Présentation de l'entreprise

| Pictet Résumé de l'examen | |

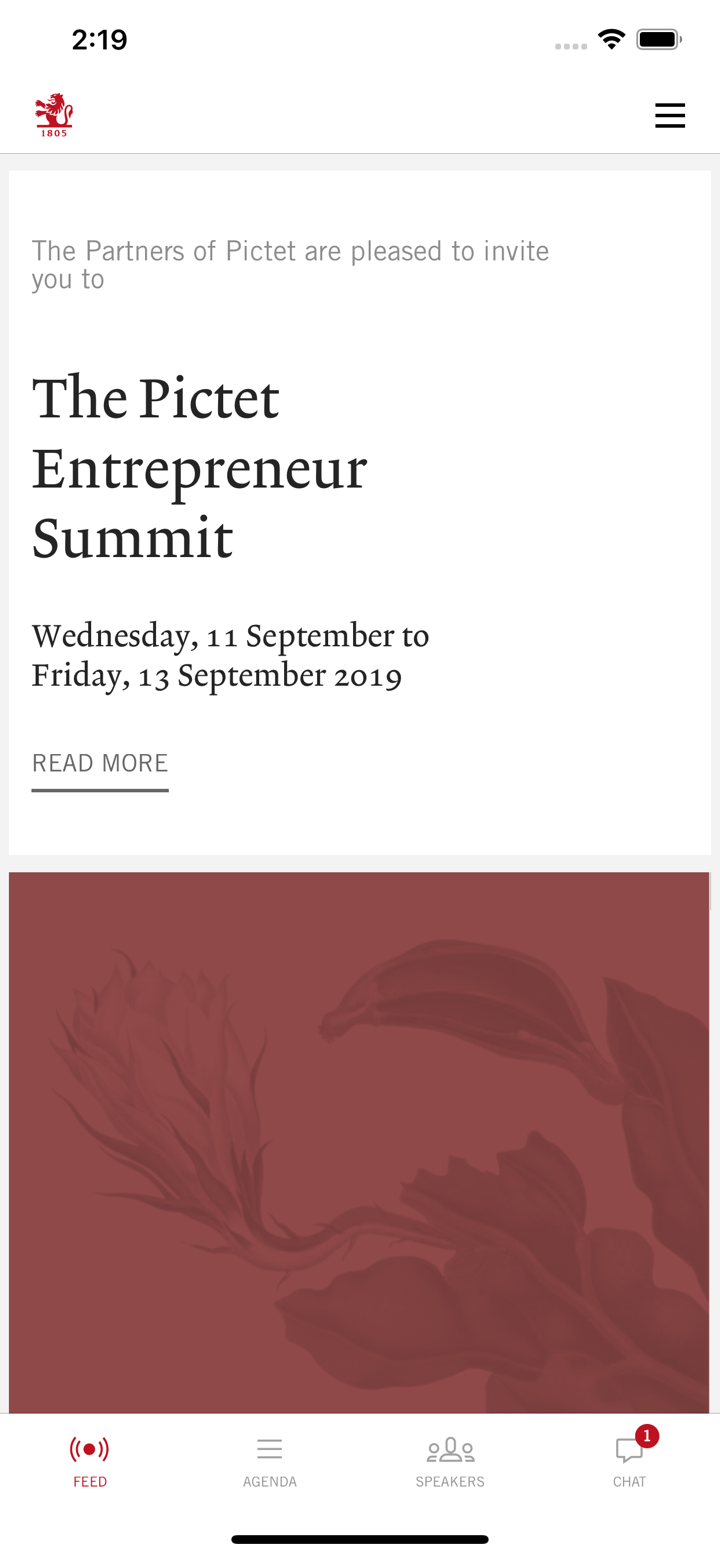

| Fondé | 1805 |

| Pays/Région d'enregistrement | Suisse |

| Régulation | SFC |

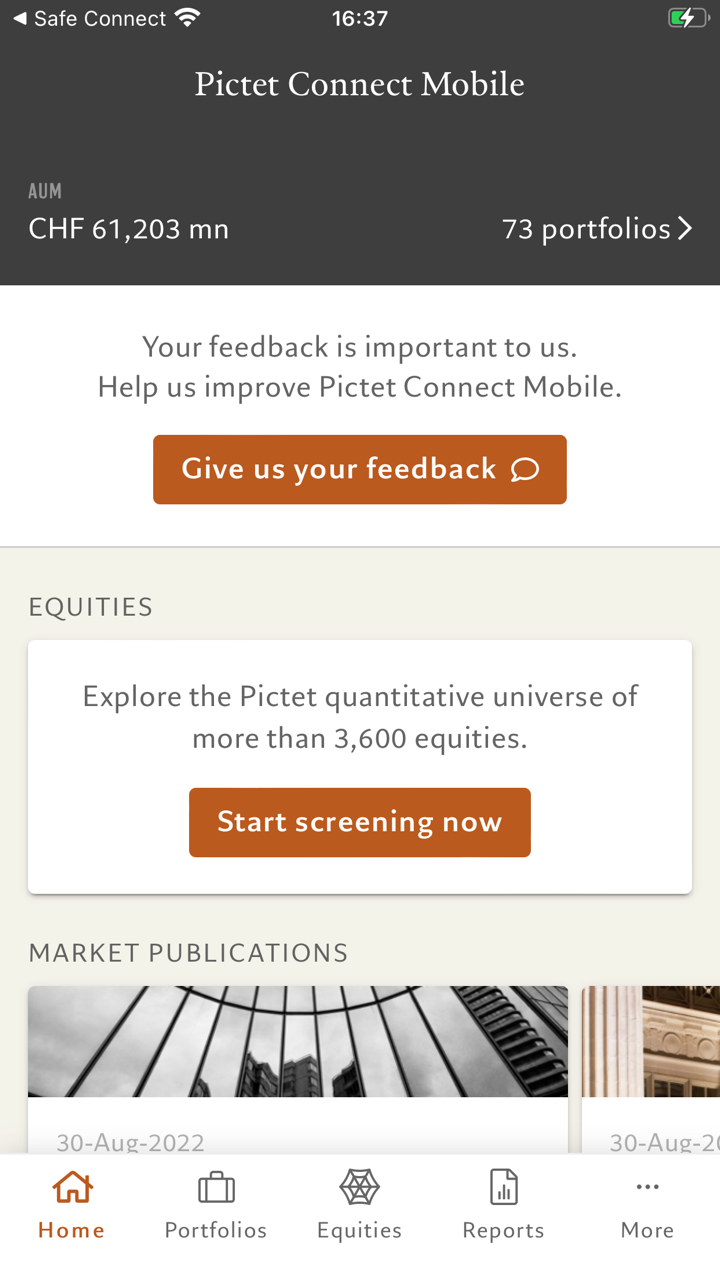

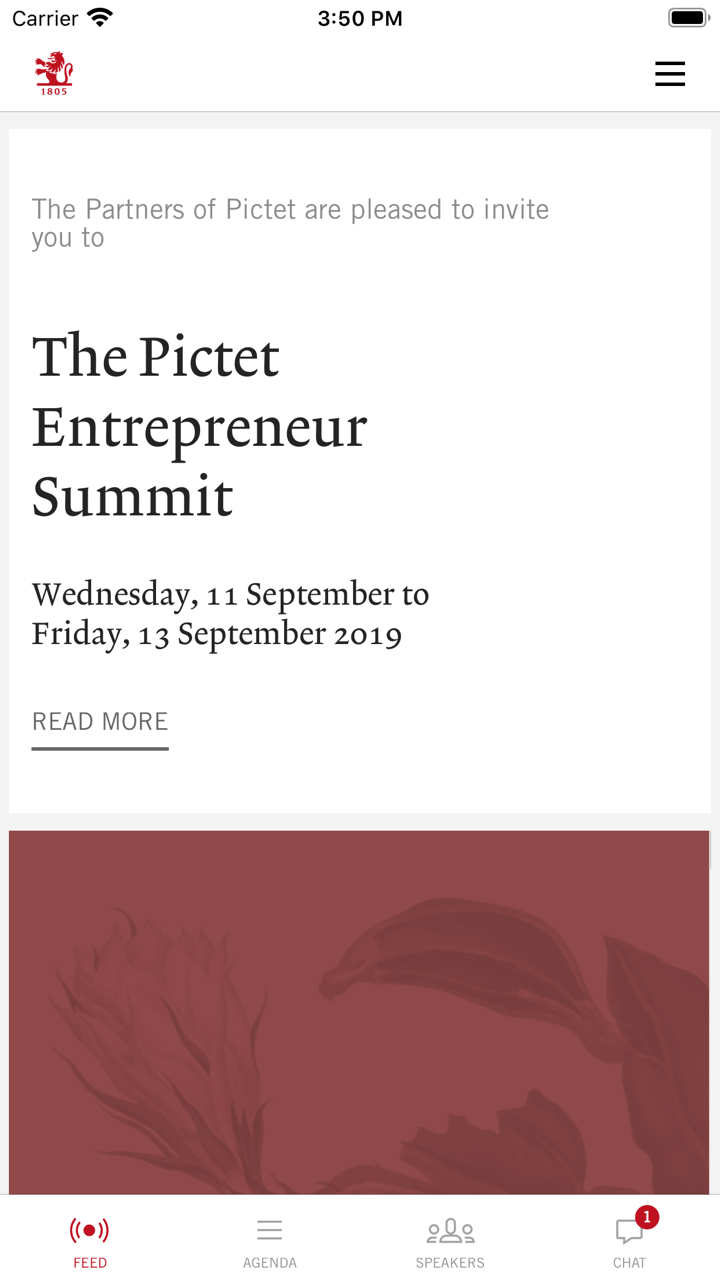

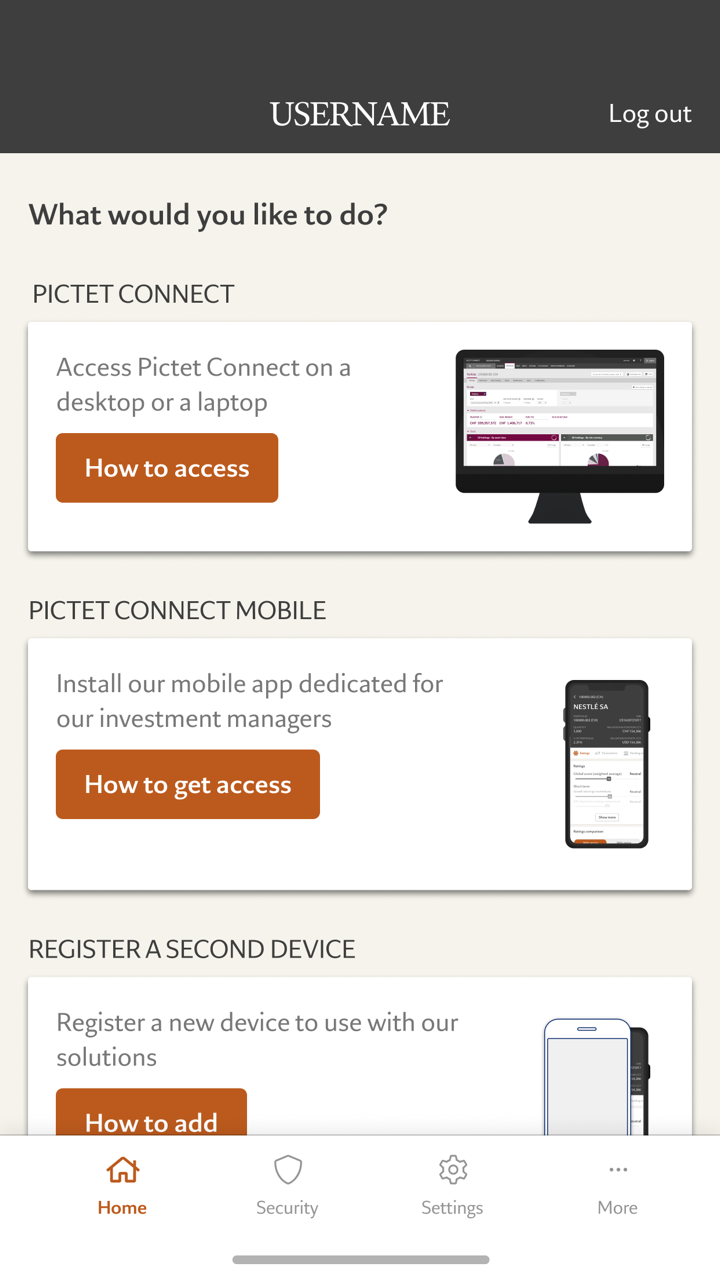

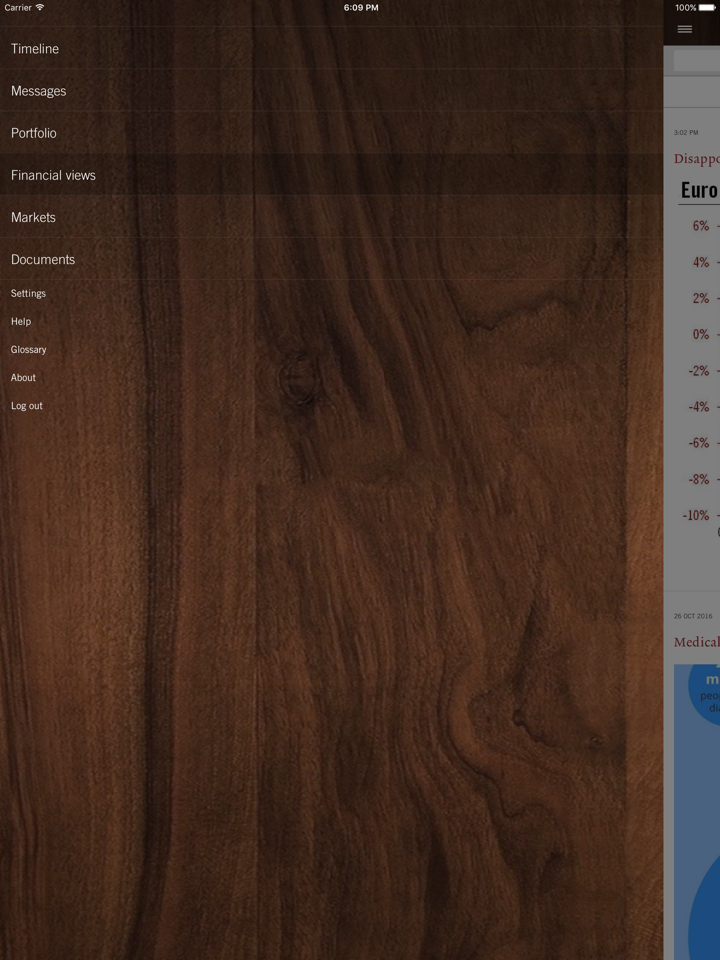

| Services | Gestion de patrimoine, gestion d'actifs, investissements alternatifs, services d'actifs |

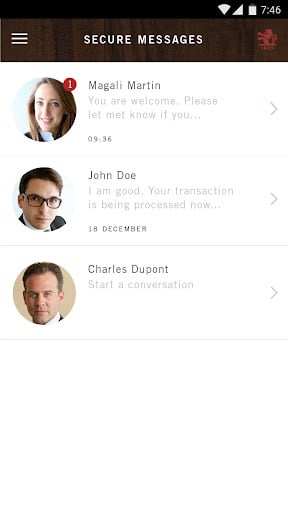

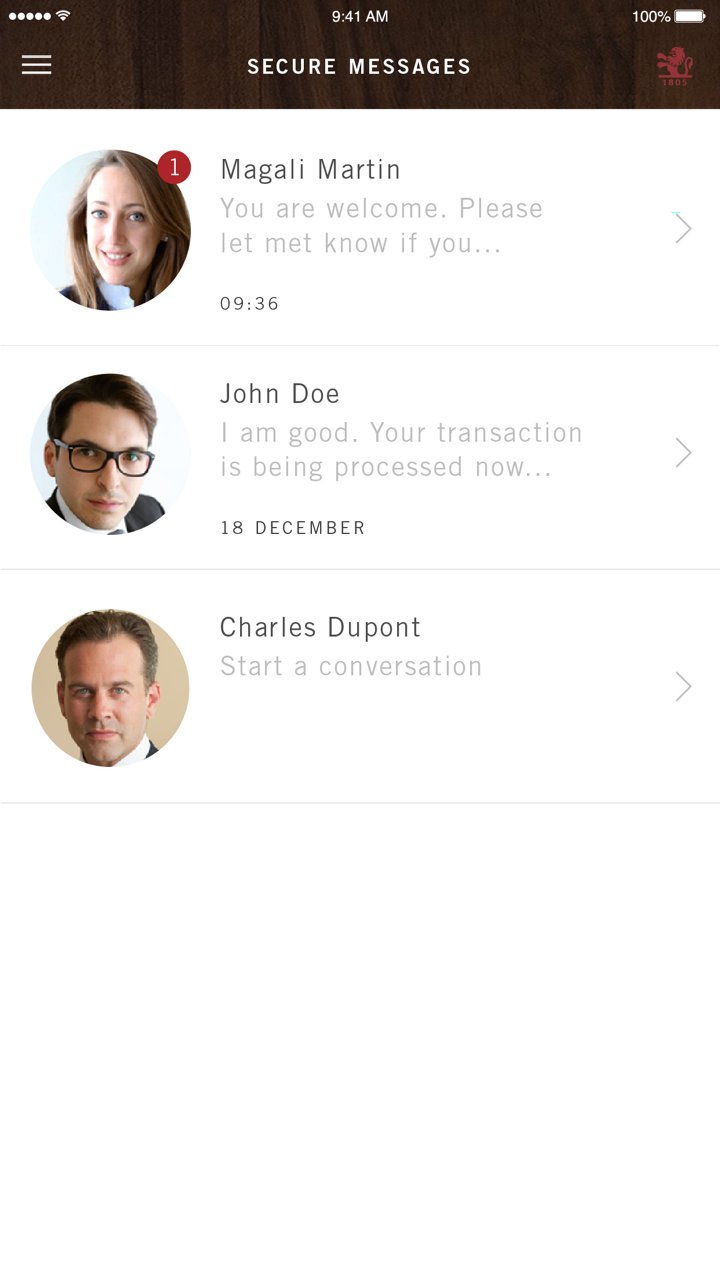

| Support client | Tél : +41 58 323 23 23Tél. : +852 3191 1805 |

| Fax : +852 3191 1808 | |

Informations sur Pictet

