회사 소개

| EGM Securities 리뷰 요약 | |

| 설립 연도 | 2018 |

| 등록 국가/지역 | 케냐 |

| 규제 | 규제 없음 |

| 거래 상품 | 통화, 상품, 주식, 지수, ETF |

| 데모 계정 | ✅ |

| 레버리지 | 최대 1:400 |

| 스프레드 | 0.0 픽스부터 |

| 거래 플랫폼 | MT4, MT5 |

| 최소 입금 | / |

| 고객 지원 | 24/6 지원 |

| WhatsApp: +254-730-676-002 | |

| 전화 (무료 전화 케냐): 0800-211-185 | |

| 전화 (국제 전화): +254-730-676-002 | |

| 이메일: support@egmsecurities.com | |

| 주소: 12층, 타워 2, 델타 코너 타워, 와이야키 웨이, 웨스트랜즈, 나이로비, 케냐 | |

| 보너스 | 첫 입금에 30% 추가 보너스 |

EGM Securities 정보

2018년에 설립된 EGM Securities은 케냐에 등록된 규제되지 않은 브로커입니다. 최대 1:400 레버리지로 거래 가능한 상품에는 통화, 상품, 주식, 지수, ETF가 포함됩니다. 해당 브로커는 MT4 및 MT5 플랫폼을 지원합니다.

장단점

| 장점 | 단점 |

| 24/6 고객 지원 | 규제 없음 |

| MT4 및 MT5 플랫폼 제공 | 알려진 최소 입금 없음 |

| 데모 계정 제공 | |

| 다양한 거래 상품 | |

| 보너스 제공 | |

| 인기 있는 결제 옵션 |

EGM Securities 합법적인가요?

EGM Securities은 규제되지 않았으며, 케냐 자본시장당국에 의해 라이선스를 받고 규제되었다고 주장하고 있습니다. 규제되지 않은 브로커는 규제된 브로커만큼 안전하지 않습니다.

EGM Securities에서 무엇을 거래할 수 있나요?

EGM Securities은(는) 통화, 상품, 주식, 지수 및 ETF를 포함한 다양한 시장 기구를 제공합니다.

| 거래 가능한 기구 | 지원 |

| 통화 | ✔ |

| 상품 | ✔ |

| 주식 | ✔ |

| 지수 | ✔ |

| ETF | ✔ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| 펀드 | ❌ |

레버리지

최대 레버리지는 1:400로, 이는 이익과 손실이 400배로 증폭된다는 것을 의미합니다. 더 높은 레버리지는 이익 가능성을 향상시킬 수 있지만 동시에 리스크도 증가시키므로 적절한 리스크 관리가 중요합니다.

EGM Securities 수수료

스프레드는 0.0 픽스이며, 수수료는 $0입니다. 스프레드가 낮을수록 유동성이 빨라집니다.

거래 플랫폼

EGM Securities은(는) MT4 및 MT5 거래 플랫폼과 협력하여 모바일, 데스크톱 및 태블릿에서 거래할 수 있습니다. 초보 트레이더들은 MT4를 선호하고, 경험이 풍부한 트레이더들은 MT5를 더 많이 사용하기에 적합합니다. MT4와 MT5는 다양한 거래 전략을 제공할 뿐만 아니라 EA 시스템도 구현합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| MT4 | ✔ | 모바일/데스크톱/태블릿 | 초보자 |

| MT5 | ✔ | 모바일/데스크톱/태블릿 | 경험 있는 트레이더 |

입출금

EGM Securities은(는) 신용카드, 은행 송금, 전자지갑, 암호화폐 지갑, M-Pesa와 같은 모바일 머니 등을 입출금용으로 허용합니다. 그러나 이체 처리 시간 및 관련 수수료는 알려지지 않았습니다.

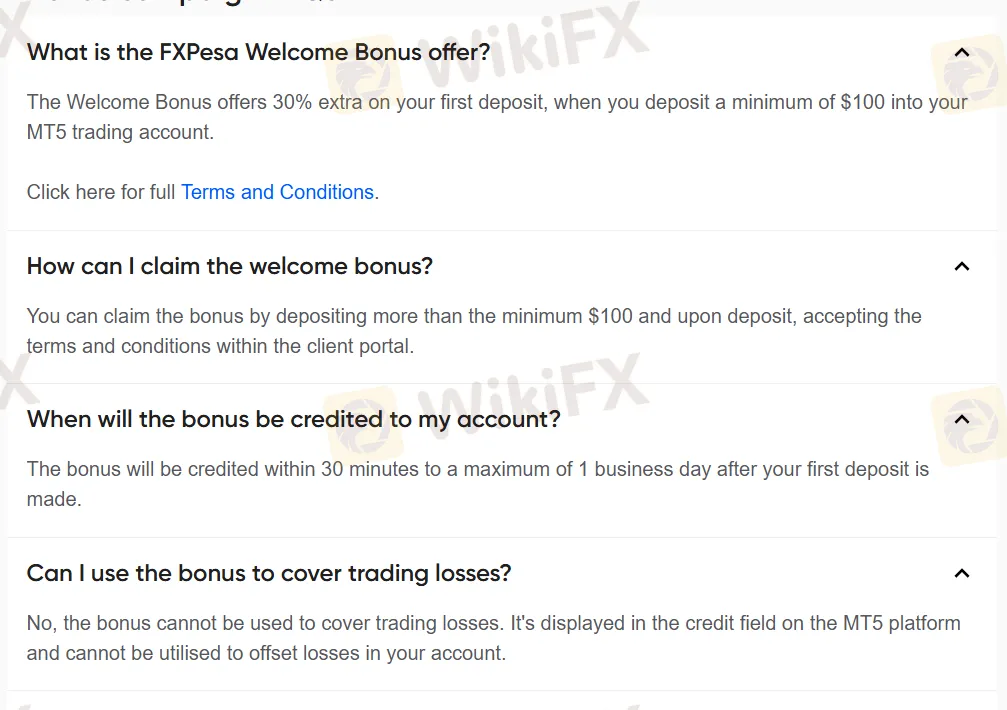

보너스

트레이더들은 첫 입금에 대한 30% 추가 환영 보너스를 받을 수 있습니다. 보너스는 첫 입금 후 30분 이내부터 최대 1영업일 이내에 지급됩니다.