Perfil de la compañía

| QNB FINANSINVEST Resumen de la reseña | |

| Fundado | 2016 |

| País/Región registrado | Turquía |

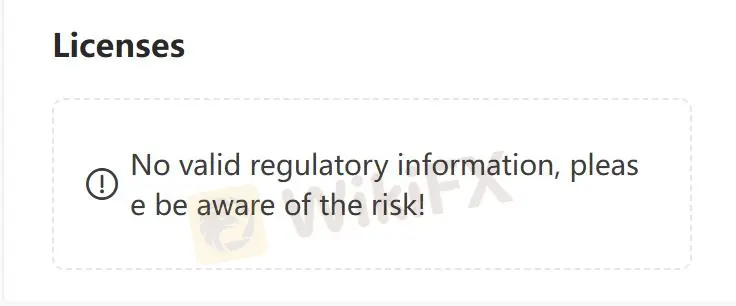

| Regulación | No regulado |

| Productos y servicios | Productos de inversión, transacciones de acciones, forex, transacciones de inversión en el extranjero, VIOP, instrumentos de deuda, warrants, derivados extrabursátiles, transacciones de fondos mutuos, transacciones de fondos cotizados en bolsa y asesoramiento de inversión |

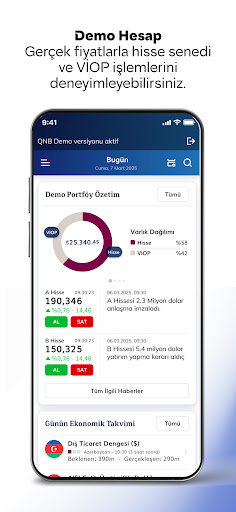

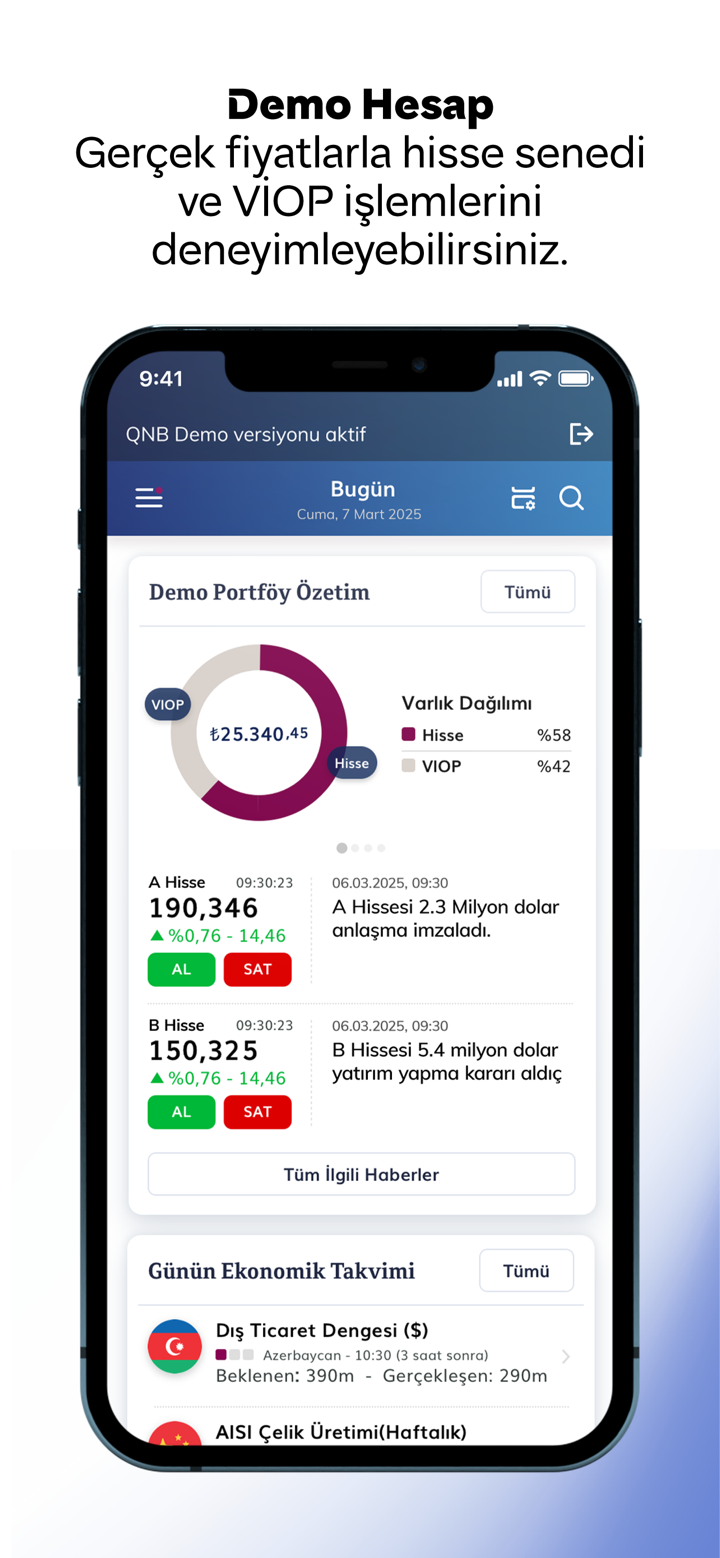

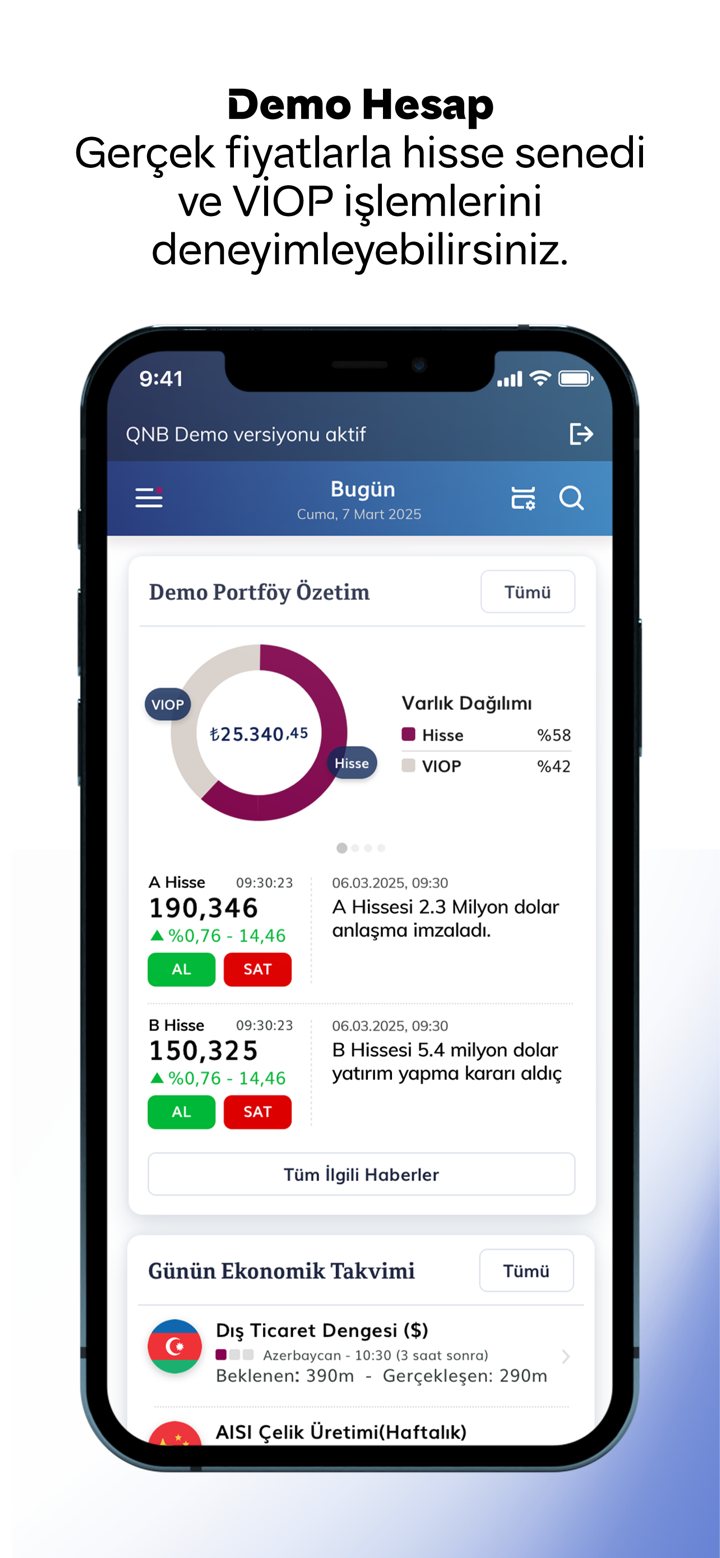

| Cuenta demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de trading | QNB Invest |

| Depósito mínimo | / |

| Soporte al cliente | Chat en vivo |

| Tel: +90 212 336 7373 | |

| Email: webinfo@qnbfi.com | |

| Twitter, Facebook, Instagram, YouTube y Linkedin | |

| Esentepe Mah. Büyükdere Cad. Kristal Kule Binası No: 215 Kat: 6-7 34394 Şişli / İstanbul | |

QNB Finansinvest, establecido en 2016 y con sede en Turquía, es una institución financiera que ofrece una amplia gama de servicios y productos a sus clientes. Como subsidiaria del Grupo QNB, una de las principales instituciones financieras de Oriente Medio y África con más de $150 mil millones en activos, QNB Finansinvest se beneficia de la fortaleza y estabilidad de su empresa matriz.