Pictet, fondé en 1805 et basé en Suisse, est réglementé par la SFC. Ils proposent des services de gestion de patrimoine, de gestion d'actifs, d'investissements alternatifs et de services d'actifs, avec un support client disponible par téléphone et fax.

Avantages et Inconvénients

| Avantages | Inconvénients |

|

|

|

Pictet est-il légitime ?

Pictet détient une licence "Dealing in futures contracts" réglementée par la Securities and Futures Commission (SFC) à Hong Kong avec un numéro de licence AAG715.

Pour qui travaille Pictet ?

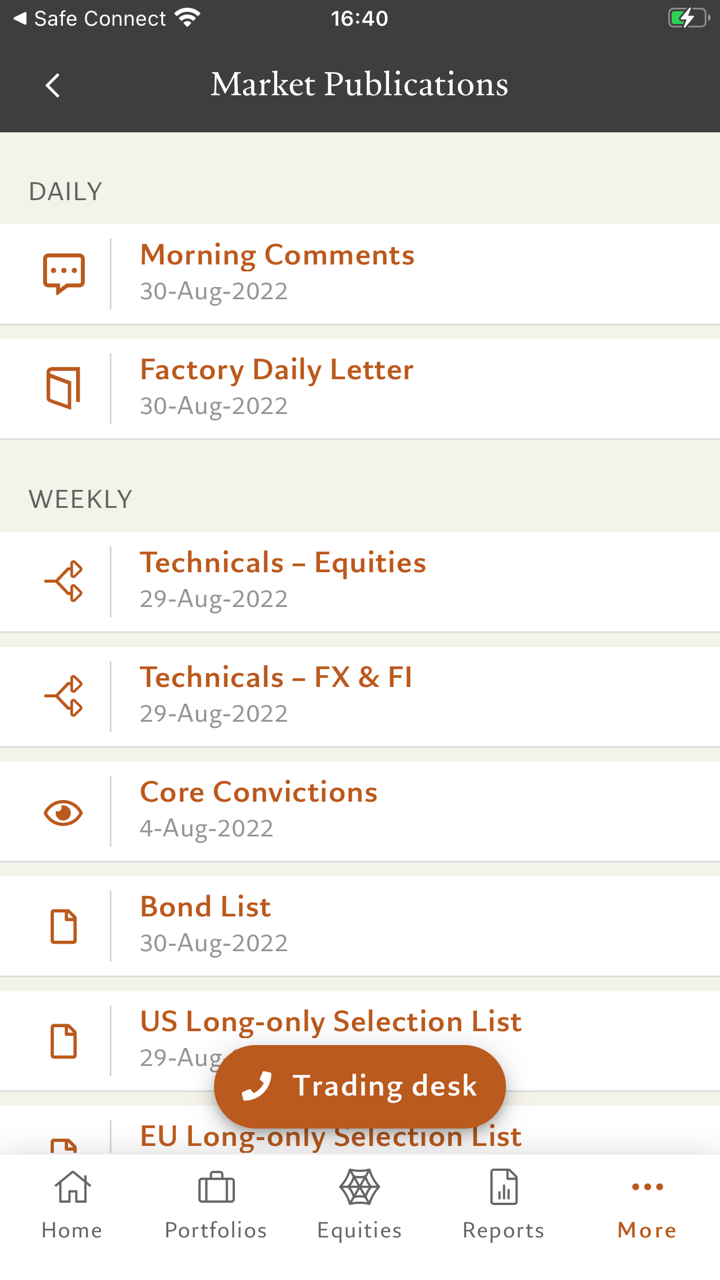

- Particuliers et familles: Pictet propose des fonds pour aider les institutions financières et les intermédiaires à atteindre les objectifs d'investissement de leurs clients, tout en fournissant des solutions de service pour simplifier l'administration, le trading et les rapports.

