회사 소개

| UP TREND 리뷰 요약 | |

| 설립 연도 | 1997 |

| 등록 국가/지역 | 불가리아 |

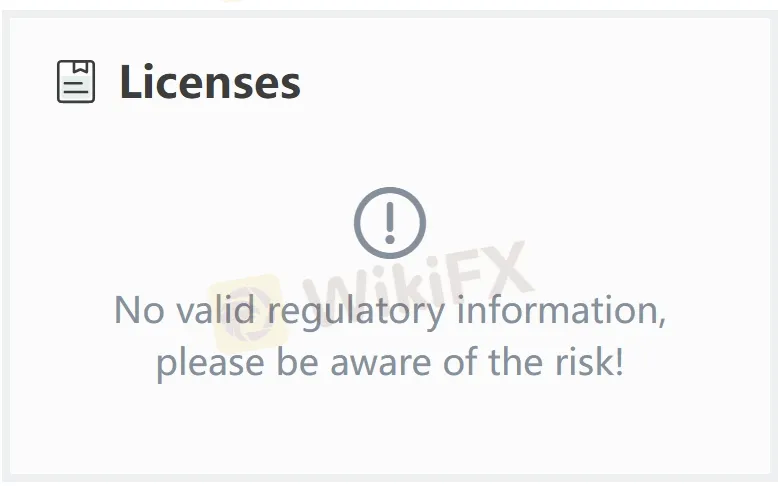

| 규제 | 규제 없음 |

| 금융 서비스 | 자산 관리, 투자 자문, 중개 서비스, IPO/SPO 지원, 금융 상품 보호 등 |

| 고객 지원 | 전화: +359 2 815 56 60 |

| 이메일: uptrend@uptrend.bg | |

| 주소: 소피아 1407, 불가리아, 블루바드 니콜라 Y. 바프차로브 51A, 1층 | |

UP TREND 정보

Up Trend은 1997년에 설립된 불가리아 최초의 라이선스 투자 중개업체 중 하나입니다. 1998년부터 불가리아 증권 거래소와 중앙 예탁소의 회원이었습니다. 이 회사는 EU 전역 라이선스를 보유하고 자산 관리, 투자 자문, 중개, IPO/SPO 지원 및 금융 상품 보호를 포함한 다양한 금융 서비스를 소매 및 기관 고객에게 제공합니다. 시장 분석을 발표하기 위해 톰슨 로이터스, 캐피털 아이큐, 블룸버그, 팩트셋과 파트너십을 맺고 있습니다. 본사는 불가리아 소피아에 위치해 있습니다.

그러나 현재 해당 브로커는 공식 당국에 의해 잘 규제되지 않고 있습니다, 이는 신뢰성과 신뢰성이 떨어질 수 있음을 의미하므로 주의가 필요합니다.

장단점

| 장점 | 단점 |

| 다양한 금융 서비스 | 규제 없음 |

| 수년간의 산업 경험 |

UP TREND이 신뢰할 만한가요?

브로커리지 플랫폼의 안전성을 측정하는 가장 중요한 요소는 공식적으로 규제되었는지 여부입니다. UP TREND은 규제되지 않은 브로커로, 사용자 자금과 거래 활동의 안전이 효과적으로 보호되지 않습니다. 투자자는 UP TREND을 신중히 선택해야 합니다.

UP TREND에서 무엇을 거래할 수 있나요?

Up Trend Ltd.는 소매 및 기관 고객을 대상으로 다음과 같은 다양한 투자 서비스를 제공합니다:

- 중개 서비스: 불가리아 및 국제 시장에서 매수/매도 주문.

- 자산 관리: 재량적 위임 하에 개별 포트폴리오 관리.

- 투자 자문: 고객 목표와 위험 프로필에 기반한 맞춤형 금융 상담.

- 보관 서비스: 금융 상품의 안전 보관 및 관리.

- IPO/SPO 지원: 초기 및 이차 공개 제공과 관련된 서비스.

그들은 다음에 액세스할 수 있는 중개 서비스를 제공합니다:

- 주식

- ETFs

- 채권

- 외환

- 상품

- CFDs (차이 계약)

- 지수 및 파생 상품

| 거래 상품 | 지원됨 |

| 주식 | ✔ |

| ETFs | ✔ |

| 채권 | ✔ |

| 외환 | ✔ |

| 상품 | ✔ |

| CFDs | ✔ |

| 지수 | ✔ |

| 파생 상품 | ✔ |

| 암호화폐 | ❌ |

| 옵션 | ❌ |