Con un enfoque en la gestión de carteras, asesoramiento de inversiones, gestión patrimonial, banca de inversión, renta fija, valores y fondos mutuos, QNB Finansinvest atiende tanto a clientes individuales como corporativos. Desde su creación en 1996, la empresa ha acumulado más de 25 años de experiencia en actividades del mercado de capitales.

Pros y contras

| Pros | Contras |

| Varios productos y servicios | Sitio web inaccesible |

| Soporte de chat en vivo | No regulado |

| No hay cuentas demo | |

| Información limitada sobre las condiciones de trading | |

| No es compatible con MT4/5 |

¿Es QNB FINANSINVEST legítimo?

QNB Finansinvest afirma que ofrece medidas de seguridad. Enfatizan la superioridad de su programa de seguridad encriptado de 128 bits sobre el cifrado estándar SSL de 40 bits utilizado por otros actores en el mercado de comercio electrónico, destacando su amplia adopción por parte de las principales casas de corretaje en Turquía. Esta tecnología de encriptación se promociona como el estándar de la industria, proporcionando una protección mejorada para la información sensible intercambiada en su plataforma.

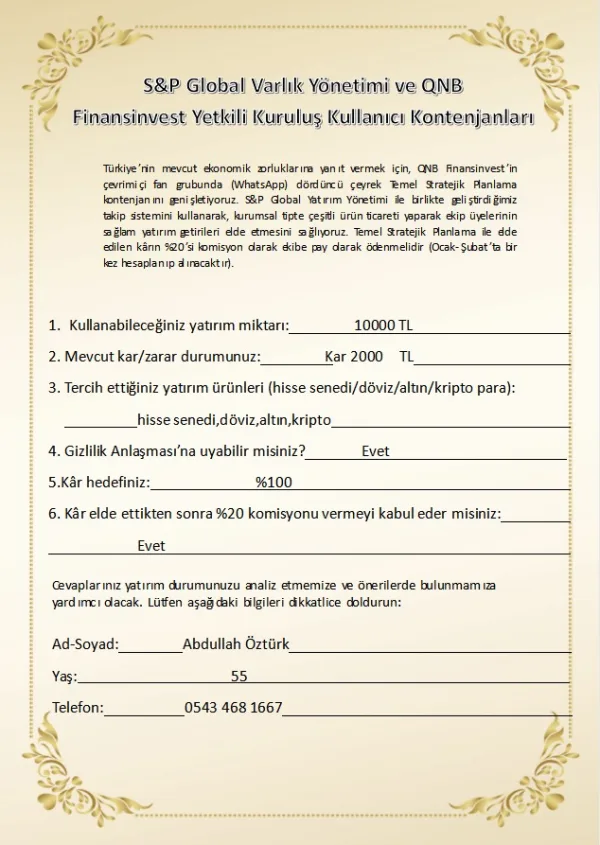

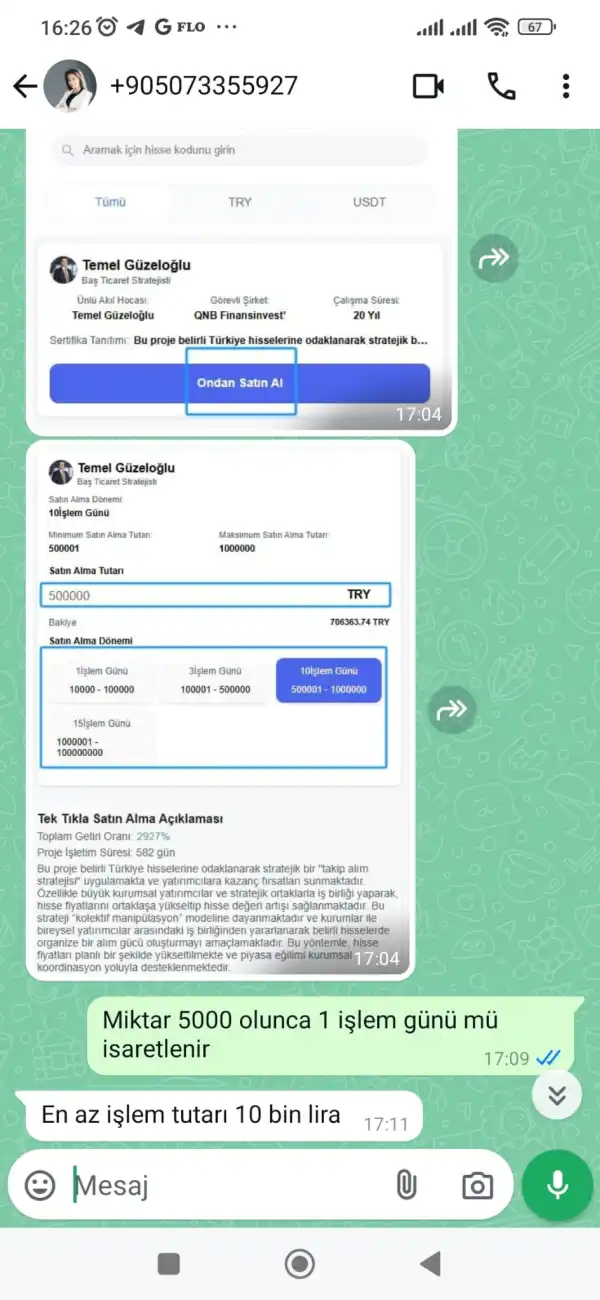

Sin embargo, surge una preocupación notable debido a la ausencia de una regulación válida que rija las operaciones de QNB Finansinvest. Sin la supervisión del gobierno o de una autoridad financiera, los inversores enfrentan riesgos inherentes. La falta de supervisión regulatoria significa que no hay un organismo externo que garantice el cumplimiento de los estándares de la industria, las mejores prácticas y los requisitos legales. En consecuencia, los inversores están expuestos a posibles explotaciones, ya que la falta de regulación deja espacio para prácticas indebidas y actividades fraudulentas.

