Profil perusahaan

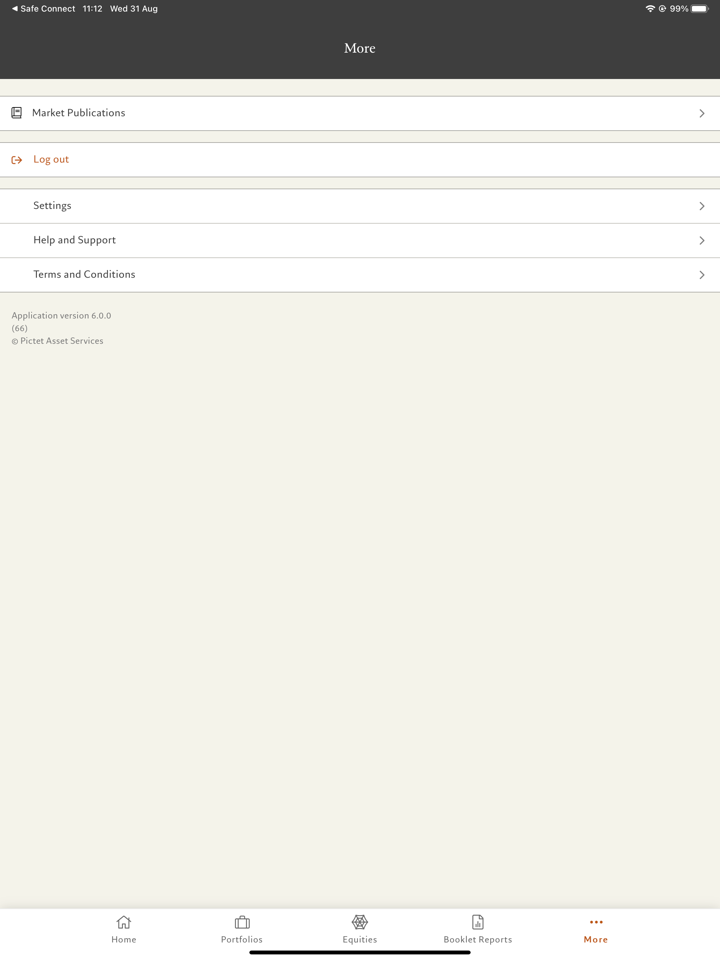

| Pictet Ringkasan Ulasan | |

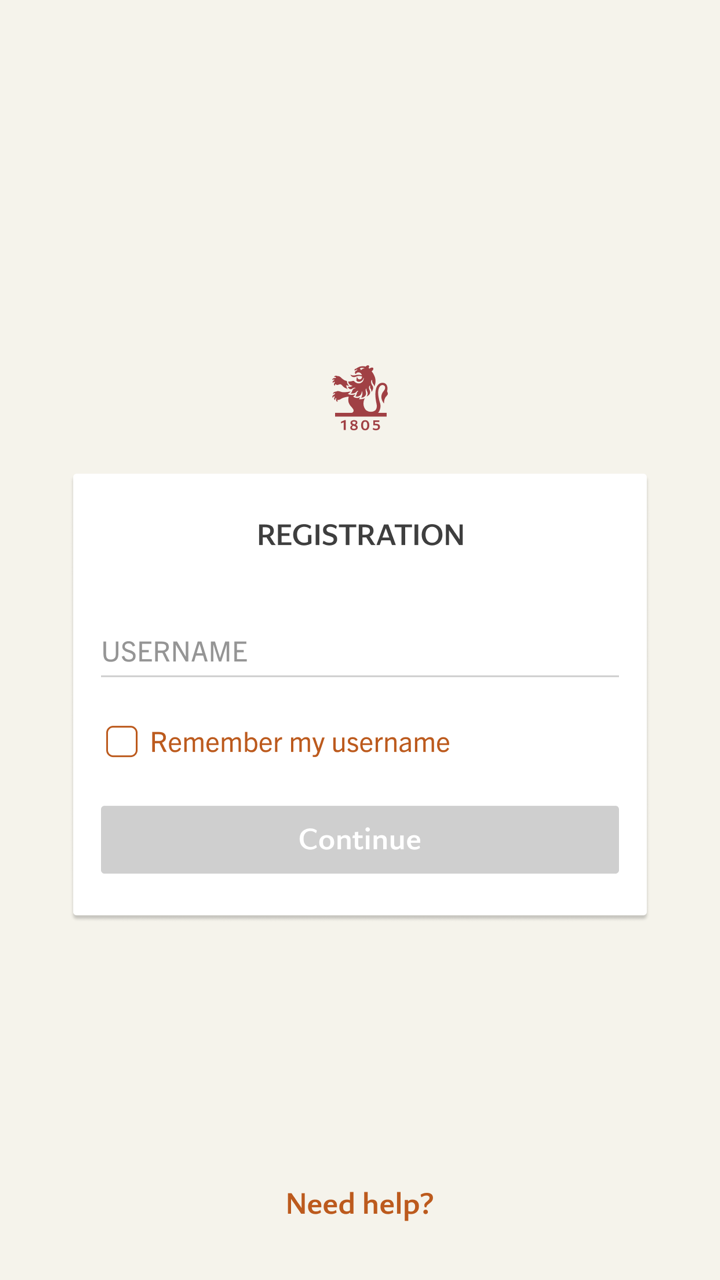

| Dibentuk | 1805 |

| Negara/Daerah Terdaftar | Swiss |

| Regulasi | SFC |

| Layanan | Manajemen kekayaan, manajemen aset, investasi alternatif, layanan aset |

| Dukungan Pelanggan | Tel: +41 58 323 23 23Tel.: +852 3191 1805 |

| Fax: +852 3191 1808 | |

Informasi Pictet

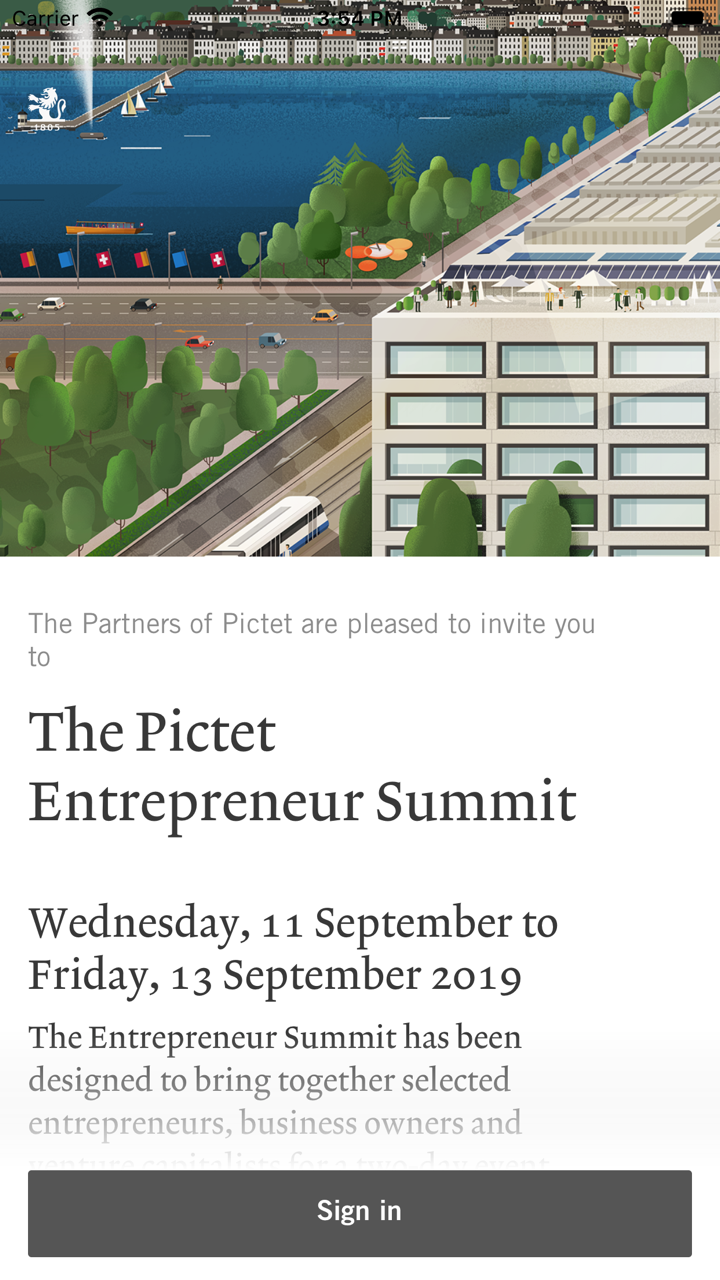

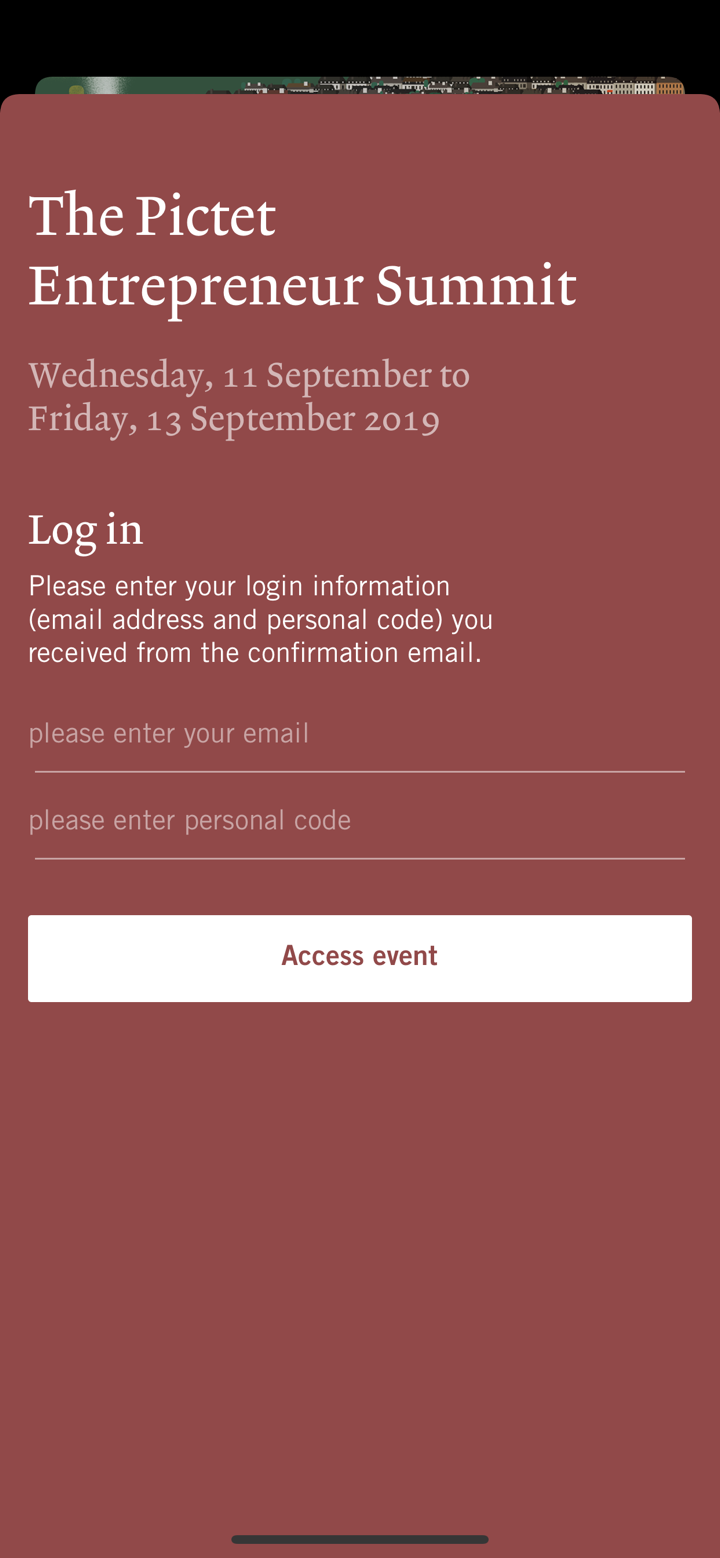

Pictet, didirikan pada tahun 1805 dan berbasis di Swiss, diatur oleh SFC. Mereka menawarkan layanan manajemen kekayaan, manajemen aset, investasi alternatif, dan layanan aset, dengan dukungan pelanggan yang tersedia melalui telepon dan faks.

Pro dan Kontra

| Pro | Kontra |

|

|

|

Apakah Pictet Legal?

Pictet memiliki lisensi "Bertransaksi dalam kontrak berjangka" yang diatur oleh Otoritas Sekuritas dan Berjangka (SFC) di Hong Kong dengan nomor lisensi AAG715.

Untuk Siapa Pictet Melayani?

