Profil perusahaan

| Mega SecuritiesRingkasan Ulasan | |

| Didirikan | / |

| Negara/Daerah Terdaftar | China (Taiwan) |

| Regulasi | TPEx |

| Produk & Layanan | Saham, futures, manajemen keuangan, trust |

| Dukungan Pelanggan | Obrolan AI |

| Tel: (02)2351-7017; (02)4055-3355 | |

| Alamat: 台北市中正區忠孝東路二段95號 | |

Mega Securities terdaftar di Taiwan. Perusahaan ini mengkhususkan diri dalam saham, futures, manajemen keuangan, dan trust. Selain itu, perusahaan ini diatur oleh TPEx di Taiwan.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh TPEx | Struktur biaya yang tidak jelas |

| Banyak platform perdagangan |

Apakah Mega Securities Legal?

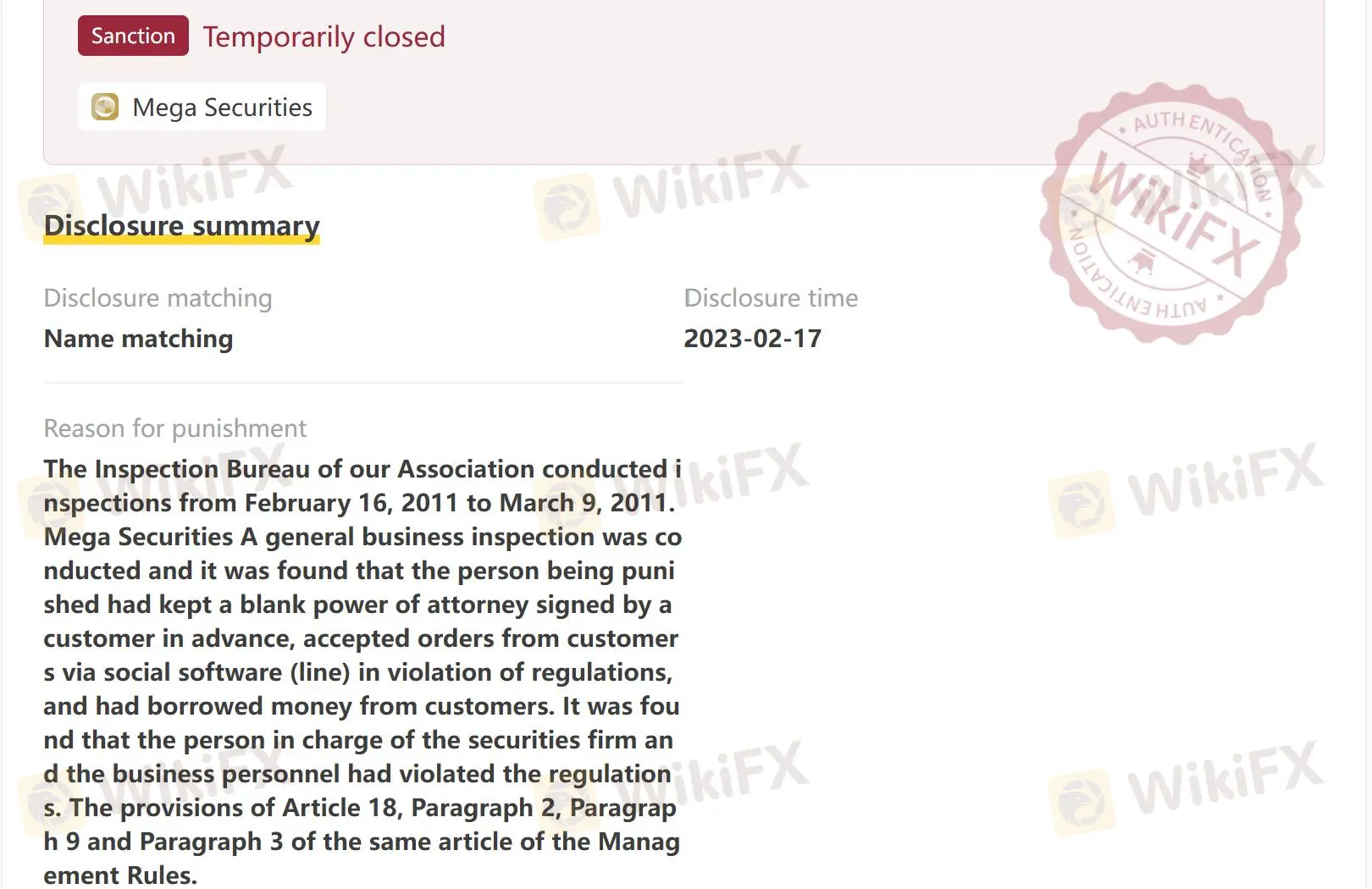

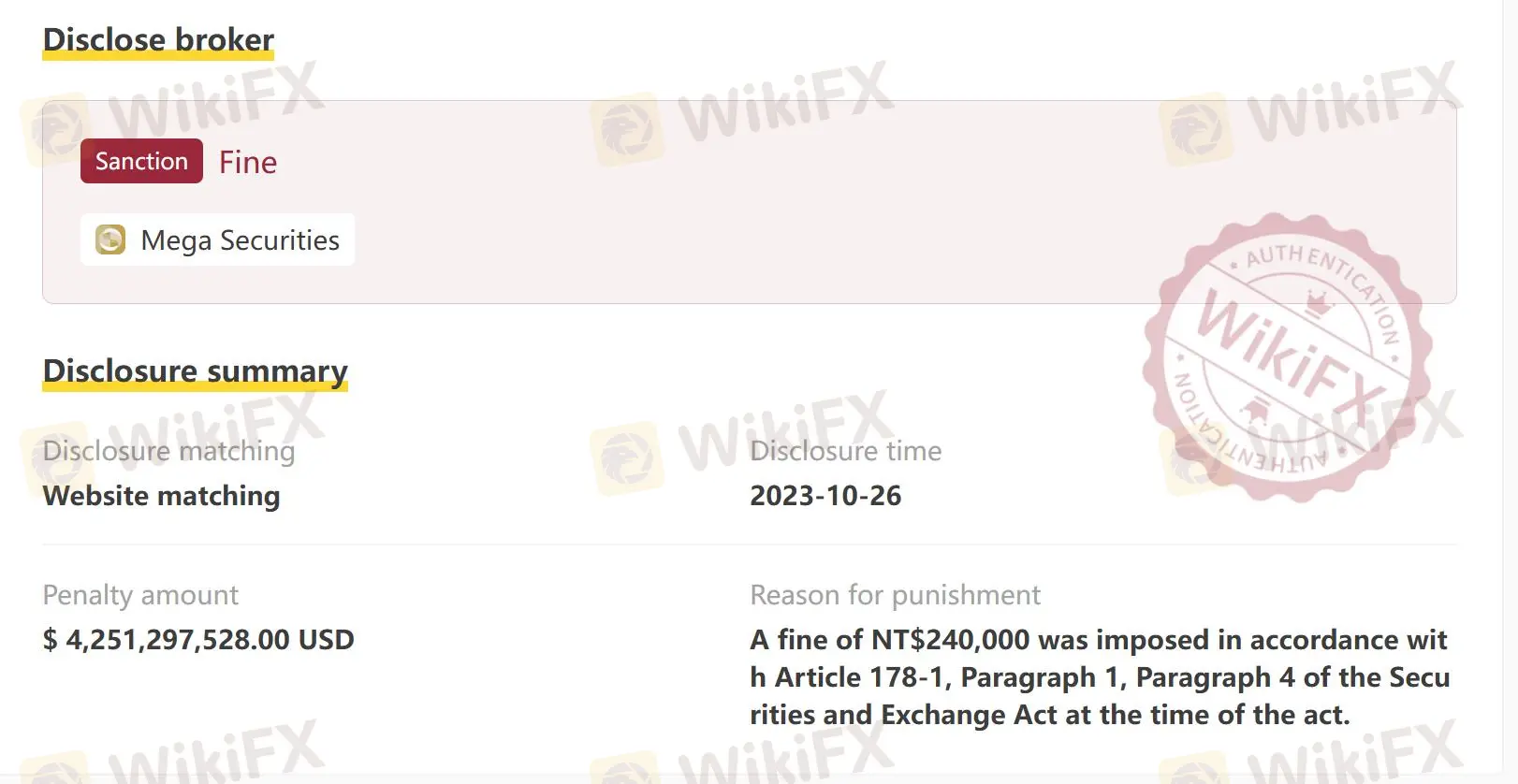

Ya, Mega Securities diatur oleh Bursa Taipei (TPEx). Namun, Biro Sekuritas dan Futures memberikan sanksi kepada Mega Securities dua kali. Harap waspada terhadap risiko potensial!

