Resumo da empresa

| Tapbit Resumo da Revisão | |

| Fundado | 2021 |

| País/Região Registrada | China |

| Regulação | Sem regulação |

| Instrumentos de Mercado | Derivativos, Criptomoedas |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | Aplicativo móvel |

| Depósito Mínimo | / |

| Suporte ao Cliente | Suporte ao cliente 24/7 |

| Chat ao vivo | |

| Telegram, Instagram, X, Medium, Facebook, YouTube, LinkedIn, Reddit | |

| Email: support@tapbit.com | |

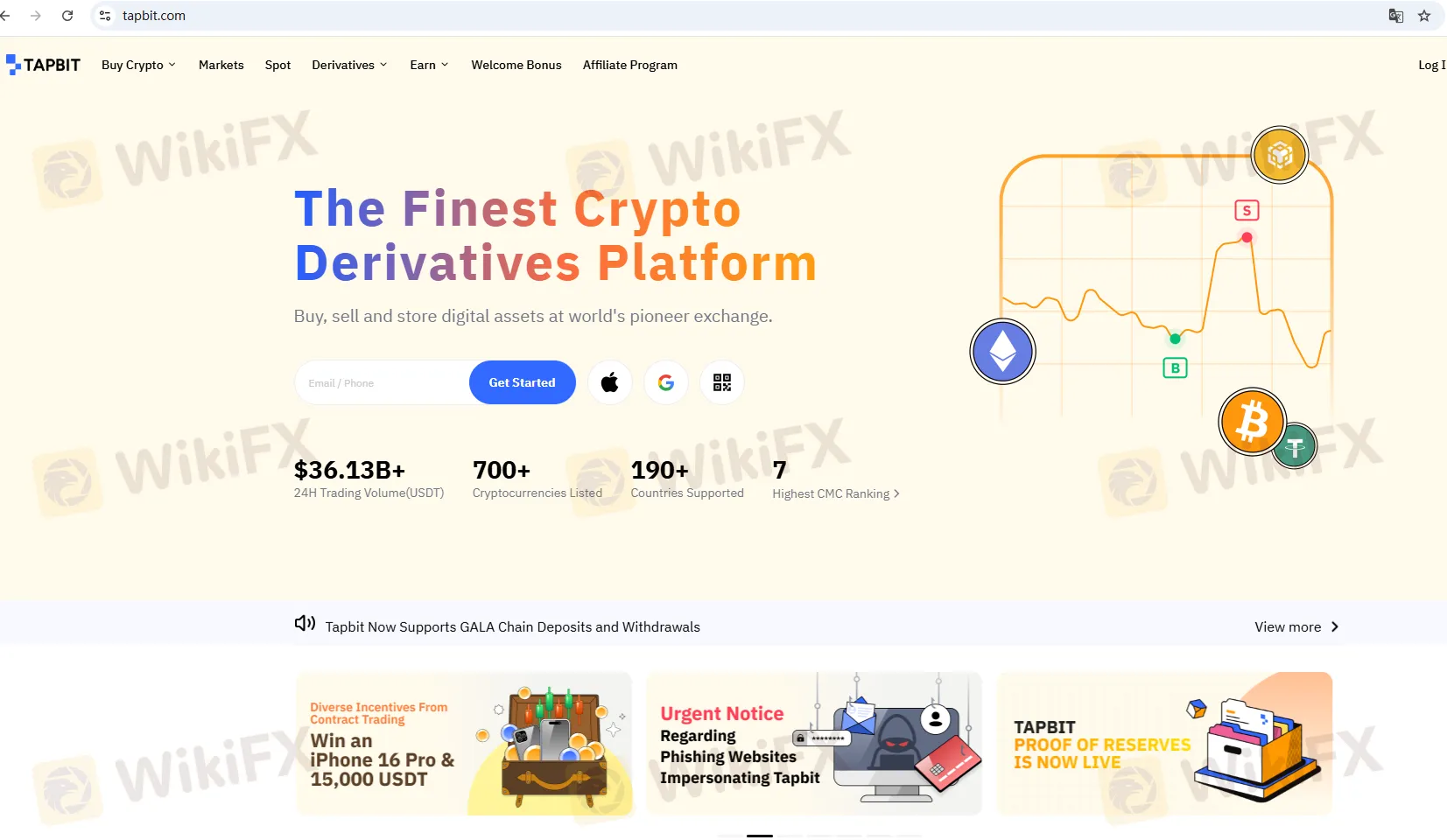

Informações sobre Tapbit

Tapbit foi fundada em 2021, está registrada na China e atualmente não é regulamentada, oferece negociação de Derivativos e Criptomoedas.