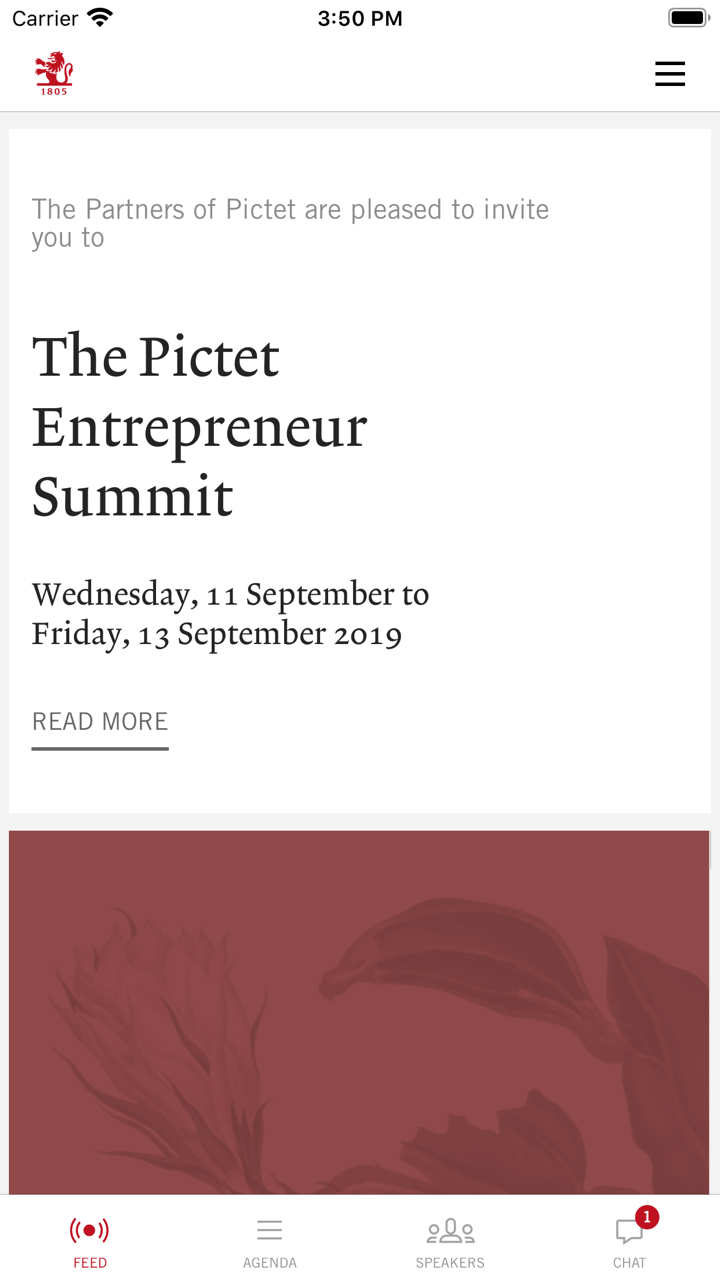

- Individu dan keluarga: Pictet menawarkan dana untuk membantu lembaga keuangan dan perantara mencapai tujuan investasi klien mereka, sambil juga menyediakan solusi layanan untuk menyederhanakan administrasi, perdagangan, dan pelaporan.

- Lembaga keuangan dan perantara: Pictet menawarkan dana untuk membantu lembaga keuangan dan perantara mencapai tujuan investasi klien mereka. Mereka juga menyediakan solusi layanan untuk menyederhanakan proses administrasi, perdagangan, dan pelaporan.

- Investor institusi: Pictet menyediakan strategi investasi dan solusi layanan kepada investor institusi utama secara global, termasuk dana pensiun, yayasan, dan dana kekayaan negara.

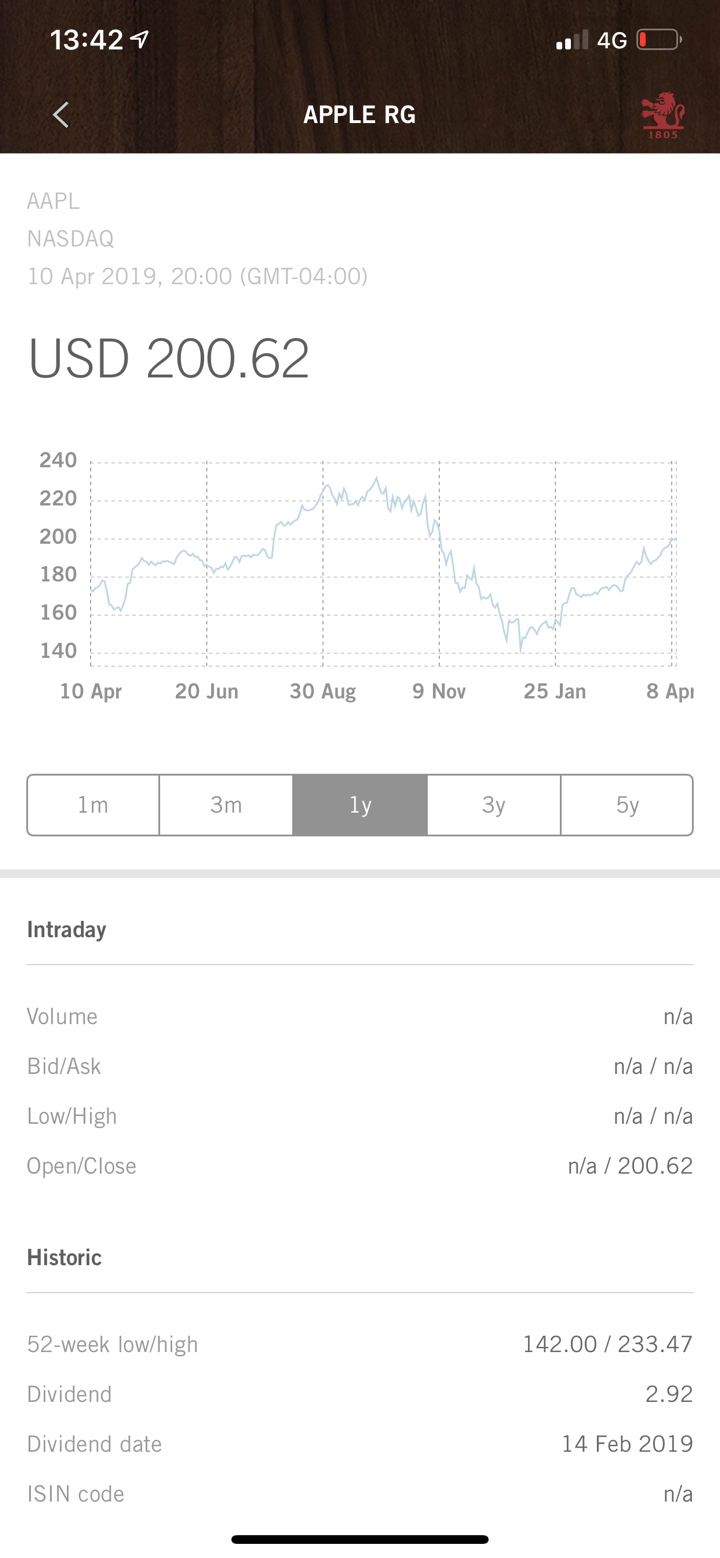

Apa yang Dilakukan Pictet?