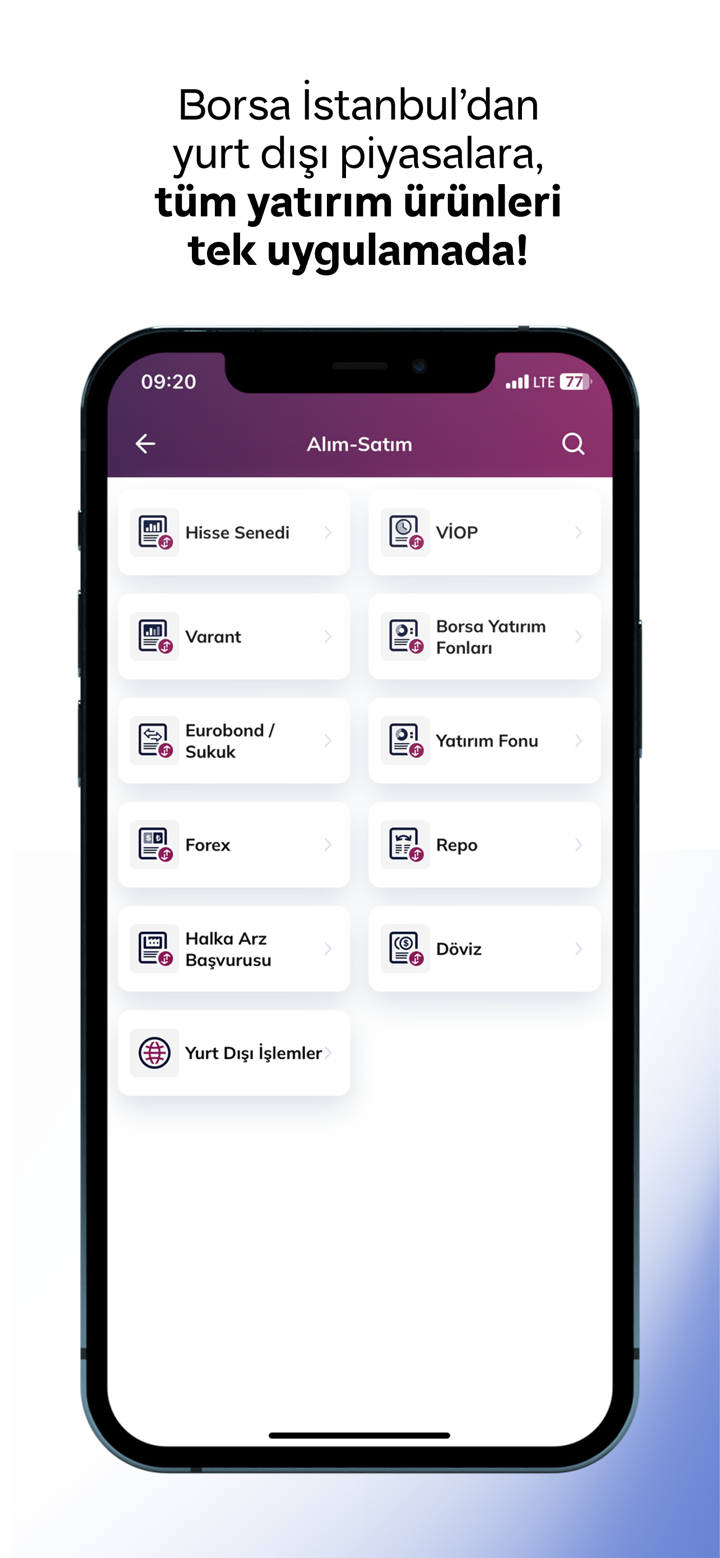

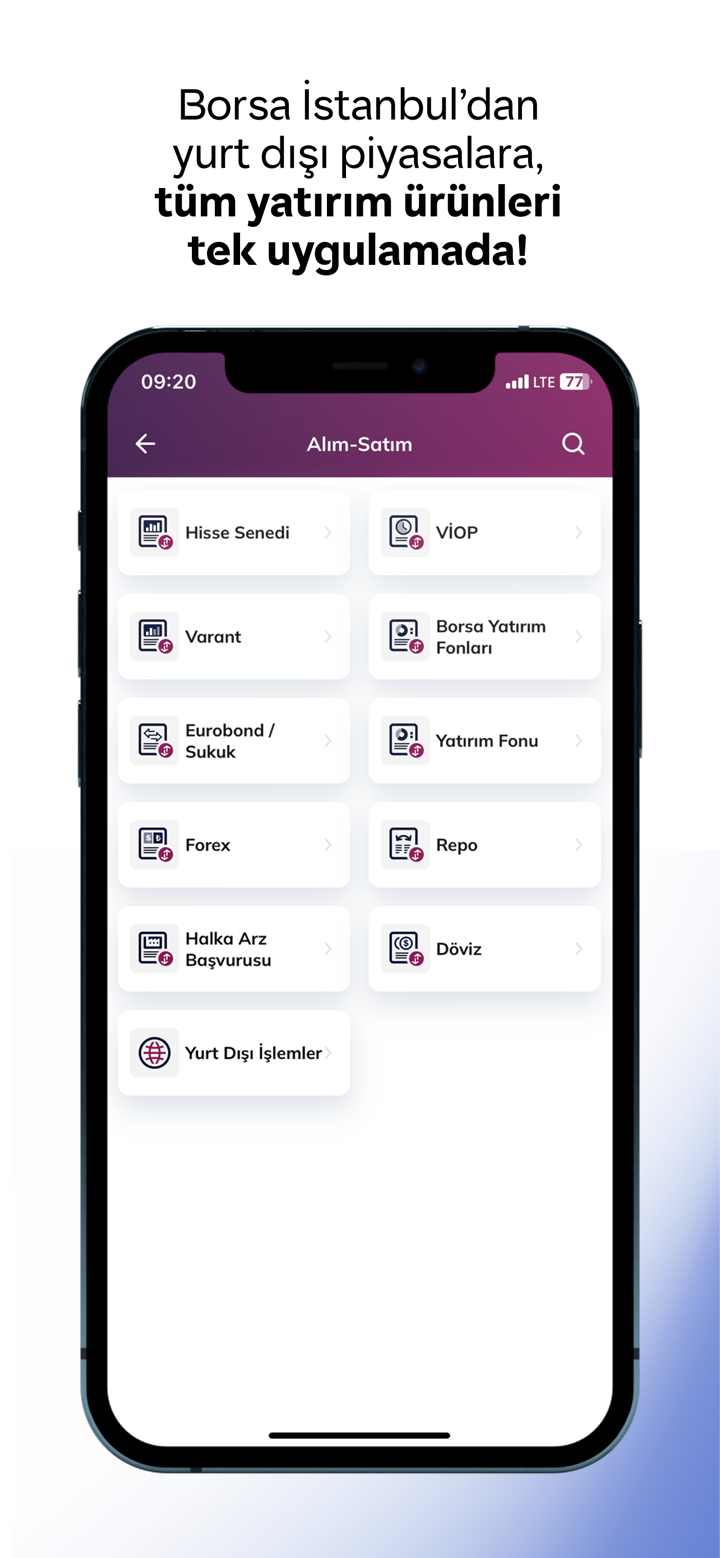

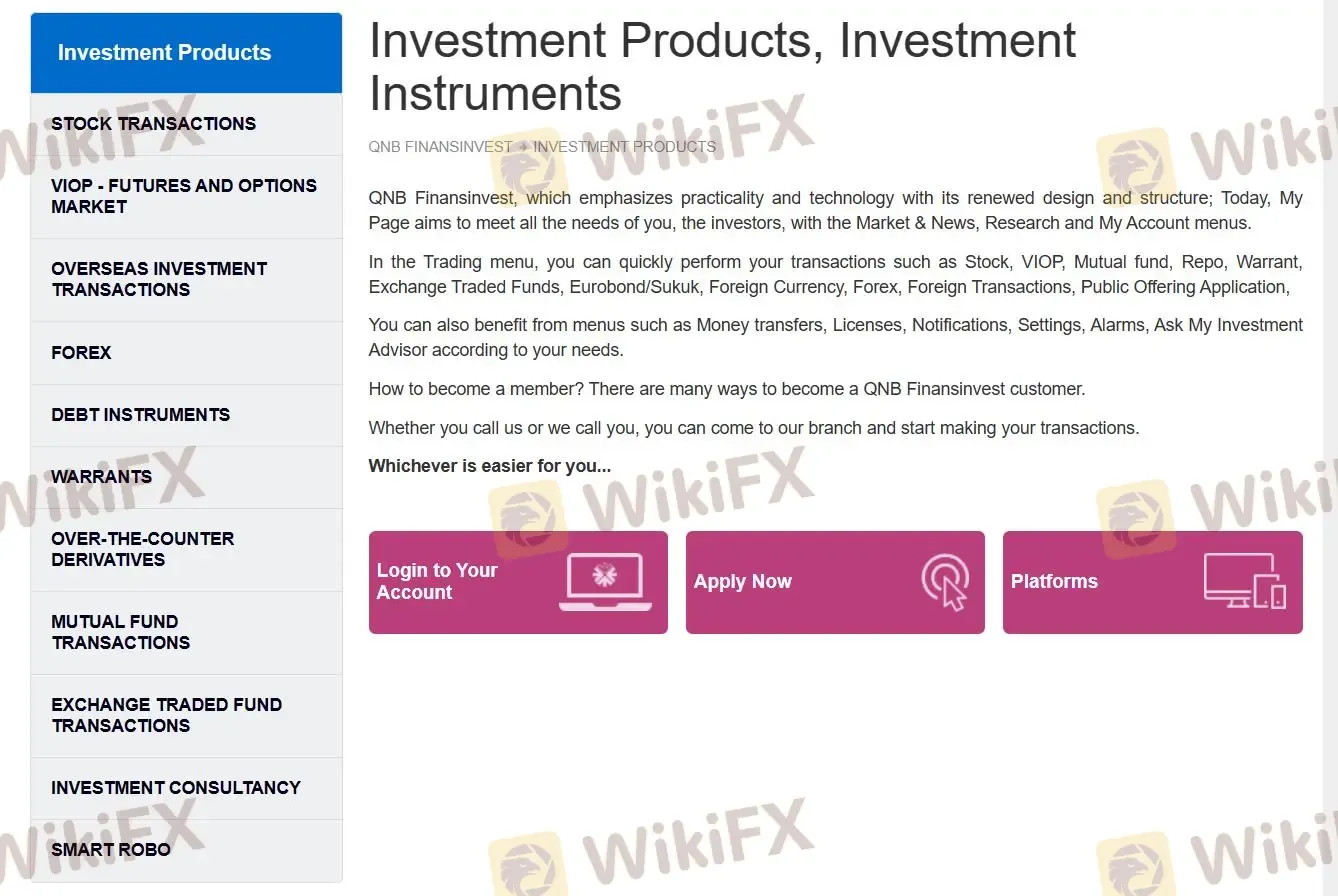

Productos y Servicios

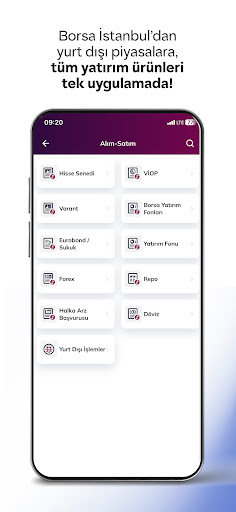

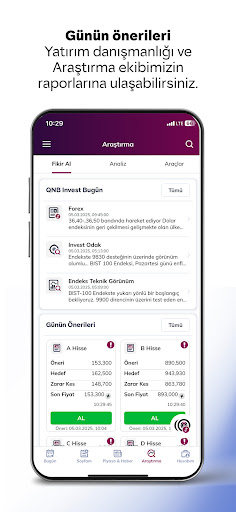

QNB FINANSINVEST ofrece diversos productos y servicios de inversión, incluyendo productos de inversión, transacciones de acciones, forex, transacciones de inversión en el extranjero, VIOP, instrumentos de deuda, warrants, derivados extrabursátiles, transacciones de fondos mutuos, transacciones de fondos cotizados en bolsa y asesoramiento de inversión.

