Présentation de l'entreprise

| Mega SecuritiesRésumé de l'examen | |

| Fondé | / |

| Pays/Région enregistré(e) | Chine (Taiwan) |

| Régulation | TPEx |

| Produits et services | Actions, contrats à terme, gestion financière, fiducies |

| Assistance clientèle | Chat IA |

| Tél : (02)2351-7017 ; (02)4055-3355 | |

| Adresse : 台北市中正區忠孝東路二段95號 | |

Mega Securities a été enregistré à Taiwan. Cette entreprise est spécialisée dans les actions, les contrats à terme, la gestion financière et les fiducies. De plus, elle est réglementée par TPEx à Taiwan.

Avantages et inconvénients

| Avantages | Inconvénients |

| Réglementé par TPEx | Structure des frais peu claire |

| Plateformes de trading multiples |

Mega Securities est-il légitime ?

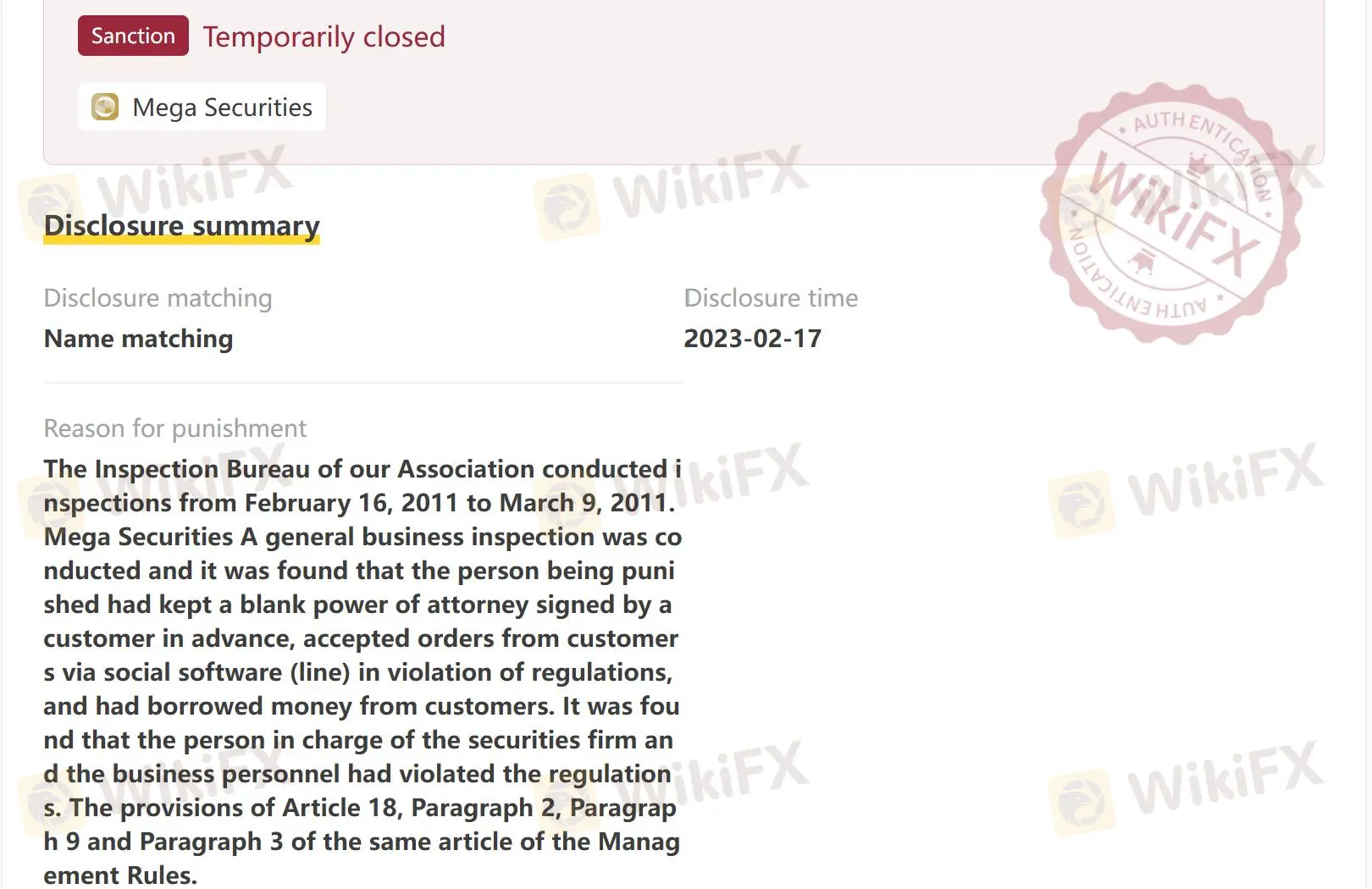

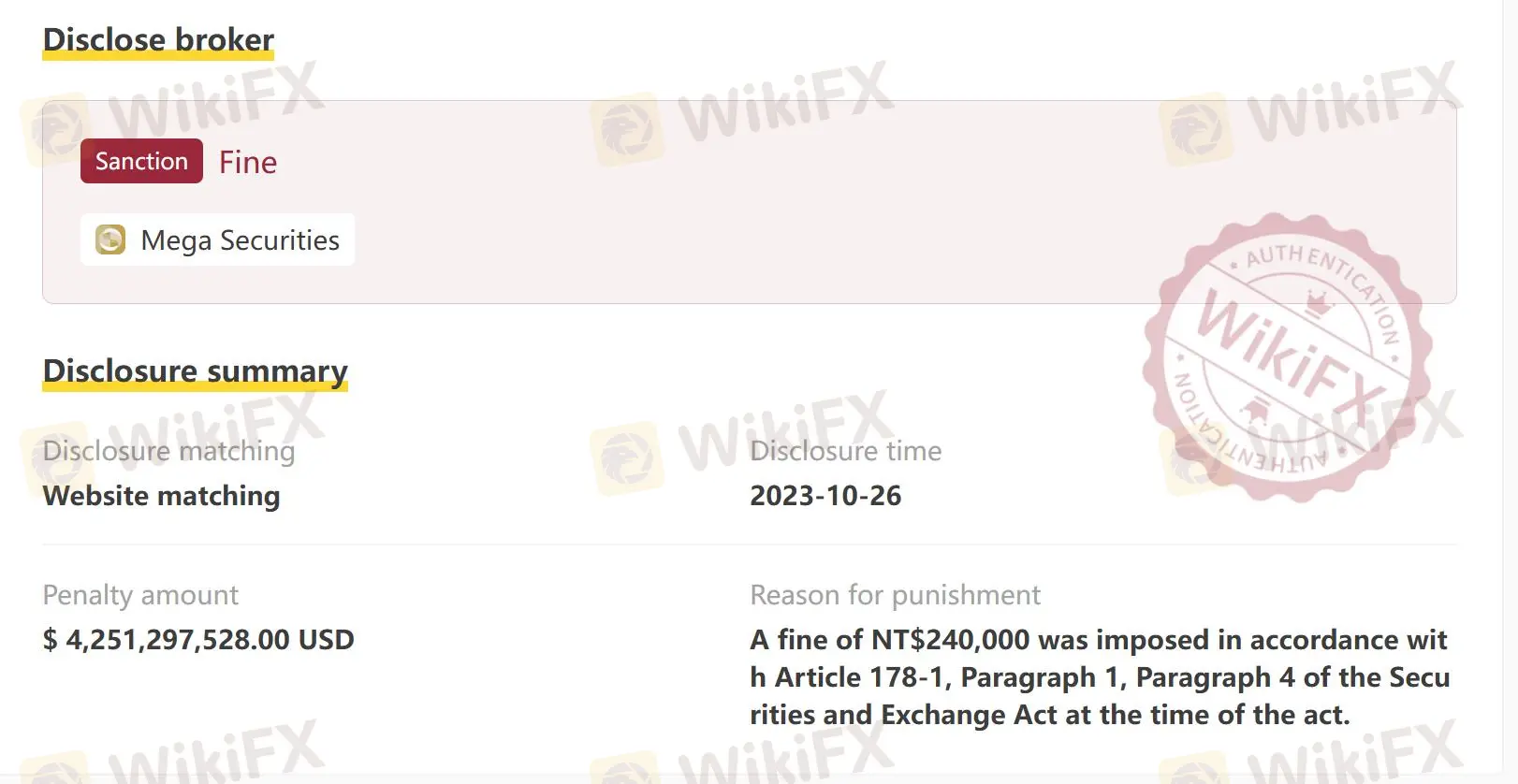

Oui, Mega Securities est réglementé par la Bourse de Taipei (TPEx). Cependant, le Bureau des valeurs mobilières et des contrats à terme a sanctionné Mega Securities à deux reprises. Veuillez prendre en compte les risques potentiels !

| Autorité de régulation | Statut actuel | Pays réglementé | Type de licence | Numéro de licence |

| Bourse de Taipei (TPEx) | Réglementé | Chine (Taiwan) | Opérations sur titres | Non publié |

Enquête sur le terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse réglementaire de Mega Securities à Taiwan et nous avons trouvé son adresse physique.

