Présentation de l'entreprise

| MAHFAZARésumé de l'examen | |

| Fondé | / |

| Pays/Région enregistré | Jordanie |

| Régulation | Aucune régulation |

| Instruments de marché | Forex, crosses, indices, matières premières |

| Compte de démonstration | ✅ |

| Effet de levier | / |

| Spread EUR/USD | À partir de 0,5 pips |

| Plateforme de trading | MT5 |

| Dépôt minimum | / |

| Assistance clientèle | Formulaire de contact |

| Tél : +962 6 560 9000 | |

| Fax : +962 6 560 9001 | |

| Email : mahfaza@mahfaza.com.jo | |

Informations sur MAHFAZA

MAHFAZA est un courtier non réglementé enregistré en Jordanie, proposant des transactions sur le forex, les crosses, les indices et les matières premières avec un spread à partir de 0,5 pips via la plateforme de trading MT5.

Avantages et inconvénients

| Avantages | Inconvénients |

| Diversité des actifs de trading | Aucune régulation |

| Comptes de démonstration | Effet de levier non clair |

| Multiples types de compte | Aucune information sur les dépôts et les retraits |

| Pas de commissions | |

| Plateforme MT5 |

MAHFAZA est-il légitime ?

Non. MAHFAZA n'a aucune régulation valide actuellement. Veuillez prendre conscience du risque !

Que puis-je trader sur MAHFAZA ?

| Instruments de trading | Pris en charge |

| Forex | ✔ |

| Crosses | ✔ |

| Indices | ✔ |

| Matières premières | ✔ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETF | ❌ |

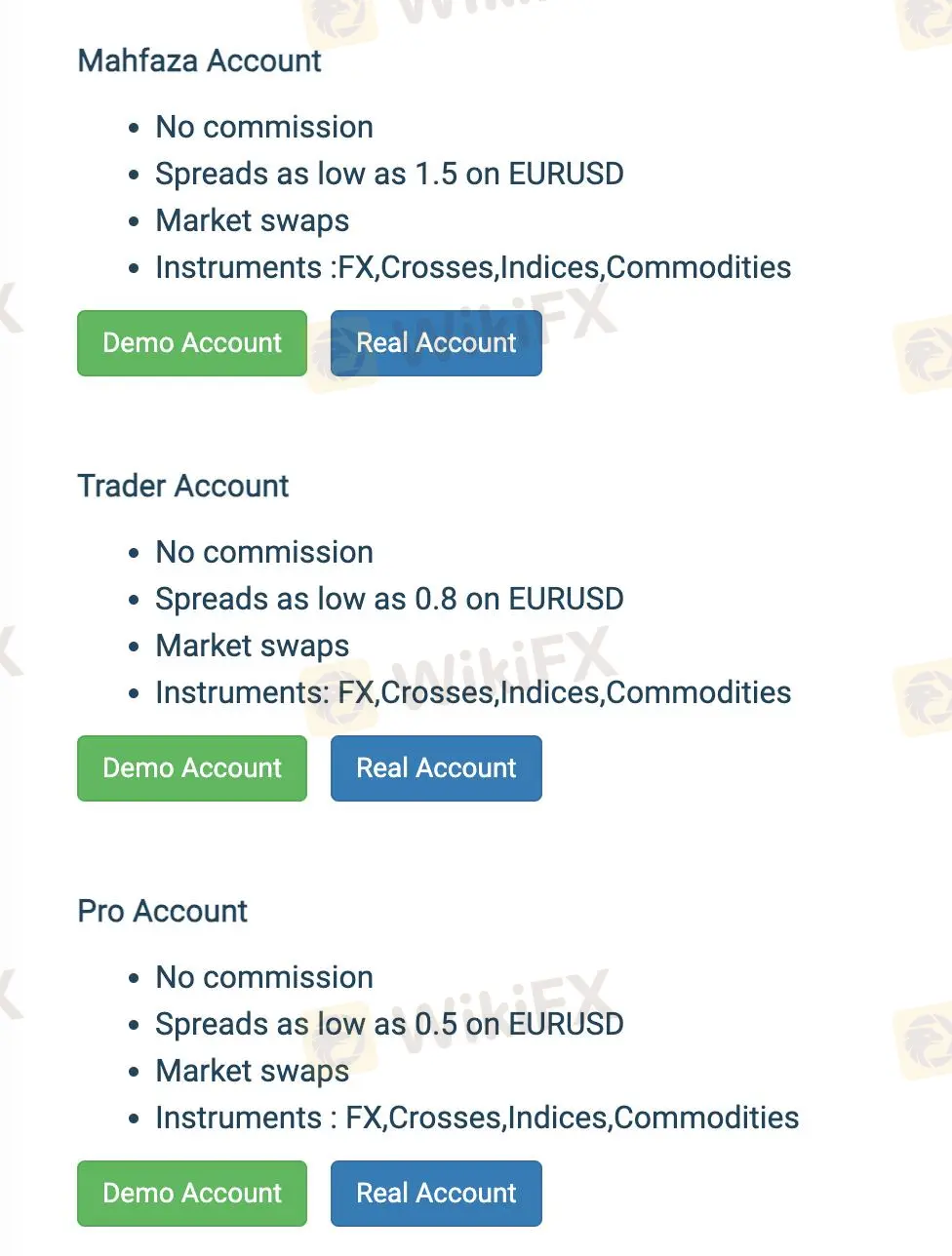

Type de compte/Frais

Mahfaza propose trois types de compte: Compte Mahfaza, Compte Trader et Compte Pro.

| Type de compte | Spread EUR/USD | Commission |

| Mahfaza | À partir de 1,5 pips | ❌ |

| Trader | À partir de 0,8 pips | ❌ |

| Pro | À partir de 0,5 pips | ❌ |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| MT5 | ✔ | / | Traders expérimentés |

| MT4 | ❌ | Débutants |