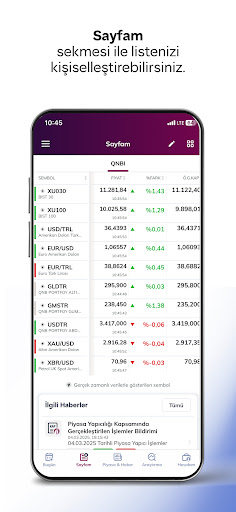

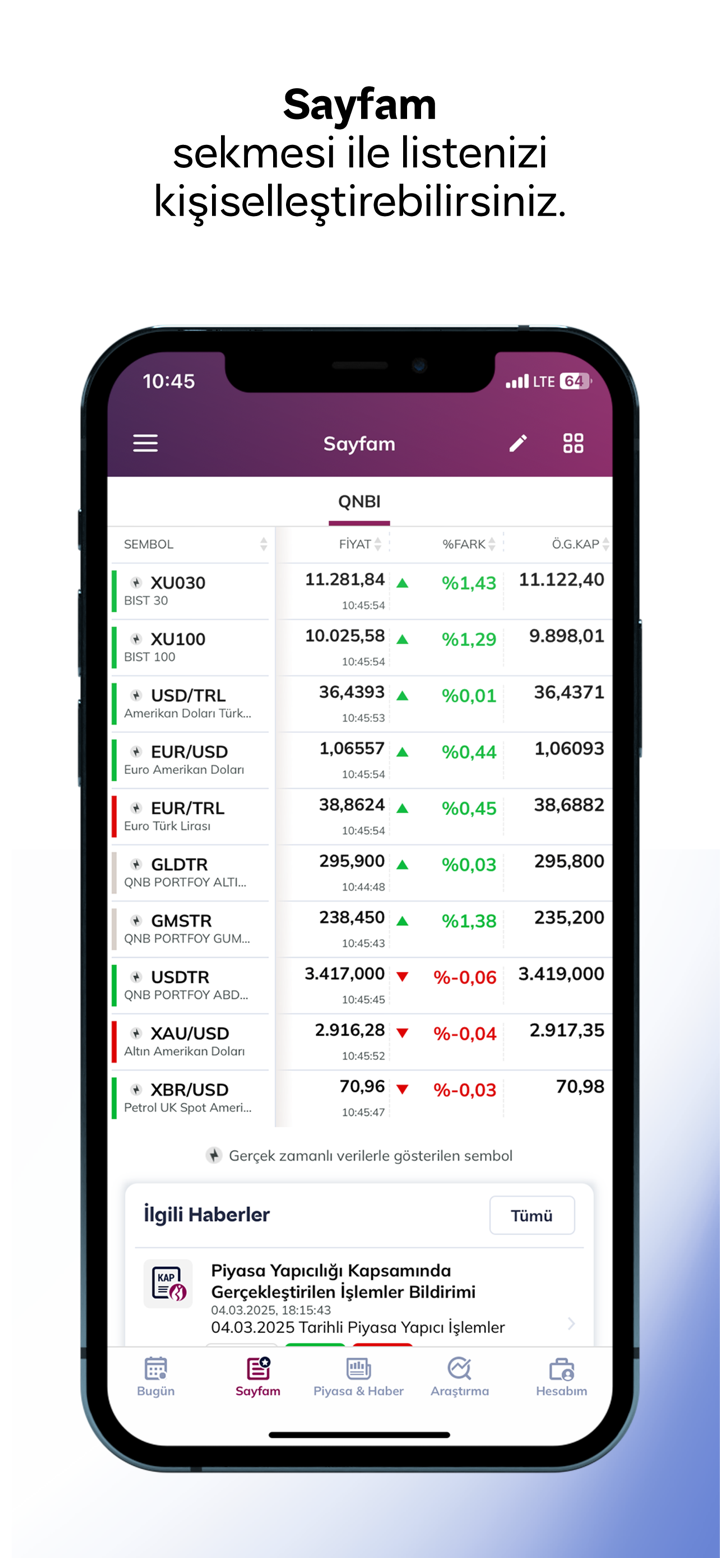

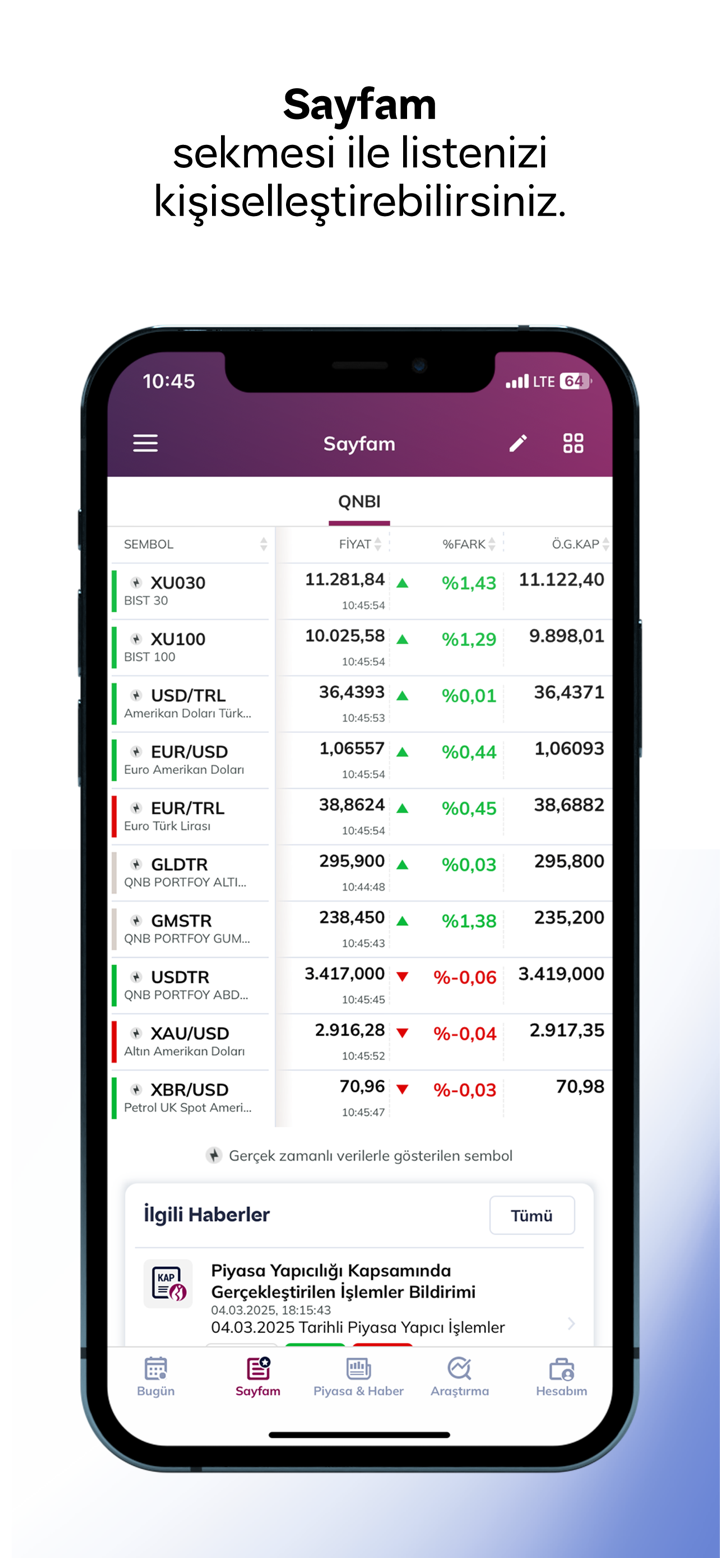

Forex: Pares de divisas, productos básicos, índices y Forex.

