Buod ng kumpanya

| UP TREND Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Rehistradong Bansa/Rehiyon | Bulgaria |

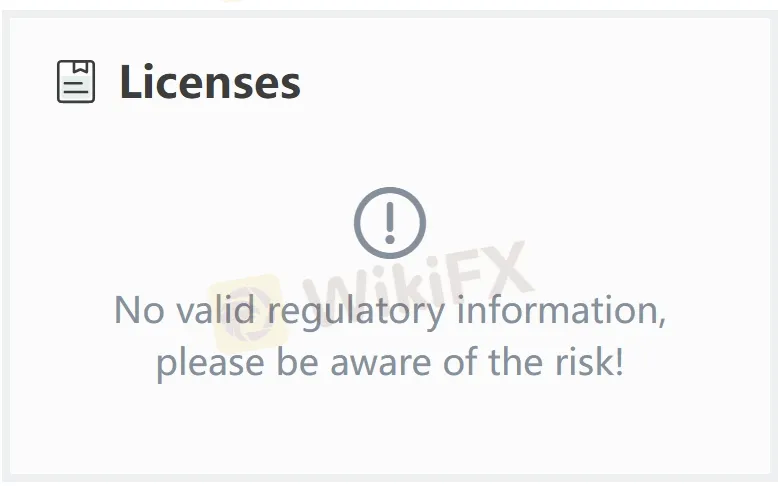

| Regulasyon | Walang regulasyon |

| Mga Serbisyong Pinansyal | Asset management, investment advisory, brokerage services, IPO/SPO support, financial instrument custody, at iba pa. |

| Suporta sa Customer | Tel: +359 2 815 56 60 |

| Email: uptrend@uptrend.bg | |

| Address: Sofia 1407, blvd. Nikola Y. Vaptsarov No51A, fl. 1 | |

Impormasyon Tungkol sa UP TREND

Ang Up Trend ay isa sa mga unang lisensyadong intermediary sa pamumuhunan sa Bulgaria, itinatag noong 1997. Kasapi ito ng Bulgarian Stock Exchange at ng Central Depository mula noong 1998. Mayroon itong lisensya sa buong EU at nag-aalok ng malawak na hanay ng mga serbisyong pinansyal sa parehong mga retail at institutional na kliyente, kabilang ang asset management, investment advisory, brokerage, IPO/SPO support, at financial instrument custody. Nagtutulungan ito sa mga plataporma tulad ng Thomson Reuters, Capital IQ, Bloomberg, at FactSet upang maglabas ng kanilang mga pagsusuri sa merkado. Ang punong tanggapan nito ay nasa Sofia, Bulgaria.

Gayunpaman, ang broker sa kasalukuyan ay hindi lubos na nairegula ng anumang opisyal na awtoridad, na dapat magbigay sa iyo ng babala dahil sa posibleng kakulangan sa kredibilidad at pagtitiwala.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Malawak na hanay ng mga serbisyong pinansyal | Walang regulasyon |

| Maraming taon ng karanasan sa industriya |

Tunay ba ang UP TREND?

Ang pinakamahalagang salik sa pagmamatimbang ng kaligtasan ng isang plataporma ng brokerage ay kung ito ay pormal na nairegula. Ang UP TREND ay isang di nairegulang broker, na nangangahulugang ang kaligtasan ng pondo ng mga gumagamit at mga aktibidad sa kalakalan ay hindi epektibong pinoprotektahan. Dapat mag-ingat ang mga mamumuhunan sa pagpili ng UP TREND.

Ano ang Maaari Kong I-trade sa UP TREND?

Nag-aalok ang Up Trend Ltd. ng malawak na hanay ng mga serbisyong pang-invest para sa parehong mga retail at institutional na kliyente, kabilang ang:

- Mga Serbisyong Brokerage: Mga order ng pagbili/pagbenta sa mga pamilihan sa Bulgaria at internasyonal.

- Asset Management: Indibidwal na pamamahala ng portfolio sa ilalim ng isang discretionary mandate.

- Investment Advisory: Personalisadong financial consulting batay sa mga layunin ng kliyente at profile ng panganib.

- Custody Services: Pag-iingat at administrasyon ng mga instrumento ng pananalapi.

- IPO/SPO Support: Mga serbisyo kaugnay ng mga panimulang at pangalawang pampublikong alokasyon.

Nag-aalok sila ng mga serbisyong brokerage na may access sa:

- Mga Stocks

- ETFs

- Bonds

- Forex

- Commodities

- CFDs (Contracts for Difference)

- Indices at Derivatives

| Mga Instrumento sa Paghahalal | Supported |

| Mga Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Derivatives | ✔ |

| Cryptocurrencies | ❌ |

| Options | ❌ |