مقدمة عن الشركة

| DALU ملخص المراجعة | |

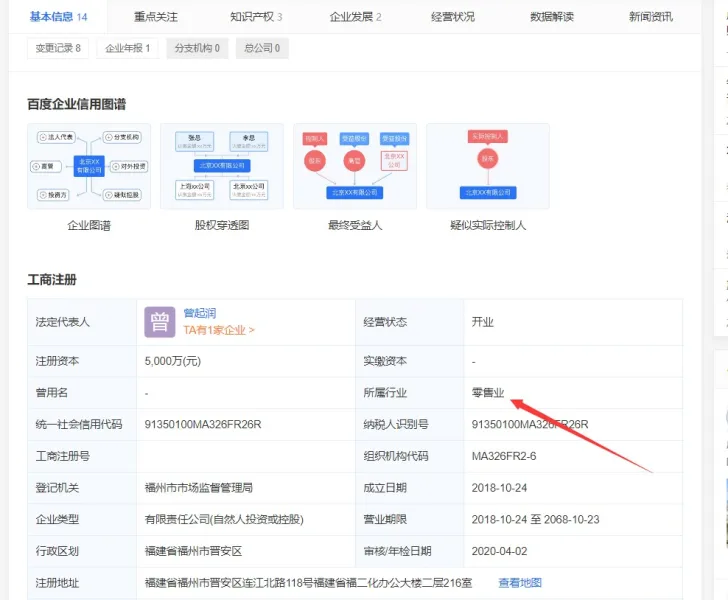

| تأسست | ٢٠٠٢ |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | منظم بواسطة CFFEX |

| صكوك السوق | العقود الآجلة |

| حساب تجريبي | / |

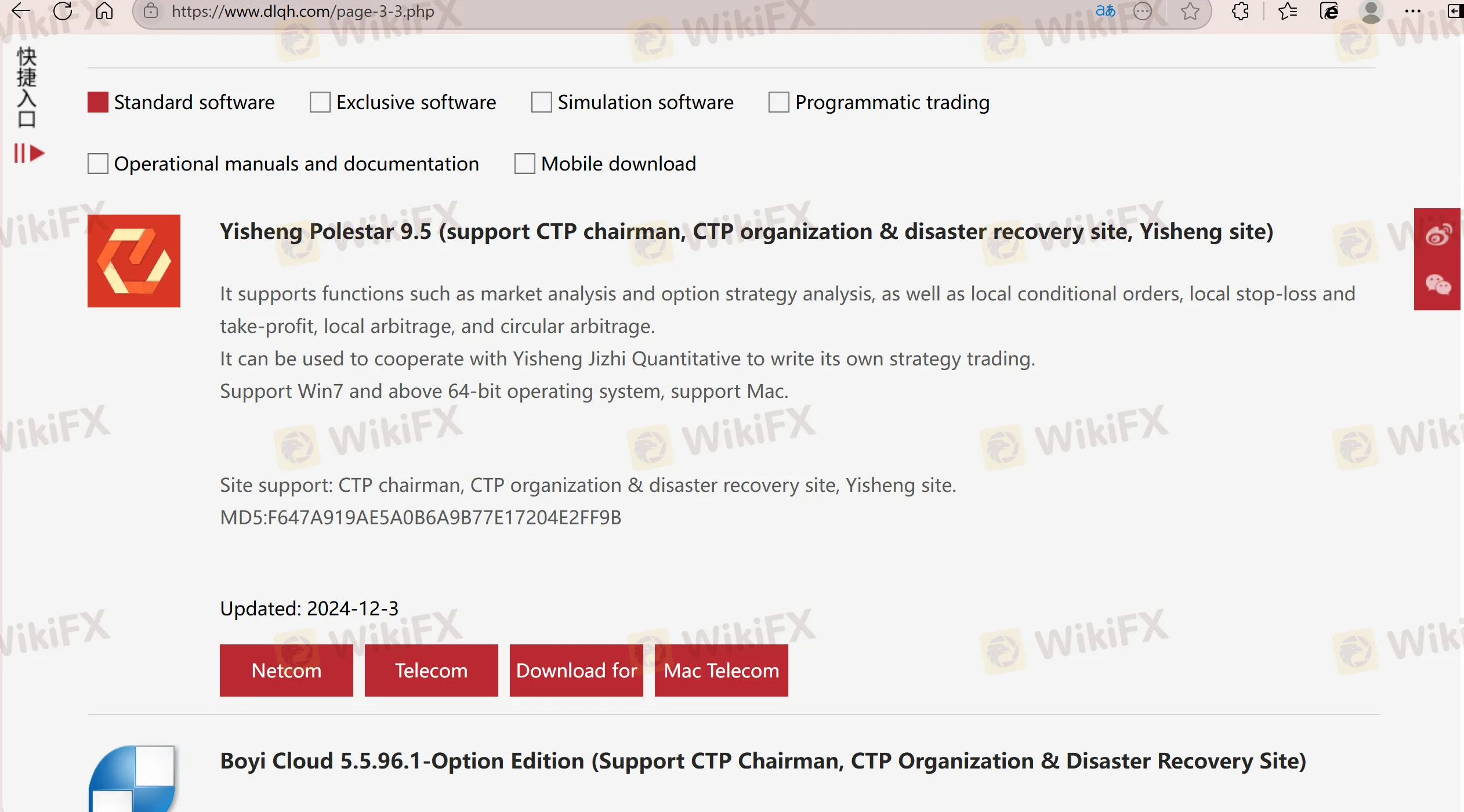

| منصة التداول | Yisheng Polestar 9.5، Boyi Cloud، Continental Futures Infinity Pro، China Futures Express Online Trading، Wenhua Yingshun Cloud Market Software |