Productos de inversión: Acciones, VIOP, Fondos mutuos, Repo, Warrant, Fondos cotizados en bolsa, Eurobonos/Sukuk, Moneda extranjera, Forex, Transacciones extranjeras, Solicitud de oferta pública.

VIOP: Compra y venta de contratos de acciones, índices bursátiles (BIST-30), tipos de cambio (TL/Dólar, TL/Euro, Euro/Dólar), oro, productos básicos y electricidad por una cierta garantía/prima para fines de cobertura, inversión y arbitraje de acuerdo con las expectativas.

Transacciones de inversión en el extranjero: Acciones extranjeras, fondos cotizados en bolsa, eurobonos y productos sukuk.

Instrumentos de deuda: Productos de renta fija como repo, letras del tesoro, bonos del gobierno, eurobonos y bonos del sector privado.

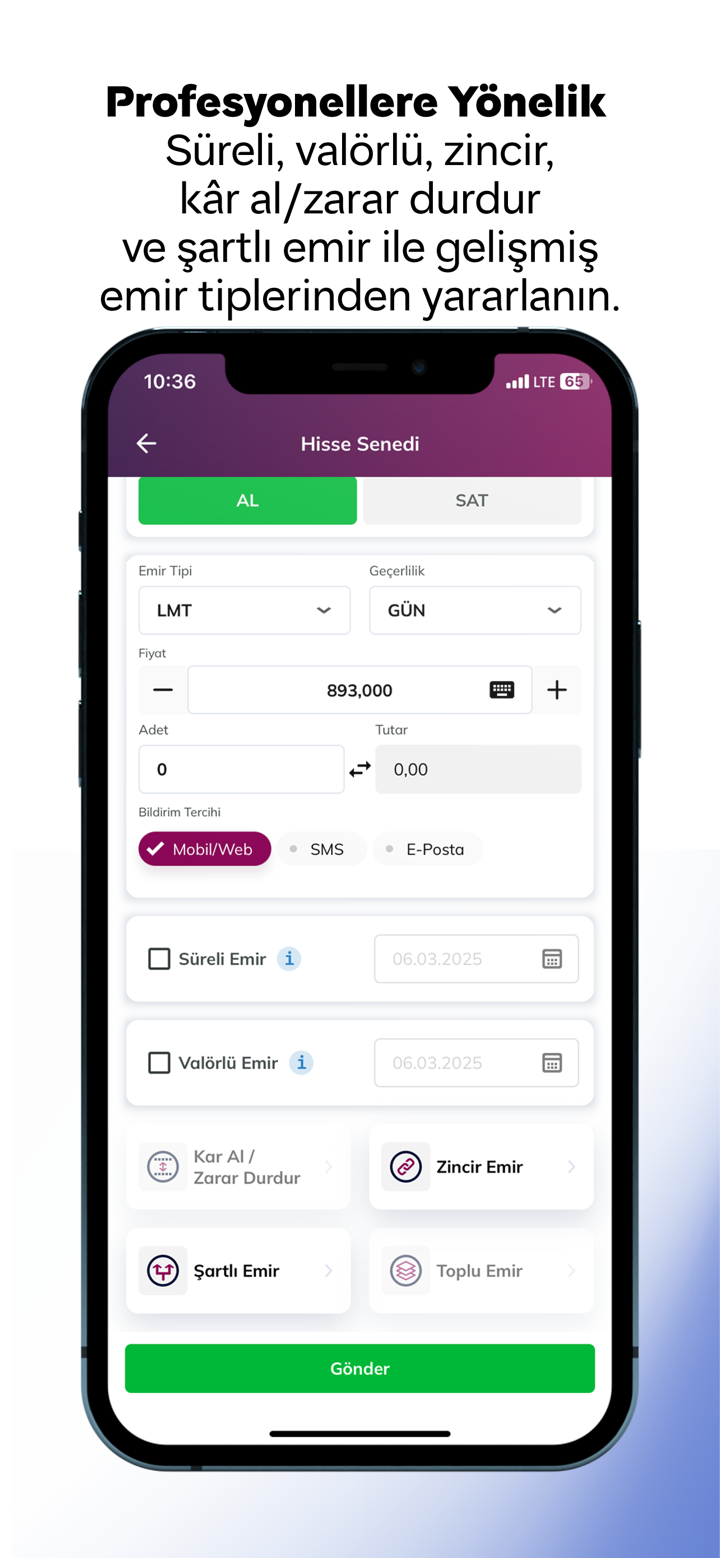

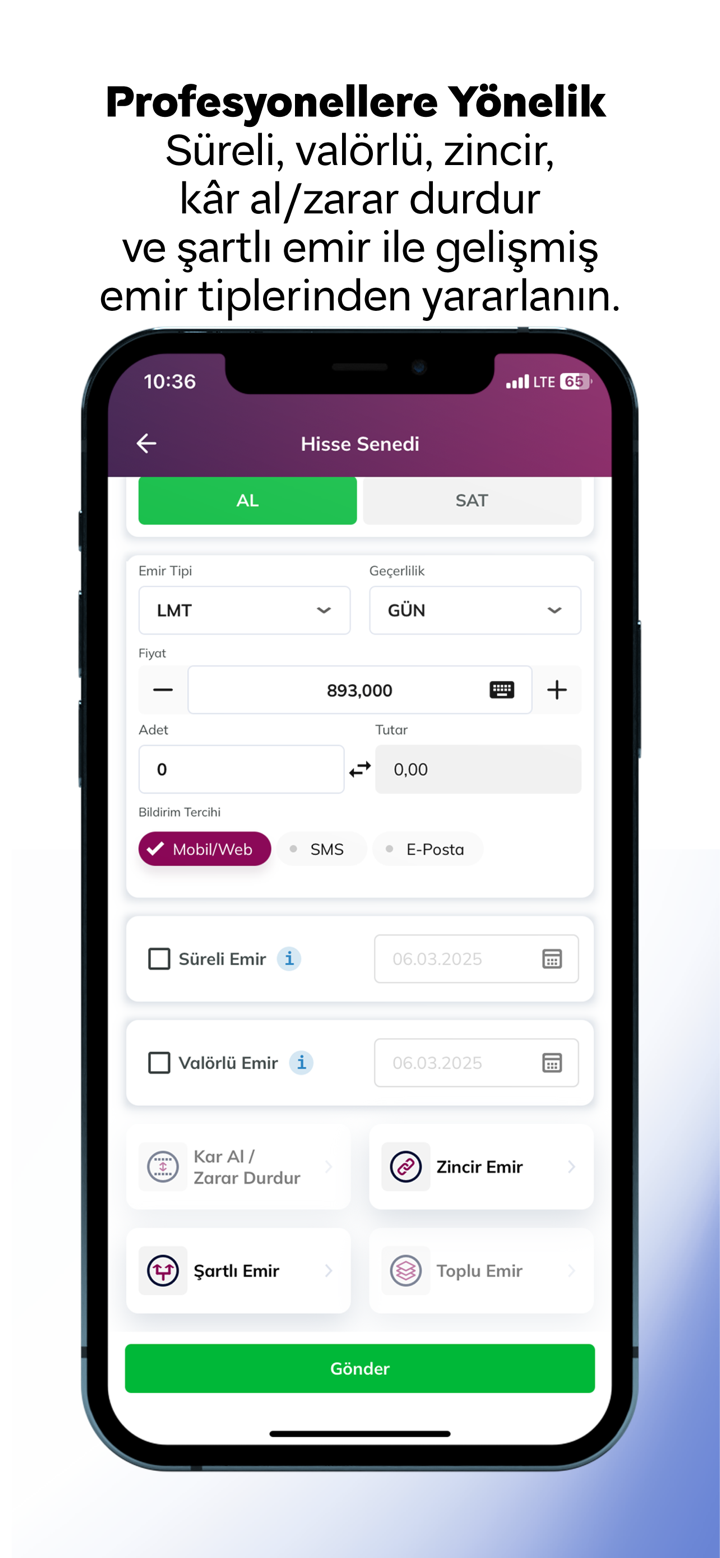

Derivados extrabursátiles: Forwards, Swaps, Futuros, Opciones y productos estructurados.

Transacciones de fondos mutuos: Fondo de mercado monetario, fondo de valores de deuda del sector privado, fondo de valores de deuda a corto plazo, fondo de valores de deuda, fondo de valores de deuda de eurobonos, primer fondo de cobertura, primer fondo variable de cartera de QNB y fondo de capital primario de cartera de ONB.

Transacciones de fondos cotizados en bolsa: GOLDIST, USDTR, QOUR y GMSTR.