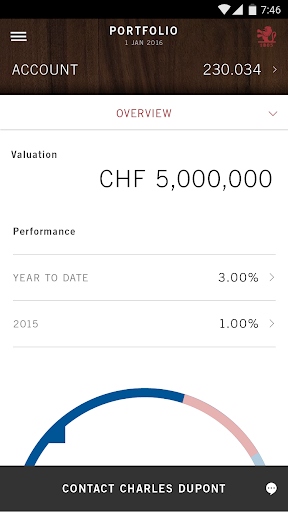

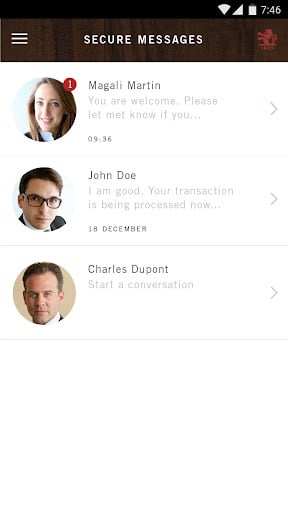

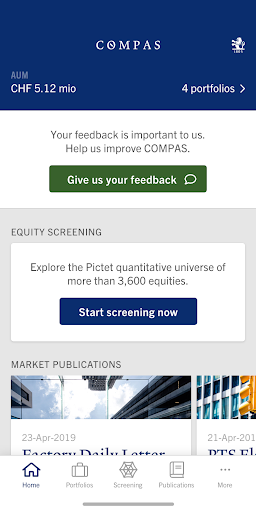

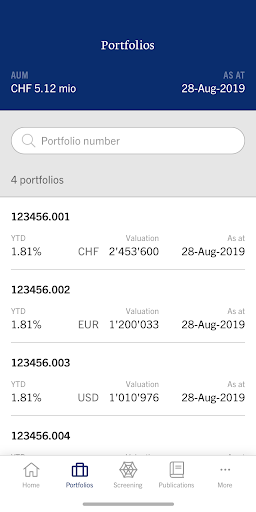

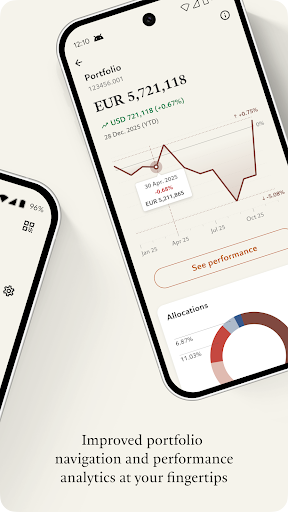

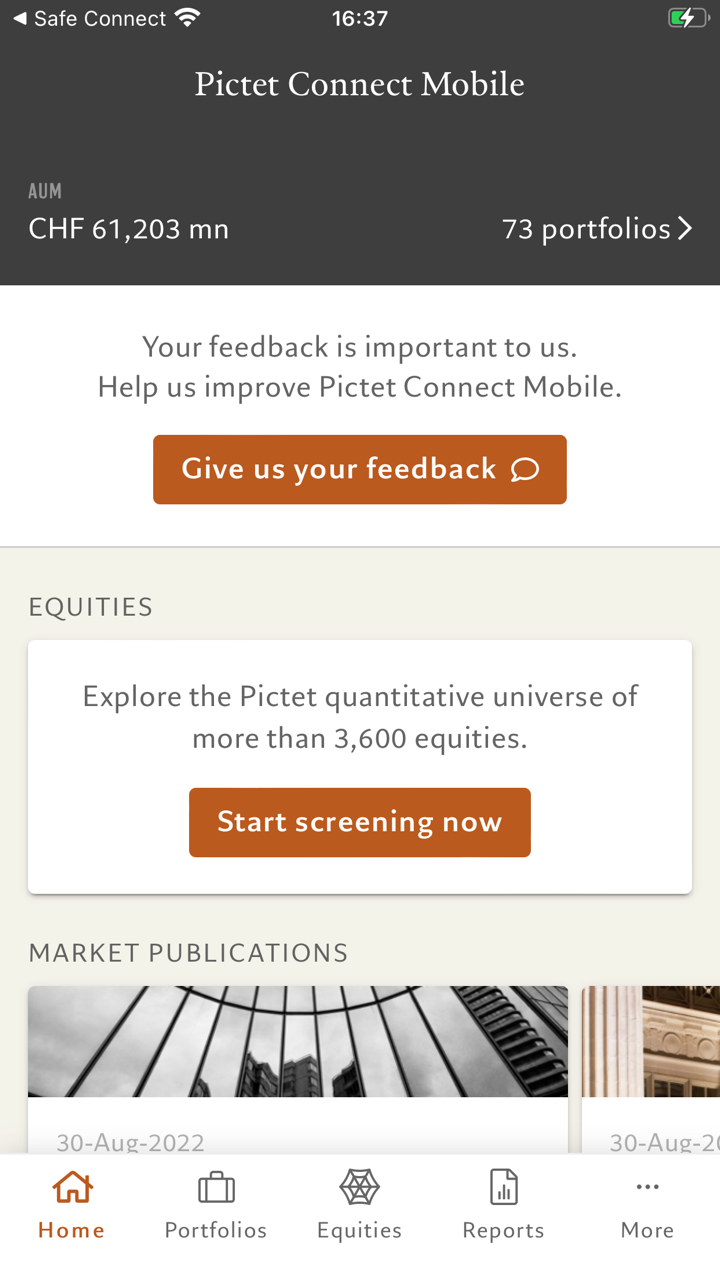

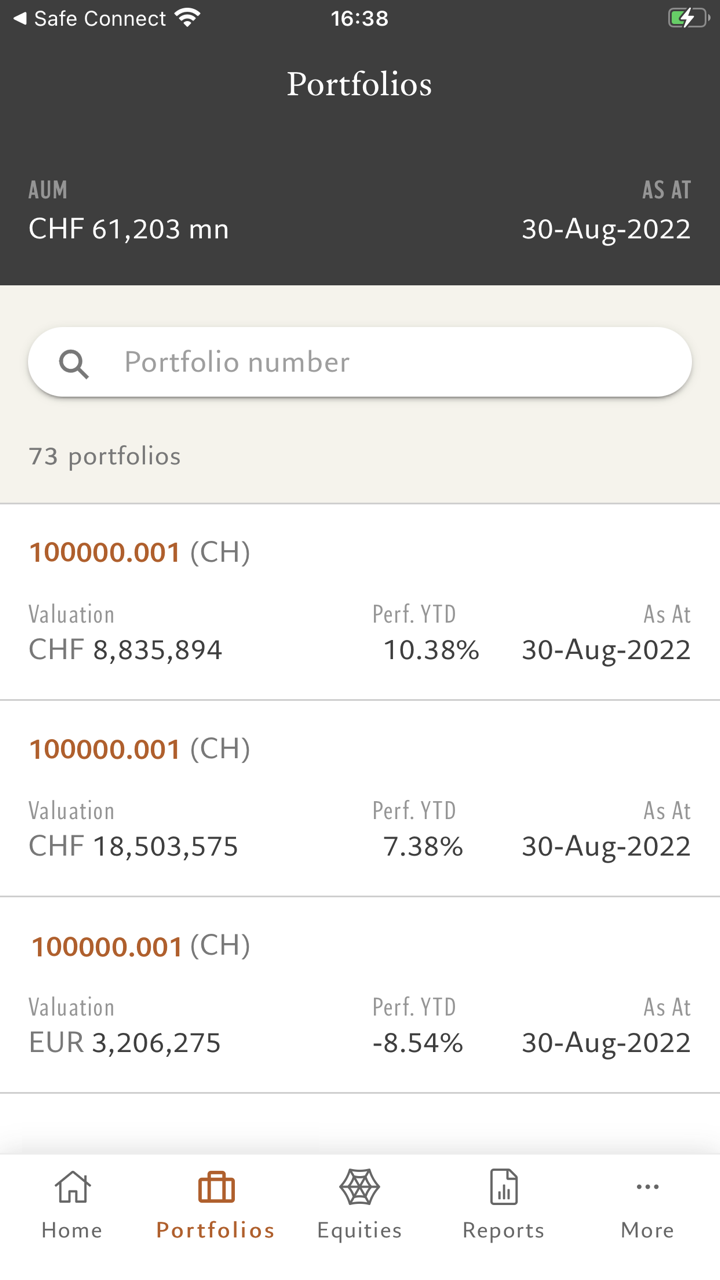

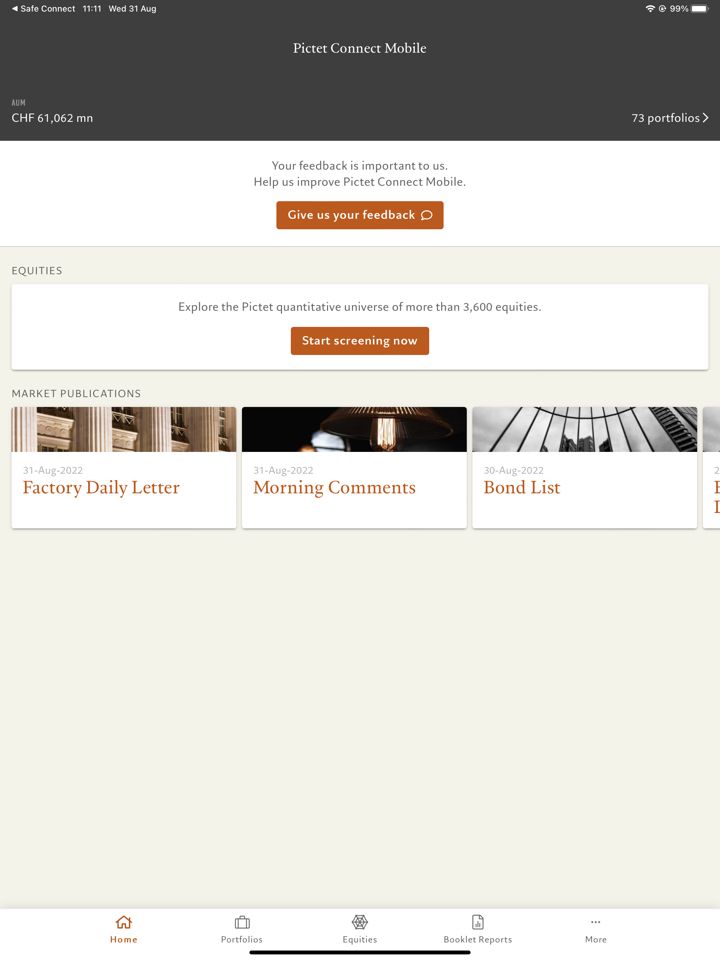

