Perfil de la compañía

| GRANDIS SECURITIESResumen de la reseña | |

| Registrado en | 5-10 años |

| País/Región de registro | Chipre |

| Regulación | No regulado |

| Servicios | Activos básicos, Derivados |

| Soporte al cliente | Tel: +357 22 350 854 |

| Email: info@grandissecurities.com.cy | |

| Dirección: 7 Stasandrou Street, Edificio Eleniko, 2do piso, oficina 203CY-1060, Nicosia, Chipre | |

GRANDIS SECURITIES Información

Grandis Securities (ahora EXENICO (CY) LTD) tiene calificaciones regulatorias de la UE. Su alcance de servicios incluye servicios de inversión, servicios auxiliares y áreas de cobertura. Es adecuado para inversores que valoran el cumplimiento normativo y necesitan instrumentos financieros diversos. Sin embargo, la transparencia de la información actual es baja, y se recomienda verificar detalles como el apalancamiento, las tarifas y las plataformas de negociación a través de canales oficiales antes de abrir una cuenta real.

Pros y contras

| Pros | Contras |

| Regulado | Sin soporte 24/7 |

| Múltiples instrumentos de negociación | Información faltante (por ejemplo, apalancamiento, plataforma de negociación) |

| Tarifas poco claras |

¿Es GRANDIS SECURITIES legítimo?

La empresa posee una licencia de Empresa de Inversión (CIF 343/17) emitida por CySEC, y el regulador ha aprobado sus cambios comerciales, lo que la convierte en una institución financiera legítima en la UE. Sin embargo, no se encontró información de registro de dominio en Whois.

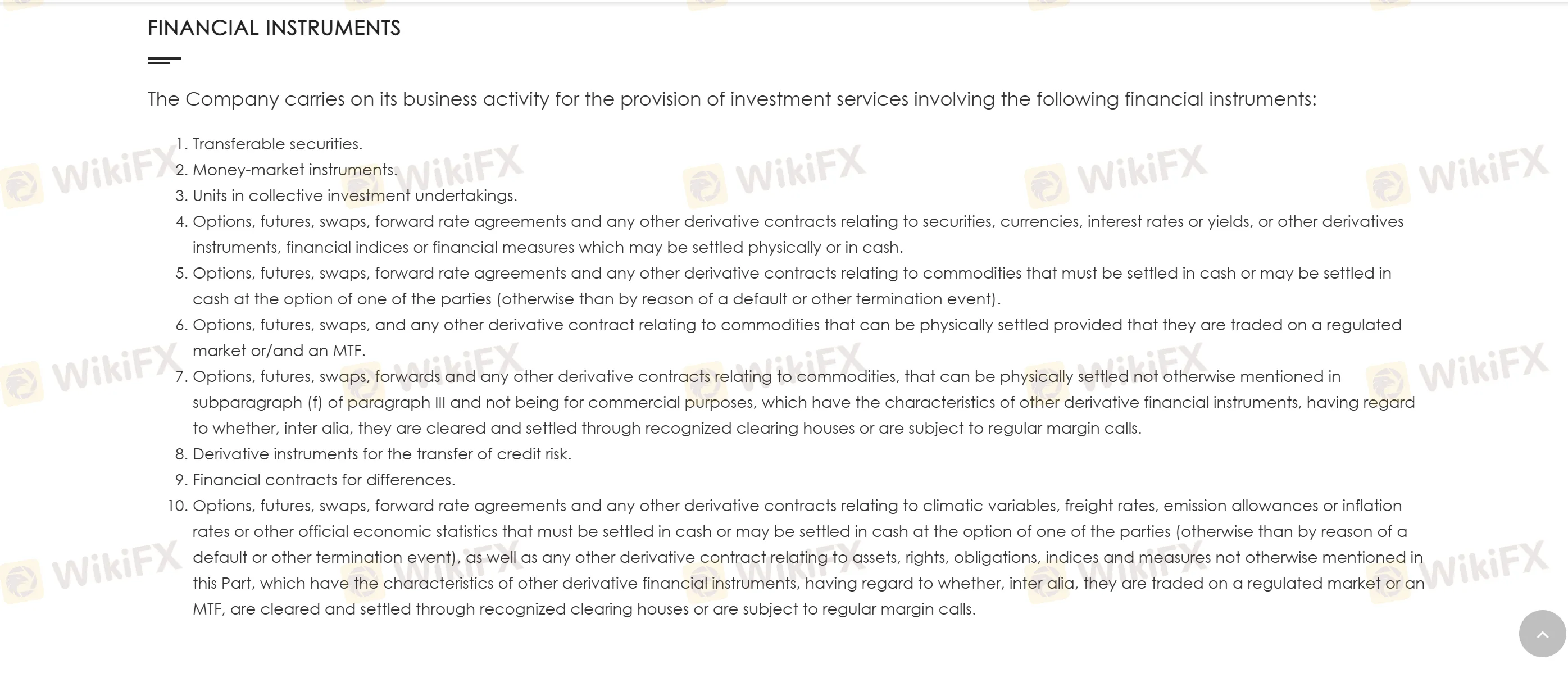

¿Qué puedo negociar en GRANDIS SECURITIES?

Los instrumentos financieros negociables de GRANDIS SECURITIES se clasifican en activos subyacentes y derivados.

| Categoría | Instrumentos de negociación | Ejemplos específicos |

| Activos básicos | Valores negociables | Acciones, bonos |

| Instrumentos del mercado monetario | Notas a corto plazo, certificados de depósito | |

| Productos de inversión colectiva | Unidades de fondos | |

| Derivados | Derivados financieros | Futuros, opciones, swaps (por ejemplo, permutas de tasas de interés) |

| Derivados de materias primas | Futuros de petróleo crudo, opciones de productos agrícolas | |

| Otros derivados | Derivados climáticos, derivados de crédito (CDS) |