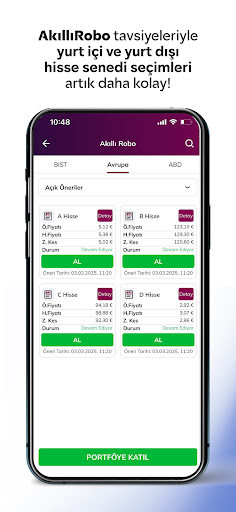

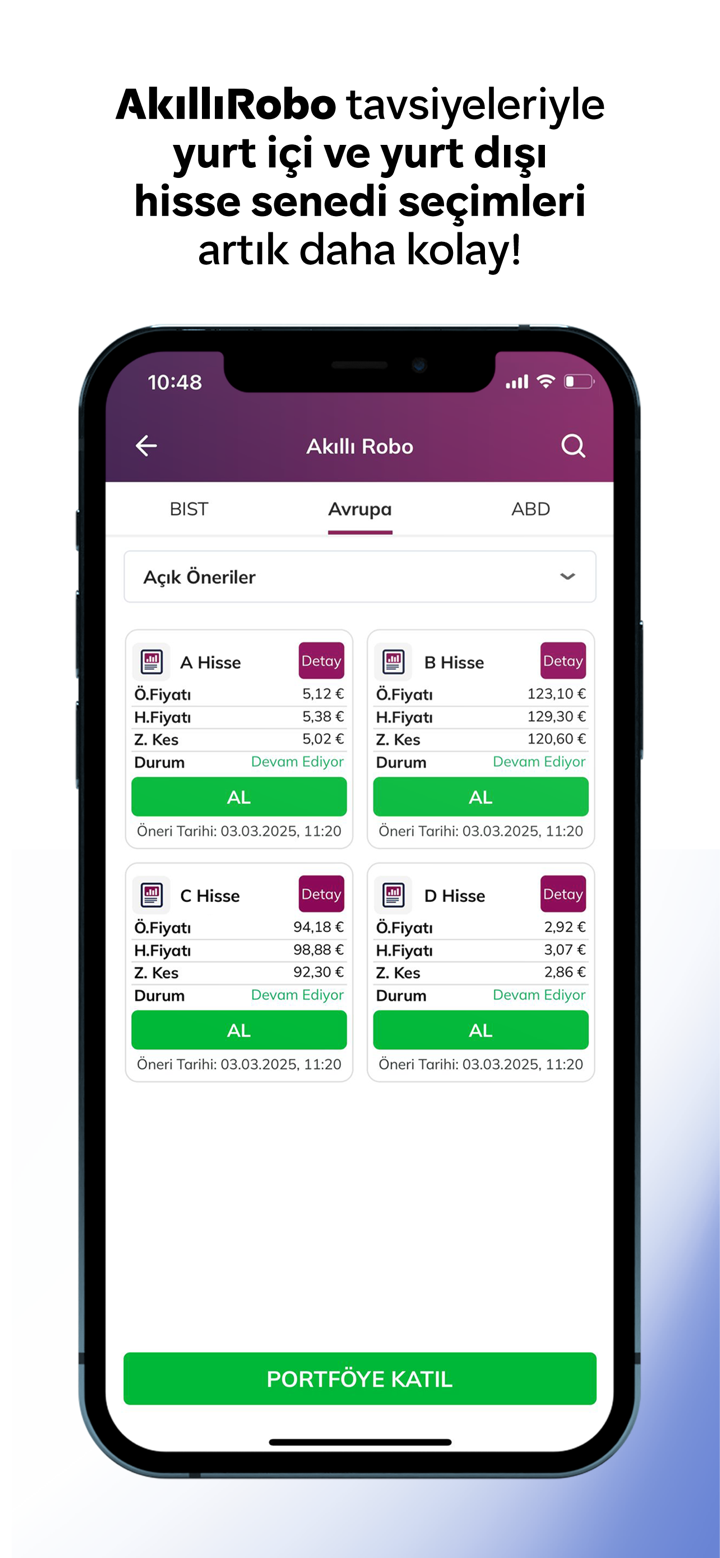

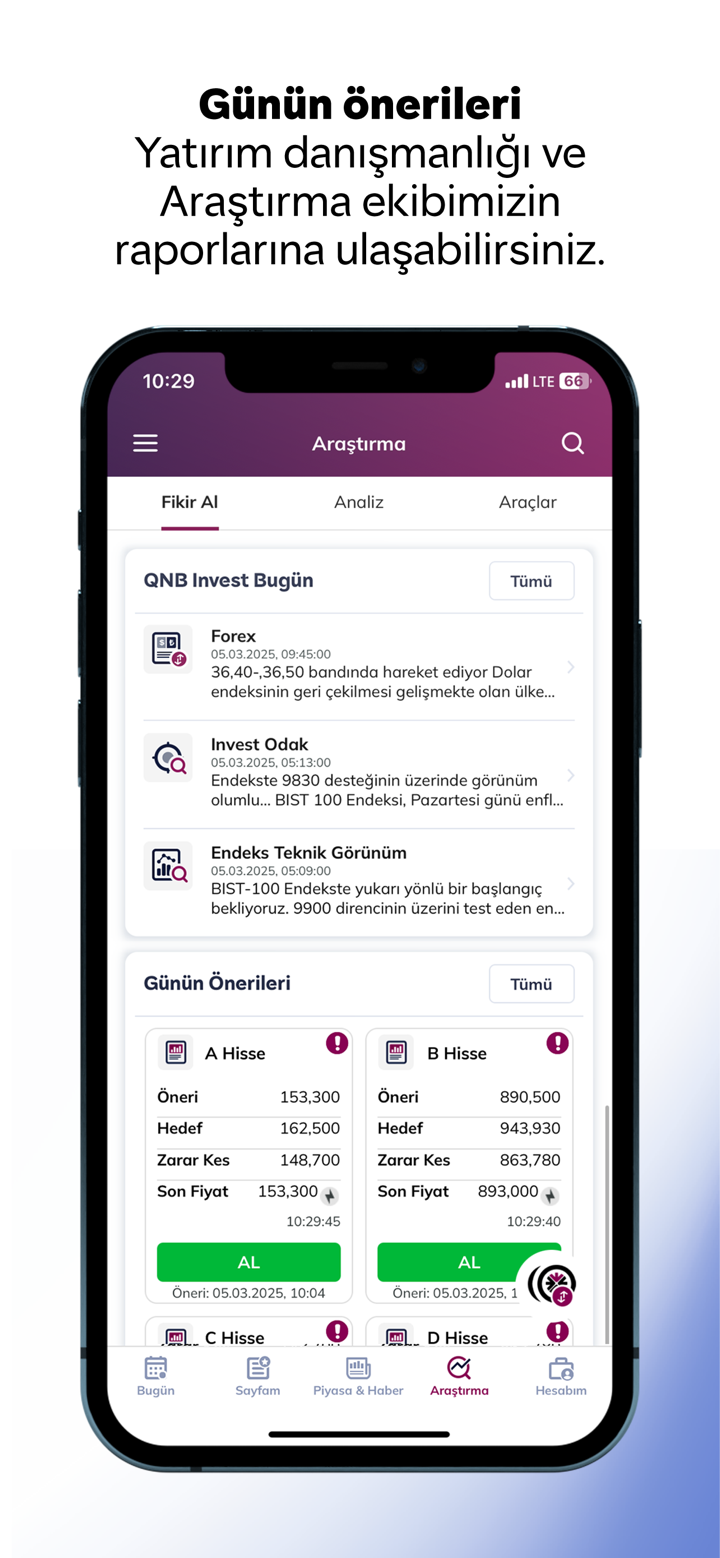

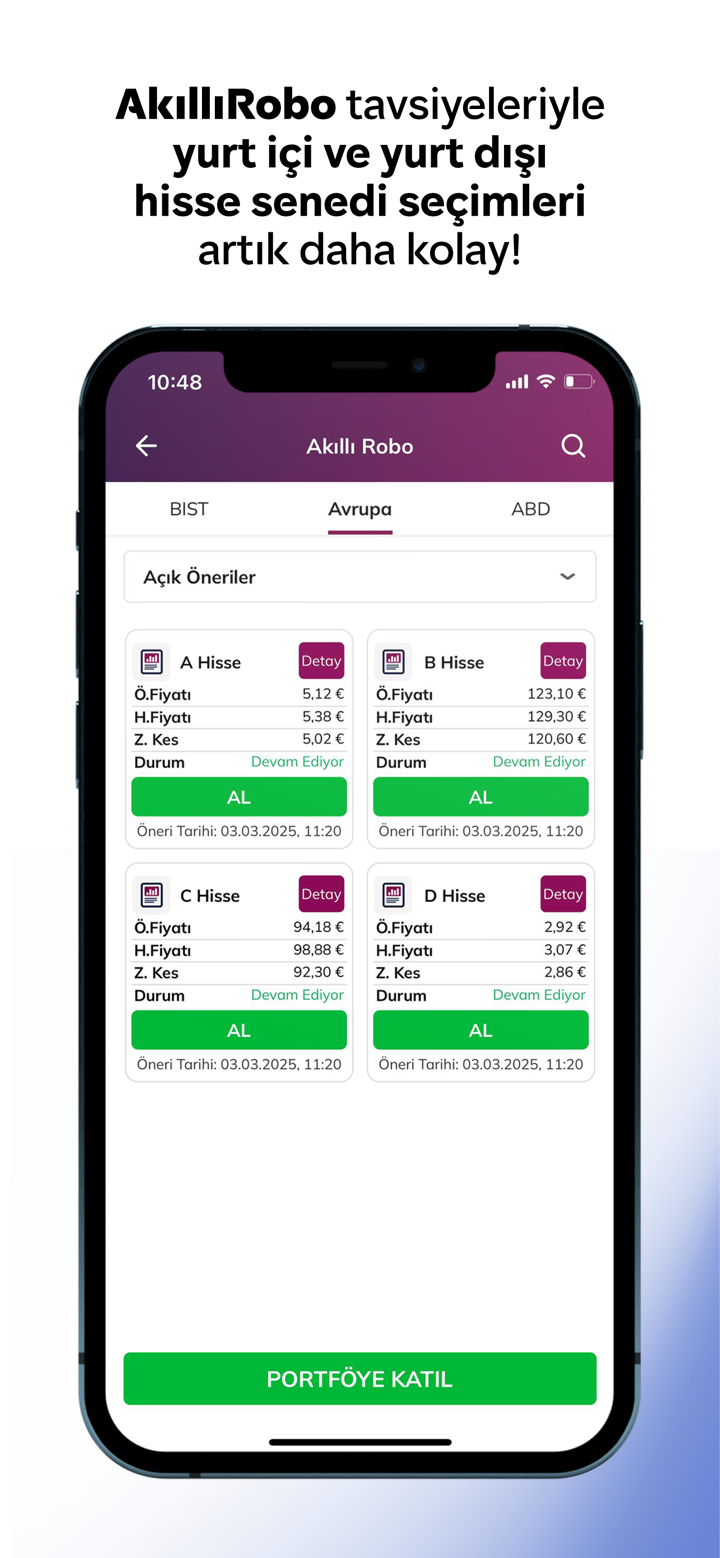

