Présentation de l'entreprise

| TF SECURITIES Résumé de l'examen | |

| Fondé | 2003-11-19 |

| Pays/Région d'enregistrement | Chine |

| Réglementation | Non réglementé |

| Services et produits | Services de recherche, Banque d'investissement, Gestion de patrimoine, Gestion d'actifs, Activités à l'étranger, Trading propriétaire, Capital-investissement et capital-risque, Investissement alternatif et contrats à terme |

| Assistance clientèle | 95391; 400-800-5000 |

| Chat en ligne | |

TF SECURITIES Informations

TF SECURITIES a été créé en 2000, avec son siège social situé à Wuhan, dans la province du Hubei. En tant qu'institution financière complète, elle propose un système de services riche, diversifié et distinctif.

Elle offre aux entreprises diverses des services de financement par actions, de fusions et acquisitions, de restructuration, de financement obligataire et de conseil financier diversifié. Son champ d'activité comprend non seulement des projets traditionnels tels que des introductions en bourse de actions, des placements privés, des obligations d'entreprise, des obligations d'entreprise et des acquisitions d'actifs majeures, mais également des activités innovantes telles que des obligations privées pour les petites et moyennes entreprises, la titrisation d'actifs et les actions privilégiées.

Avantages et inconvénients

| Avantages | Inconvénients |

| Champ d'activité diversifié | Non réglementé |

| Contexte lié au gouvernement | Concurrence intense sur le marché |

TF SECURITIES est-il légitime ?

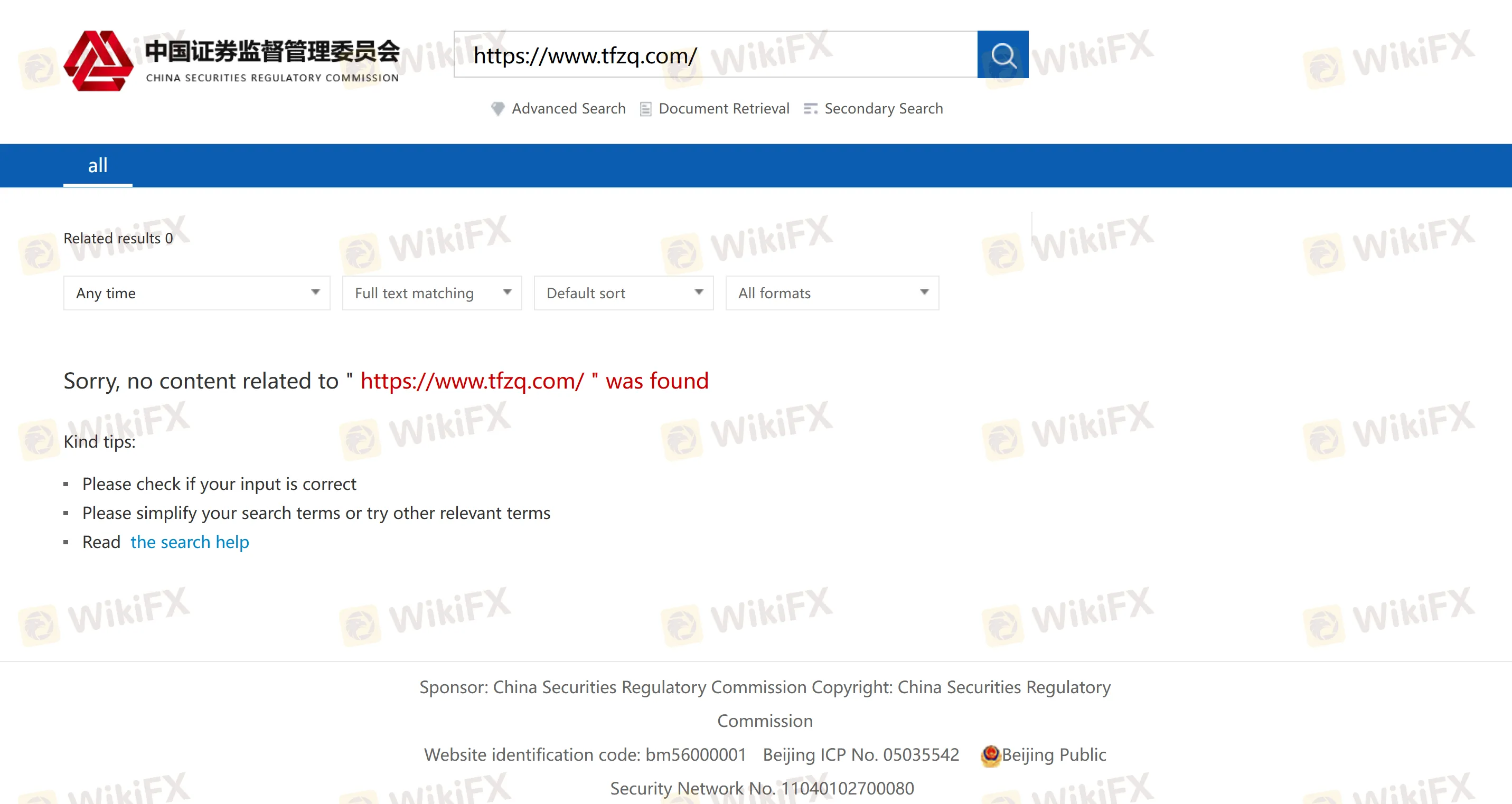

Il y a des doutes sur la légitimité de TF SECURITIES. La société est cotée à la Bourse de Shanghai. Bien que la société de valeurs mobilières prétende répondre à des exigences strictes en matière de cotation et soit supervisée par la Commission de réglementation des valeurs mobilières de Chine (CSRC) et d'autres autorités de réglementation, aucune information pertinente ne peut être trouvée sur le site officiel de la CSRC.

Quels services TF SECURITIES propose-t-il ?

TF SECURITIES propose une variété de services, notamment des services de recherche, de banque d'investissement, de gestion de patrimoine, de gestion d'actifs, d'activités à l'étranger, de trading propriétaire, de capital-investissement et de capital-risque, d'investissement alternatif et de contrats à terme.

Comment ouvrir un compte ?

TF SECURITIES permet l'ouverture de compte par téléphone mobile. Vous pouvez soit prendre des photos de votre carte d'identité avec votre téléphone portable, soit passer par une vérification vidéo. Les photos de la carte d'identité seront automatiquement lues, et cela peut être fait sous un réseau Wi-Fi ou 4G.