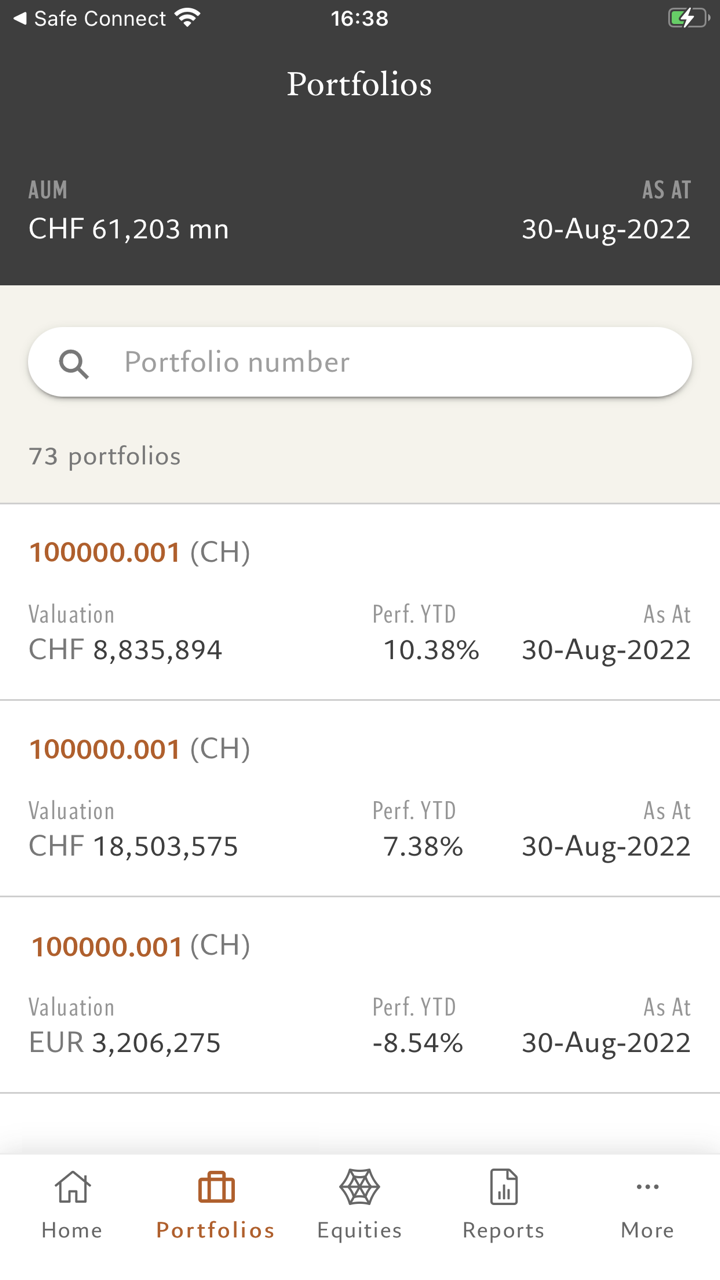

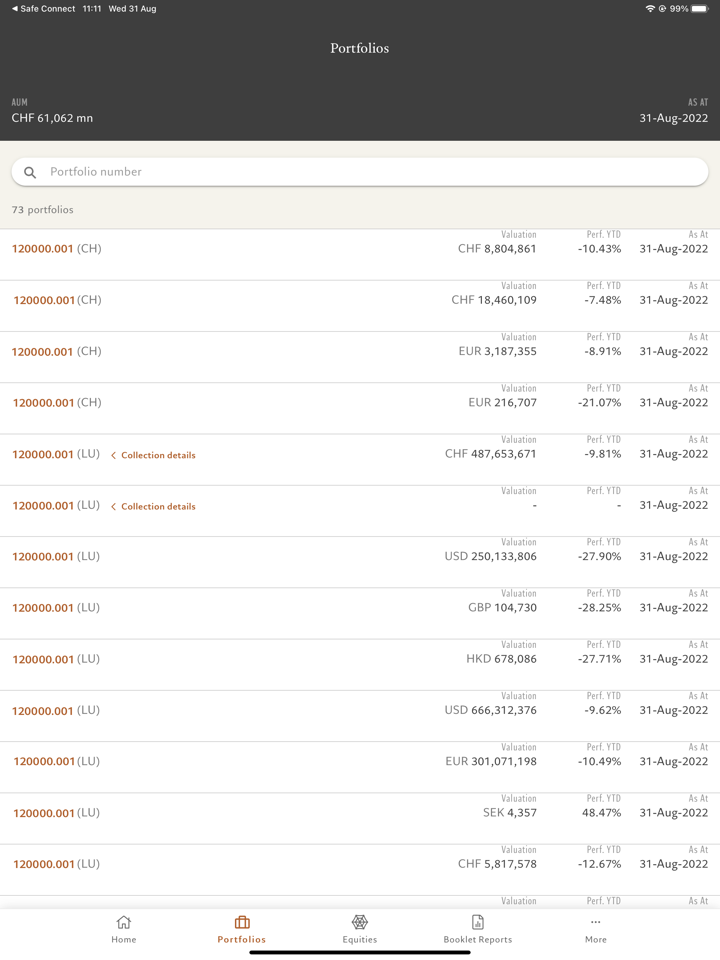

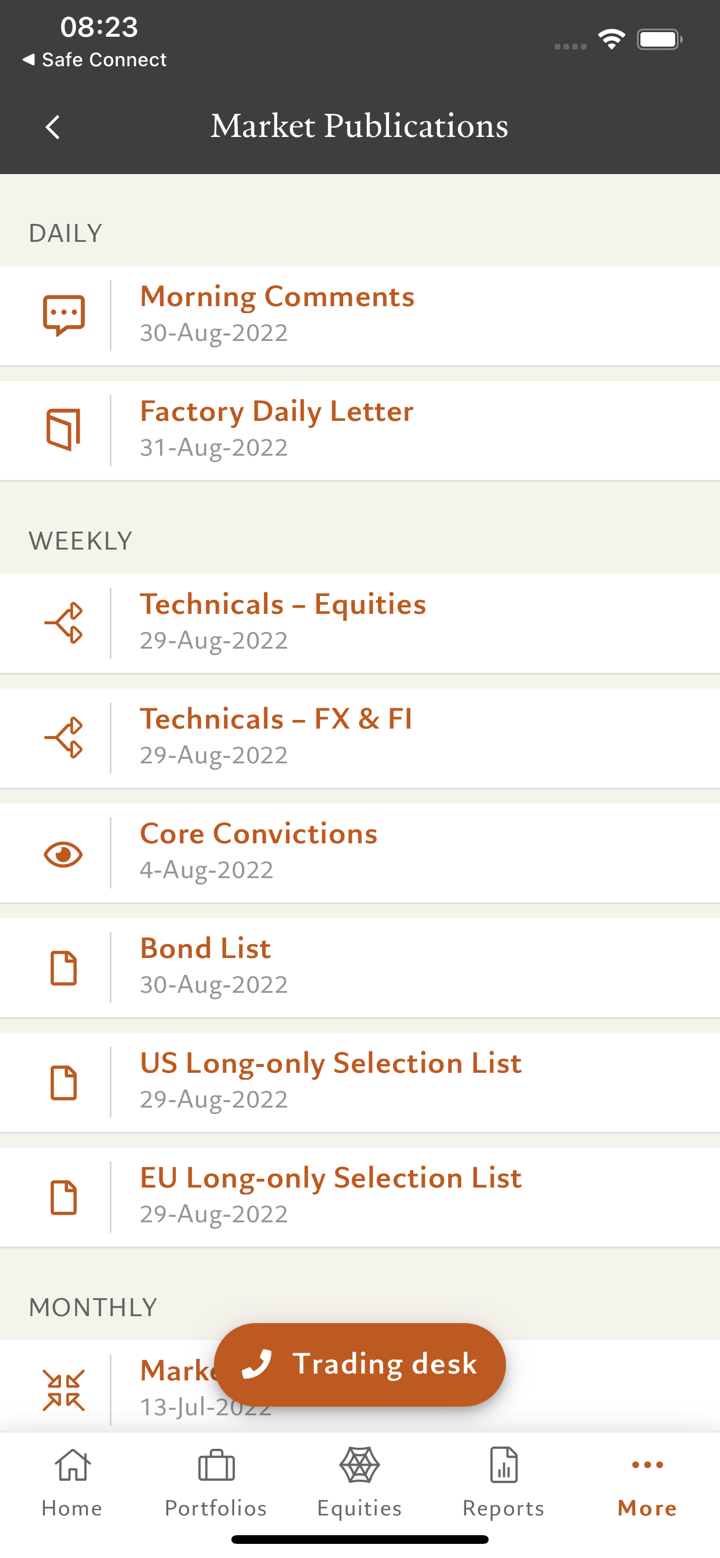

- Institutions financières et intermédiaires: Pictet propose des fonds pour aider les institutions financières et les intermédiaires à atteindre les objectifs d'investissement de leurs clients. Ils fournissent également des solutions de service pour simplifier les processus d'administration, de trading et de reporting.

- Investisseurs institutionnels: Pictet propose des stratégies d'investissement et des solutions de service aux principaux investisseurs institutionnels à l'échelle mondiale, y compris les fonds de pension, les dotations et les fonds souverains.

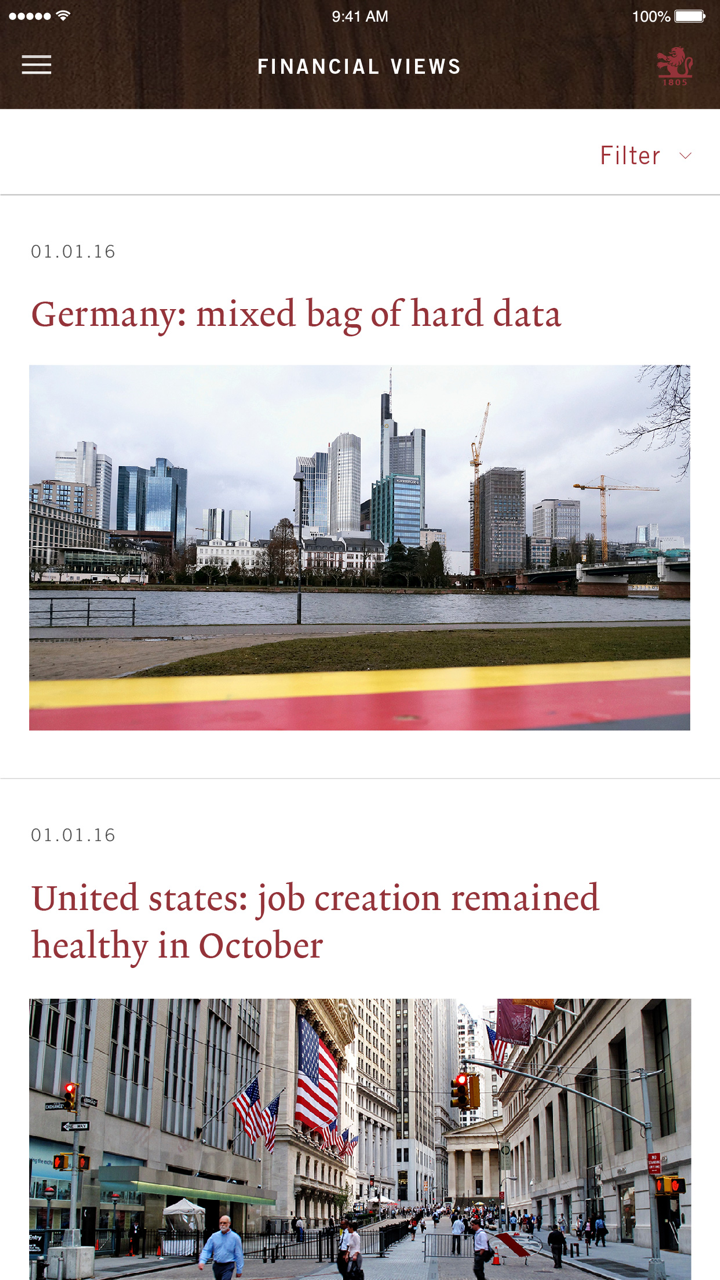

Que fait Pictet ?

