Grundlegende Informationen

China

ChinaBewertung

China

|

5-10 Jahre

|

China

|

5-10 Jahre

| http://www.dlqh.com/

Website

Bewertungsindex

Einfluss

D

Einflussindex NO.1

Vereinigte Staaten 2.52

Vereinigte Staaten 2.52 Lizenzen

LizenzenLizenzierte Einheit:上海大陆期货有限公司

Lizenznummer:0188

China

China dlqh.com

dlqh.com China

China

| DALU Überprüfungszusammenfassung | |

| Gegründet | 2002 |

| Registriertes Land/Region | China |

| Regulierung | Reguliert durch CFFEX |

| Marktinstrument | Futures |

| Demo-Konto | / |

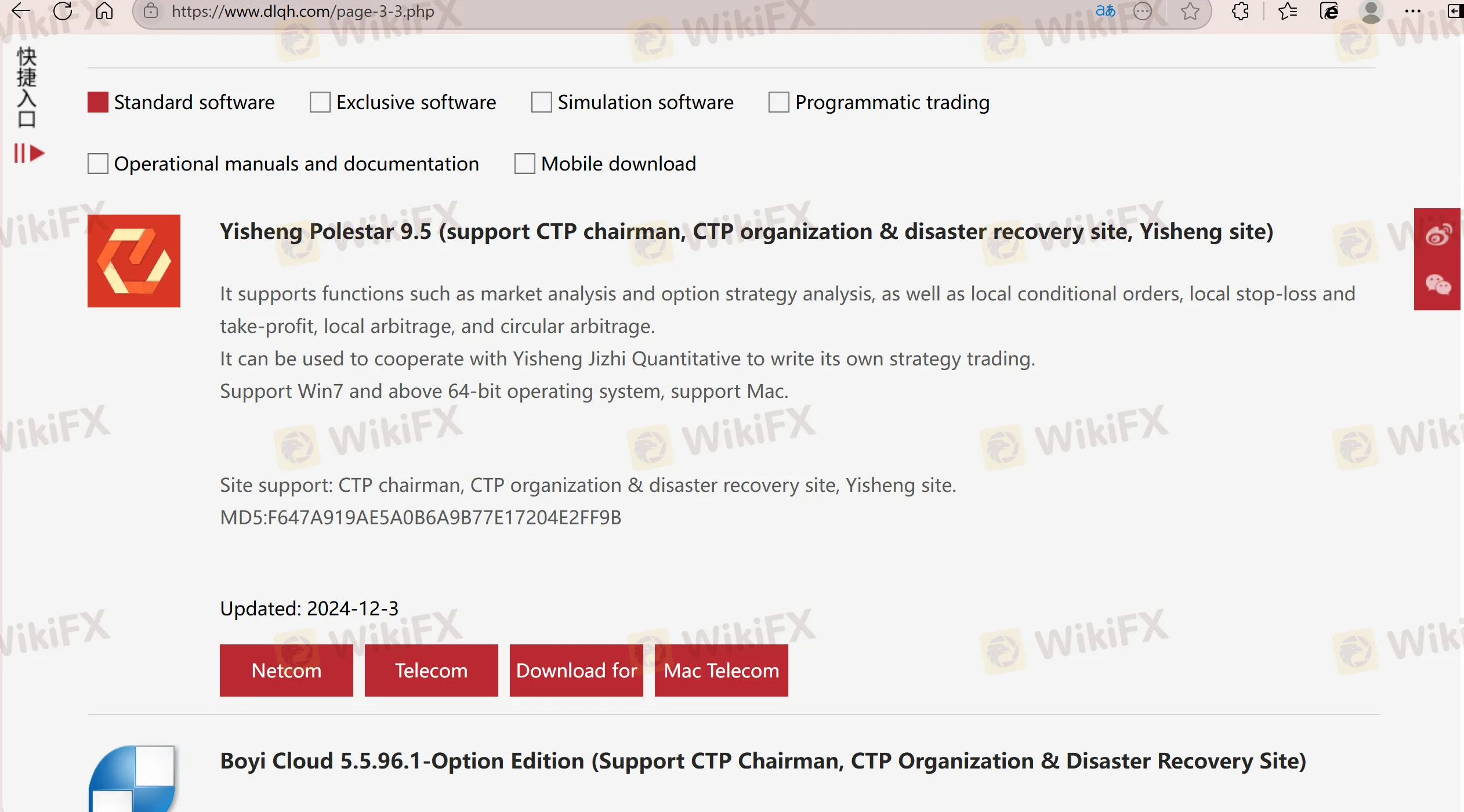

| Handelsplattform | Yisheng Polestar 9.5, Boyi Cloud, Continental Futures Infinity Pro, China Futures Express Online Trading, Wenhua Yingshun Cloud Market Software |

| Mindesteinzahlung | / |

| Kundensupport | Wechat, Weibo, 24/5 Kundenservice |

| Tel: 021-54071888 (Handel), 021-54071111 (Demat) | |

DALU ist ein regulierter Broker, der 2002 in China gegründet wurde. Er konzentriert sich hauptsächlich auf den Handel mit Futures und bietet verschiedene Arten von Futures-Handelsdienstleistungen an. Darüber hinaus wird er in China von CFFEX reguliert.

