maseko

1-2年

How do the different account types available on the LME compare to each other?

As an independent trader with years of experience, I need to emphasize that my evaluation of LME is grounded in a close review of public information. Based on what I’ve researched, LME does not follow the typical forex broker model and, as such, does not offer the standard range of account types that traders might expect—such as demo, standard, or ECN accounts.

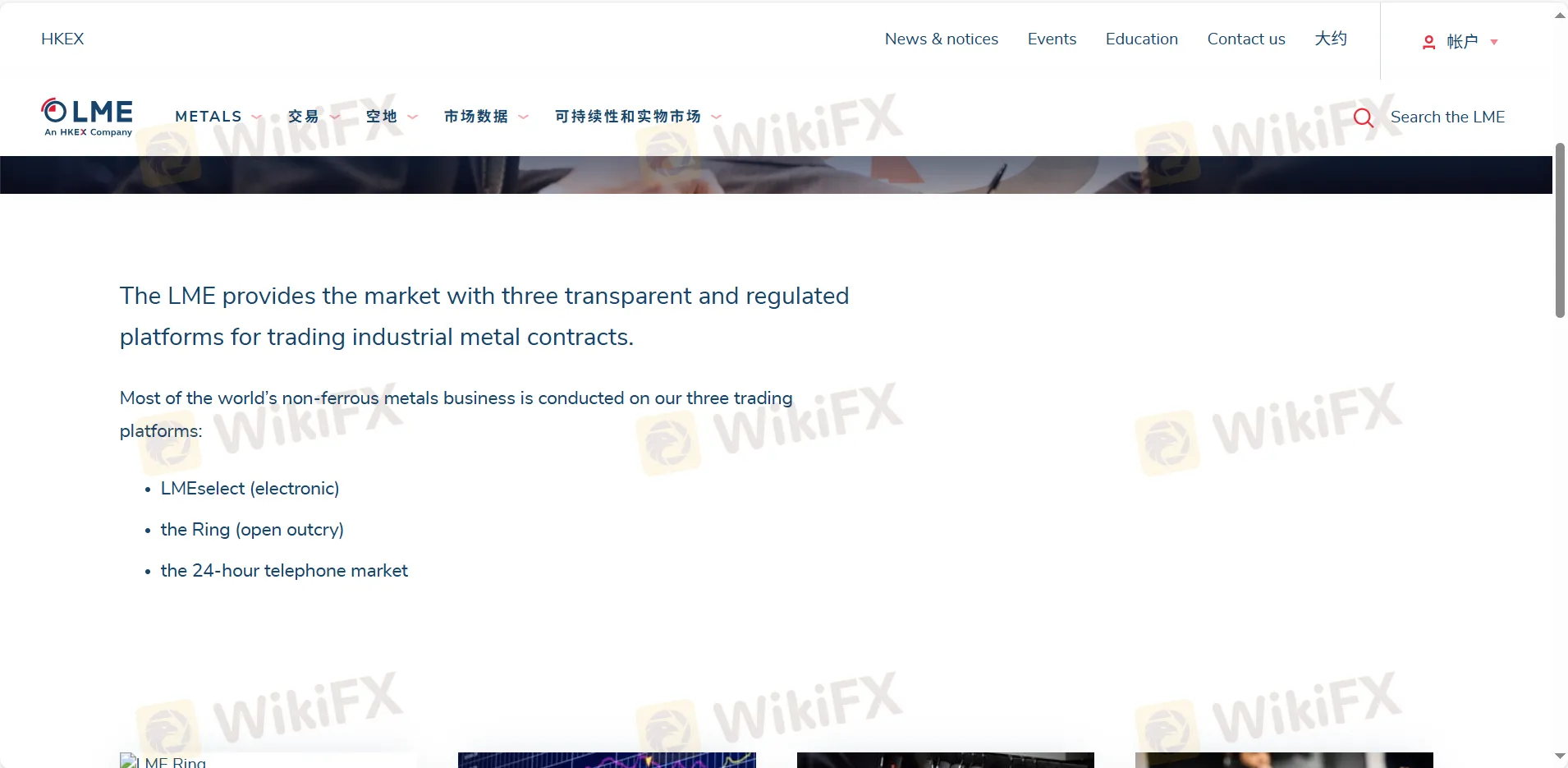

Instead, LME provides access to specific metal trading through a few unique platforms: LMEselect (an electronic system), open outcry trading known as “the Ring,” and a 24-hour telephone market. These aren’t “account types” in the sense most retail traders are accustomed to; rather, they’re alternative trading venues suited primarily to institutional or professional metals market participants. There is no mention of MT4 or MT5 support, which is a significant limitation for traders who depend on modern analytic or algorithmic tools.