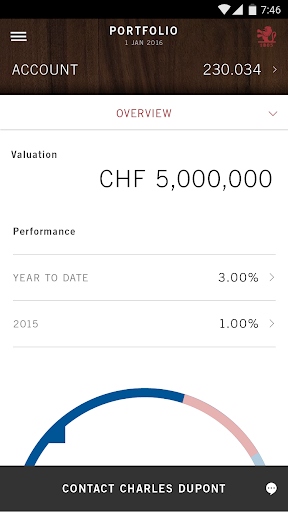

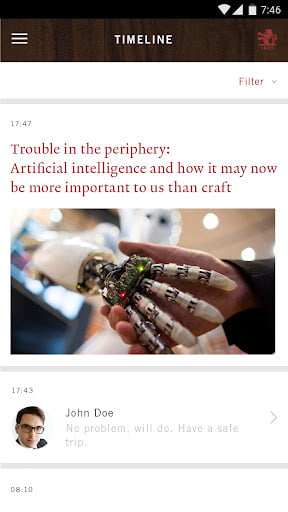

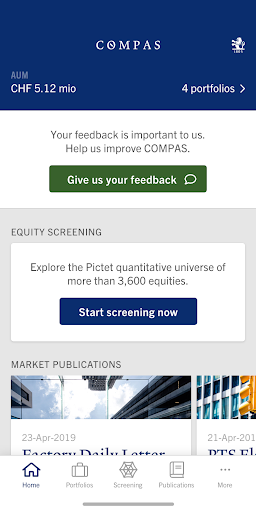

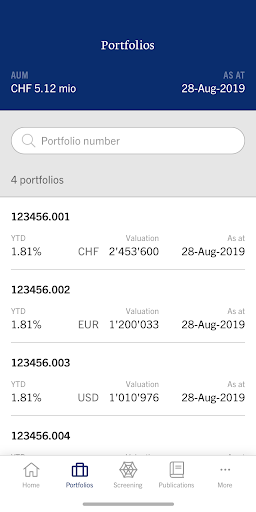

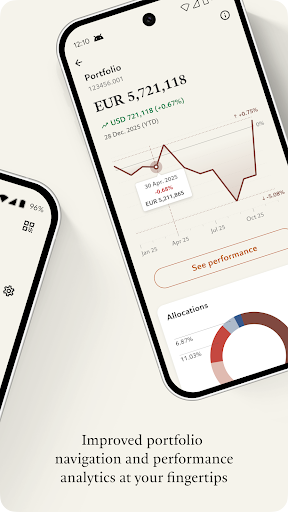

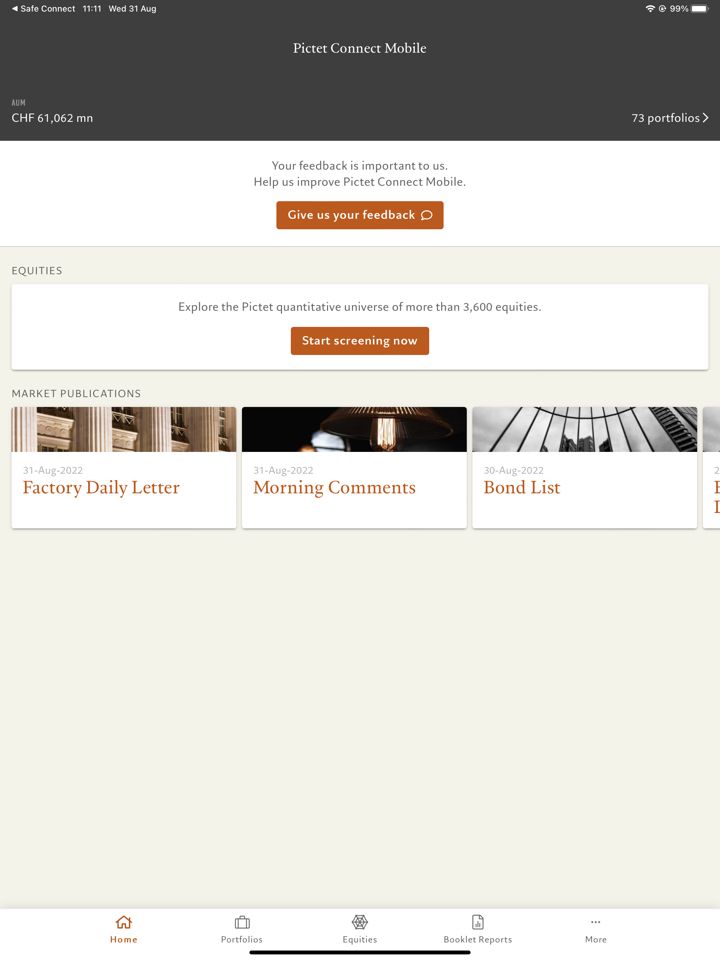

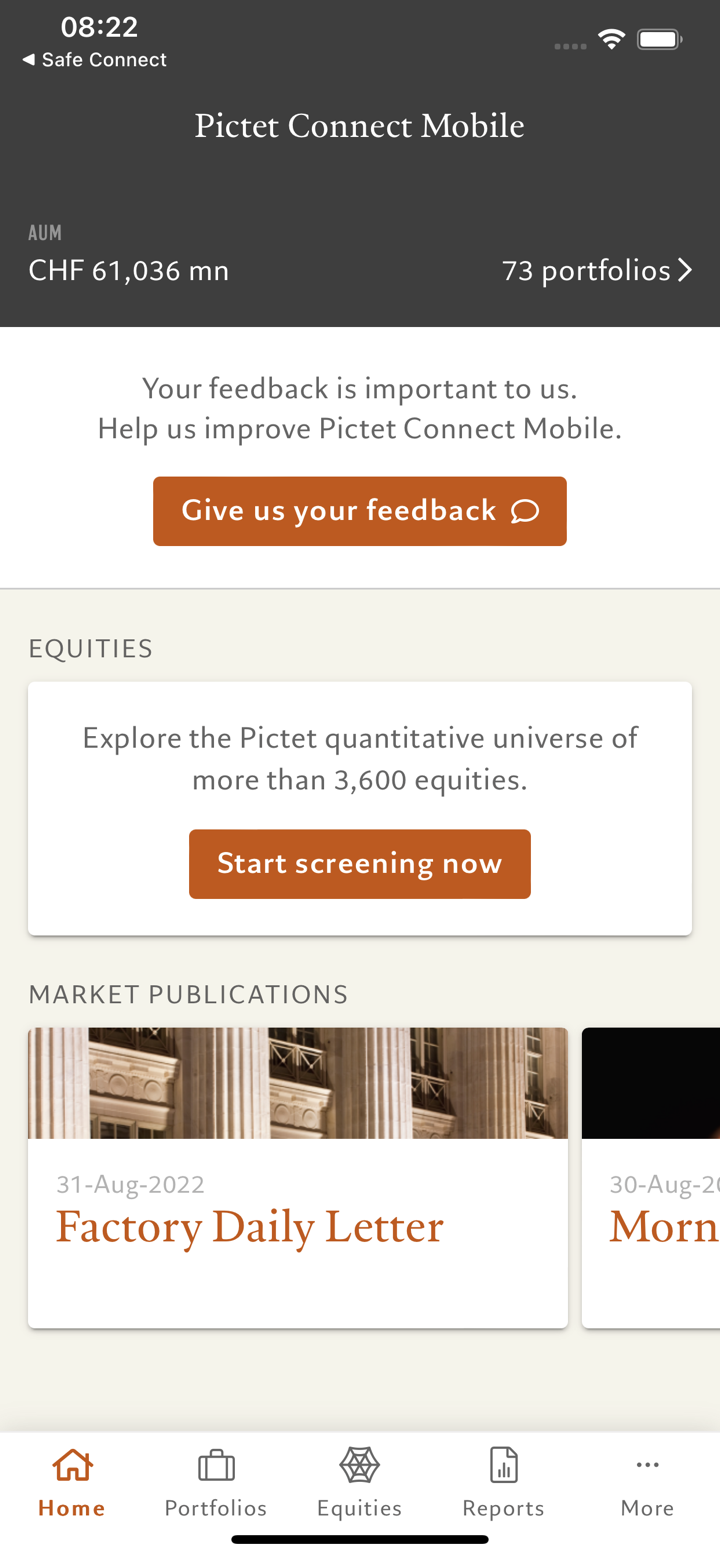

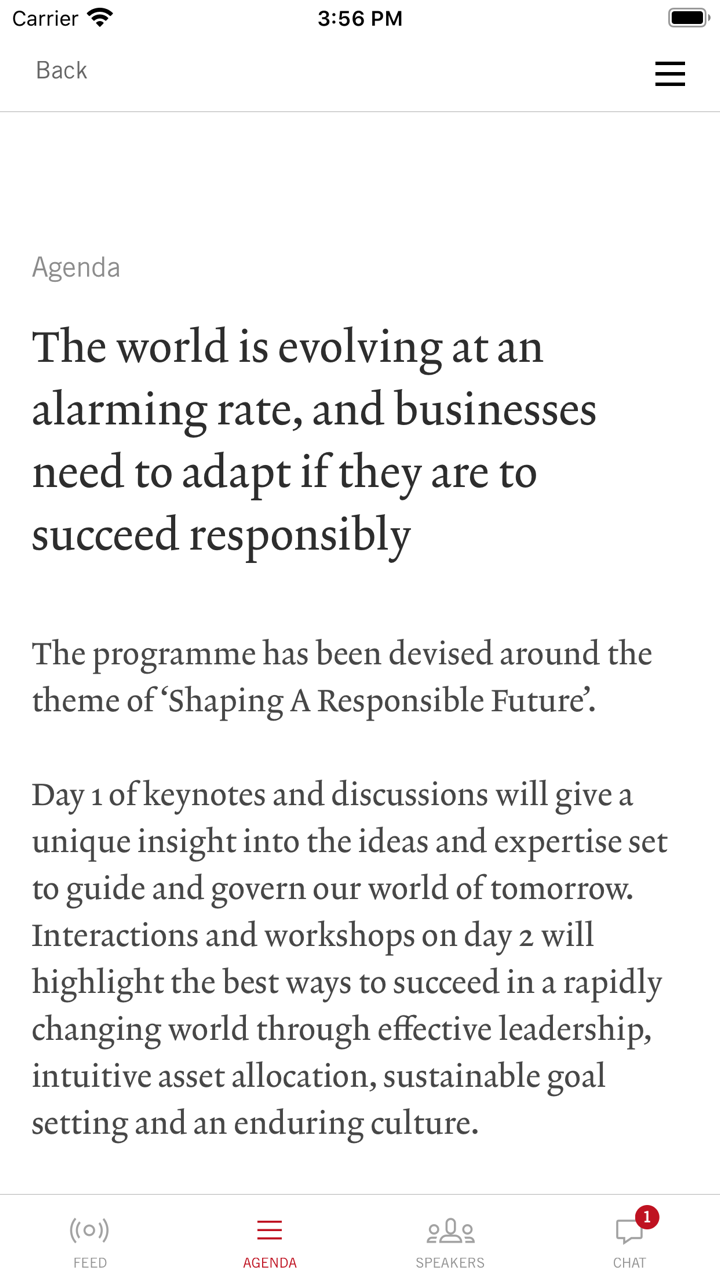

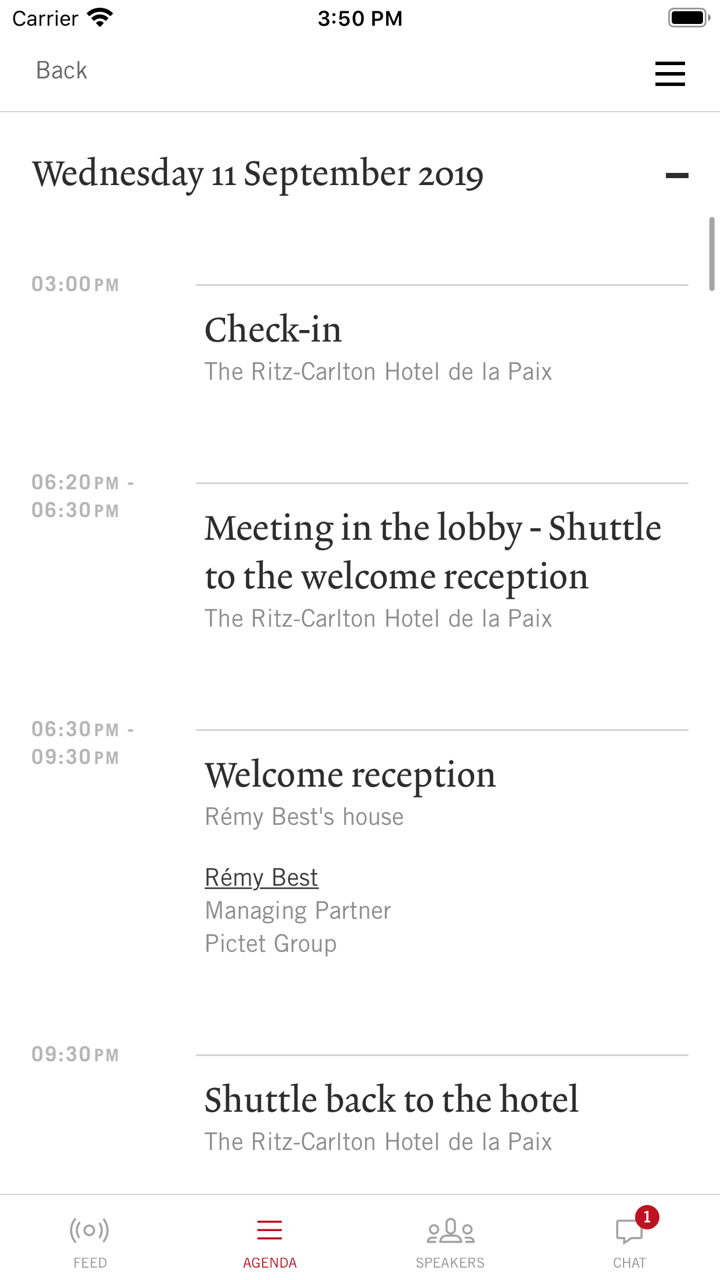

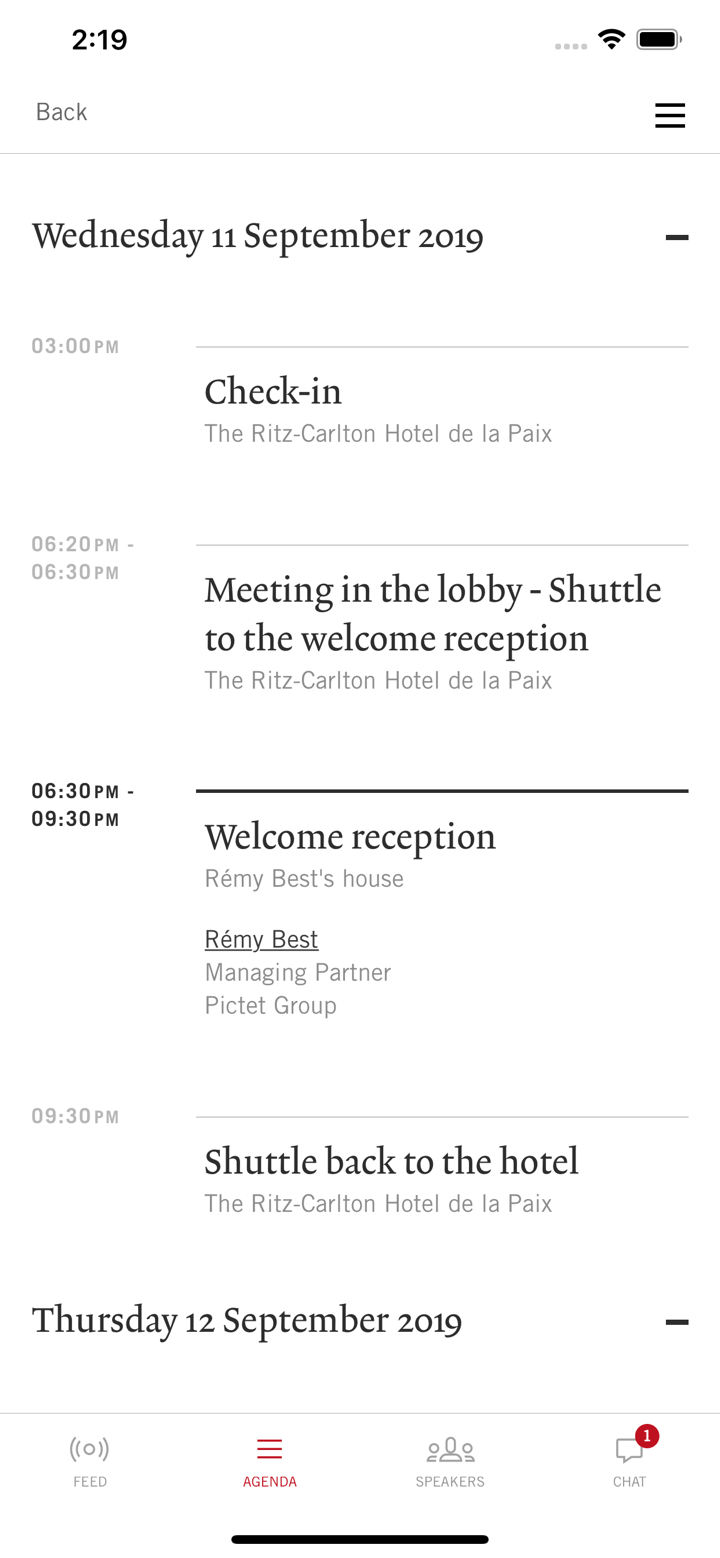

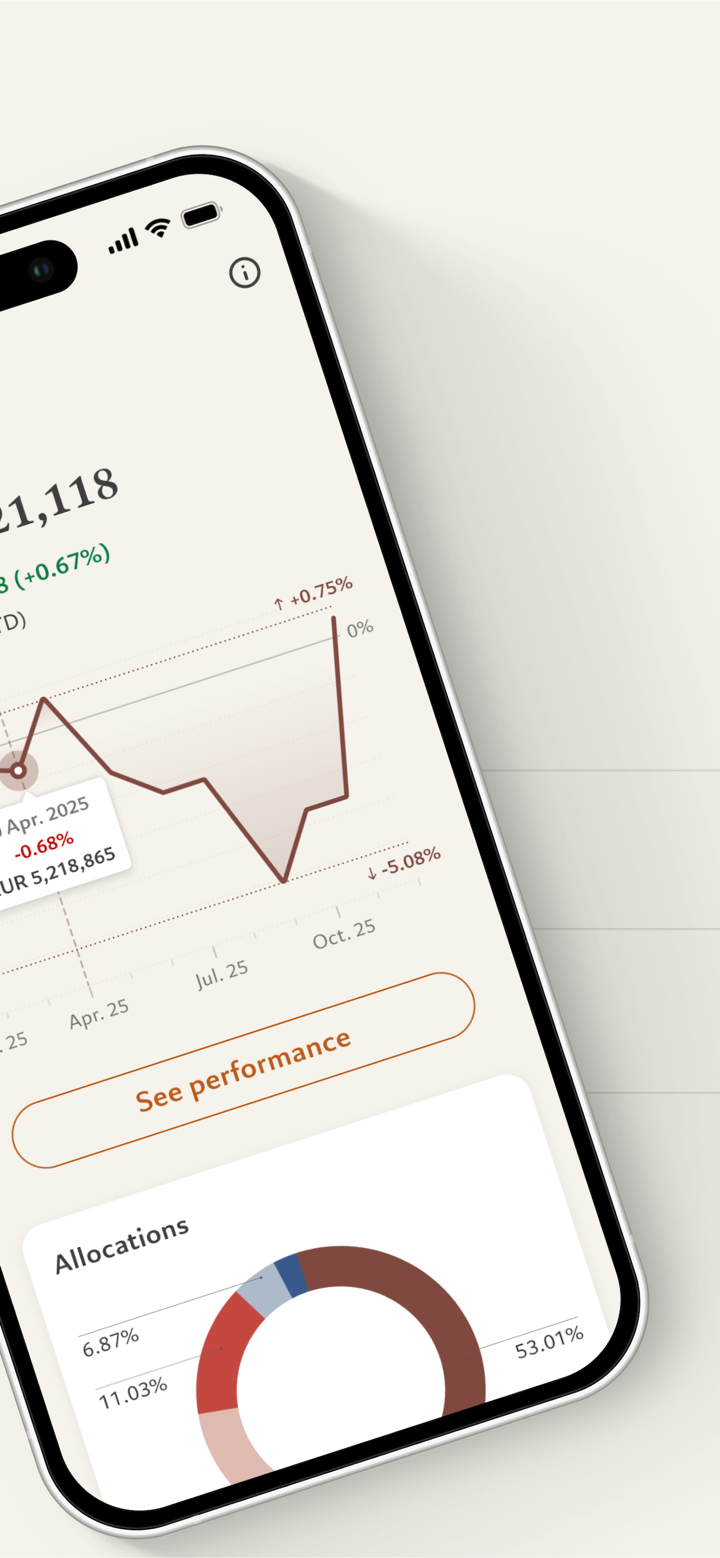

