Company Summary

| MAHFAZAReview Summary | |

| Founded | / |

| Registered Country/Region | Jordan |

| Regulation | No regulation |

| Market Instruments | Forex, crosses, indices, commodities |

| Demo Account | ✅ |

| Leverage | / |

| EUR/USD Spread | From 0.5 pips |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | Contact form |

| Tel: +962 6 560 9000 | |

| Fax: +962 6 560 9001 | |

| Email: mahfaza@mahfaza.com.jo | |

MAHFAZA Information

MAHFAZA is an unregulated broker registered in Jordan , offering trading in forex, crosses, indices and commodities with spread from 0.5 pips through the MT5 trading platform.

Pros and Cons

| Pros | Cons |

| Diverse trading assets | No regulation |

| Demo accounts | Unclear leverage |

| Multiple account types | No info on deposits and withdrawals |

| No commissions | |

| MT5 platform |

Is MAHFAZA Legit?

No. MAHFAZA has no valid regulations currently. Please be aware of the risk!

What Can I Trade on MAHFAZA?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Crosses | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

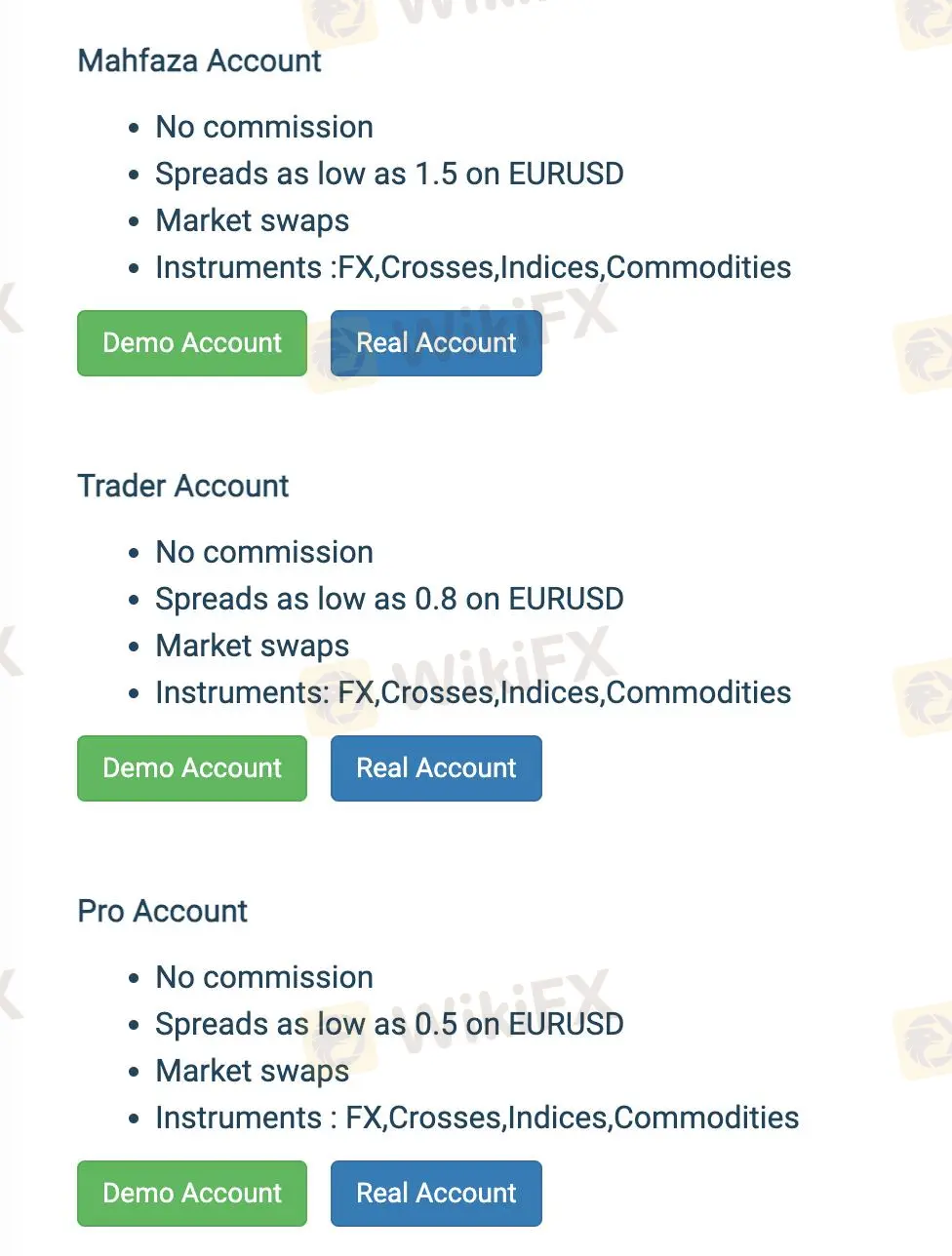

Mahfaza offers three account types: Mahfaza Account, Trader Account and Pro Account.

| Account Type | EUR/USD Spread | Commission |

| Mahfaza | From 1.5 pips | ❌ |

| Trader | From 0.8 pips | ❌ |

| Pro | From 0.5 pips | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | / | Experienced traders |

| MT4 | ❌ | Beginners |