Prós e Contras

| Prós | Contras |

| Suporte de aplicativo móvel | Sem regulação |

| Falta de instrumentos | |

| Conta demo indisponível | |

| MT4/MT5 indisponível | |

| Falta de informações sobre spread |

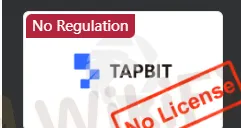

É Tapbit Legítimo?

Não. Tapbit não possui regulação. Por favor, esteja ciente do risco!

O Que Posso Negociar na Tapbit?

Tapbit fornece derivativos e criptomoedas.

| Instrumentos Negociáveis | Suportado |

| Criptomoedas | ✔ |

| Derivativos | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Aplicativo móvel | ✔ | / | Iniciantes e traders casuais que buscam simplicidade e rapidez |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |

Depósito e Saque

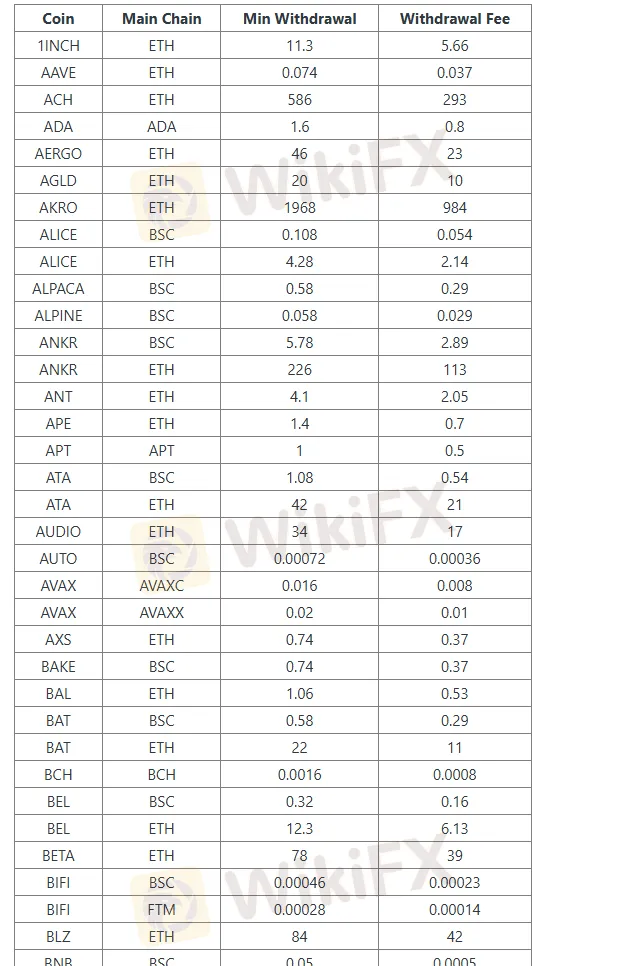

O depósito é gratuito na Tapbit, para saber a taxa específica de cada moeda, consulte a tabela abaixo:

Aqui está a tabela organizada com os detalhes de retirada de criptomoedas:

| Moeda | Cadeia Principal | Retirada Mínima | Taxa de Retirada |

| 1INCH | ETH | 11.3 | 5.66 |

| AAVE | ETH | 0.074 | 0.037 |

| ACH | ETH | 586 | 293 |

| ADA | ADA | 1.6 | 0.8 |

| AERGO | ETH | 46 | 23 |

| AGLD | ETH | 20 | 10 |

| AKRO | ETH | 1968 | 984 |

| ALICE | BSC | 0.108 | 0.054 |

| ALICE | ETH | 4.28 | 2.14 |

| ALPACA | BSC | 0.58 | 0.29 |

| ALPINE | BSC | 0.058 | 0.029 |

| ANKR | BSC | 5.78 | 2.89 |

| ANKR | ETH | 226 | 113 |

| ANT | ETH | 4.1 | 2.05 |

| APE | ETH | 1.4 | 0.7 |

| APT | APT | 1 | 0.5 |

| ATA | BSC | 1.08 | 0.54 |

| ATA | ETH | 42 | 21 |

| AUDIO | ETH | 34 | 17 |

| AUTO | BSC | 0.00072 | 0.00036 |

| AVAX | AVAXC | 0.016 | 0.008 |

| AVAX | AVAXX | 0.02 | 0.01 |

| AXS | ETH | 0.74 | 0.37 |

| BAKE | BSC | 0.74 | 0.37 |