Unternehmensprofil

| MGM Überprüfungszusammenfassung | |

| Gegründet | 2003 |

| Registriertes Land/Region | Pakistan |

| Regulierung | Nicht reguliert |

| Marktinstrumente | Aktienmakler, Aktienverwahrungsdienste, Unternehmensfinanzierung, Online-Aktienhandel |

| Demo-Konto | / |

| Hebelwirkung | / |

| Spread | / |

| Handelsplattform | KITS, Remote-Handelsterminals, Web-basiertes Handeln |

| Mindesteinzahlung | / |

| Kundensupport | Adresse: Raum Nr. G-10, Erdgeschoss, LSE Plaza, 19-Khyaban-e-Aiwan-e-Iqbal, Lahore |

| E-Mail: mgmsecurities@mgm-lse.com / mgmsecurities@yahoo.com / info@mgm-lse.com | |

| Telefon: 042-36279181-2 / 042-36280761 / 042-36310753 | |

| Handy: 0333-4296005 | |

MGM Informationen

Gegründet im Jahr 2003 und in Pakistan registriert, bietet MGM Unternehmensfinanzierung, Internet-Aktienhandel, Aktienhandel und Aktienverwahrungsdienste an. Trotz des breiten Leistungsspektrums unterliegt es keiner regulatorischen Überprüfung, was Anleger einem Risiko aussetzen könnte.

Vor- und Nachteile

| Vorteile | Nachteile |

| Bietet eine Vielzahl von Handelsdienstleistungen | Nicht reguliert |

| Bietet mehrere Plattformen für den Online-Handel | Keine Demo-Konten |

| Keine Informationen zu Gebühren |

Ist MGM seriös?

MGM ist in seinem registrierten Land Pakistan nicht reguliert und besitzt keine Lizenzen von anerkannten Regulierungsbehörden wie der FCA (UK) oder ASIC (Australien). Bitte beachten Sie das potenzielle Risiko.

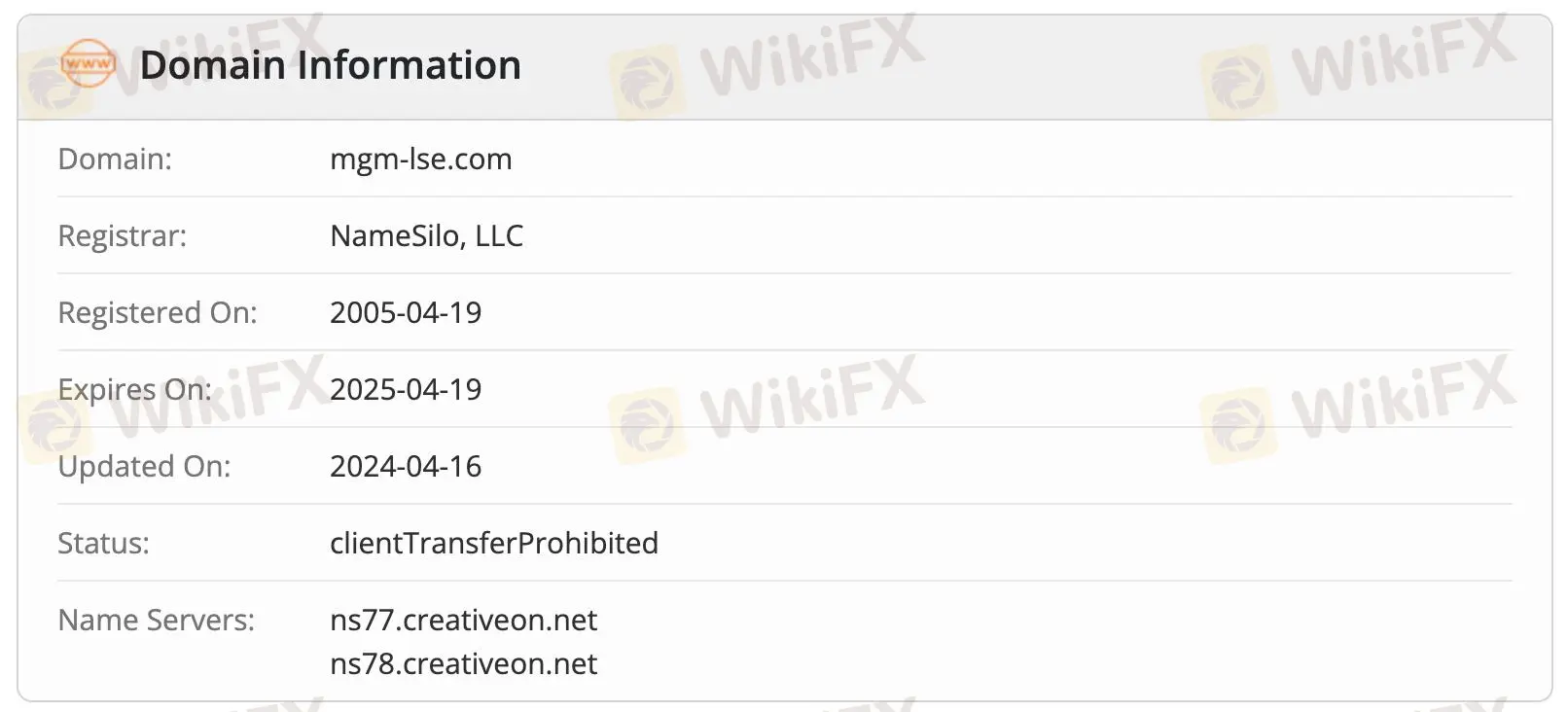

Mgm-lse.com wurde am 19. April 2005 registriert und befindet sich derzeit im Status "clientTransferProhibited", was auf eine eingeschränkte administrative Kontrolle hinweist.

Dienstleistungen von MGM

MGM bietet den Handel mit Aktien, Depotdienstleistungen, Unternehmensfinanzierung und den Online-Aktienhandel über verschiedene Plattformen an.

| Dienstleistungen | Unterstützt |

| Aktienhandel | ✔ |

| Depotdienstleistungen | ✔ |

| Unternehmensfinanzierung | ✔ |

| Online-Aktienhandel | ✔ |

| Remote-Trading-Terminals | ✔ |

| Webbasiertes Trading | ✔ |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Für welche Art von Händlern geeignet |

| KITS | ✔ | Desktop | Aktive Händler, die fortschrittliche Tools benötigen |

| Remote-Trading-Terminals | ✔ | Desktop | Institutionelle und professionelle Händler |

| Webbasiertes Trading | ✔ | Web (Browser) | Einzelhändler, die Bequemlichkeit und Flexibilität suchen |