| Otoritas yang Diatur | Status Saat Ini | Negara yang Diatur | Jenis Lisensi | Nomor Lisensi |

| Bursa Taipei (TPEx) | Diatur | China (Taiwan) | Berurusan dengan sekuritas | Belum dirilis |

Survey Lapangan WikiFX

Tim survei lapangan WikiFX mengunjungi alamat regulasi Mega Securities di Taiwan, dan kami menemukan alamat fisiknya.

Apa yang Bisa Saya Perdagangkan di Mega Securities?

Mega Securities menyediakan perdagangan saham, futures, dan trust.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Saham | ✔ |

| Futures | ✔ |

| Trust | ✔ |

Platform Perdagangan

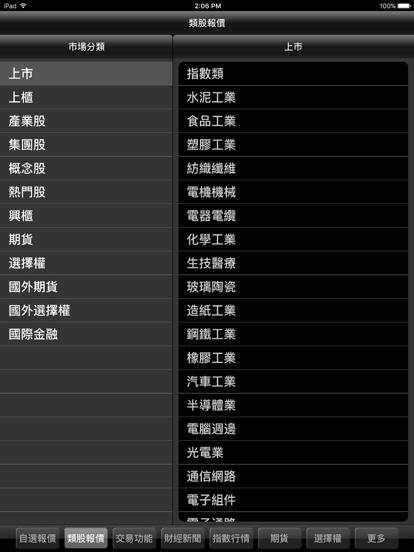

Mega Securities menyediakan beberapa jenis platform, termasuk Mega Fortune Securities, Global Finance, Trillion Wins, Mega HTS, dan Credentials.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Mega Fortune Securities | ✔ | Mobile | / |

| Global Finance | ✔ | PC | |

| Trillion Wins | ✔ | ||

| Mega HTS | ✔ | ||

| Credentials | ✔ |