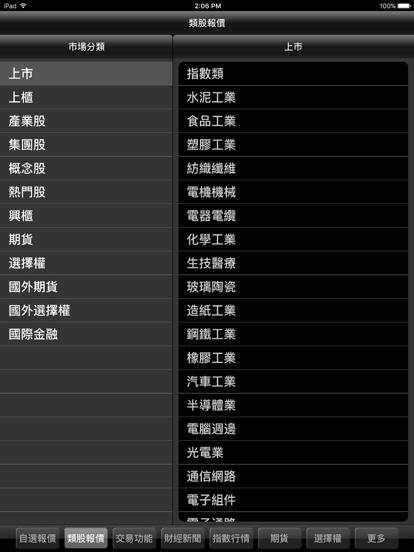

Que puis-je trader sur Mega Securities ?

Mega Securities propose des transactions sur des actions, des contrats à terme et des fiducies.

| Instruments négociables | Pris en charge |

| Actions | ✔ |

| Contrats à terme | ✔ |

| Fiducies | ✔ |

Plateforme de trading

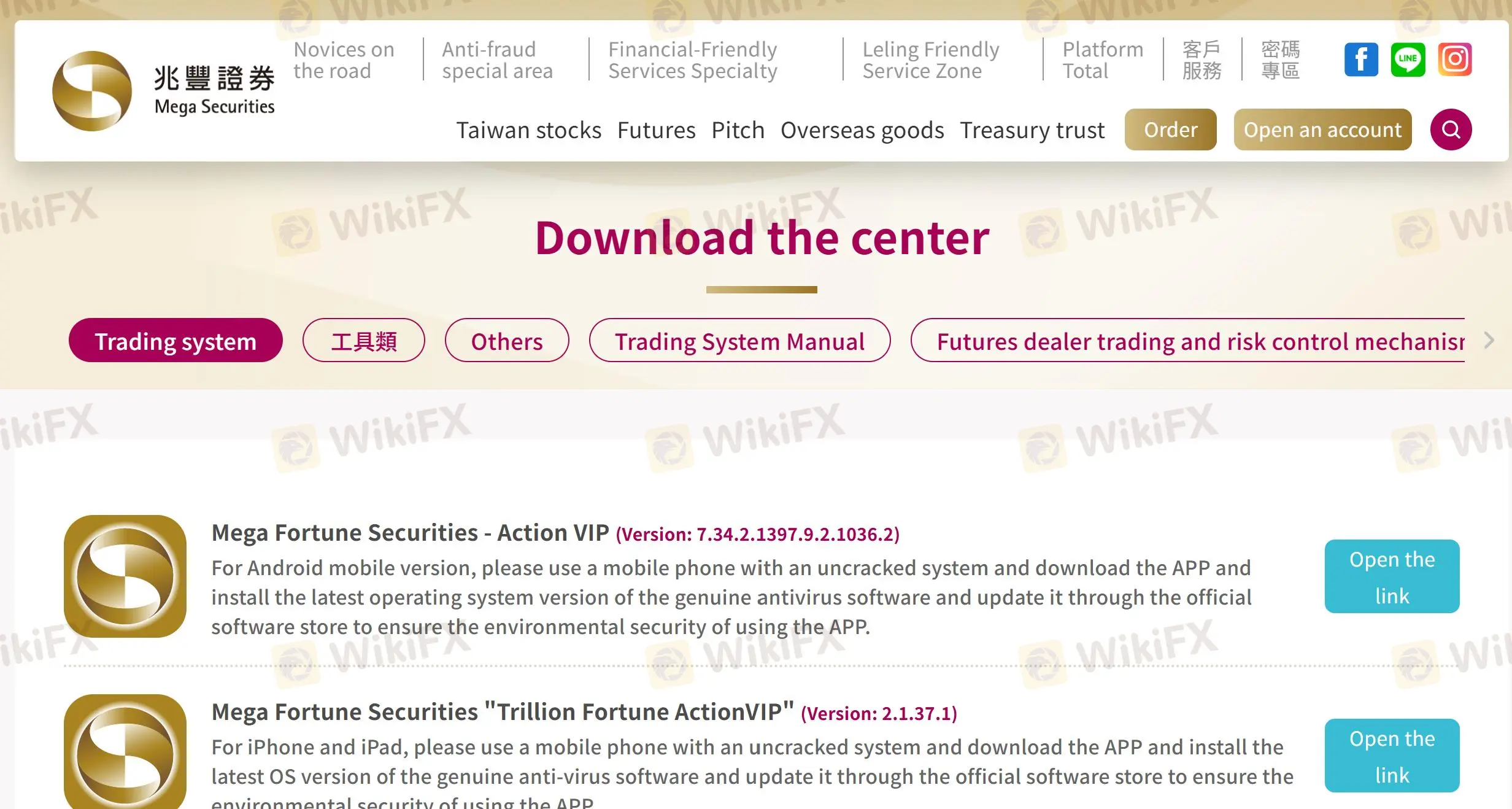

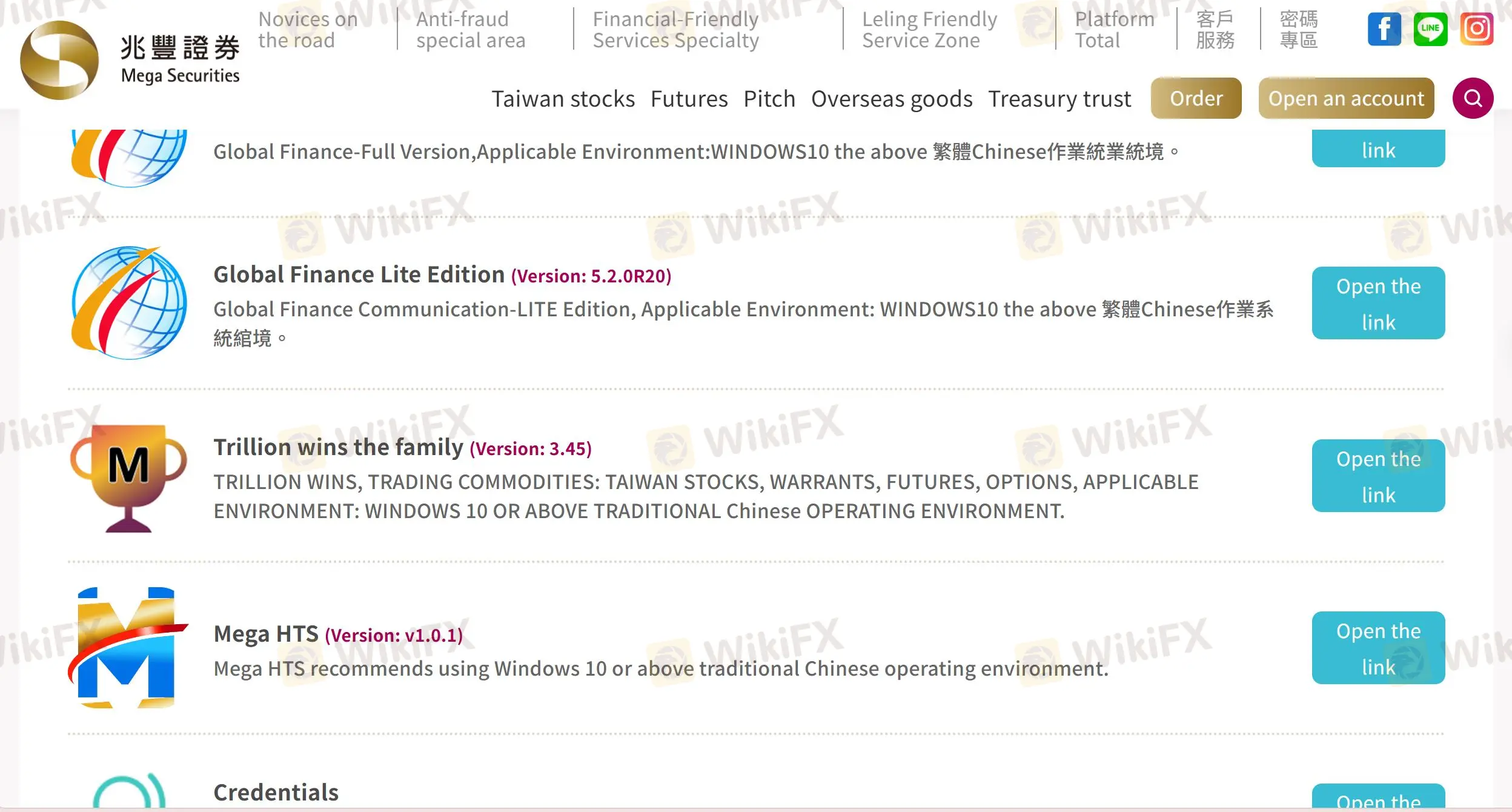

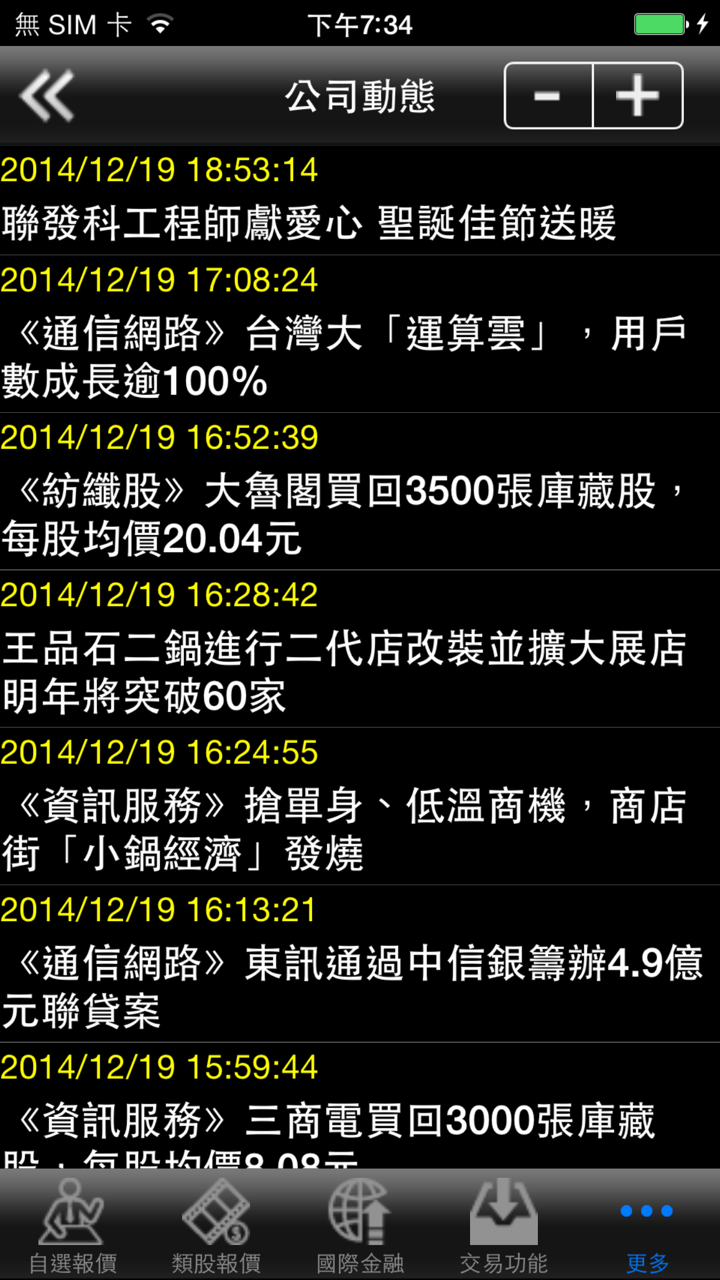

Mega Securities propose plusieurs types de plateformes, notamment Mega Fortune Securities, Global Finance, Trillion Wins, Mega HTS et Credentials.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Mega Fortune Securities | ✔ | Mobile | / |

| Global Finance | ✔ | PC | |

| Trillion Wins | ✔ | ||

| Mega HTS | ✔ | ||

| Credentials | ✔ |