Divulgation

D'énormes pertes causées par la recommandation défavorable de l'enseignant. Il y avait également des frais de traitement élevés.

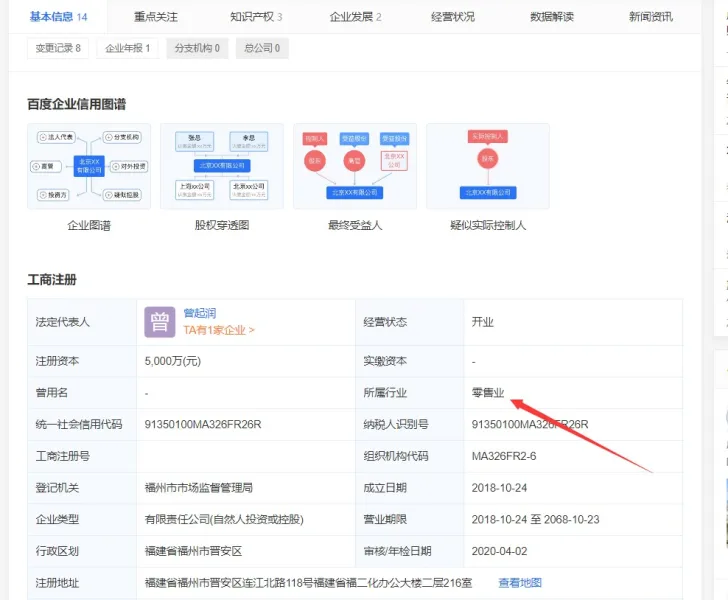

En juin 2018, le soi-disant vendeur de Shanghai Continental Futures m'a ajouté et m'a recommandé des actions. Puis il m'a incité à négocier des contrats à terme sur le continent car le marché boursier était volatil. Alors je me suis inscrit et j'ai transféré mon fonds. Après une opération fréquente d'un an, j'ai perdu près de 100 000 yuans, avec d'énormes frais de traitement. DALU a évité le fardeau du médiateur. Après enquête, j'ai découvert qu'il appartenait à un secteur de la vente au détail, Fujian Zhongsheng Hengji Industrial Co., Ltd., qui n'a aucune qualification pour s'engager dans des investissements. Pourquoi une telle entreprise peut-elle devenir un intermédiaire de la plate-forme à terme de Shanghai continentale?