Présentation de l'entreprise

| ABN AMRO ClearingRésumé de l'examen | |

| Fondé | 2009 |

| Pays/Région d'enregistrement | Pays-Bas |

| Régulation | Pas de régulation |

| Produits et Services | Services de courtage, Services d'actifs, Services spécialisés et Réglementation & Divulgations |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | / |

| Dépôt minimum | / |

| Support client | Email: ronald.breault@abnamroclearing.com |

| Réseaux sociaux: LinkedIn, YouTube | |

| Adresse: ABN AMRO Clearing USA LLC 175 W. Jackson Boulevard, Suite 2050, Chicago, IL 60604 USA | |

Informations sur ABN AMRO Clearing

ABN AMRO Clearing a été fondé en 2009 et est enregistré aux Pays-Bas. Il propose une gamme complète de produits et services, y compris des services de courtage, des services d'actifs, des services professionnels, et des informations réglementaires et de divulgation, pour répondre aux besoins des clients en matière de trading, de gestion d'actifs, de solutions personnalisées et de conformité. Cependant, l'entreprise n'est pas réglementée, et il y a un manque d'informations spécifiques concernant les fonctionnalités du compte, les dépôts et les processus de retrait. Les investisseurs doivent faire preuve de prudence en ce qui concerne la sécurité des fonds et la transparence lorsqu'ils utilisent ses services.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Multiples services | Pas de régulation |

| Longue histoire d'opération | Pas d'informations sur les détails du trading |

ABN AMRO Clearing est-il légitime ?

ABN AMRO Clearing a été fondé en 2009 et n'est pas réglementé. Les traders doivent faire preuve de prudence lorsqu'ils tradent et utiliser les fonds de manière prudente.

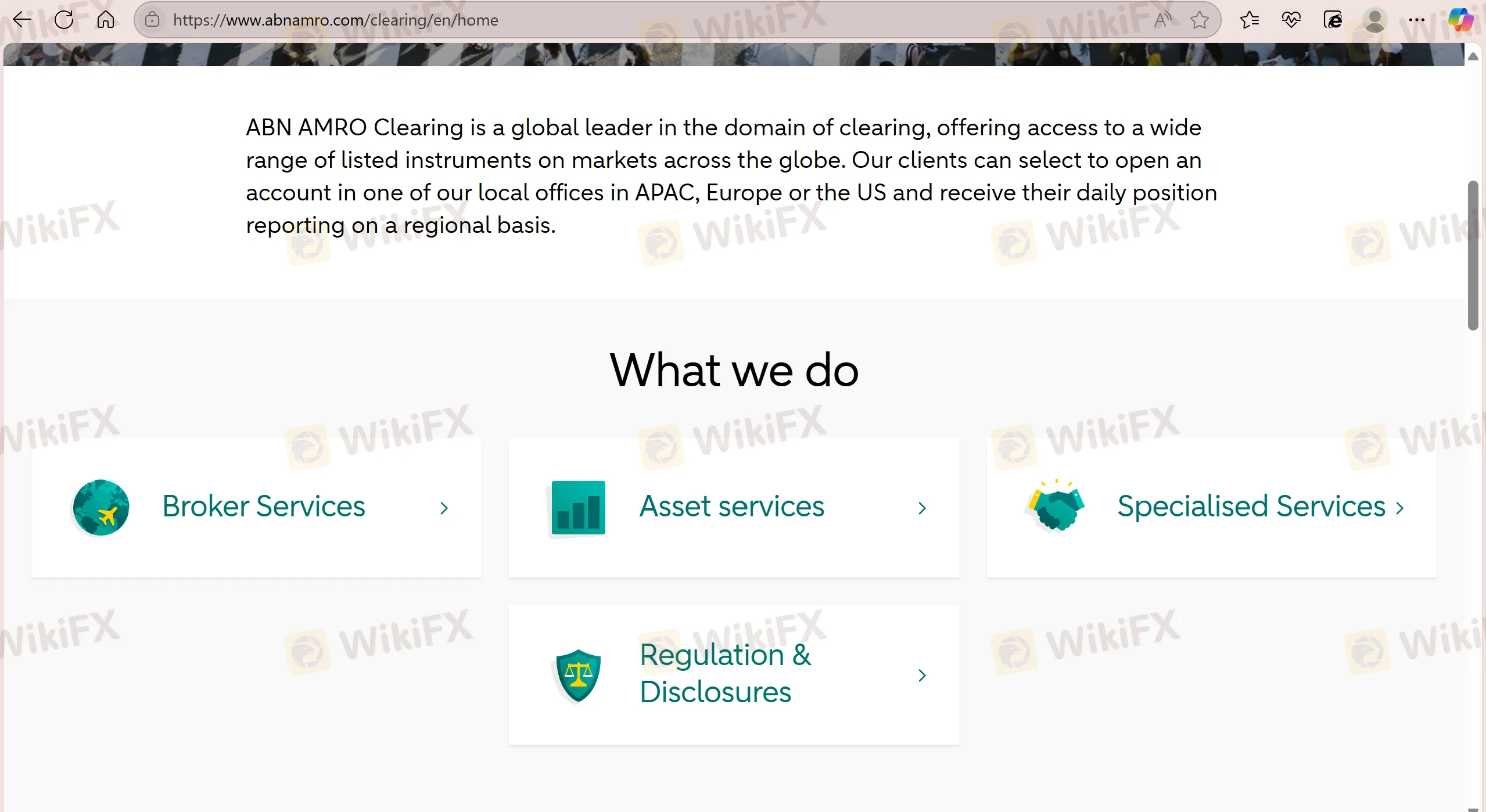

Produits & Services

ABN AMRO Clearing propose une gamme complète de produits et services, y compris des services de courtage, des services d'actifs, des services spécialisés et des réglementations & divulgations, pour répondre aux besoins diversifiés des clients en matière de trading, de gestion d'actifs, de solutions personnalisées et de conformité.

| Produits & Services | Pris en charge |

| Services de courtage | ✔ |

| Services d'actifs | ✔ |

| Services spécialisés | ✔ |

| Réglementations et Divulgations | ✔ |