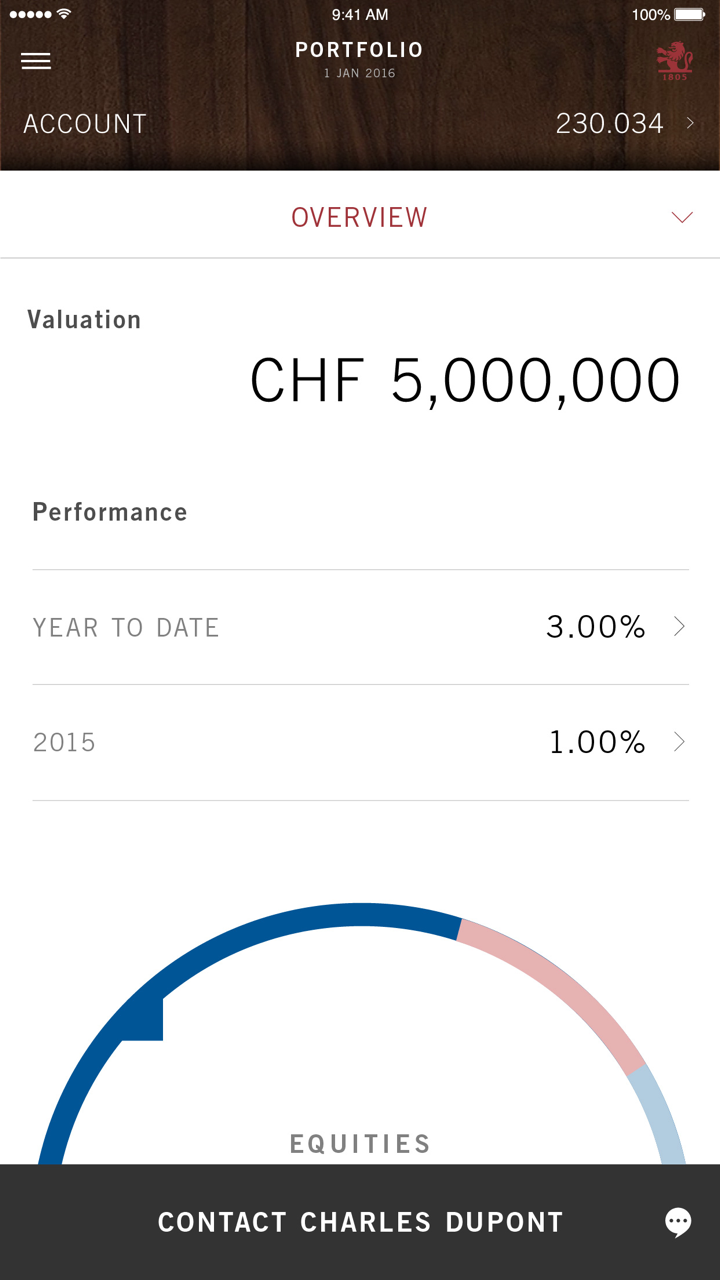

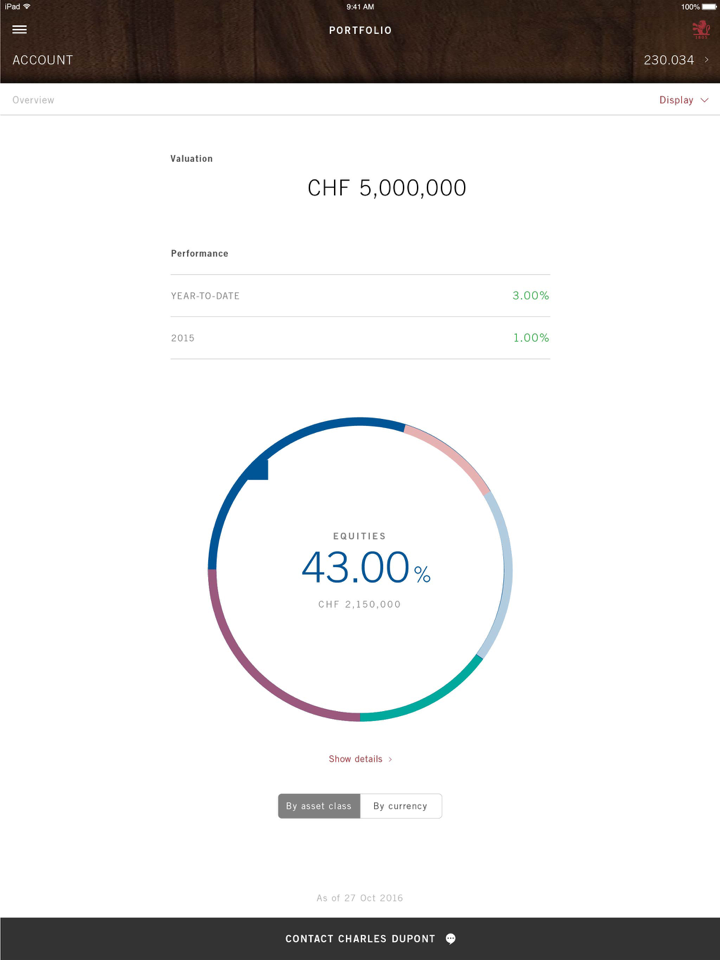

- Gestion de patrimoine: Depuis plus de 200 ans, Pictet Wealth Management se concentre sur l'assistance aux clients privés et aux family offices dans la gestion, la croissance et la protection de leur patrimoine à long terme. Leurs services visent à aider les clients à développer des entreprises, protéger les actifs et garantir la préservation pour les générations futures.

