Profil perusahaan

| Hicend Ringkasan Ulasan | |

| Dibentuk | 2008 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFE (Teregulasi) |

| Instrumen Pasar | Futures, logam, energi, dan kimia |

| Akun Demo | ❌ |

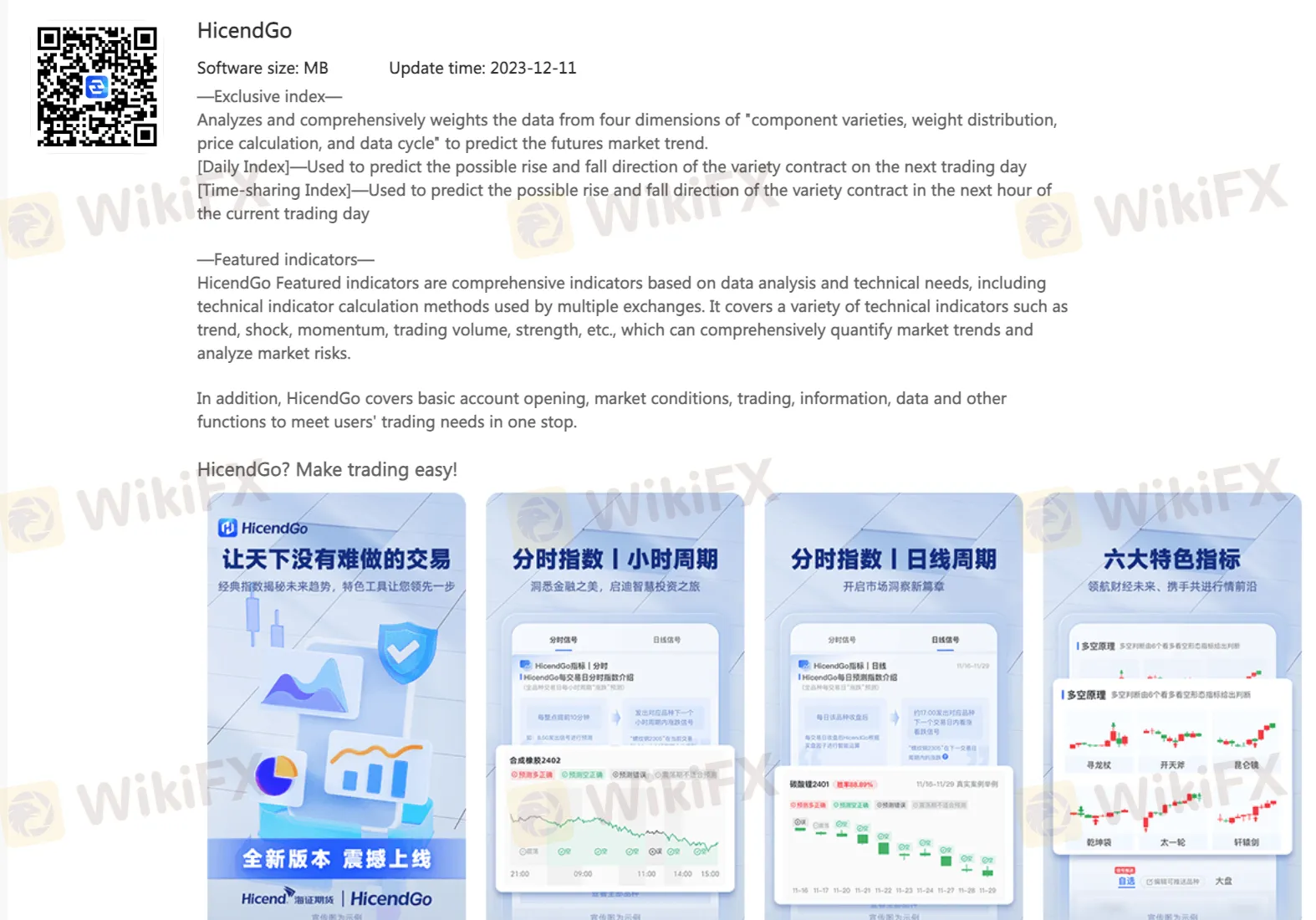

| Platform Perdagangan | Fast Trading Terminal V2, Unlimited Easy Client, Esunny Client 8.5, Esunny Client 8.3, Sui Xin Yi (hanya untuk kompetisi real-time), Lightning King, HicendGo, Shanghai Securities and Futures, HSI Futures, Mandarin Travel, Pocket Precious Metals, Yixing APP, Quick Issue APP, Dalian Financial News, Quhe APP |

| Dukungan Pelanggan | Obrolan langsung |

| Tel: 400-880-8998; 021-60169066/9058 | |

| Email: hzqh@hicend.com.cn | |

Informasi Hicend

Hicend adalah broker yang teregulasi, menawarkan perdagangan futures, logam, energi, dan kimia pada platform perdagangan yang beragam.