| Vorteile | Nachteile |

| Gut reguliert | Keine Informationen zur Mindesteinzahlung |

| Lange Betriebszeiten | |

| Verschiedene Kanäle für den Kundensupport |

Ja. DALU ist von der CFFEX mit der Lizenznummer 0188 lizenziert, um Dienstleistungen anzubieten.

| Regulierungsbehörde | Aktueller Status | Reguliertes Land | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| China Financial Futures Exchange (CFFEX) | Reguliert | China | 上海大陆期货有限公司 | Futures-Lizenz | 0188 |

| Handelswerte | Unterstützt |

| Futures | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| Yisheng Polestar 9.5 | ✔ | Mobile |

| Boyi Cloud | ✔ | Mobile |

| Continental Futures Infinity Pro | ✔ | Mobile |

| China Futures Express Online Trading | ✔ | Mobile |

| Wenhua Yingshun Cloud Market Software | ✔ | Mobile |

In my experience as a trader assessing DALU, there are several important risks and drawbacks I need to carefully consider before engaging with them. First, although DALU operates under a China Financial Futures Exchange (CFFEX) futures license and has been active for over five years, its business scope has been marked as suspicious. For me, this signals the need for heightened vigilance regarding how their services are structured or marketed. Also, DALU focuses exclusively on futures trading rather than broader forex, commodities, or equity markets, which may not suit those who prefer portfolio diversification. Another key risk comes from user reports highlighting significant personal losses, high handling fees, and troubling interactions with intermediaries. I noticed detailed accounts of aggressive promotion, pressure to increase deposits, and an apparent lack of accountability when problems arose—such as being steered towards high-risk trades by sales staff or analysts. From my perspective, any environment where guidance is incentive-driven rather than transparent increases my caution, especially if withdrawal processes become problematic or if communication turns unprofessional once I question their practices. Finally, DALU's minimum deposit requirements and some operational details remain unclear. Lack of fee transparency and the potential for third-party involvement increase the overall risk for me. Therefore, while DALU is technically regulated, I must remain conservative, skeptical of promised returns, and completely clear about all costs and withdrawal procedures before considering any engagement.

As someone who has been independently trading and reviewing brokers for many years, I pay particular attention to transparency around fees, especially regarding deposits and withdrawals. After evaluating DALU, I found that their WikiFX profile does not explicitly mention policies or charges related to deposit or withdrawal fees. This absence of clear information can be a concern for traders like myself, as undisclosed costs can significantly impact the overall trading experience and financial results. Moreover, I noted user complaints referencing high handling fees, although these seem primarily related to trading activities rather than transactional fees tied to deposits or withdrawals. From my experience, when a broker does not clarify its fee structure up front, caution is warranted. Lack of transparency increases the risk of encountering unforeseen charges, which is something I have seen cause frustration and loss among traders in the past. Given DALU’s regulatory status and operating history, I would expect a reasonable standard of disclosure. However, until I receive comprehensive, official documentation or satisfactory clarification from their support channels, I cannot rule out the possibility of hidden costs on deposits or withdrawals. For my own trading, I would only proceed with significant caution and would insist on getting written confirmation of all fees before funding an account. Responsible risk management means not making assumptions about broker costs.

Based on my personal experience as a trader reviewing DALU's available information, I found that DALU is not a forex broker and does not provide trading in major forex pairs. Instead, DALU is a China-based, CFFEX-regulated broker with a strong focus on futures trading. They offer various domestic futures products but do not list forex, commodities, indices, stocks, cryptos, or other common asset classes outside of futures. As leverage is a central point of concern for risk management in any trading strategy, I always verify precisely what instruments are available and what margin policies are in place. In DALU’s case, there is no information on the provision of leverage for forex trading, simply because forex trading isn’t supported. For the futures products they do offer, leverage parameters can differ based on the contract type and prevailing exchange regulations, but those specifics are not openly disclosed on their platform overview. This absence of forex and undisclosed leverage details for supported futures is important for any trader to consider. Leverage can be both an effective tool and a potential risk, so full transparency on asset coverage and actual margin requirements is essential for me before opening an account or allocating funds. Given these limitations, I approach DALU with caution, focusing only on regulated futures trading and carefully scrutinizing any asset or leverage claims presented by intermediaries or sales staff.

Based on my analysis and direct review of DALU, I found there isn’t clear, publicly available information regarding their overnight financing (swap) fees. As a trader who prioritizes transparency and careful cost management, I’ve learned that access to detailed cost structures is essential when evaluating brokers, especially for frequent or leveraged trading. In DALU’s case, the absence of readily accessible data about overnight fees poses a challenge. For me, this lack of disclosure makes it very difficult to compare DALU’s swap fees objectively with those of other well-known international brokers, many of whom make these charges transparent prior to account opening. My experience has taught me that overnight financing fees can significantly impact the net profitability of certain strategies, particularly in products with higher leverage or long holding periods. Given that user reviews for DALU mention high handling fees and dissatisfaction with fee explanations, I would approach any use of their trading platform with caution until precise swap fee information is obtained in writing, directly from support or official documentation. In summary, my professional judgment is that without transparent overnight fee details, I can’t confidently rate DALU’s swaps as competitive or fair relative to peers, and I would require much greater clarity before committing significant capital to their services.

Bitte eingeben...

TOP

TOP

Chrome

Chrome Plug-In

Aufsichtsrechtliche Anfrage zu globalen Forex-Brokern

Es durchsucht die Forex-Broker-Websites und identifiziert die legitimen und betrügerischen Broker genau

Jetzt installieren