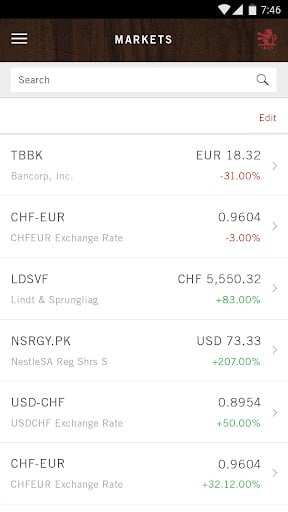

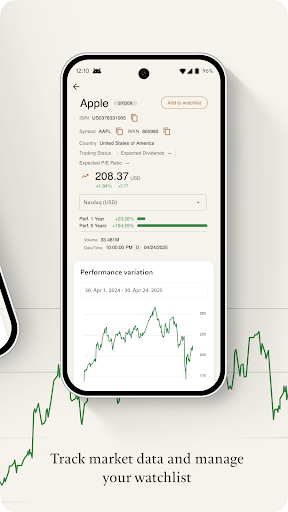

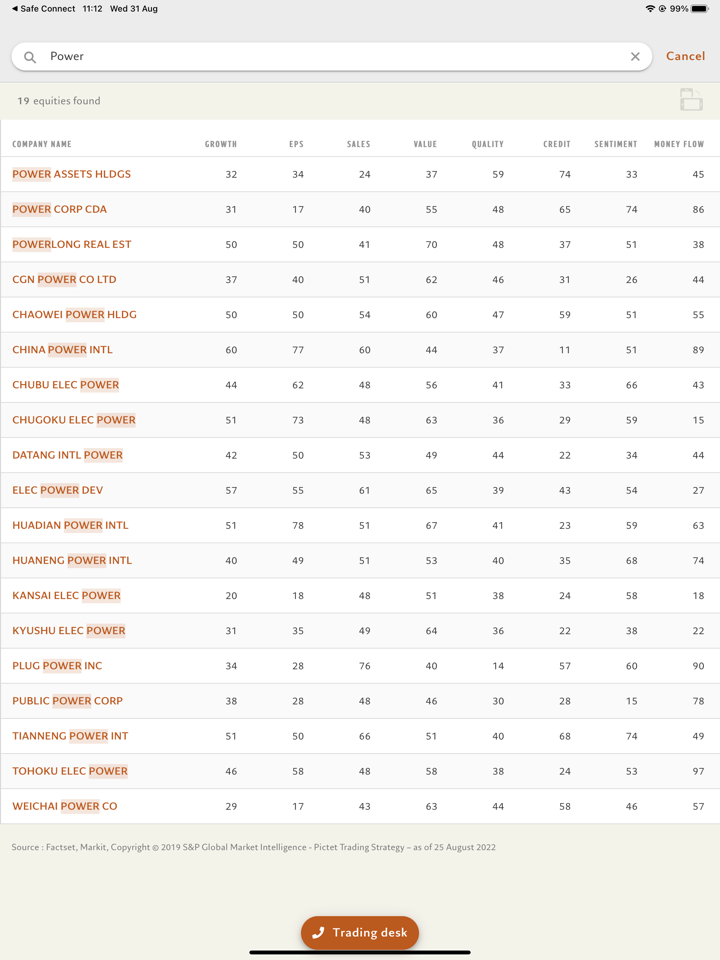

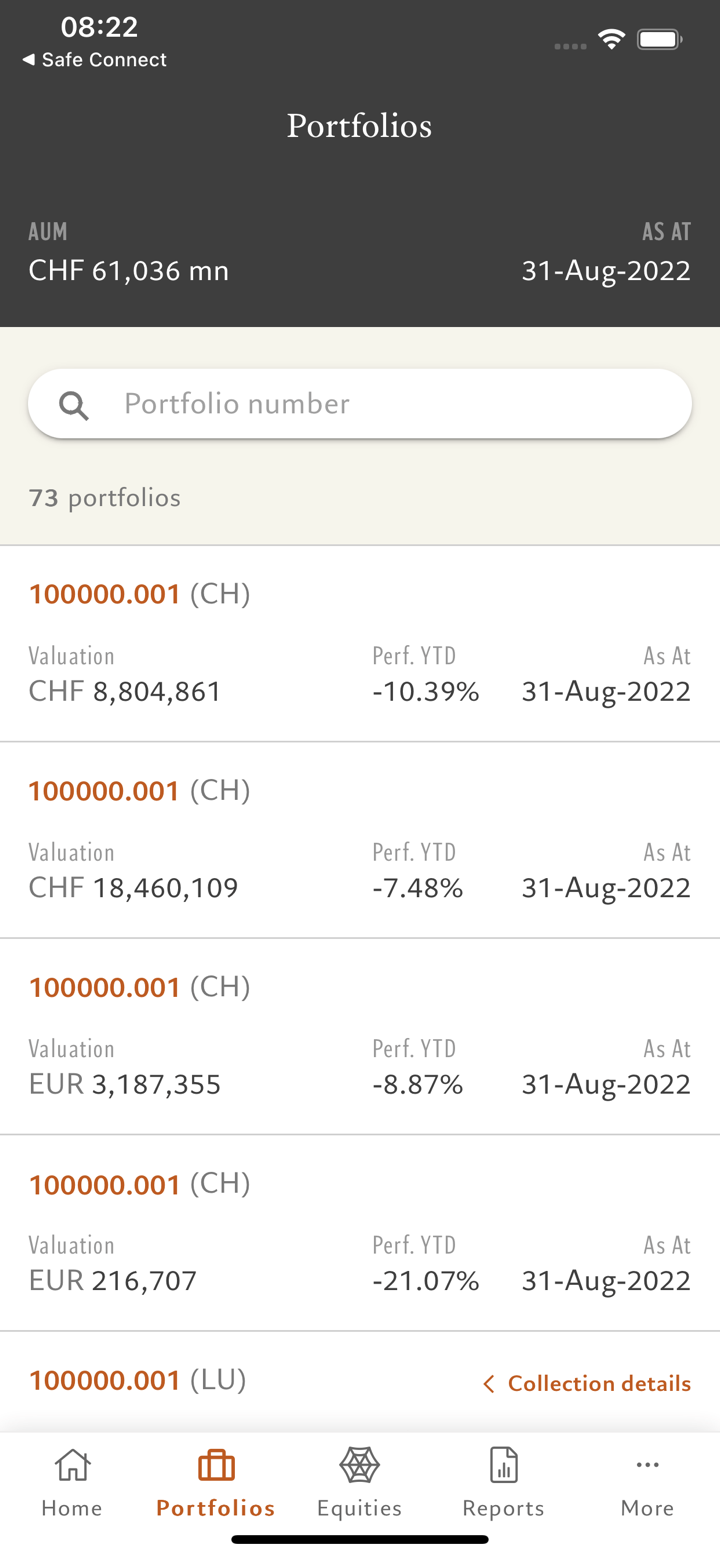

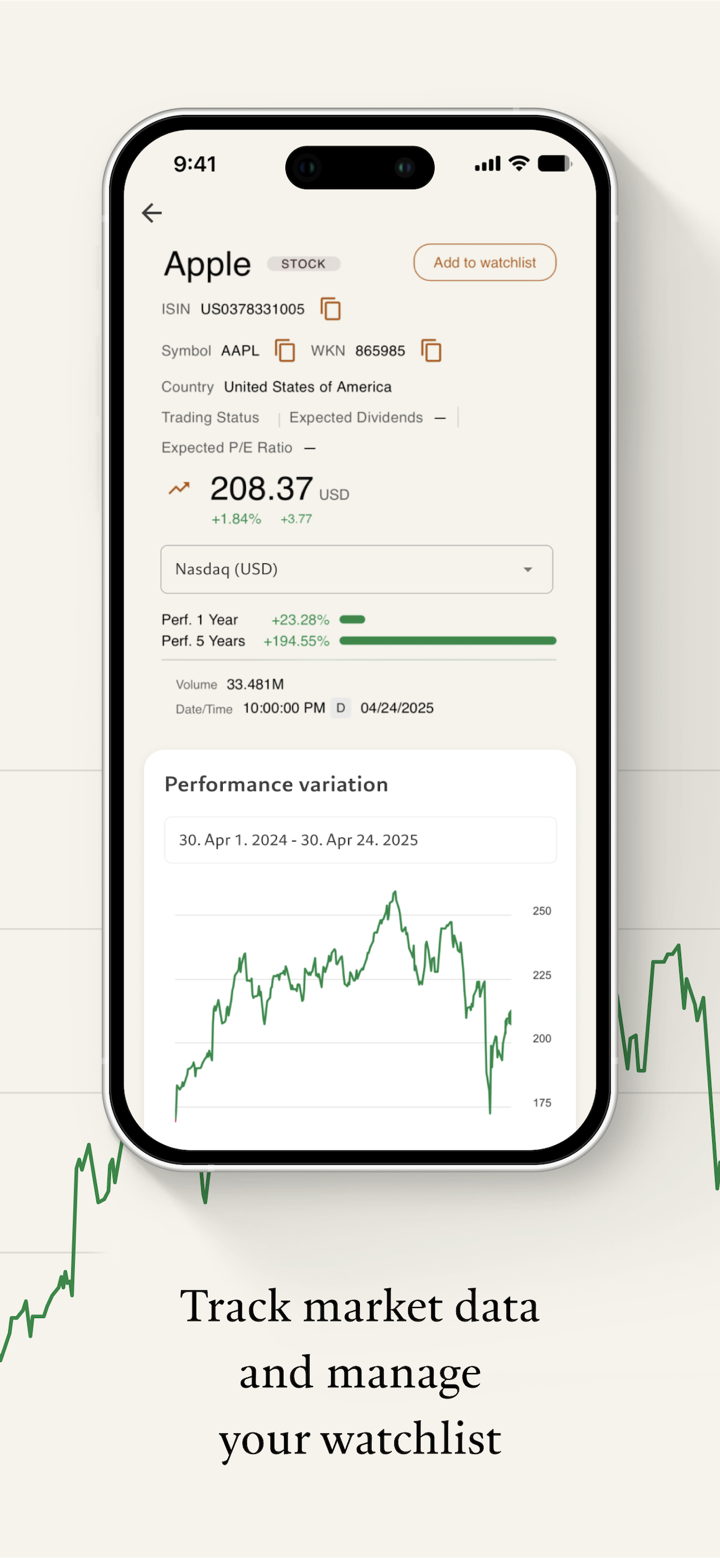

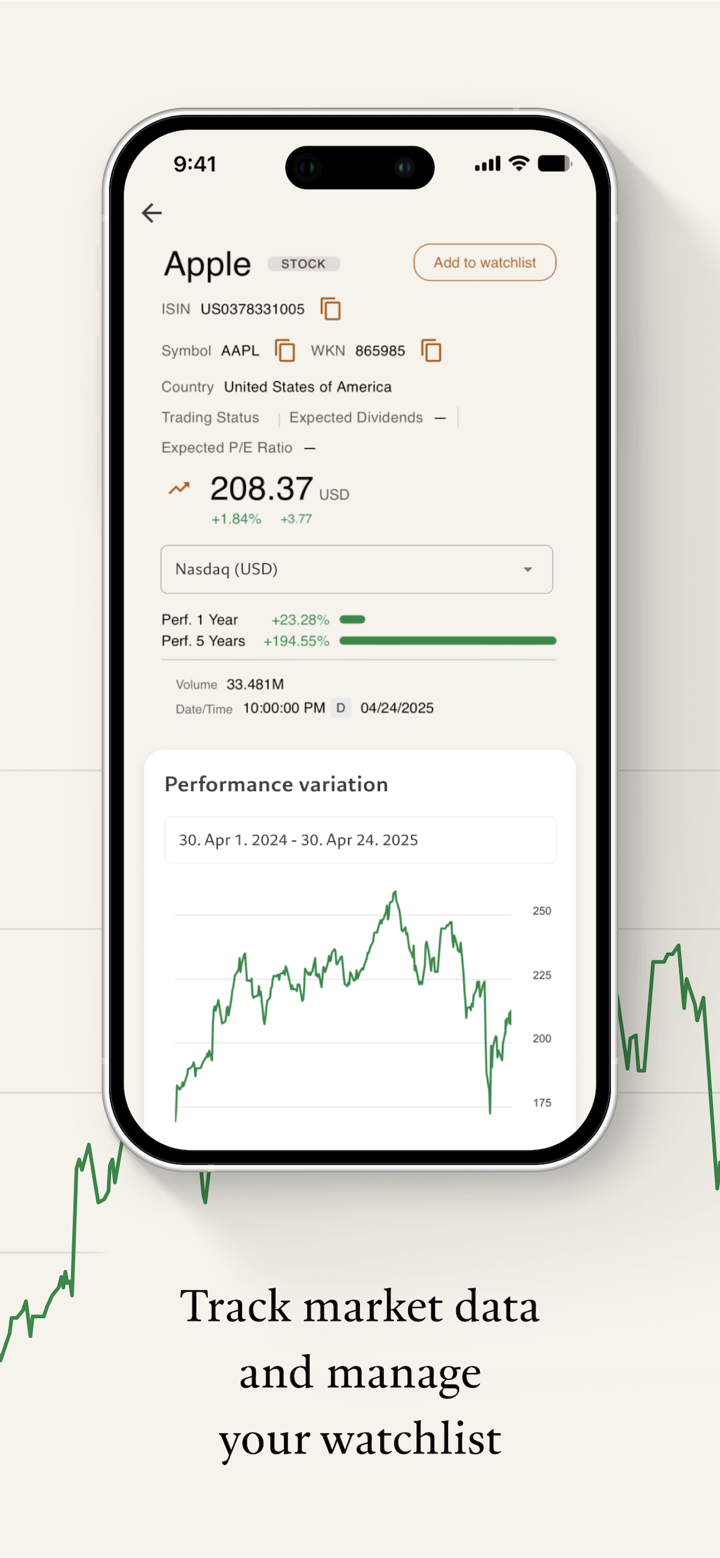

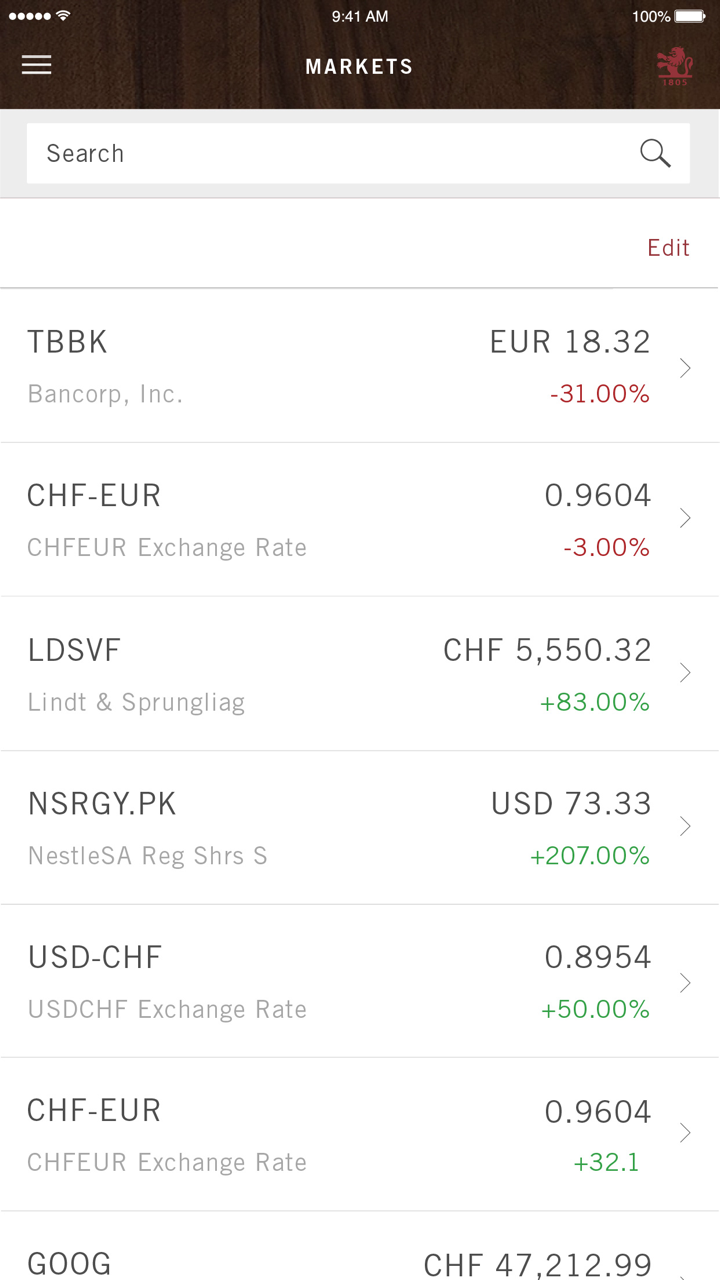

- Gestion d'actifs: Pictet Asset Management est une société indépendante qui gère des investissements dans diverses classes d'actifs comme les actions, les obligations et les alternatives pour le compte de ses clients.

- Investissements alternatifs: Pictet Alternative Investments offre aux investisseurs avertis un accès à des opportunités uniques et utilise des stratégies alternatives depuis des décennies pour viser des résultats solides.