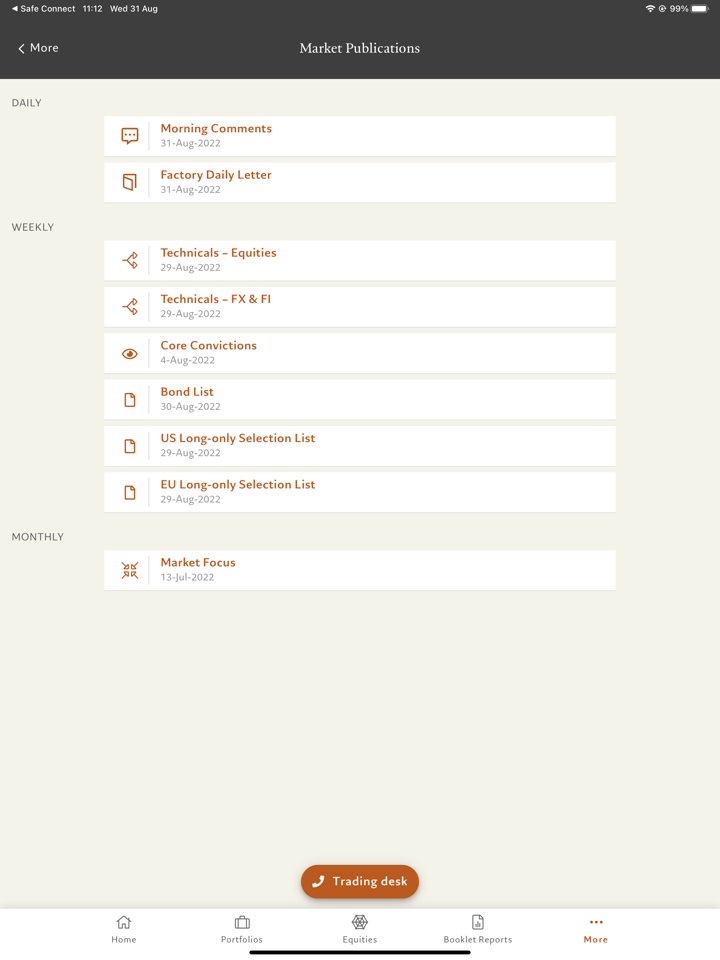

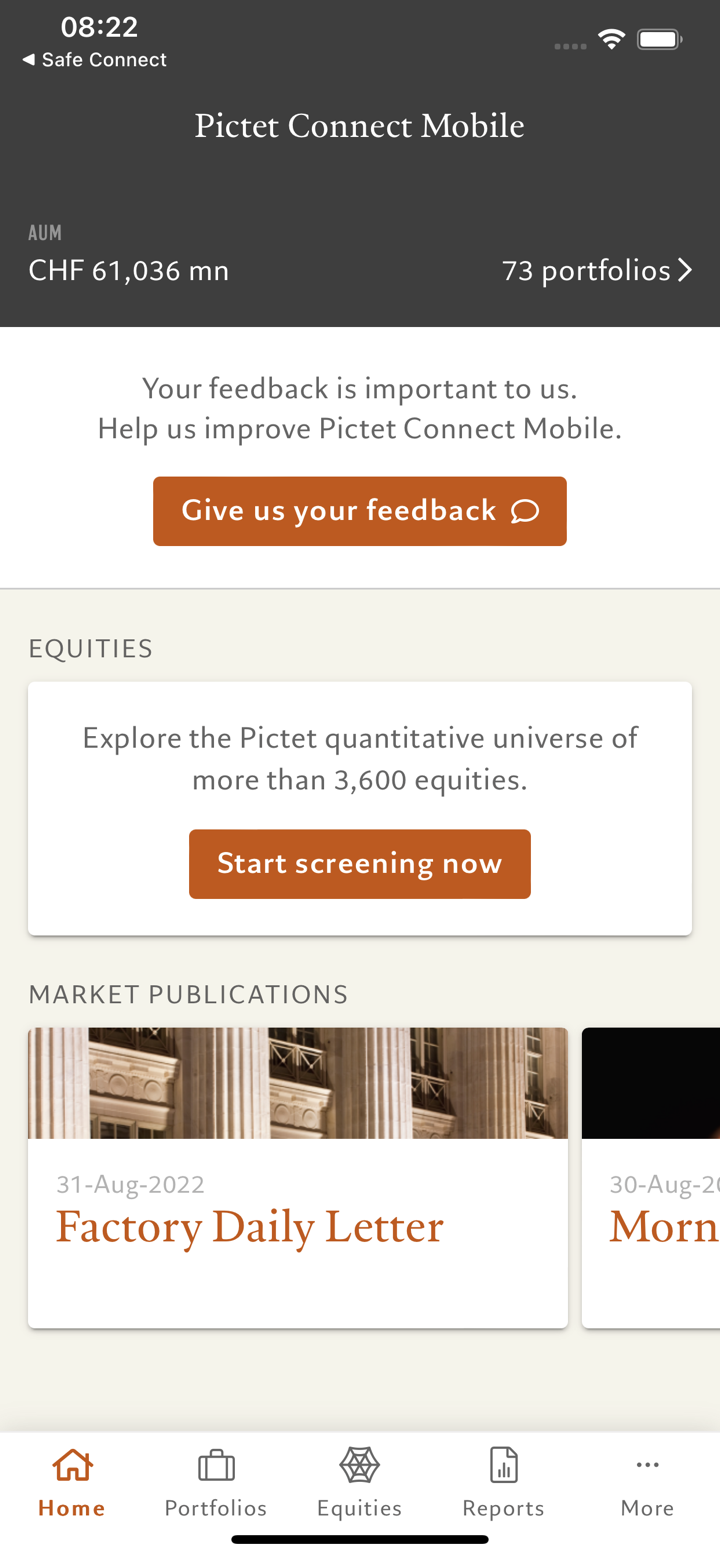

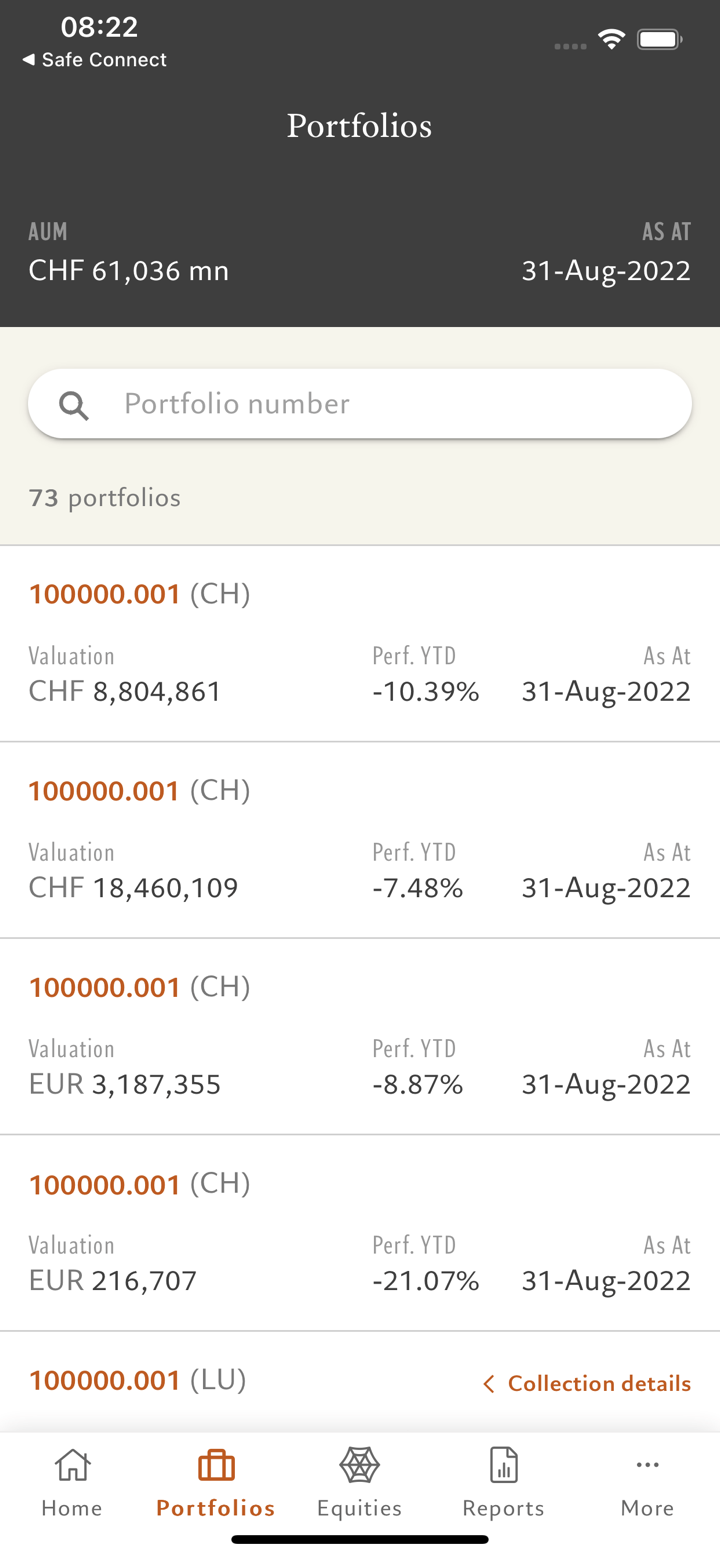

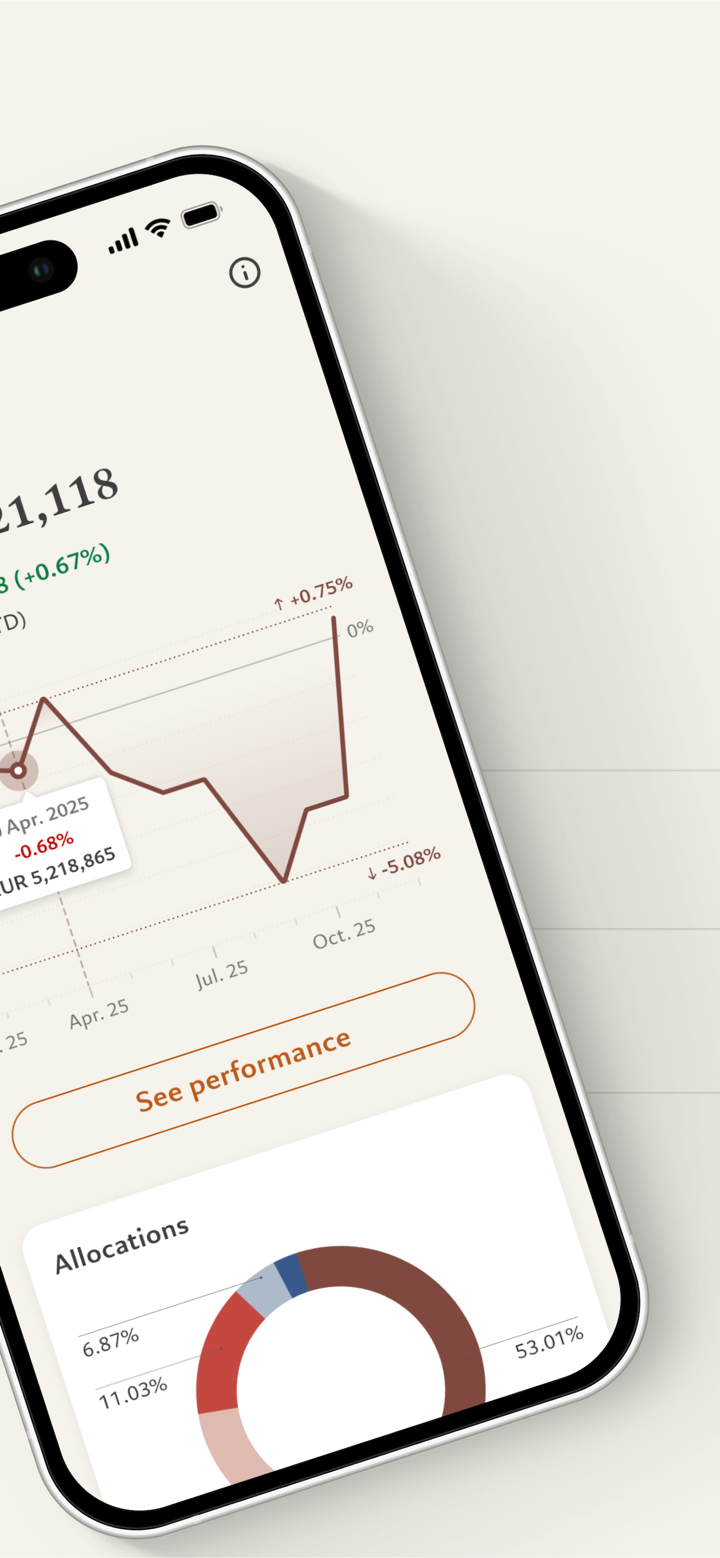

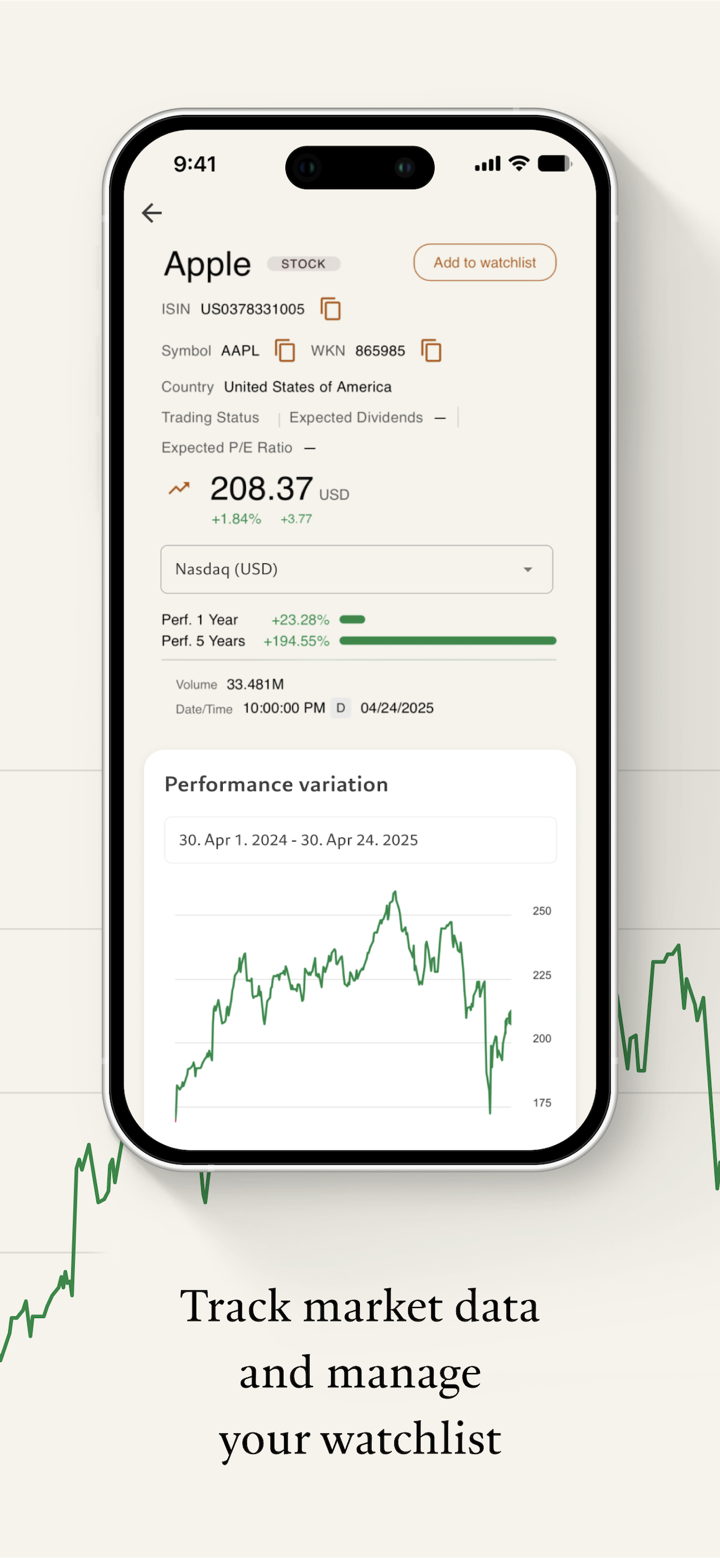

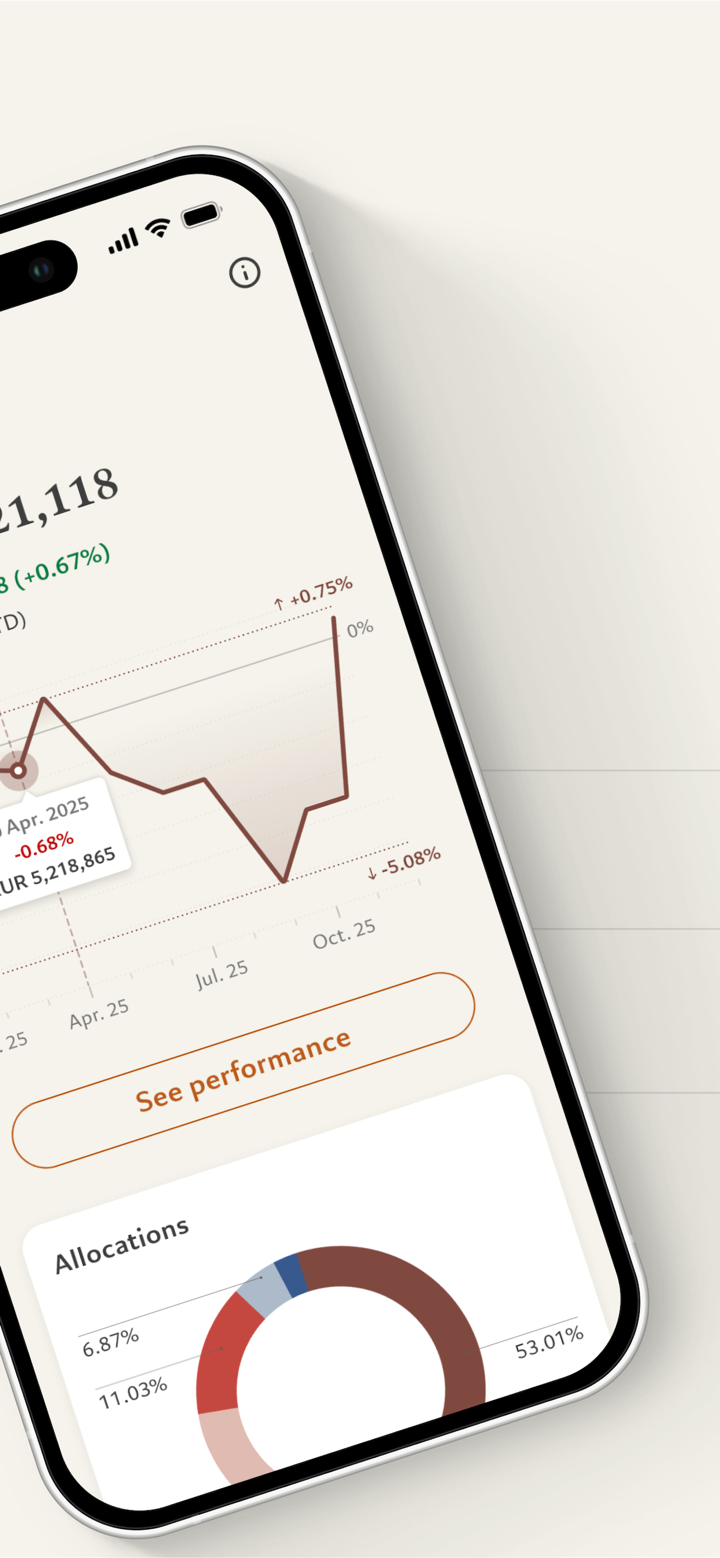

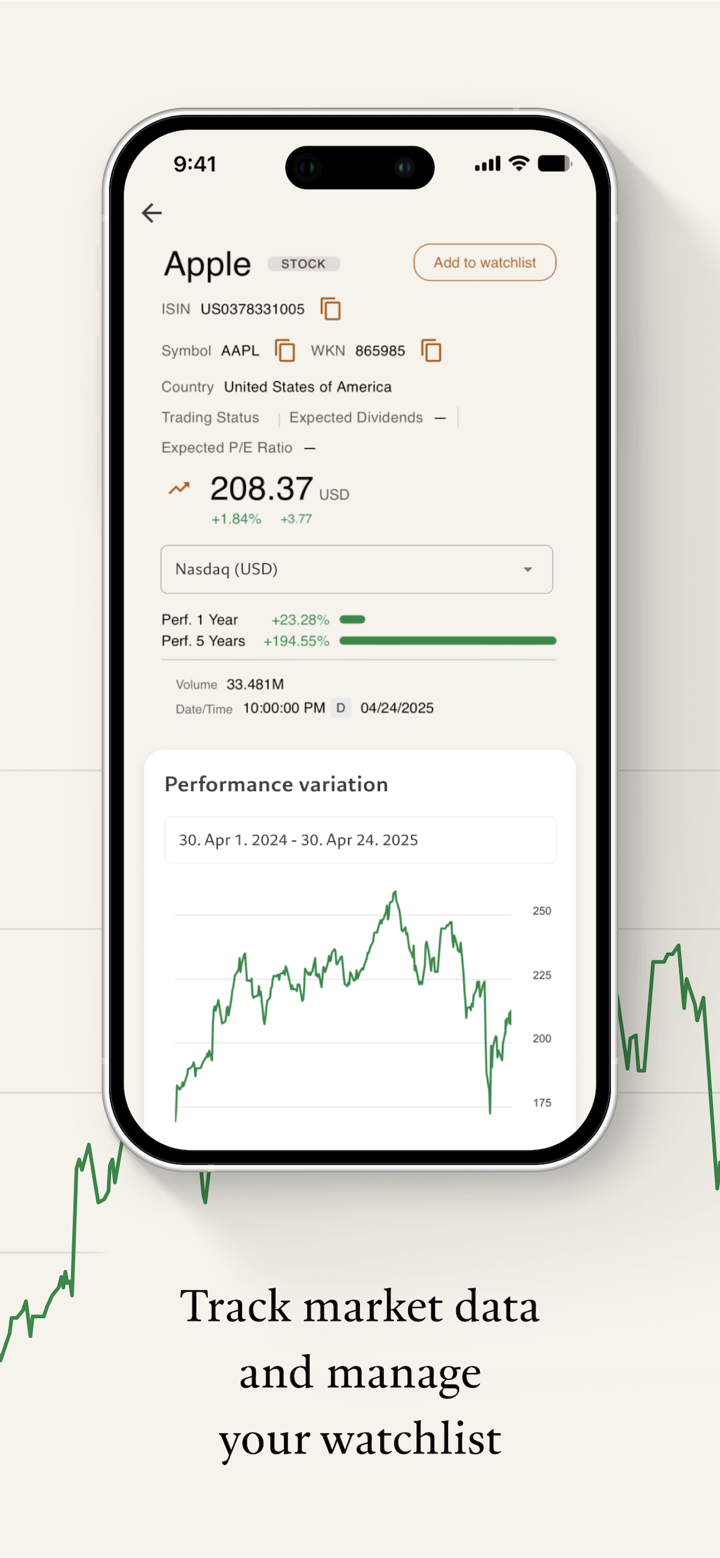