Crucially, LME is currently not regulated by any financial authority. This absence of oversight raises my risk assessment considerably, since even basic account protections cannot be guaranteed. Given these considerations, I do not see a range of account types or account benefits that would be relevant or accessible to the ordinary retail trader. From my perspective, anyone seeking a variety of transparent, well-regulated account options—particularly in currency trading—would be wise to proceed with caution, or to look elsewhere for a broker with robust regulatory standing and clear account offerings.

Broker Issues

Platform

Instruments

Leverage

Account

Franko Knavs

1-2年

Have you experienced any drawbacks with LME’s customer service or issues with how stable their platform is?

Drawing from my own experience as a trader who prioritizes both regulatory security and user support, I have some considerable reservations when it comes to LME. One of my key concerns is the firm’s complete lack of valid regulation. For anyone serious about safeguarding their funds, operating with an unregulated broker like LME increases the risk that disputes or service failures may not be fairly mediated by any independent authority. In my trading journey, I’ve learned this is not a trivial risk, especially when significant capital is on the line.

Regarding customer service, I always look for responsive and transparent channels. While LME does offer several ways to get in touch—email, telephone, and various social platforms—the absence of positive user feedback makes it difficult for me to gauge how reliable their support is during critical times. Notably, I came across user reports describing serious issues, such as untracked deposits and accounts being inaccessible. Although this is only a single report, it does reinforce my personal caution around the lack of regulation.

On the technical side, I find it limiting that LME does not support industry-standard trading platforms like MT4 or MT5. Their proprietary tools might serve niche professionals, but for me, the lack of familiar, robust platforms increases operational uncertainty and makes it harder to manage my trades confidently.

All things considered, these factors have kept me from entrusting LME with my own trading capital. My risk management approach dictates that stability, user protections, and proven customer support are essentials I can’t compromise—none of which I currently see affirmed with LME.

zack18

1-2年

Is it possible to deposit funds into my LME account with cryptocurrencies such as Bitcoin or USDT?