| الحد الأدنى للإيداع | / |

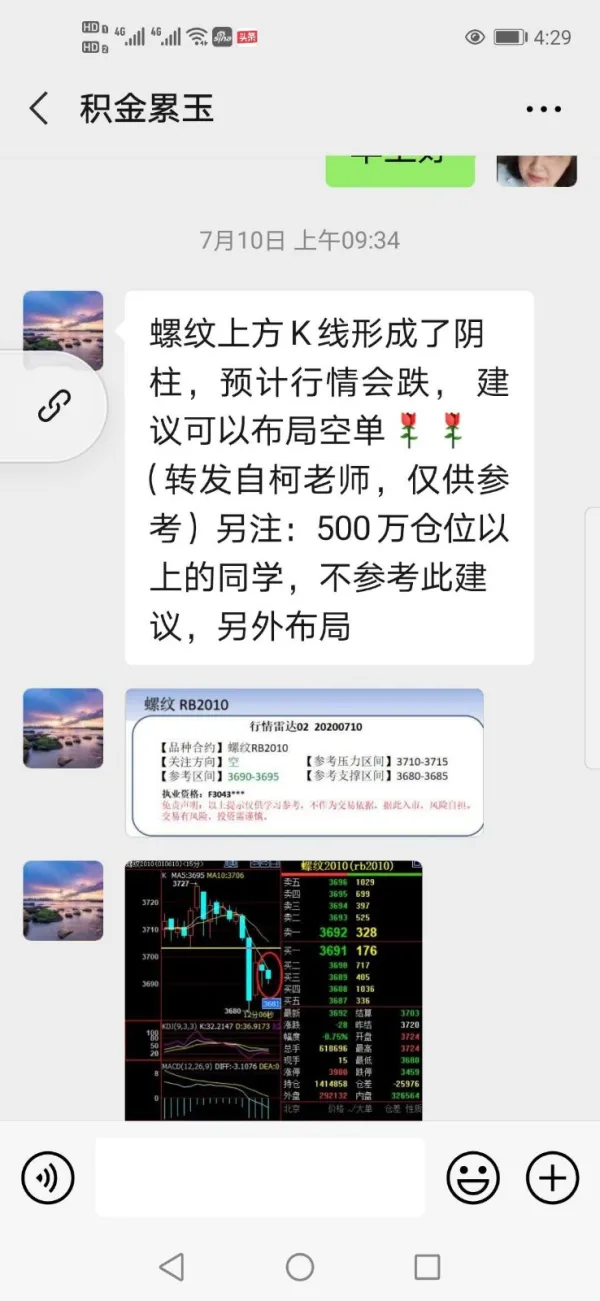

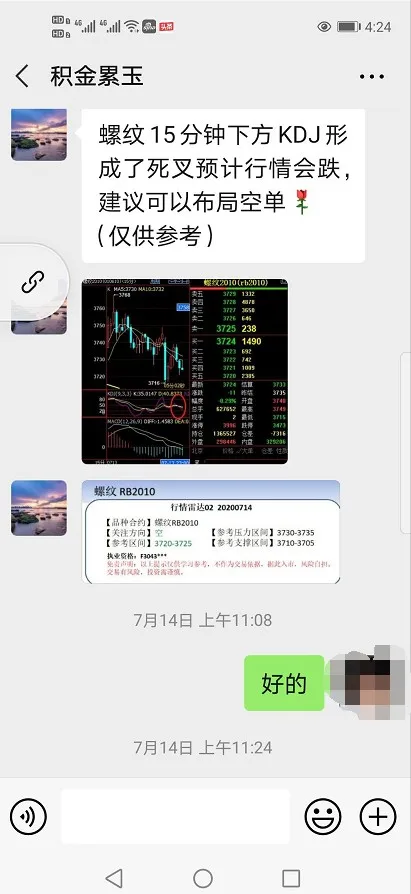

| دعم العملاء | Wechat، Weibo، خدمة عملاء على مدار 24/5 |

| هاتف: 021-54071888 (التداول)، 021-54071111 (المحفظة) | |

معلومات DALU

DALU هو وسيط مرخص، تأسس في عام ٢٠٠٢ في الصين. يركز بشكل رئيسي على تداول العقود الآجلة، ويقدم أنواعًا مختلفة من خدمات تداول العقود الآجلة. بالإضافة إلى ذلك، يتم تنظيمه بواسطة CFFEX في الصين.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تنظيم جيدًا | لا توجد معلومات عن الحد الأدنى للإيداع |

| وقت تشغيل طويل | |

| قنوات متنوعة لدعم العملاء |

هل DALU شرعي؟

نعم. DALU مرخصة من قبل CFFEX برقم ترخيص 0188 لتقديم الخدمات.

| الهيئة التنظيمية | الحالة الحالية | الدولة المنظمة | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| بورصة العقود الآجلة المالية الصينية (CFFEX) | منظم | الصين | 上海大陆期货有限公司 | ترخيص العقود الآجلة | 0188 |

ما الذي يمكنني التداول به على DALU؟

| أصول التداول | مدعوم |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

| منصة التداول | مدعوم | الأجهزة المتاحة |

| Yisheng Polestar 9.5 | ✔ | الجوال |

| Boyi Cloud | ✔ | الجوال |

| Continental Futures Infinity Pro | ✔ | الجوال |

| China Futures Express Online Trading | ✔ | الجوال |

| Wenhua Yingshun Cloud Market Software | ✔ | الجوال |