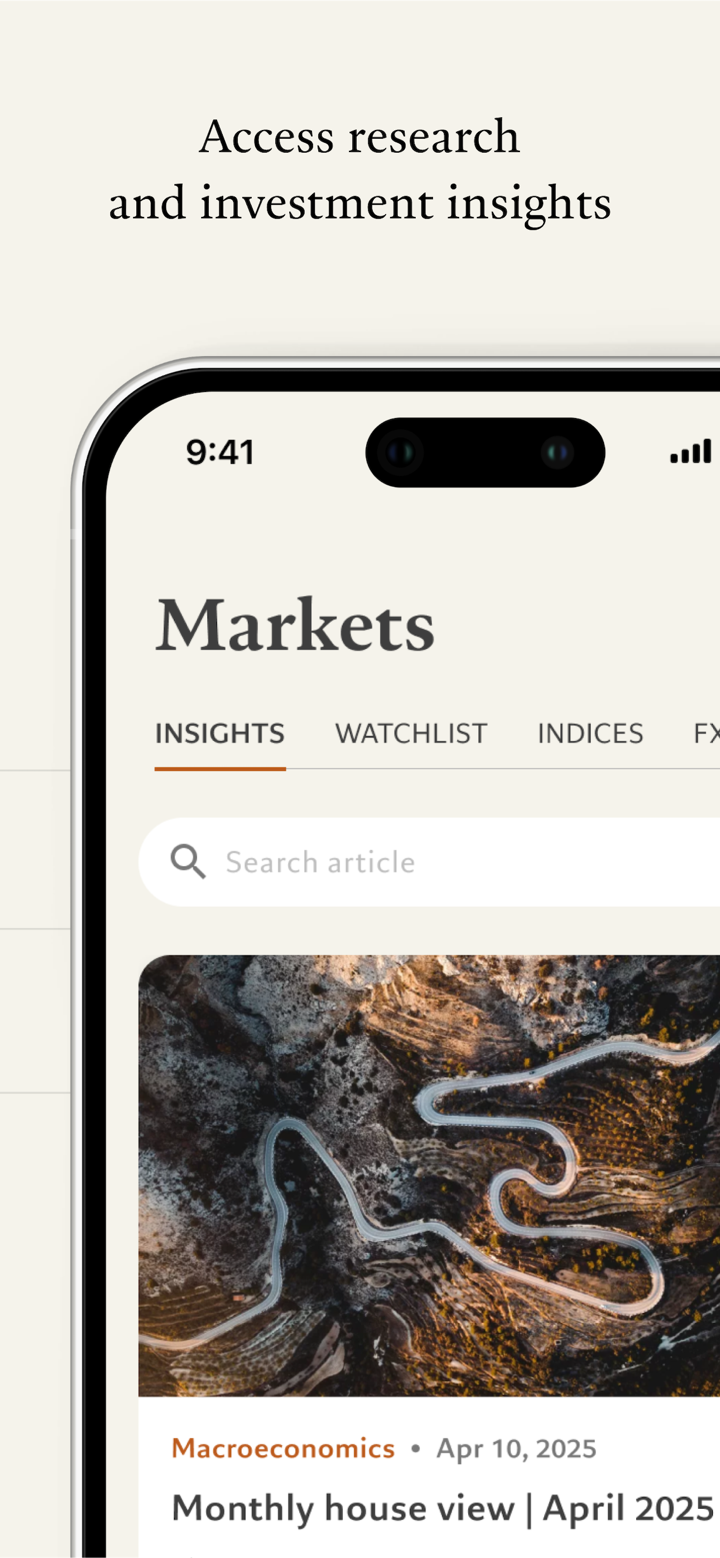

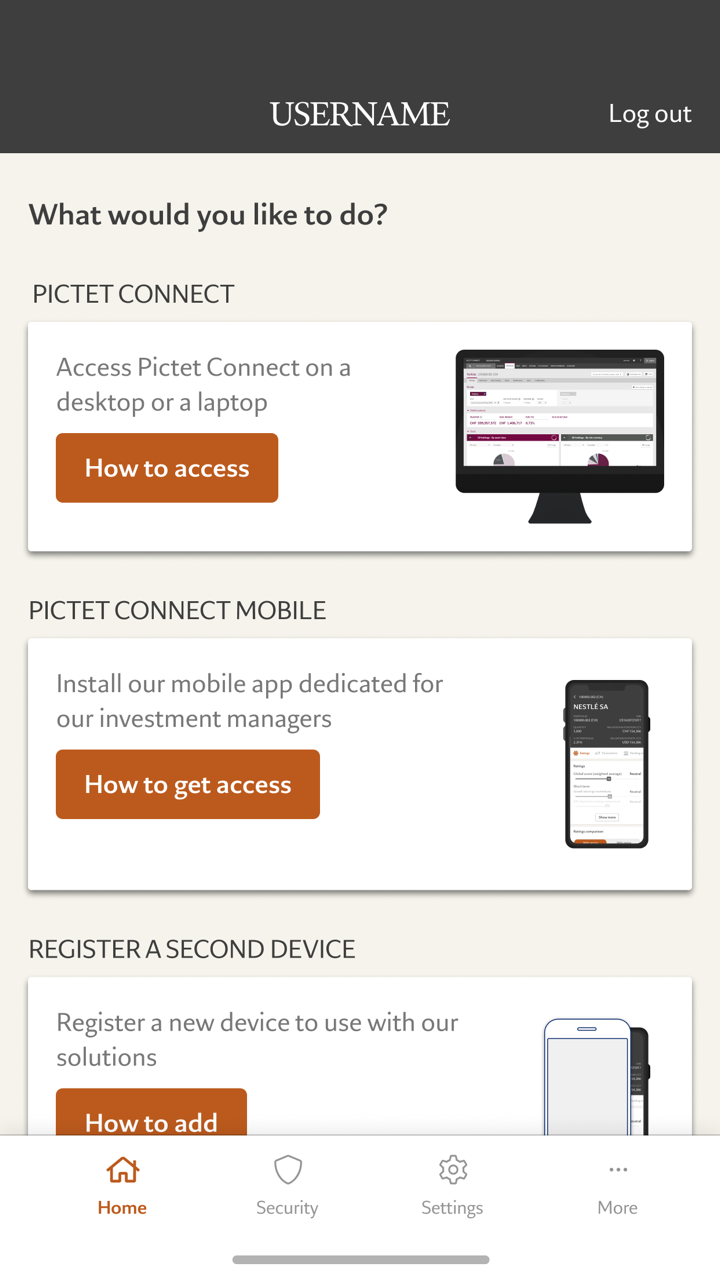

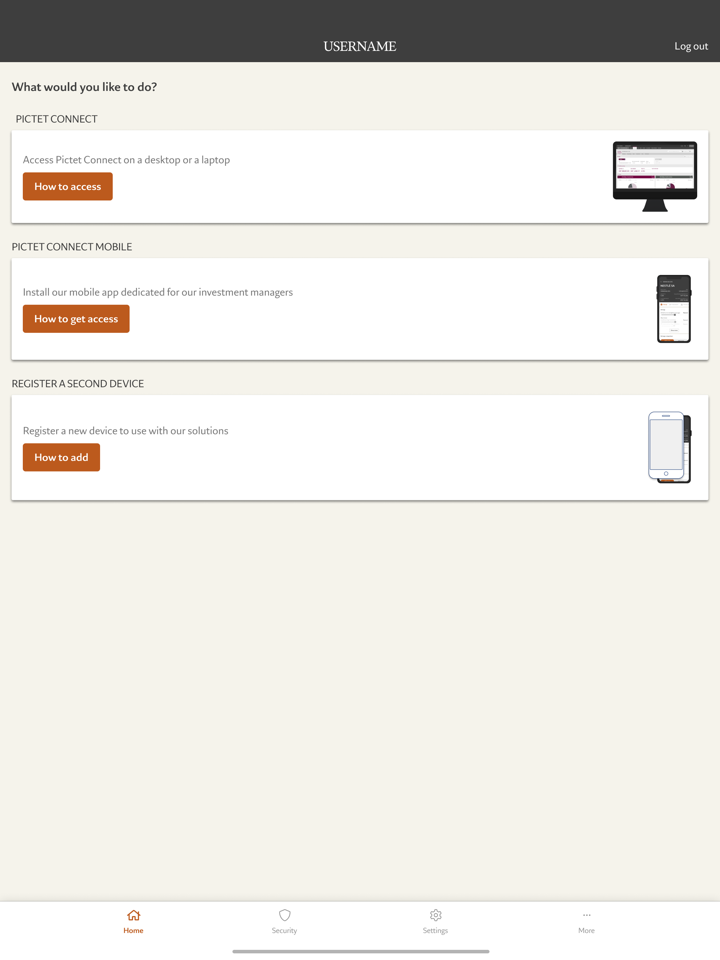

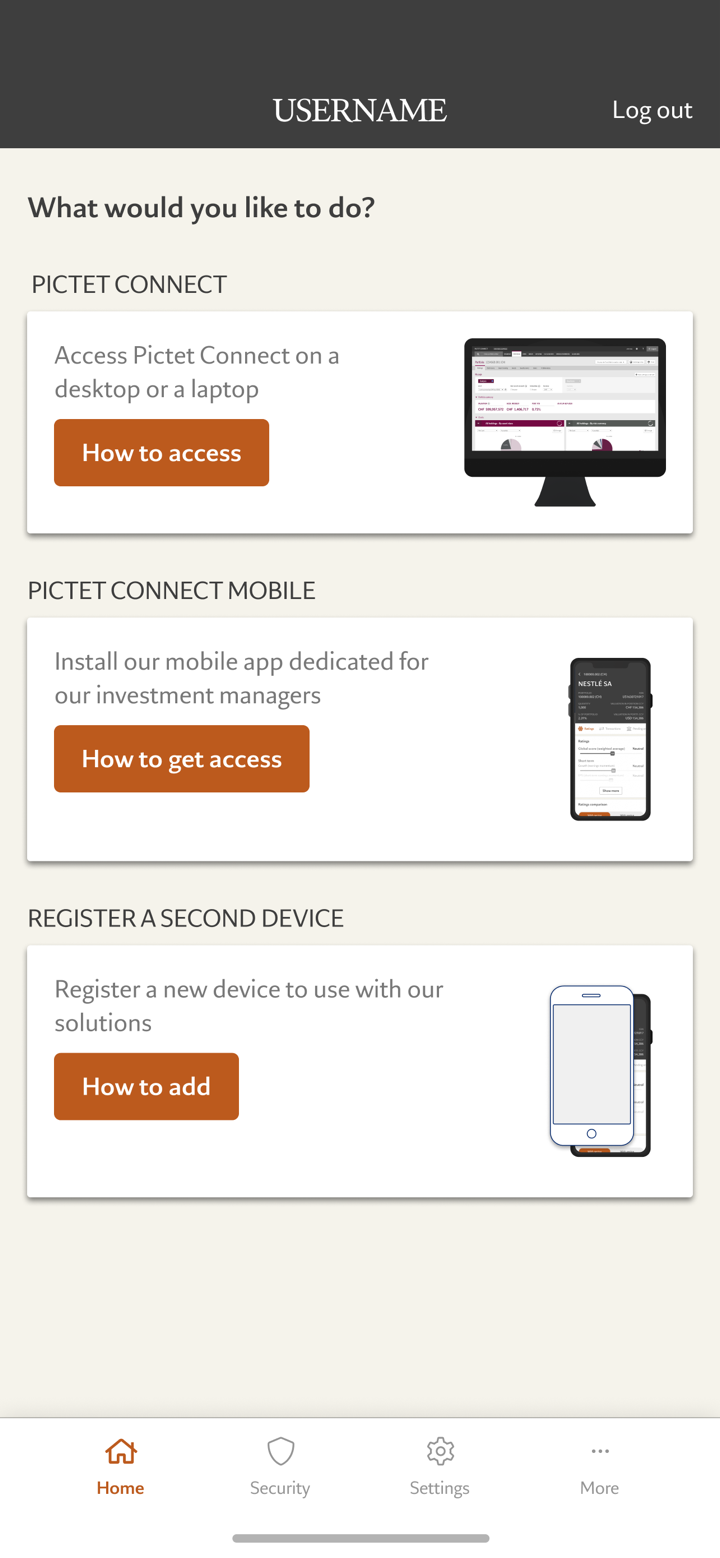

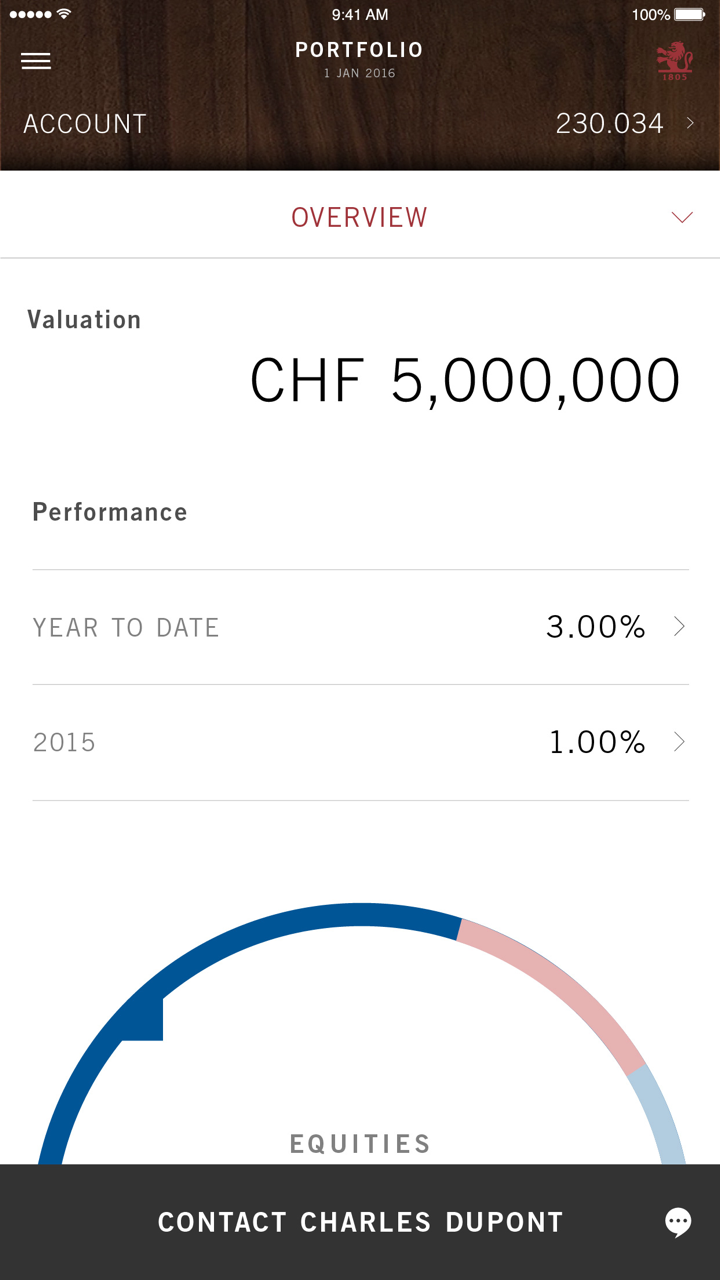

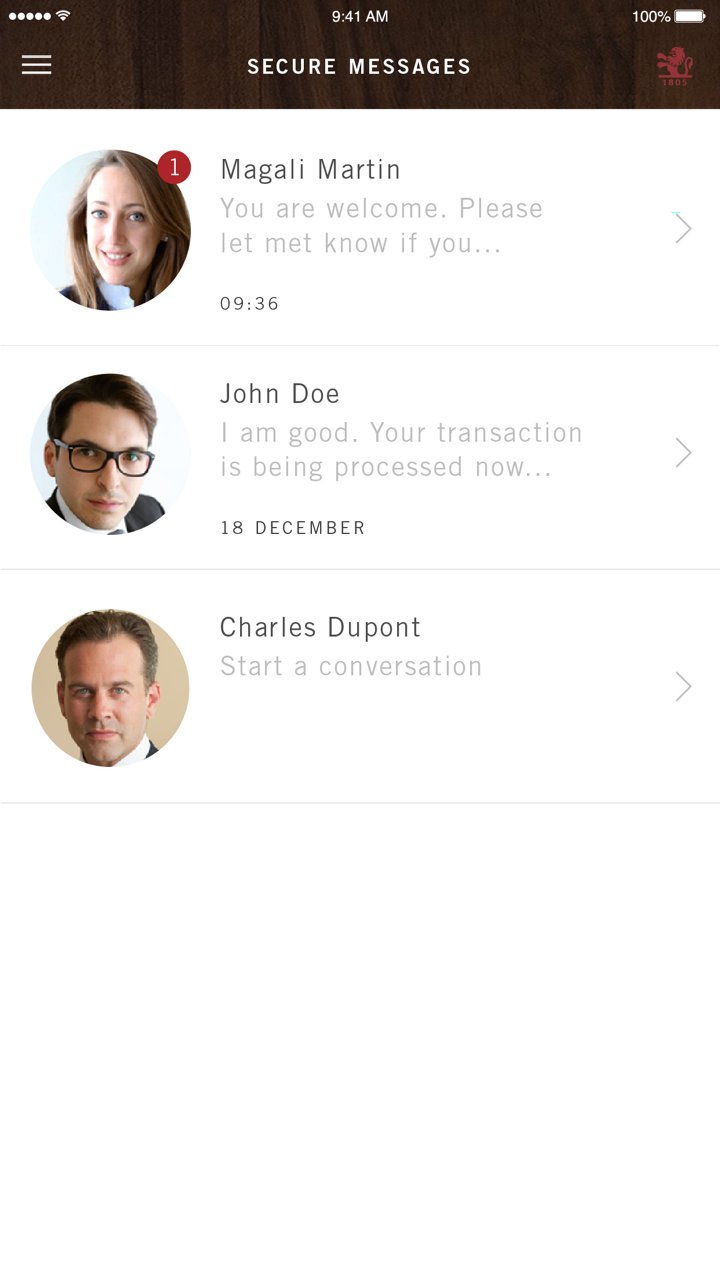

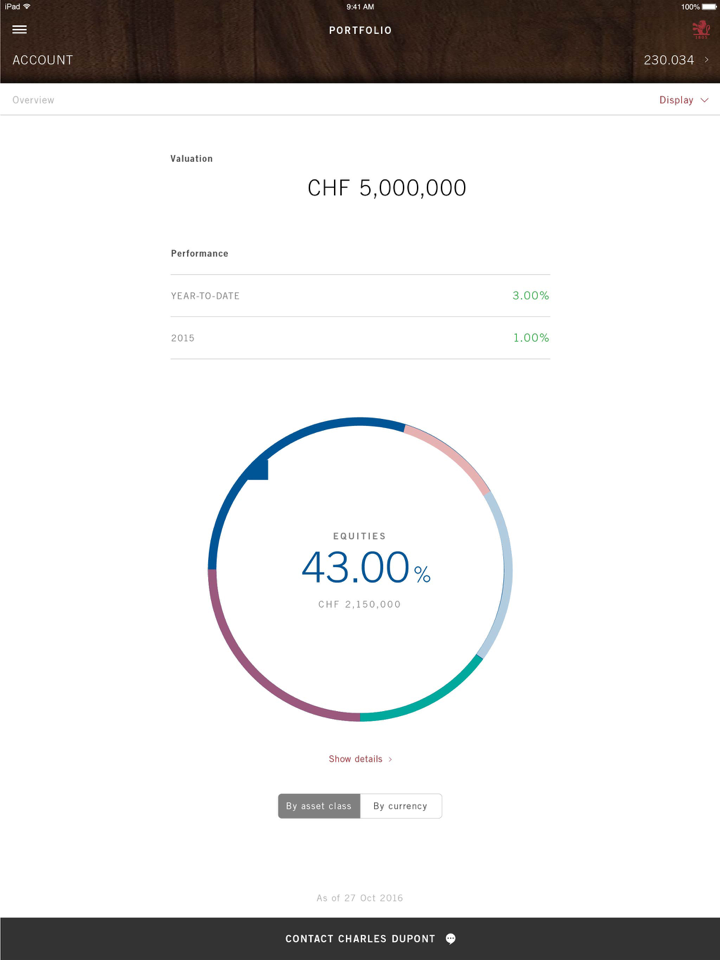

- Manajemen kekayaan: Selama lebih dari 200 tahun, Pictet Wealth Management telah fokus pada membantu klien pribadi dan kantor keluarga dalam mengelola, mengembangkan, dan menjaga kekayaan mereka untuk jangka panjang. Layanan mereka bertujuan untuk membantu klien membangun bisnis, melindungi aset, dan memastikan keberlanjutan untuk generasi mendatang.

