Présentation de l'entreprise

| LME Résumé de l'examen | |

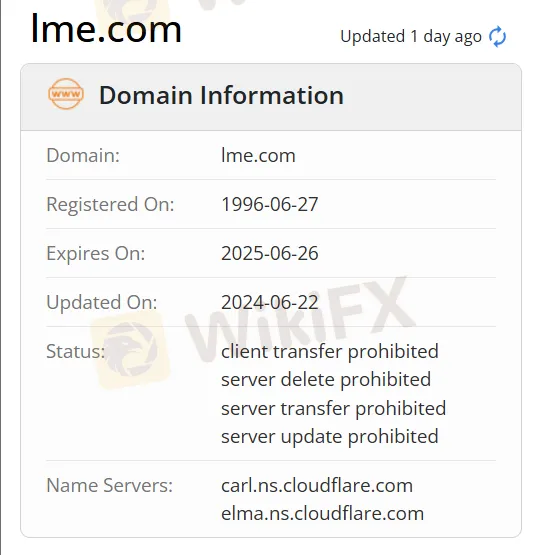

| Fondé | 1996 |

| Pays/Région d'enregistrement | Royaume-Uni |

| Régulation | Pas de régulation |

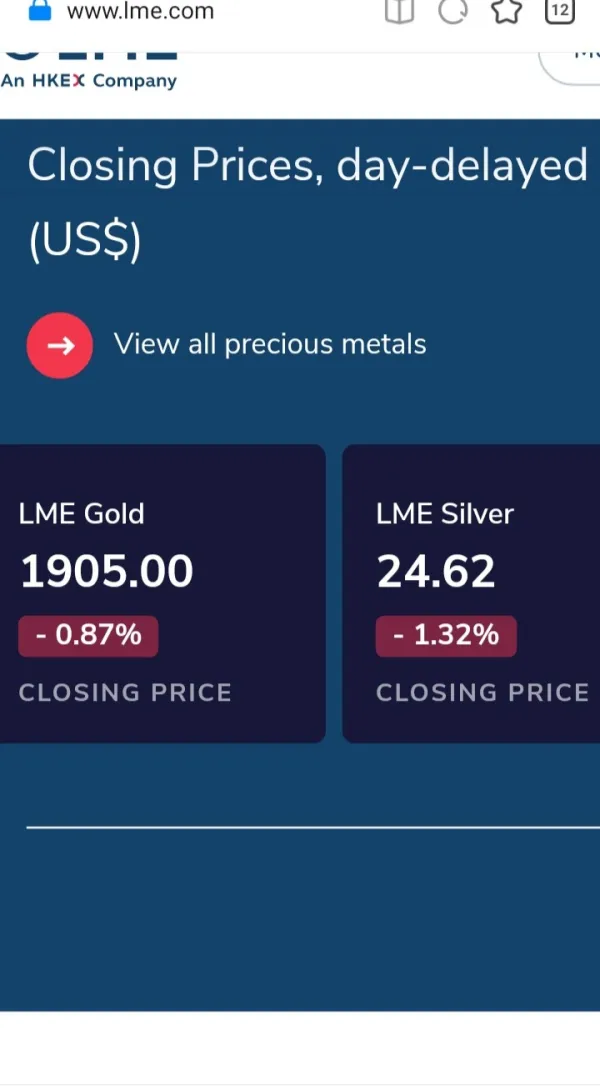

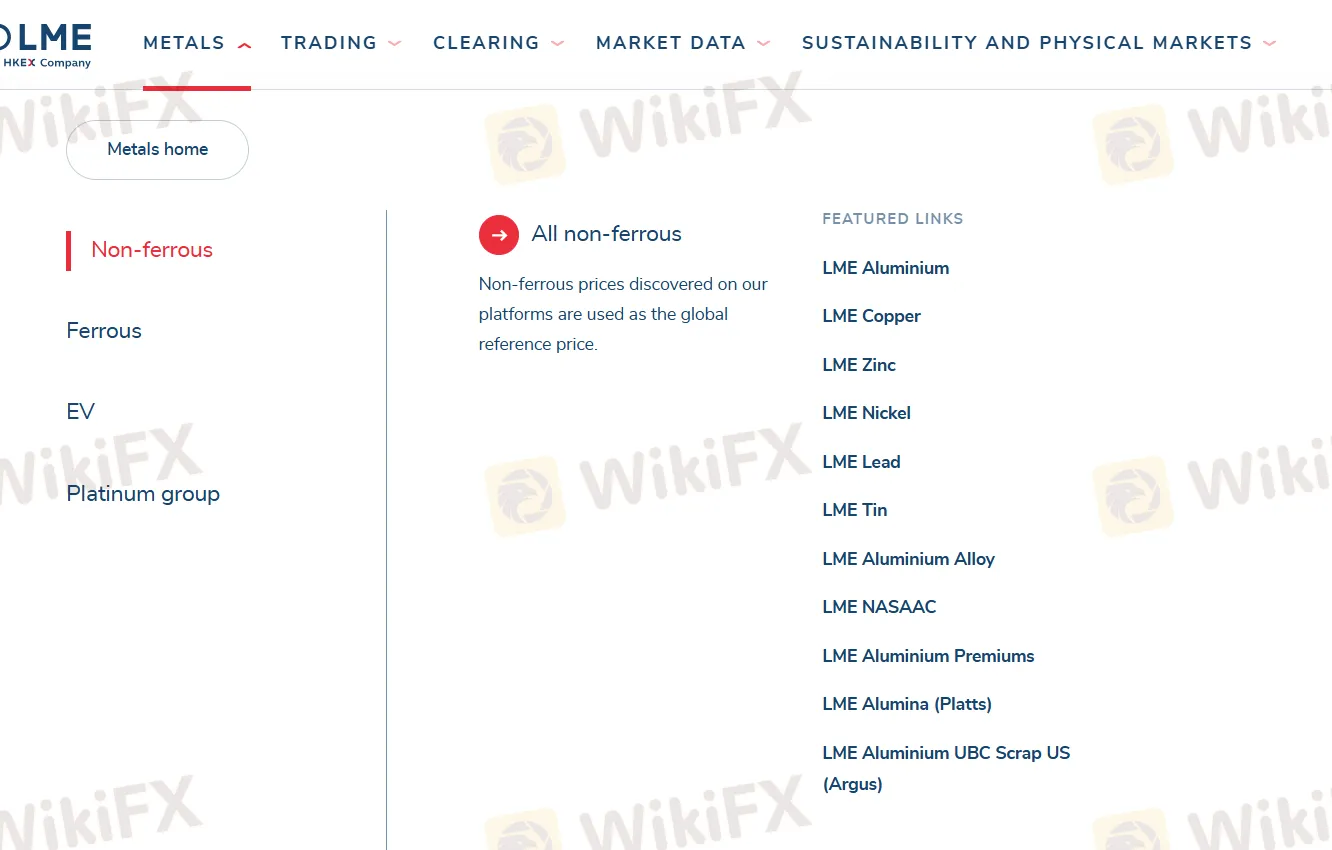

| Instruments de marché | Métaux non ferreux, Métaux ferreux, Métaux pour véhicules électriques, Métaux précieux |

| Plateforme de trading | LMEselect (électronique), the Ring (cri ouvert), le marché téléphonique 24 heures sur 24 |

| Support client | Tél : +44 (0) 20 7113 8888 |

| Email : chinateamdg@lme.com | |

| Adresse : 10 Finsbury Square, Londres, EC2A 1AJ | |

| Vimeo, X, WeChat, LinkedIn | |

Informations sur LME

LME est un fournisseur de services non réglementé dans le domaine des métaux et des services financiers, fondé au Royaume-Uni en 1996. Il propose des produits et services pour les métaux non ferreux, les métaux ferreux, les métaux pour véhicules électriques et les métaux précieux.

Avantages et inconvénients

| Avantages | Inconvénients |

| Temps d'opération long | Produits de trading limités |

| Divers canaux de contact | Absence de régulation |

| Pas de plateforme MT4/MT5 |

LME est-il légitime ?

Le numéro LME n'a actuellement aucune réglementation valide. Veuillez être conscient du risque ! De plus, son statut de domaine montre que les transferts et les mises à jour des clients sont interdits.

Que puis-je trader sur LME?

| Instruments de trading | Pris en charge |

| Métaux non ferreux | ✔ |

| Métaux ferreux | ✔ |

| Métaux EV | ✔ |

| Métaux précieux | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| LMEselect (électronique) | ✔ | PC, ordinateur portable, tablette | / |

| the Ring (cri ouvert) | ✔ | PC, ordinateur portable, tablette | / |

| le marché téléphonique 24 heures sur 24 | ✔ | mobile | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |