Perfil de la compañía

| Tapbit Resumen de la reseña | |

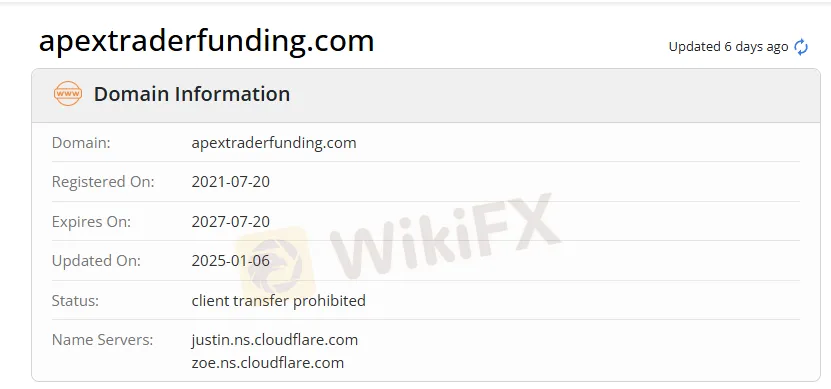

| Establecido | 2021 |

| País/Región Registrada | China |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Derivados, Criptomonedas |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | Aplicación móvil |

| Depósito Mínimo | / |

| Soporte al Cliente | Soporte al cliente 24/7 |

| Chat en vivo | |

| Telegram, Instagram, X, Medium, Facebook, YouTube, LinkedIn, Reddit | |

| Email: support@tapbit.com | |

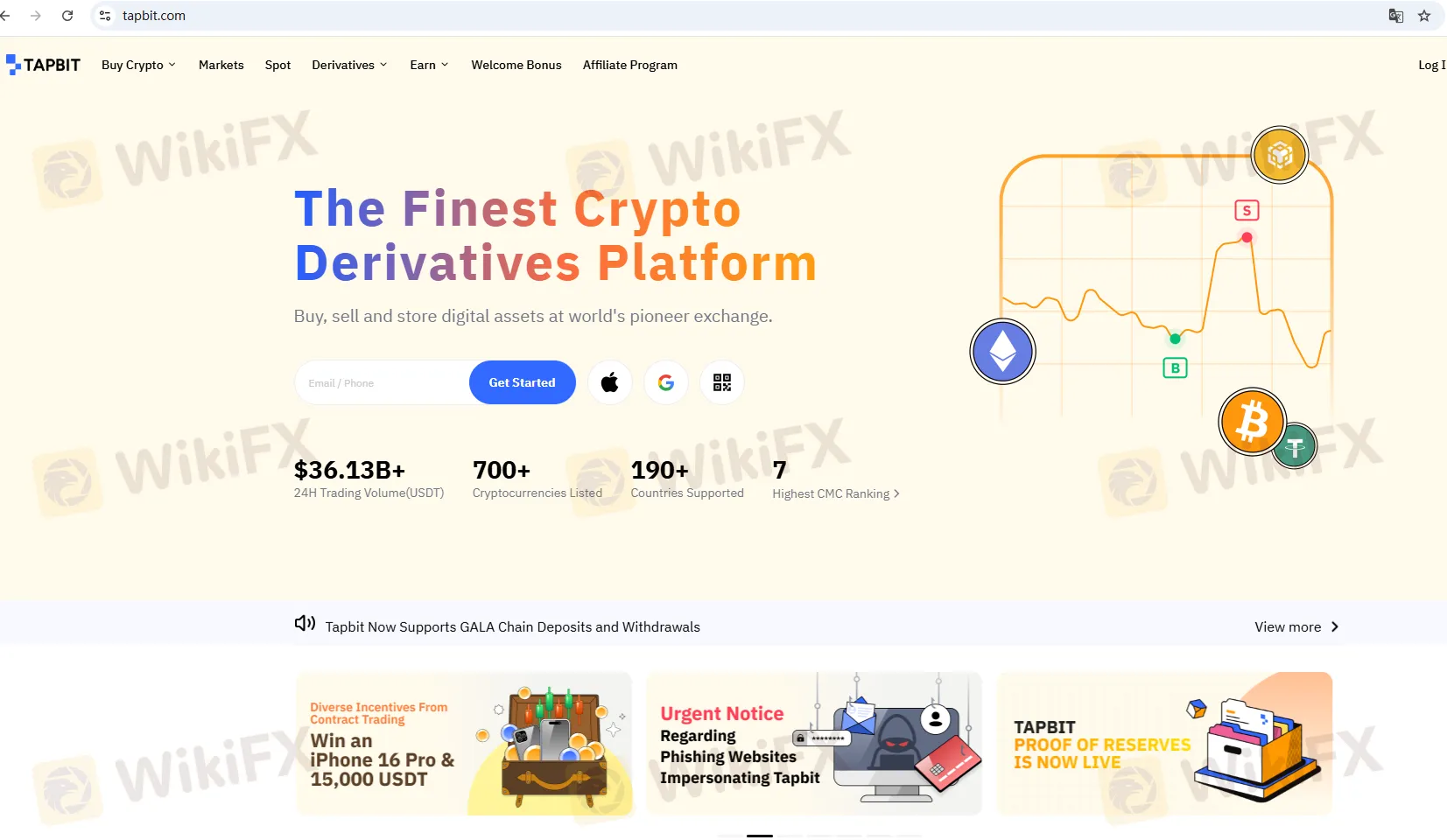

Información de Tapbit

Tapbit fue fundado en 2021, está registrado en China, actualmente no está regulado y ofrece trading de Derivados y Criptomonedas.

Pros y Contras

| Pros | Contras |

| Soporte de aplicación móvil | Sin regulación |

| Falta de instrumentos | |

| Cuenta demo no disponible | |

| MT4/MT5 no disponibles | |

| Falta de información sobre spreads |

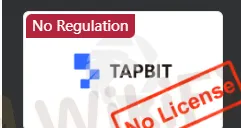

¿Es Tapbit Legítimo?

No. Tapbit no tiene regulación. ¡Por favor, tenga en cuenta el riesgo!

¿Qué puedo comerciar en Tapbit?

Tapbit ofrece derivados y criptomonedas.

| Instrumentos Negociables | Soportado |

| Criptomonedas | ✔ |

| Derivados | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| Aplicación móvil | ✔ | / | Principiantes y traders ocasionales que buscan simplicidad y rapidez |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |

Depósito y Retiro

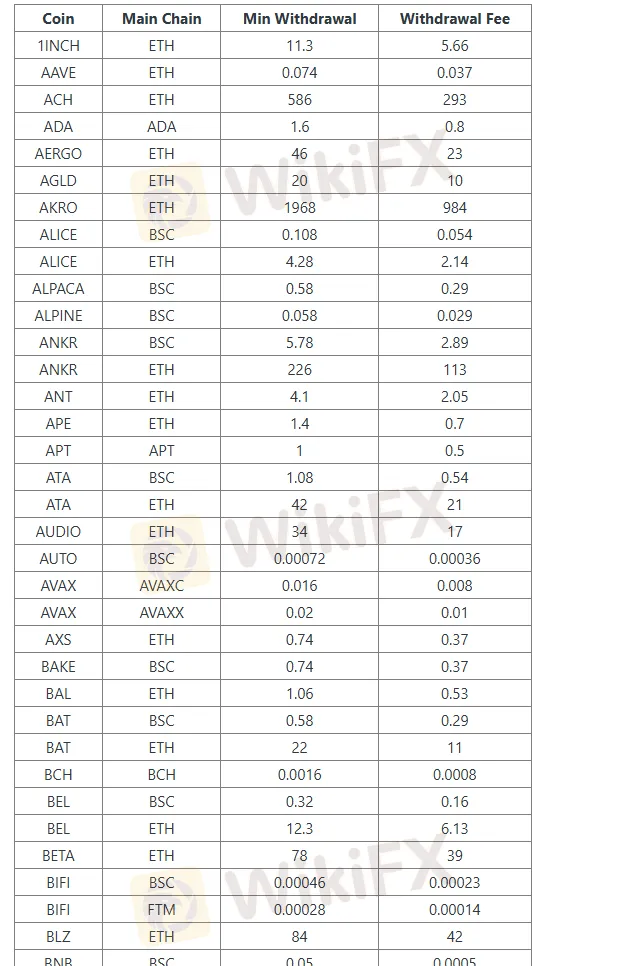

El depósito es gratuito en Tapbit, para conocer la tarifa específica de cada moneda, consulta la tabla a continuación:

Aquí está la tabla organizada de detalles de retiro de criptomonedas:

| Moneda | Cadena Principal | Retiro Mínimo | Tarifa de Retiro |

| 1INCH | ETH | 11.3 | 5.66 |

| AAVE | ETH | 0.074 | 0.037 |

| ACH | ETH | 586 | 293 |

| ADA | ADA | 1.6 | 0.8 |

| AERGO | ETH | 46 | 23 |

| AGLD | ETH | 20 | 10 |

| AKRO | ETH | 1968 | 984 |

| ALICE | BSC | 0.108 | 0.054 |

| ALICE | ETH | 4.28 | 2.14 |

| ALPACA | BSC | 0.58 | 0.29 |

| ALPINE | BSC | 0.058 | 0.029 |

| ANKR | BSC | 5.78 | 2.89 |

| ANKR | ETH | 226 | 113 |

| ANT | ETH | 4.1 | 2.05 |

| APE | ETH | 1.4 | 0.7 |

| APT | APT | 1 | 0.5 |

| ATA | BSC | 1.08 | 0.54 |

| ATA | ETH | 42 | 21 |

| AUDIO | ETH | 34 | 17 |

| AUTO | BSC | 0.00072 | 0.00036 |

| AVAX | AVAXC | 0.016 | 0.008 |

| AVAX | AVAXX | 0.02 | 0.01 |

| AXS | ETH | 0.74 | 0.37 |

| BAKE | BSC | 0.74 | 0.37 |