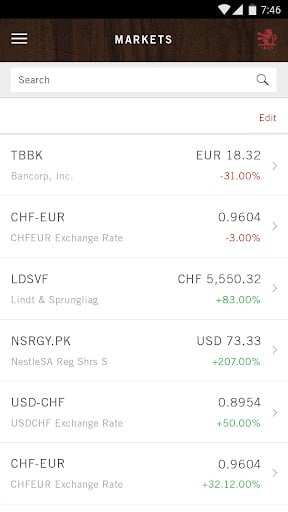

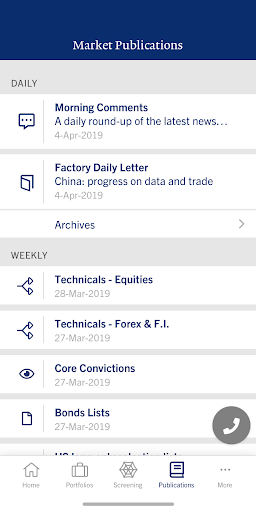

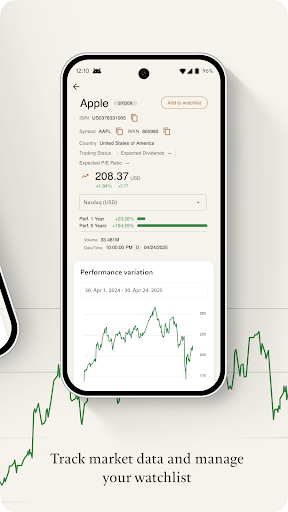

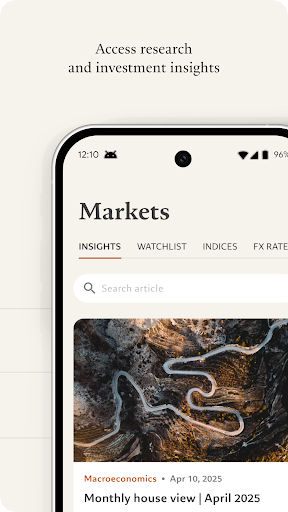

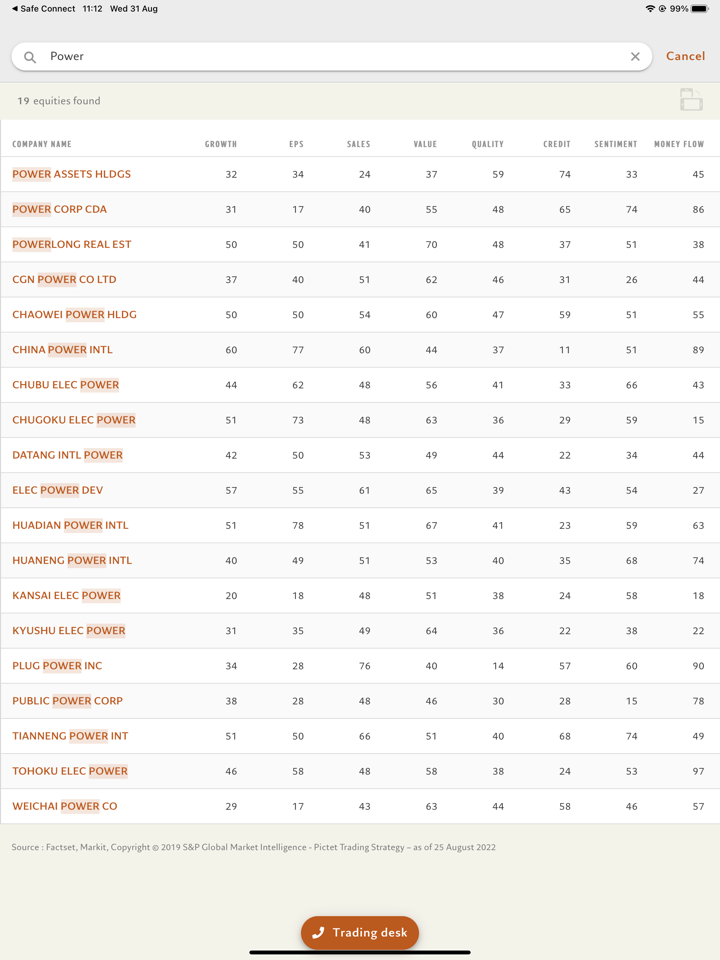

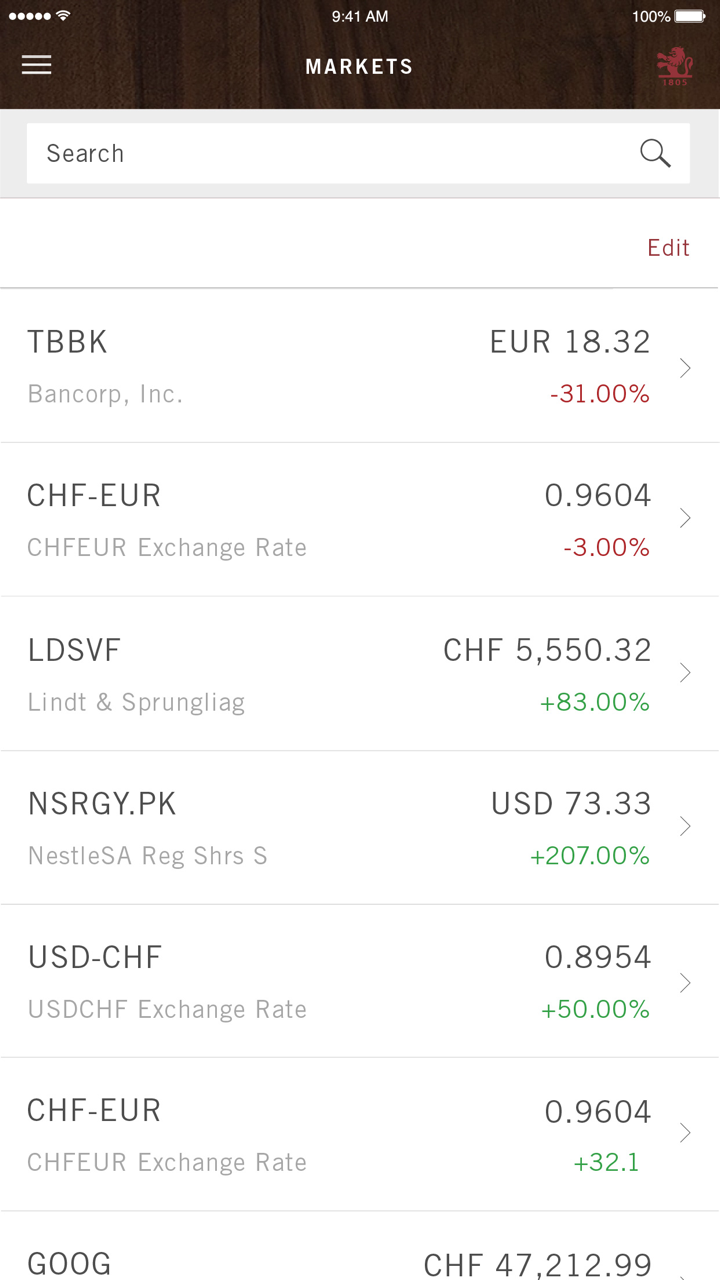

- Manajemen aset: Pictet Asset Management adalah sebuah perusahaan independen yang mengelola investasi di berbagai kelas aset seperti ekuitas, pendapatan tetap, dan alternatif atas nama kliennya.

- Investasi alternatif: Pictet Alternative Investments memberikan akses kepada investor yang cerdas dengan peluang unik dan telah menggunakan strategi alternatif selama beberapa dekade untuk mencapai hasil yang kuat.

