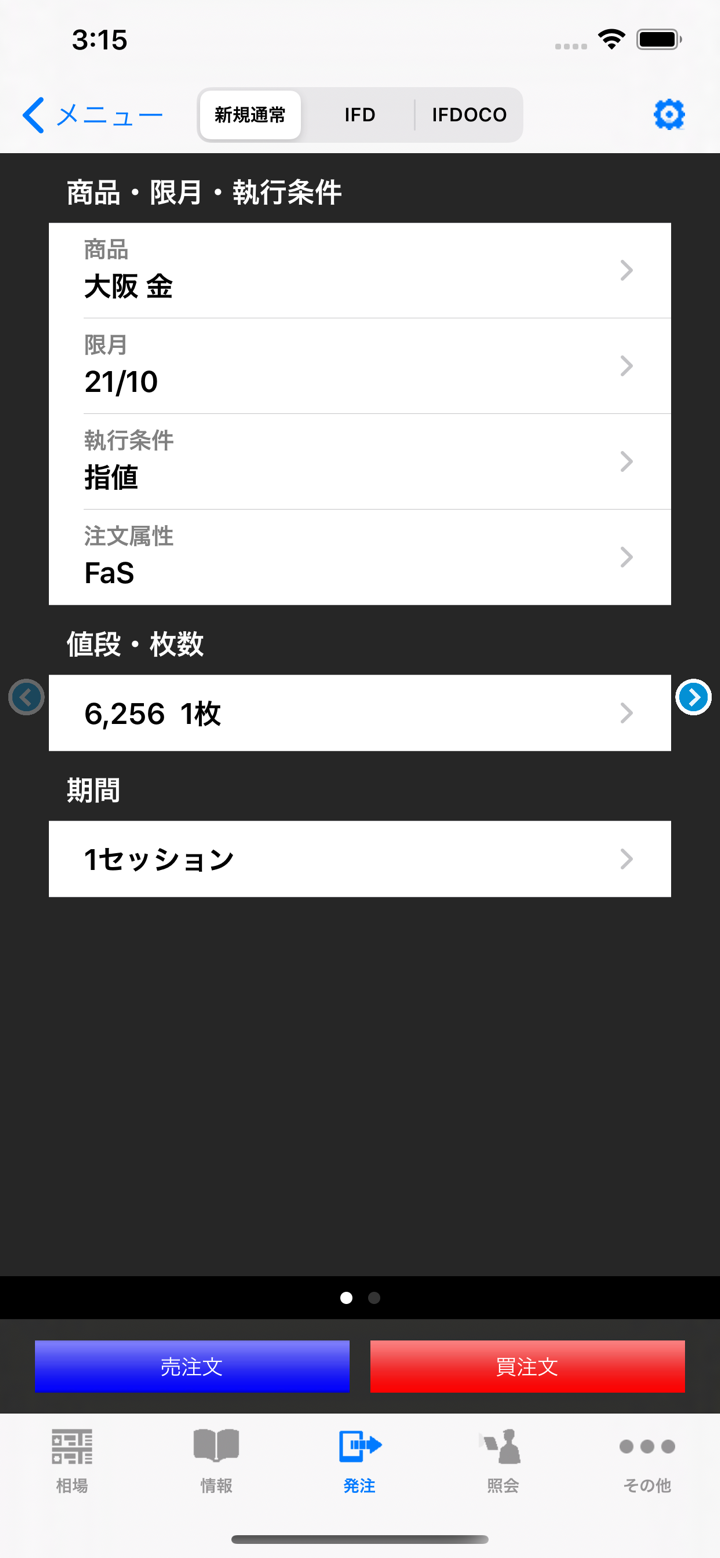

Platform Perdagangan

Selain dukungan untuk API Native dan sistem, Nissan Securities juga menawarkan platform ISV/Perdagangan termasuk Trading Technologies, Bloomberg, CQG, Stellar, dan TORA.