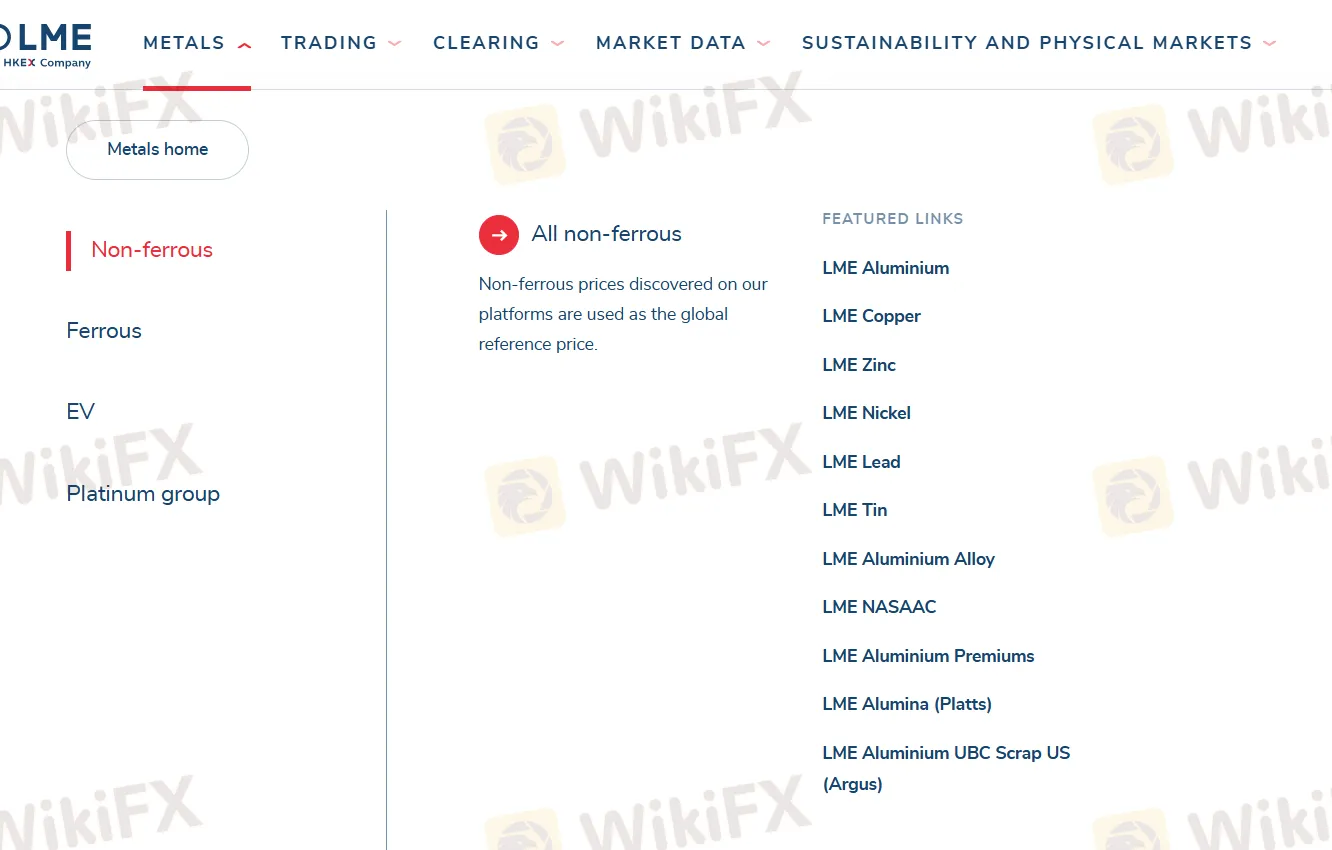

As an experienced trader evaluating LME based on the available information, I need to emphasize that LME's trading offerings are quite specialized and limited exclusively to various types of metals—such as non-ferrous, ferrous, EV, and precious metals. Critically, LME does not support forex, commodities, indices, stocks, or cryptocurrencies on its trading platforms. Also, there is no mention of support for MT4 or MT5 platforms, which typically provide broader deposit options, including crypto.

Regarding deposit methods, there is no clear or explicit indication that Bitcoin, USDT, or any other cryptocurrencies are accepted for funding an account with LME. The context specifically focuses on their proprietary platforms (like LMEselect and the Ring) and lacks references to any crypto-related financial transactions. Additionally, with LME operating without any recognized regulatory oversight and having a suspicious regulatory license, I would be highly cautious about attempting to deposit funds—especially via non-traditional, irreversible channels like crypto.

From my perspective, the absence of both regulatory protection and reliable documentation about crypto payments means that attempting to deposit using cryptocurrencies would be highly inadvisable. For me, this environment does not meet my minimum standards for security or trust. I would recommend extreme caution and would personally avoid transferring any funds—especially via crypto—until the broker offers clear, regulated, and transparent deposit processes.

Broker Issues

Withdrawal

Deposit

Ahmed Harb

1-2年

Is a free demo account available through LME, and if so, are there restrictions such as a time limit?

Based on my careful review of LME's publicly available information, I could not find any mention of a free demo account or simulation trading environment for users. From my perspective as a trader, the lack of transparency about such a basic tool signals a significant gap, especially for anyone who wants to practice with virtual funds before trading live. In my experience, reputable trading venues typically highlight demo account access, including any restrictions, since it's crucial for both newcomers and professionals testing strategies. The absence of an MT4 or MT5 platform, with LME instead relying on proprietary or niche systems like LMEselect, further complicates matters. This makes it even more important to have risk-free trial access, yet there's no sign that such an option is available.

For my own trading, I need clear guidance about available resources, and in this case, I don't see evidence that demo accounts—let alone details about expiry or limitations—are currently offered at LME. Given the broker's unregulated status and user-reported issues, I would urge extra caution. When essential education and testing tools are absent or unclear from the start, it's a red flag for me as someone who values transparent and secure trading conditions. Without confirmation or details, I must conclude that a demo account is either unavailable or not openly promoted by LME, which falls short of industry standards in my view.

Broker Issues

Platform

Instruments

Account

Leverage