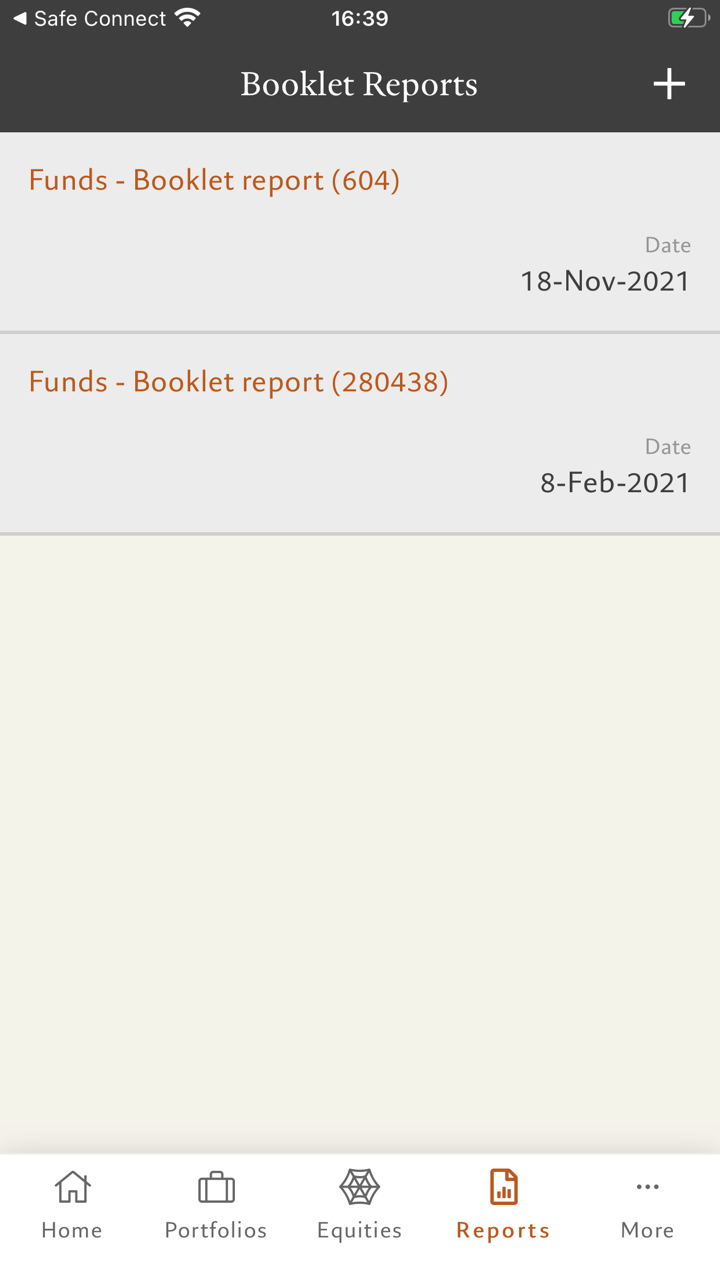

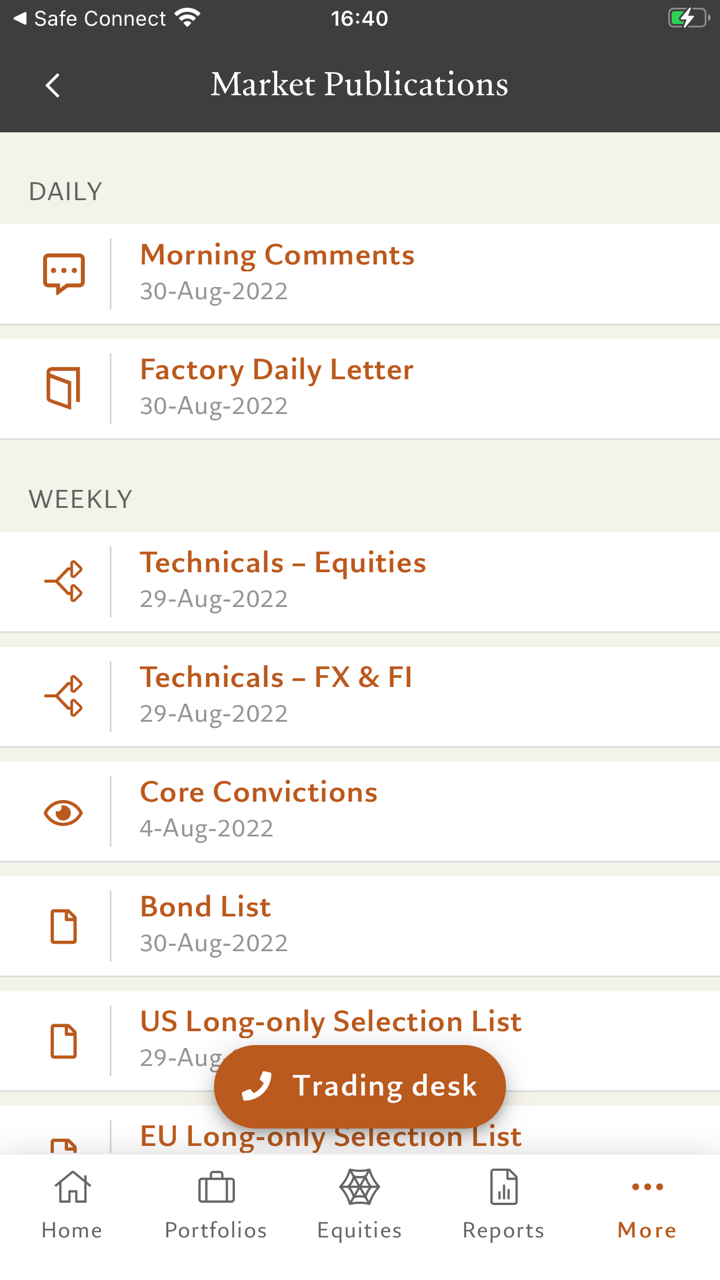

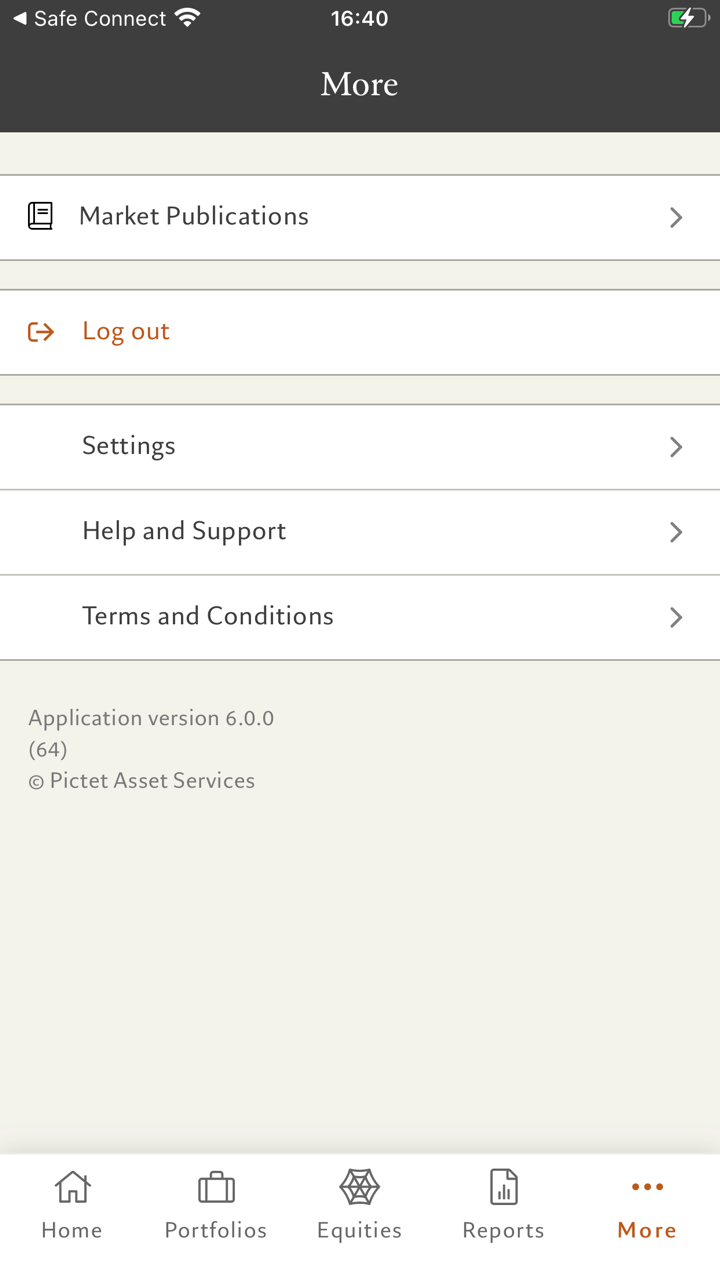

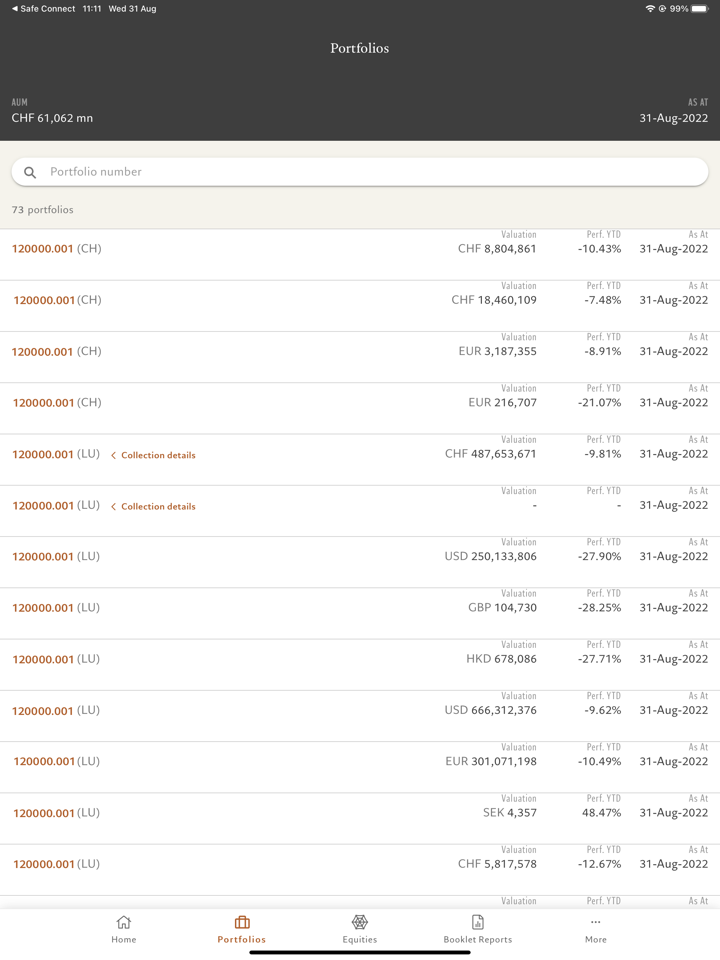

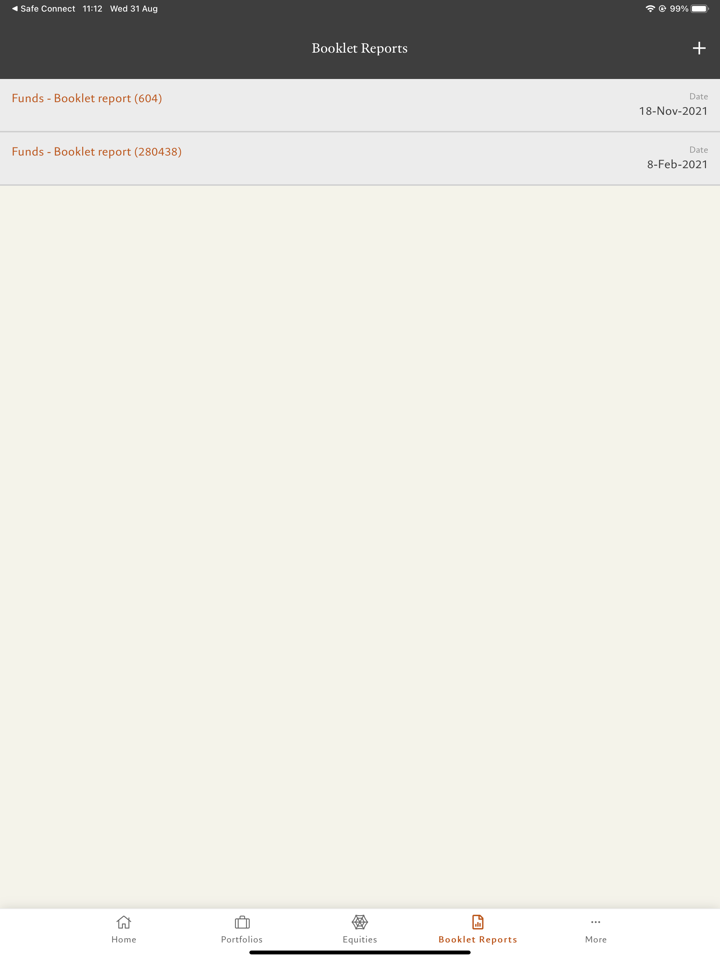

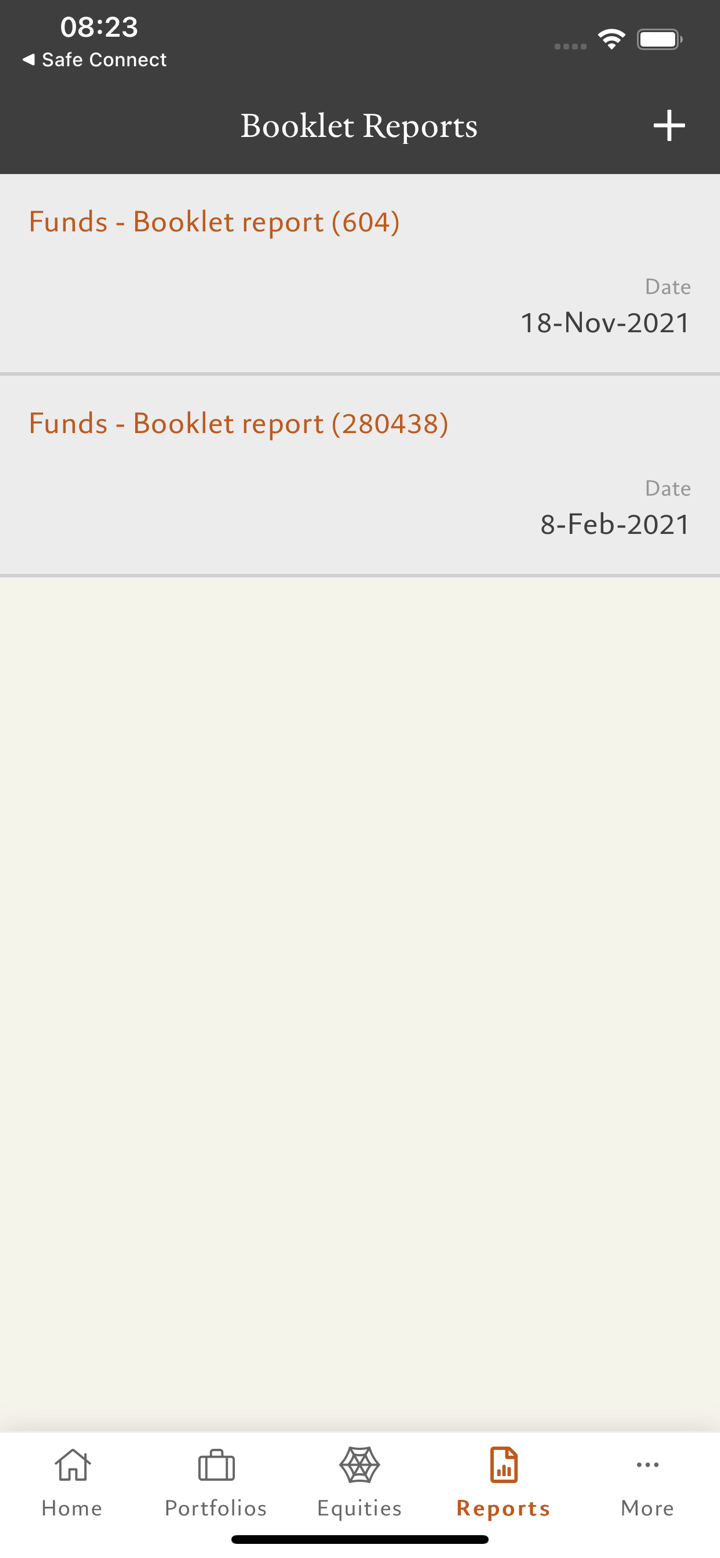

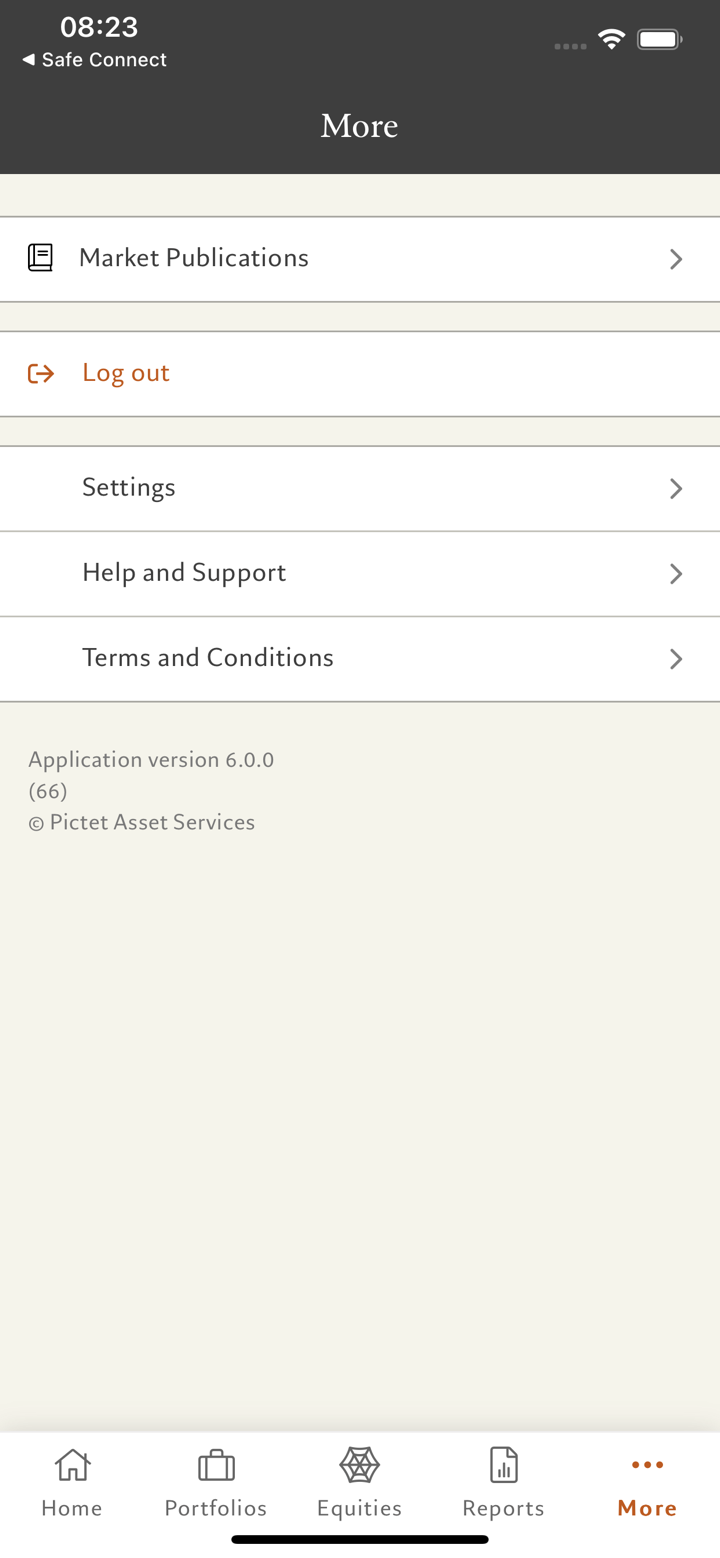

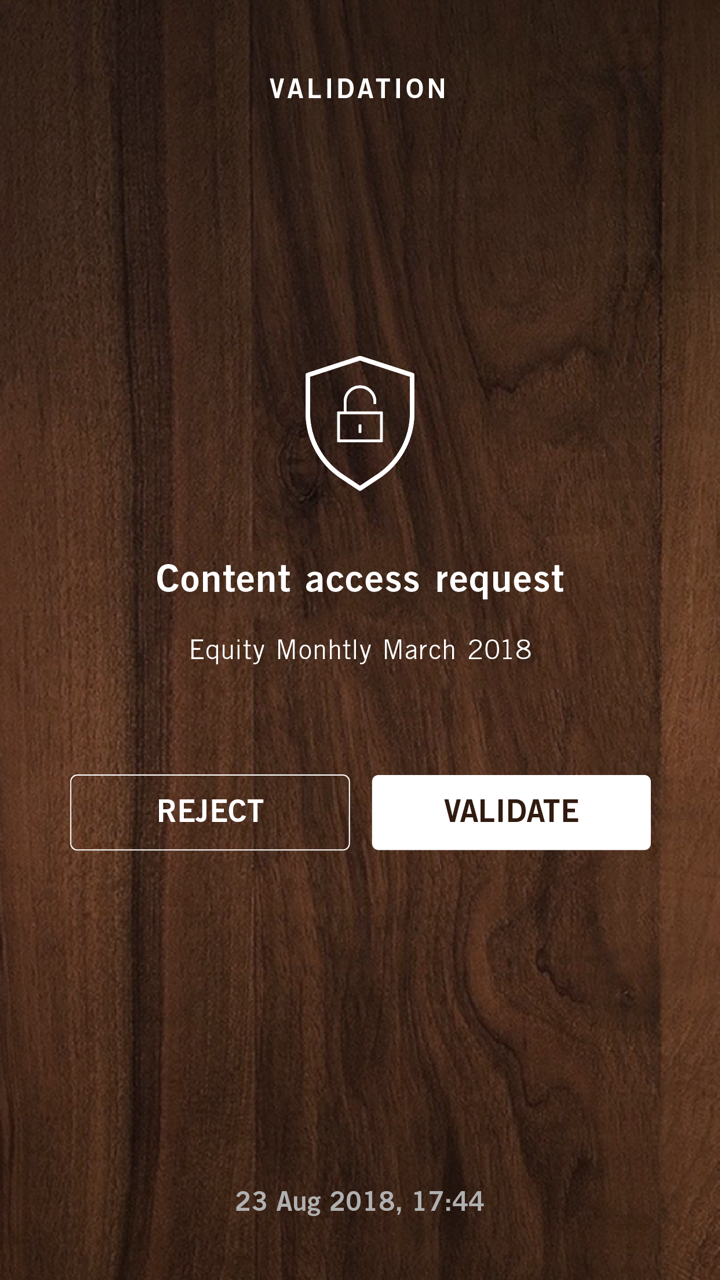

- Layanan aset: Pictet Asset Services mengelola semua aspek proses layanan aset, memungkinkan klien fokus pada distribusi dan menghasilkan kinerja portofolio.