Présentation de l'entreprise

| GRANDIS SECURITIESRésumé de l'examen | |

| Inscrit le | 5-10 ans |

| Pays/Région d'inscription | Chypre |

| Régulation | Non réglementé |

| Services | Actifs de base, Dérivés |

| Support Client | Tél : +357 22 350 854 |

| Email : info@grandissecurities.com.cy | |

| Adresse : 7 rue Stasandrou, Bâtiment Eleniko, 2ème étage, bureau 203CY-1060, Nicosie, Chypre | |

GRANDIS SECURITIES Informations

Grandis Securities (maintenant EXENICO (CY) LTD) possède des qualifications réglementaires de l'UE. Son champ de service comprend des services d'investissement, des services auxiliaires et des zones de couverture. Il convient aux investisseurs qui accordent de l'importance à la conformité et ont besoin d'instruments financiers diversifiés. Cependant, la transparence des informations actuelles est faible, et il est recommandé de vérifier les détails tels que l'effet de levier, les frais et les plateformes de trading via des canaux officiels avant l'ouverture d'un compte réel.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé | Pas de support 24/7 |

| Multiples instruments de trading | Informations manquantes (par ex. effet de levier, plateforme de trading) |

| Frais non clairs |

Est-ce que GRANDIS SECURITIES est légitime ?

La société détient une licence de société d'investissement (CIF 343/17) délivrée par la CySEC, et le régulateur a approuvé ses changements d'activité, ce qui en fait une institution financière légitime dans l'UE. Cependant, aucune information d'enregistrement de domaine n'a été trouvée dans Whois.

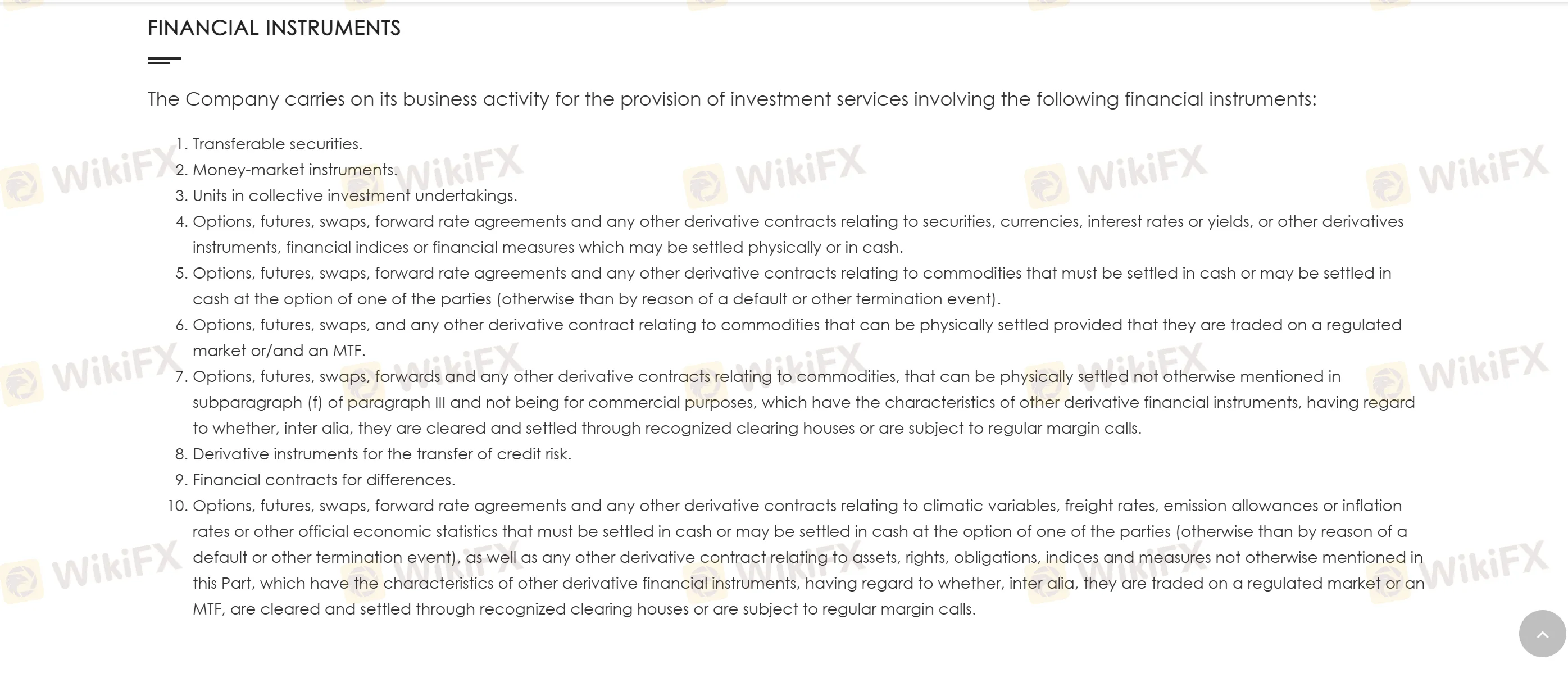

Que puis-je trader sur GRANDIS SECURITIES ?

Les instruments financiers négociables de GRANDIS SECURITIES sont classés en actifs sous-jacents et dérivés.

| Catégorie | Instruments de Trading | Exemples Spécifiques |

| Actifs de Base | Valeurs Mobilières Négociables | Actions, obligations |

| Instruments du Marché Monétaire | Bons à court terme, certificats de dépôt | |

| Produits d'Investissement Collectif | Unités de fonds | |

| Dérivés | Dérivés Financiers | Contrats à terme, options, swaps (par ex. swaps de taux d'intérêt) |

| Dérivés de Matières Premières | Contrats à terme sur le pétrole brut, options sur produits agricoles | |

| Autres Dérivés | Dérivés météorologiques, dérivés de crédit (CDS) |