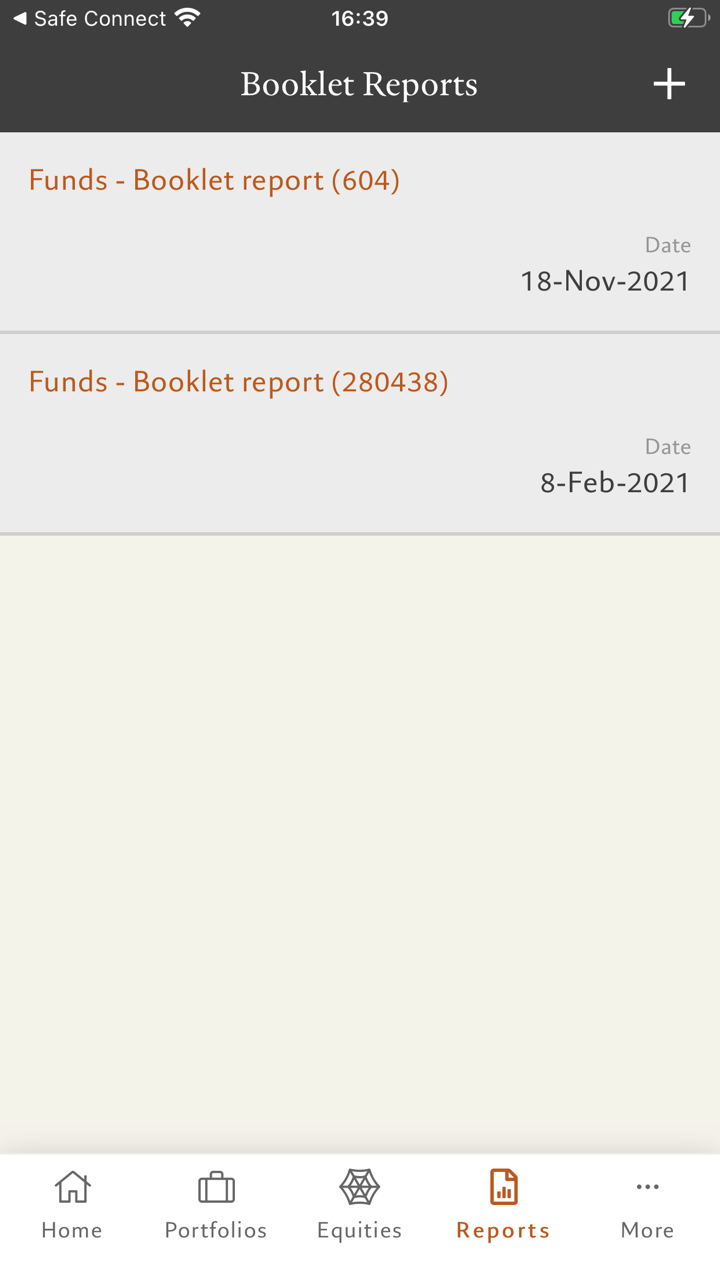

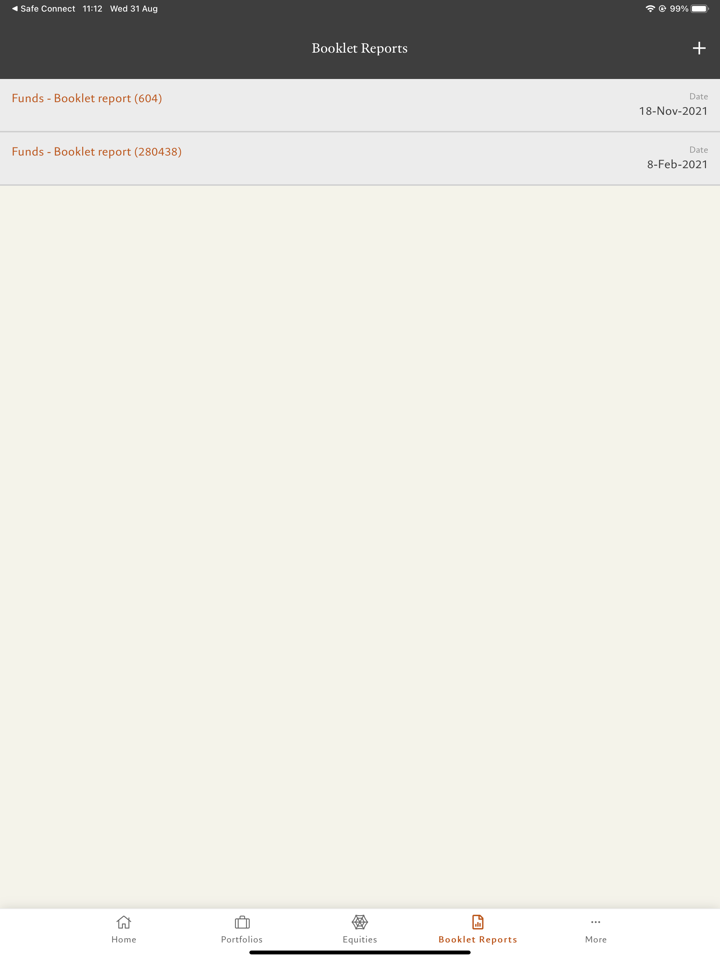

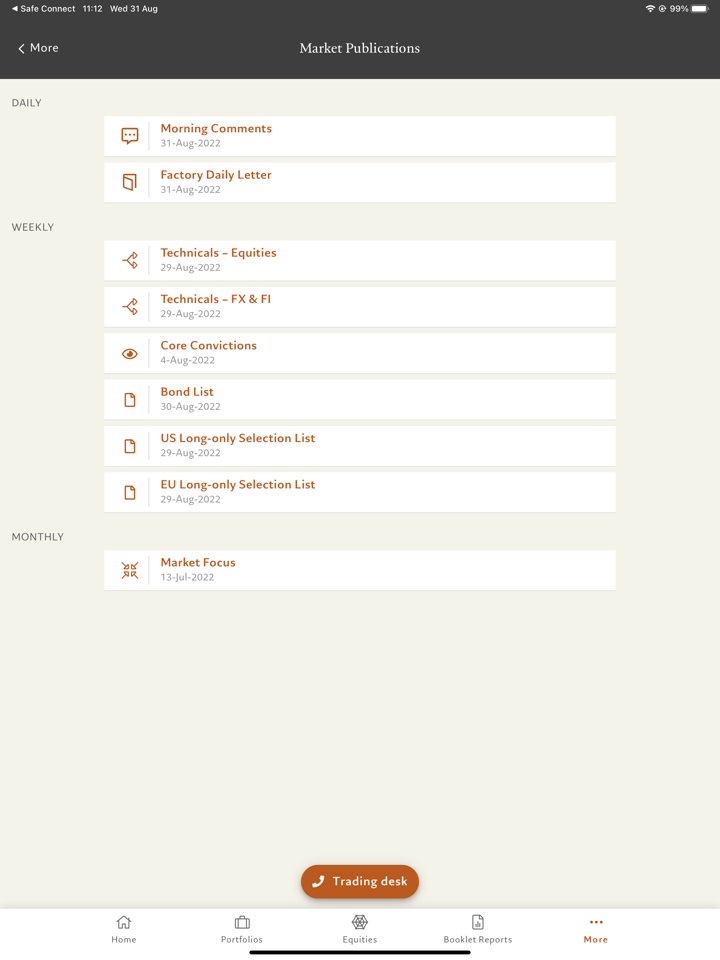

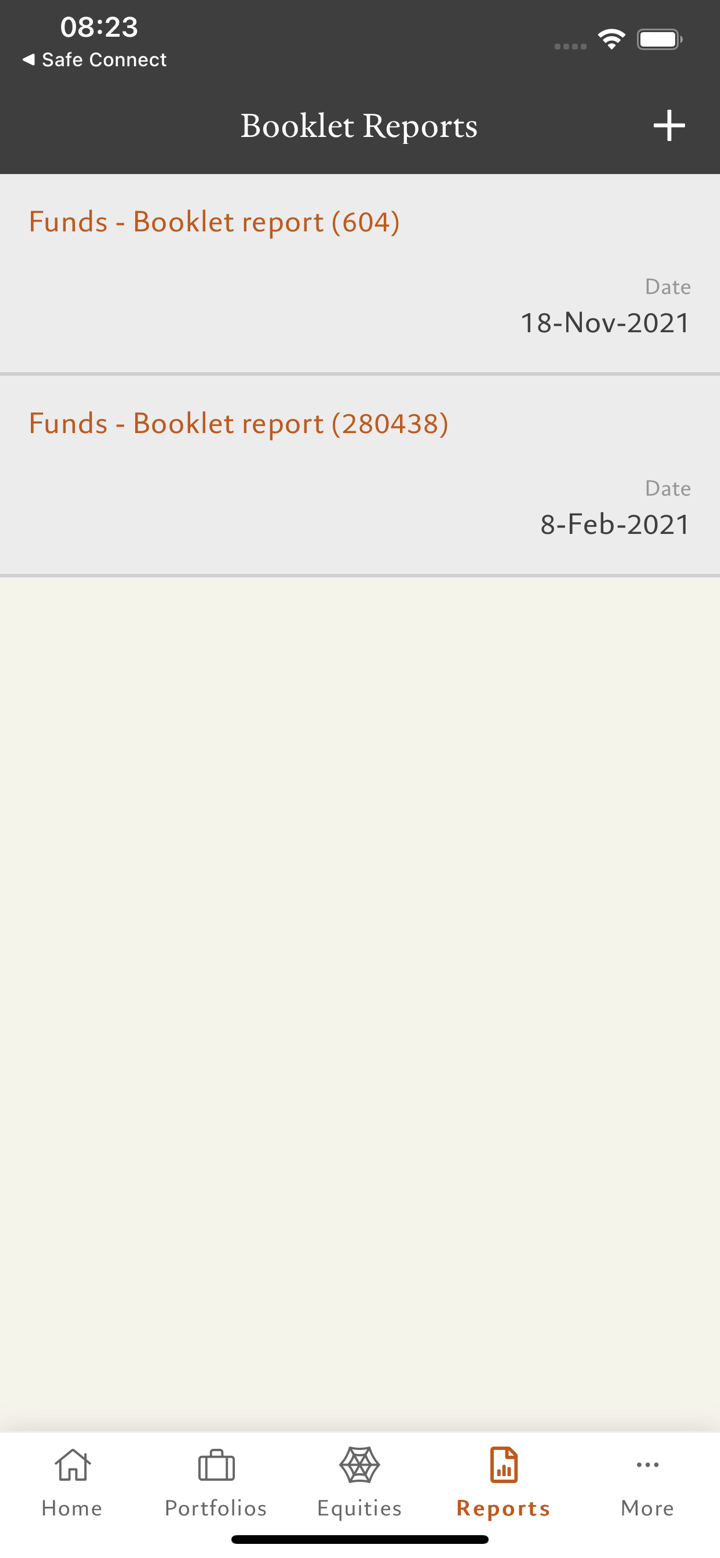

- Services d'actifs: Pictet Asset Services gère tous les aspects du processus de service d'actifs, permettant aux clients de se concentrer sur la distribution et la génération de performances de portefeuille.