Pro dan Kontra

| Pro | Kontra |

| Berbagai platform perdagangan | Tidak ada akun demo |

| Teregulasi dengan baik | Biaya aplikasi dan penanganan dikenakan |

| Berbagai saluran dukungan pelanggan | |

| Waktu operasi yang panjang | |

| Dukungan obrolan langsung |

Apakah Hicend Legal?

Ya. Hicend memiliki lisensi dari CFFEX untuk menawarkan layanan.

| Negara yang Teregulasi | Regulator | Status Saat Ini | Entitas yang Teregulasi | Tipe Lisensi | No. Lisensi |

| Bursa Futures Keuangan China | Teregulasi | Hicend有限公司 | Lisensi Futures | 0155 |

Apa yang Bisa Saya Perdagangkan di Hicend?

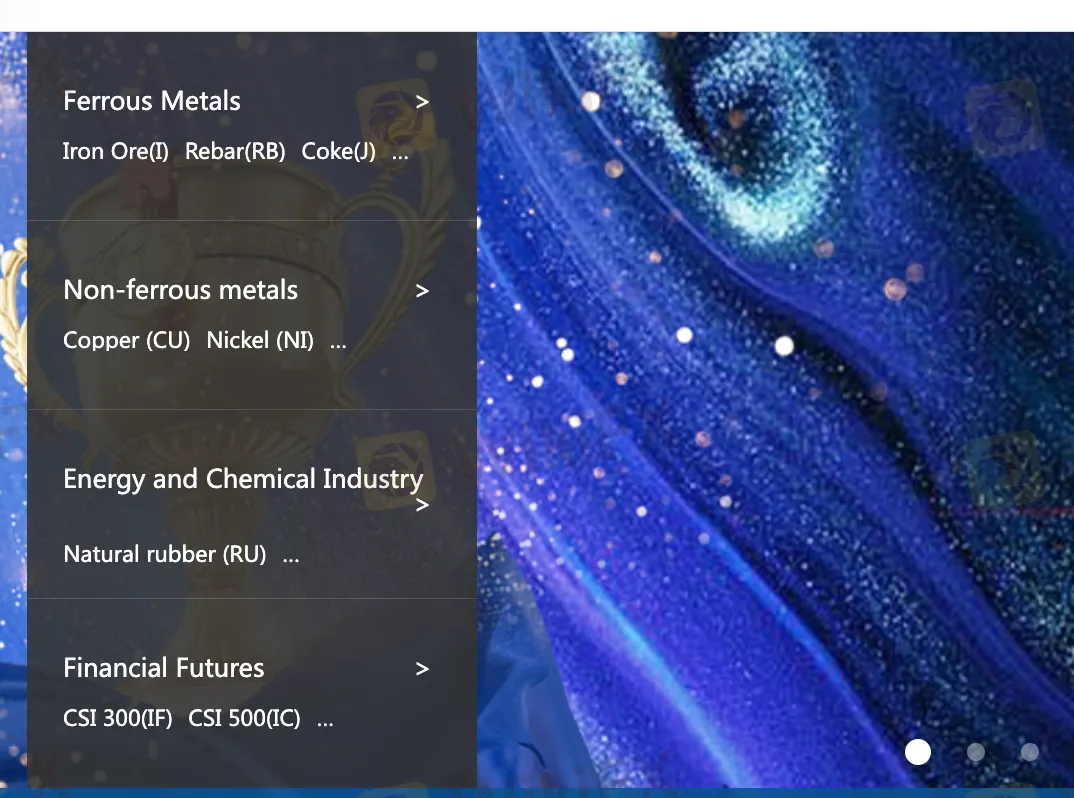

Hicend menawarkan perdagangan futures, logam, energi, dan kimia.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Logam | ✔ |

| Energi dan Kimia | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Jenis Akun

Hicend belum secara jelas menyediakan jenis akun yang ditawarkan. Klien dapat melakukan perdagangan di lima bursa futures utama menggunakan satu akun.

