Resumo da empresa

| EGM Securities Resumo da Revisão | |

| Fundação | 2018 |

| País/Região Registrada | Quênia |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Moedas, Commodities, Ações, Índices, ETFs |

| Conta Demo | ✅ |

| Alavancagem | Até 1:400 |

| Spread | A partir de 0.0 pips |

| Plataforma de Negociação | MT4, MT5 |

| Depósito Mínimo | / |

| Suporte ao Cliente | Suporte 24/6 |

| WhatsApp: +254-730-676-002 | |

| Telefone (Grátis no Quênia): 0800-211-185 | |

| Telefone (Internacional): +254-730-676-002 | |

| Email: support@egmsecurities.com | |

| Endereço: 12º Andar, Torre 2, Delta Corner Towers, Waiyaki Way, Westlands, Nairobi, Quênia | |

| Bônus | Bônus de boas-vindas de 30% extra no primeiro depósito |

Informações sobre EGM Securities

Fundada em 2018, EGM Securities é uma corretora não regulamentada registrada no Quênia. Os instrumentos negociáveis com alavancagem máxima de 1:400 incluem moedas, commodities, ações, índices e ETFs. A corretora suporta as plataformas MT4 e MT5.

Prós e Contras

| Prós | Contras |

| Suporte ao cliente 24/6 | Sem regulação |

| Plataformas MT4 e MT5 disponíveis | Depósito mínimo desconhecido |

| Contas demo disponíveis | |

| Vários instrumentos negociáveis | |

| Bônus oferecido | |

| Opções de pagamento populares |

EGM Securities é Legítimo?

EGM Securities não é regulamentado, embora afirme ser licenciado e regulamentado pela Autoridade de Mercados de Capitais do Quênia. Uma corretora não regulamentada não é tão segura quanto uma regulamentada.

O Que Posso Negociar na EGM Securities?

EGM Securities oferece uma ampla gama de instrumentos de mercado, incluindo moedas, commodities, ações, índices e ETFs.

| Instrumentos Negociáveis | Suportado |

| Moedas | ✔ |

| Commodities | ✔ |

| Ações | ✔ |

| Índices | ✔ |

| ETFs | ✔ |

| Criptomoedas | ❌ |

| Títulos | ❌ |

| Opções | ❌ |

| Fundos Mútuos | ❌ |

Alavancagem

A alavancagem máxima é de 1:400, o que significa que os lucros e perdas são ampliados 400 vezes. Note que uma alavancagem mais alta pode melhorar o potencial de lucro, mas também aumenta o risco, portanto, uma gestão de risco apropriada é crucial.

Taxas EGM Securities

O spread é a partir de 0.0 pips, e a comissão é de $0. Quanto menor o spread, mais rápida é a liquidez.

Plataforma de Negociação

EGM Securities colabora com as respeitadas plataformas de negociação MT4 e MT5 disponíveis em dispositivos móveis, desktop e tablet para negociar. Os traders iniciantes preferem o MT4 em relação ao MT5. Traders com experiência preferem o MT5. O MT4 e o MT5 não apenas oferecem várias estratégias de negociação, mas também implementam sistemas de EA.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| MT4 | ✔ | Móvel/Desktop/Tablet | Iniciantes |

| MT5 | ✔ | Móvel/Desktop/Tablet | Traders experientes |

Depósito e Saque

EGM Securities aceita cartões de crédito, transferências bancárias, eWallets, carteiras de criptomoedas, dinheiro móvel como M-Pesa e mais para depósito e saque. No entanto, os tempos de processamento de transferência e as taxas associadas são desconhecidos.

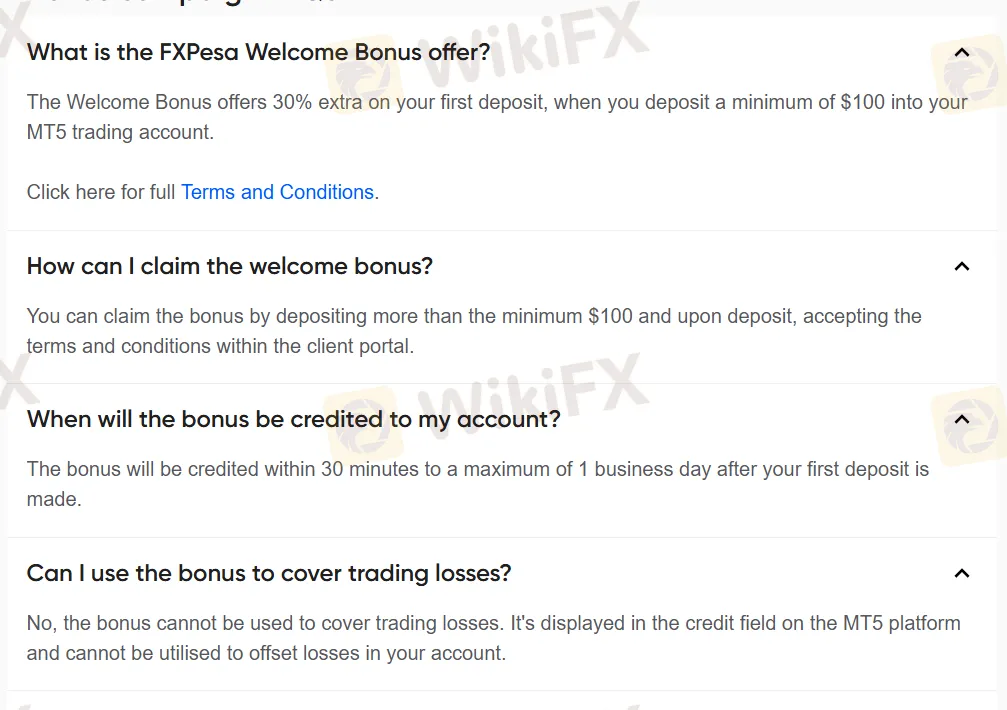

Bônus

Os traders podem receber um bônus de boas-vindas de 30% extra no primeiro depósito. O bônus será creditado dentro de 30 minutos a um máximo de 1 dia útil após o primeiro depósito.