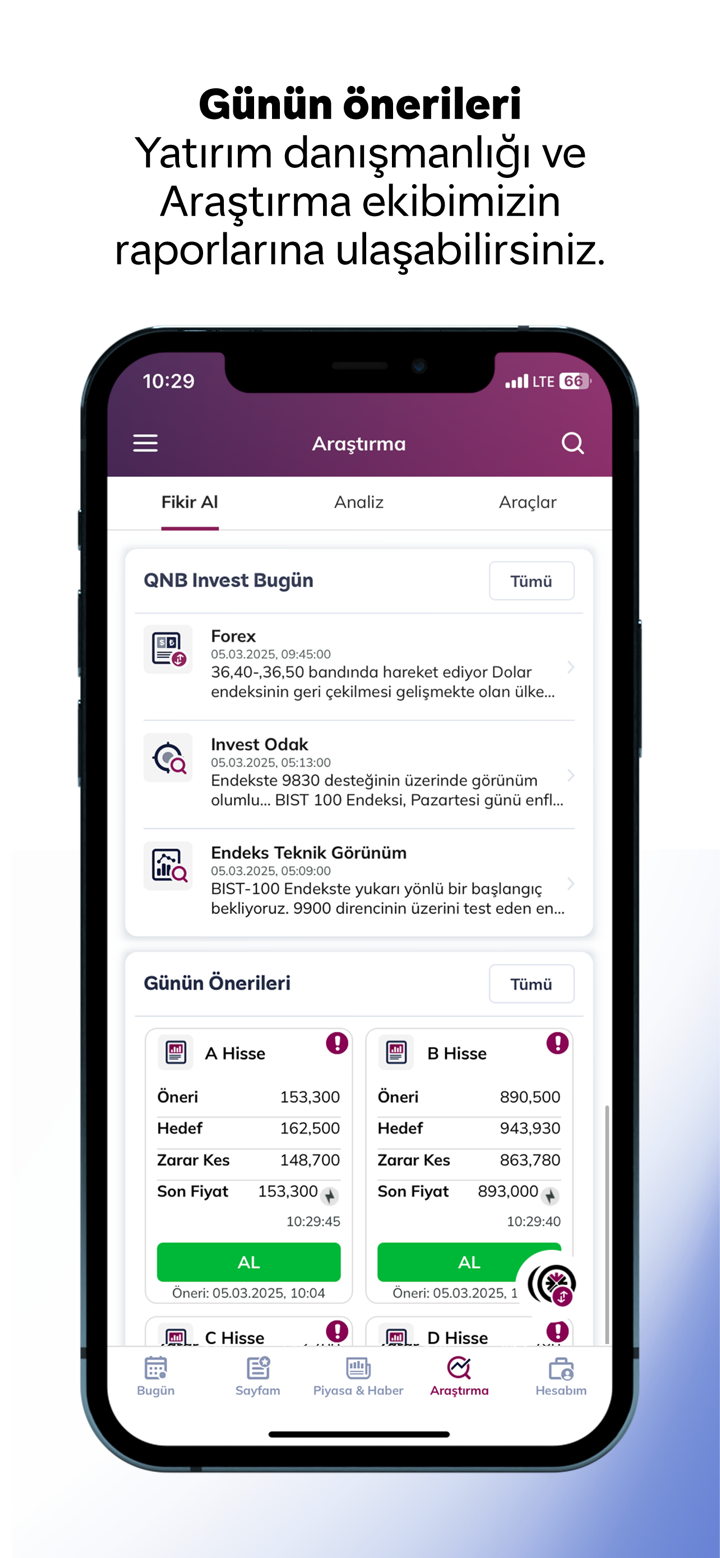

Aesoramiento de inversión: Recomendaciones de operaciones de acciones, asesor de inversión, modelo de cartera y soporte de resistencia de acciones.