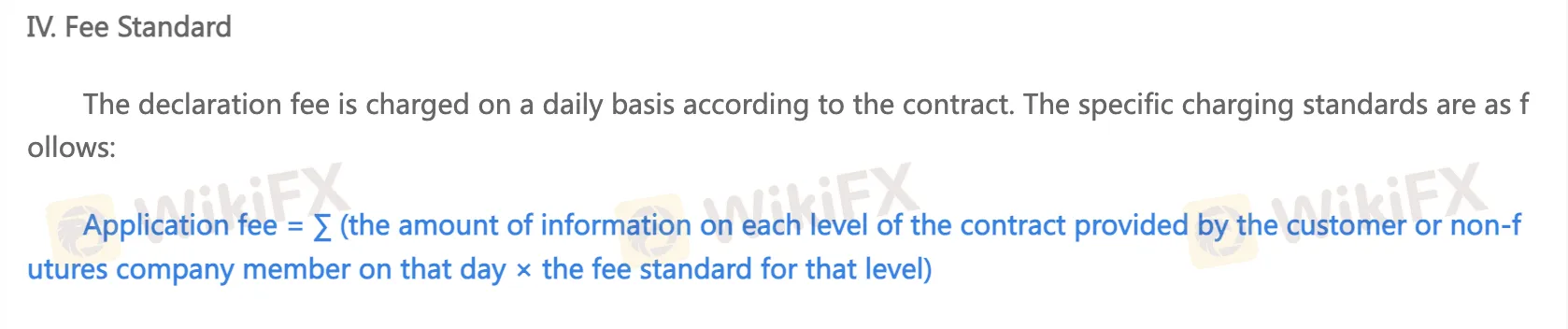

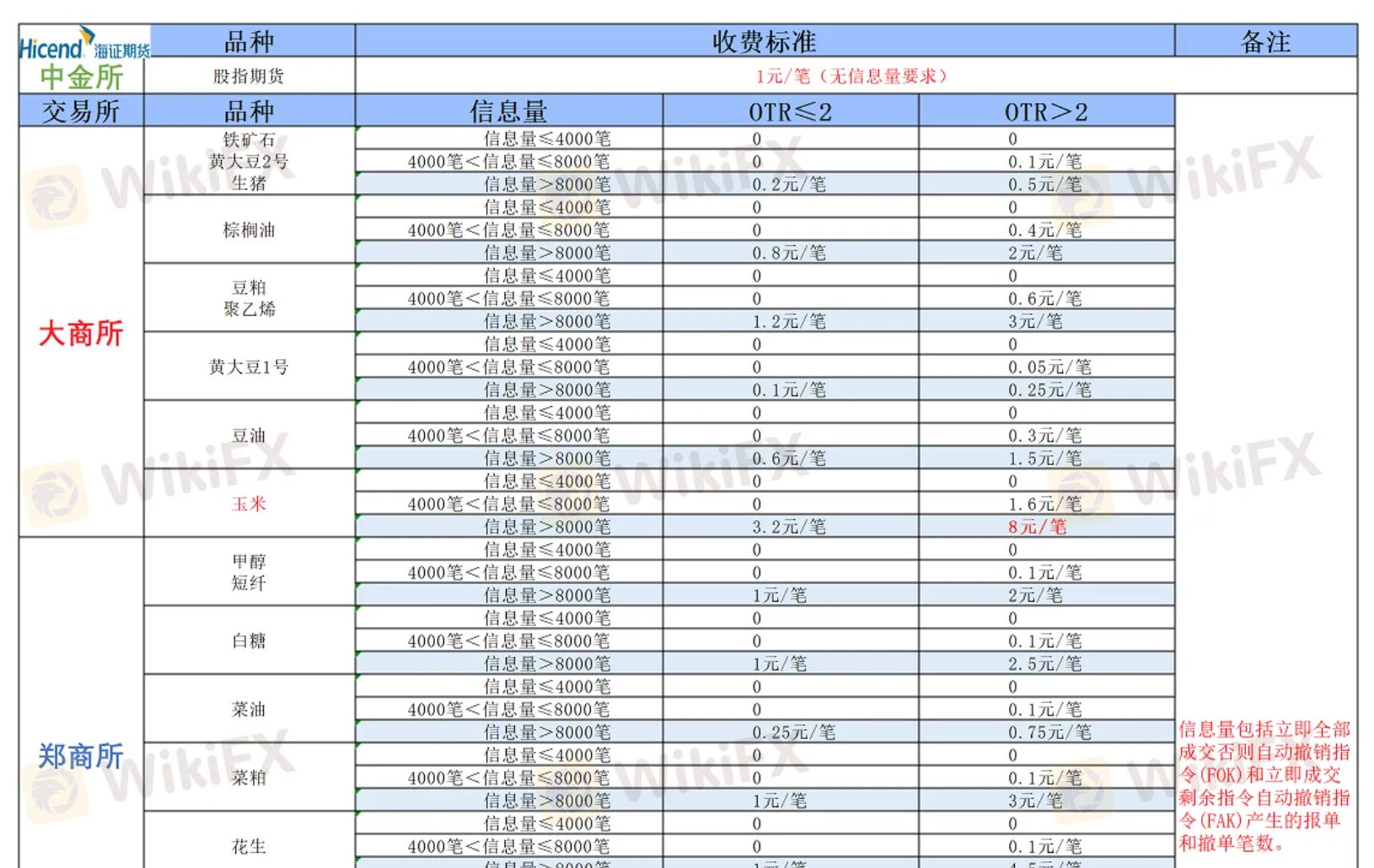

Biaya Hicend

Hicend memerlukan biaya aplikasi dan biaya penanganan saat melakukan perdagangan.

Platform Perdagangan

Hicend menyediakan berbagai platform perdagangan, termasuk Fast Trading Terminal V2, Unlimited Easy Client, Esunny Client 8.5, Esunny Client 8.3, Sui Xin Yi (hanya untuk kompetisi real-time), Lightning King, HicendGo, Shanghai Securities and Futures, HSI Futures, Mandarin Travel, Pocket Precious Metals, Yixing APP, Quick Issue APP, Dalian Financial News, dan Quhe APP.

Perangkat yang Tersedia: desktop dan mobile.