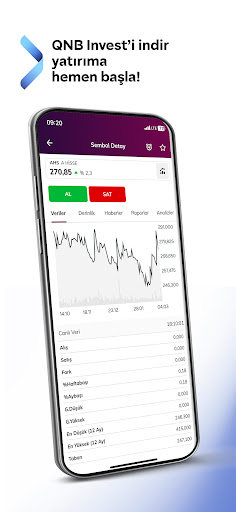

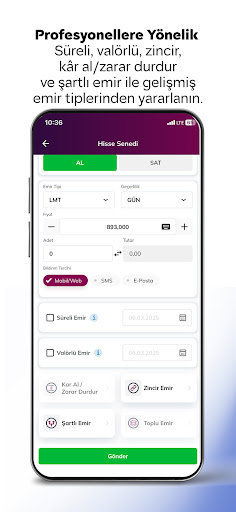

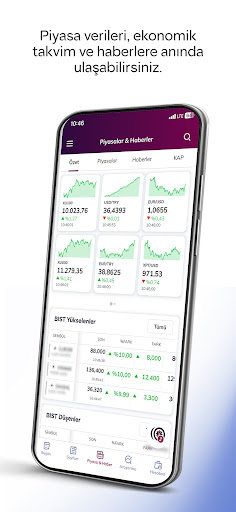

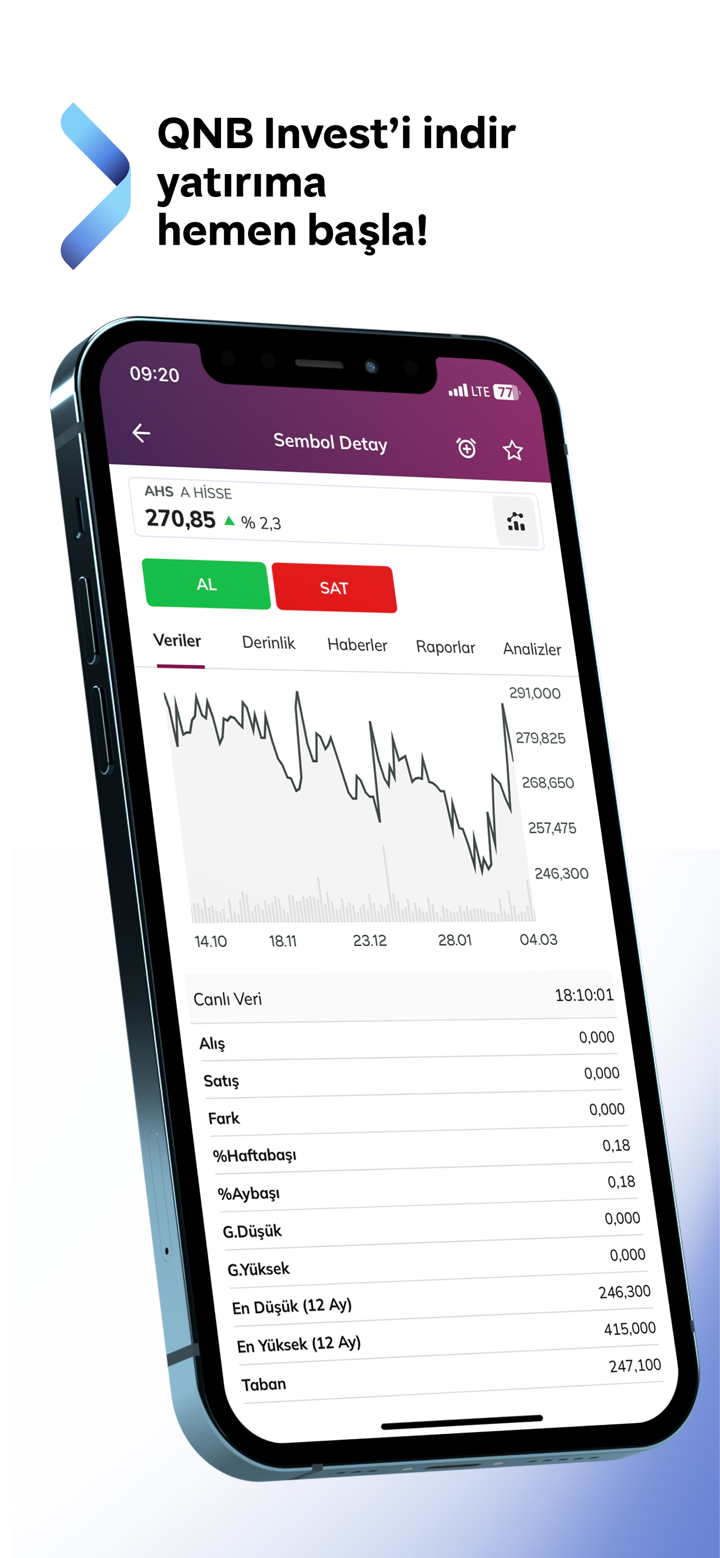

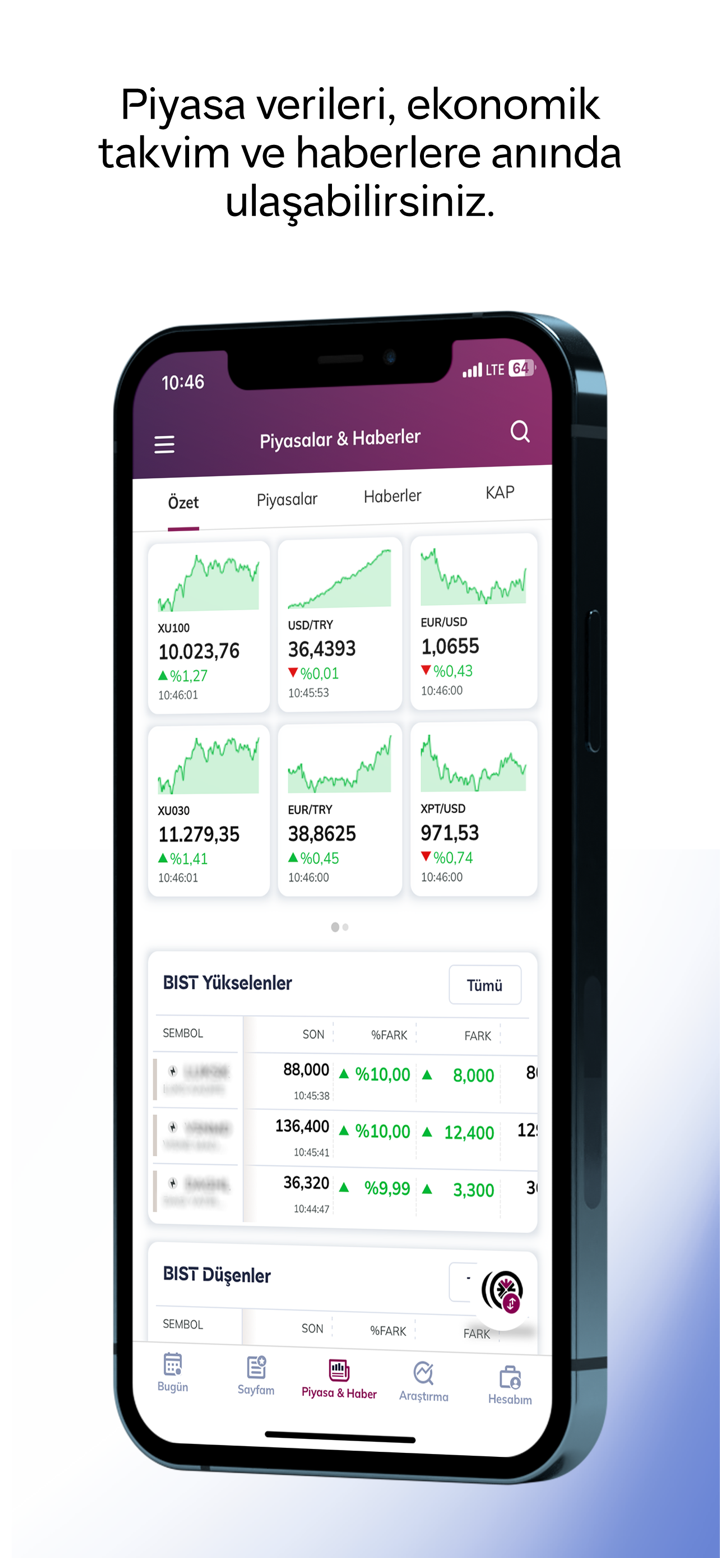

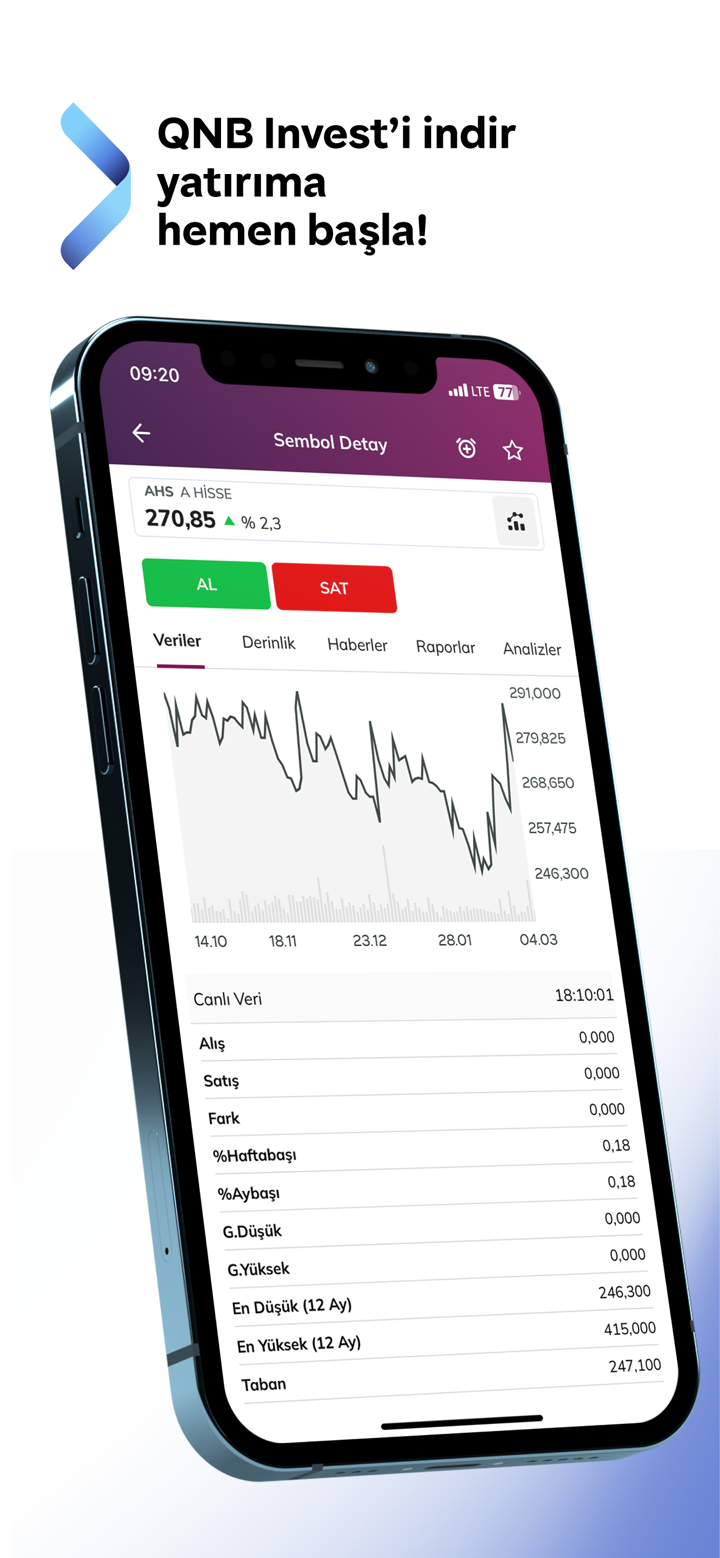

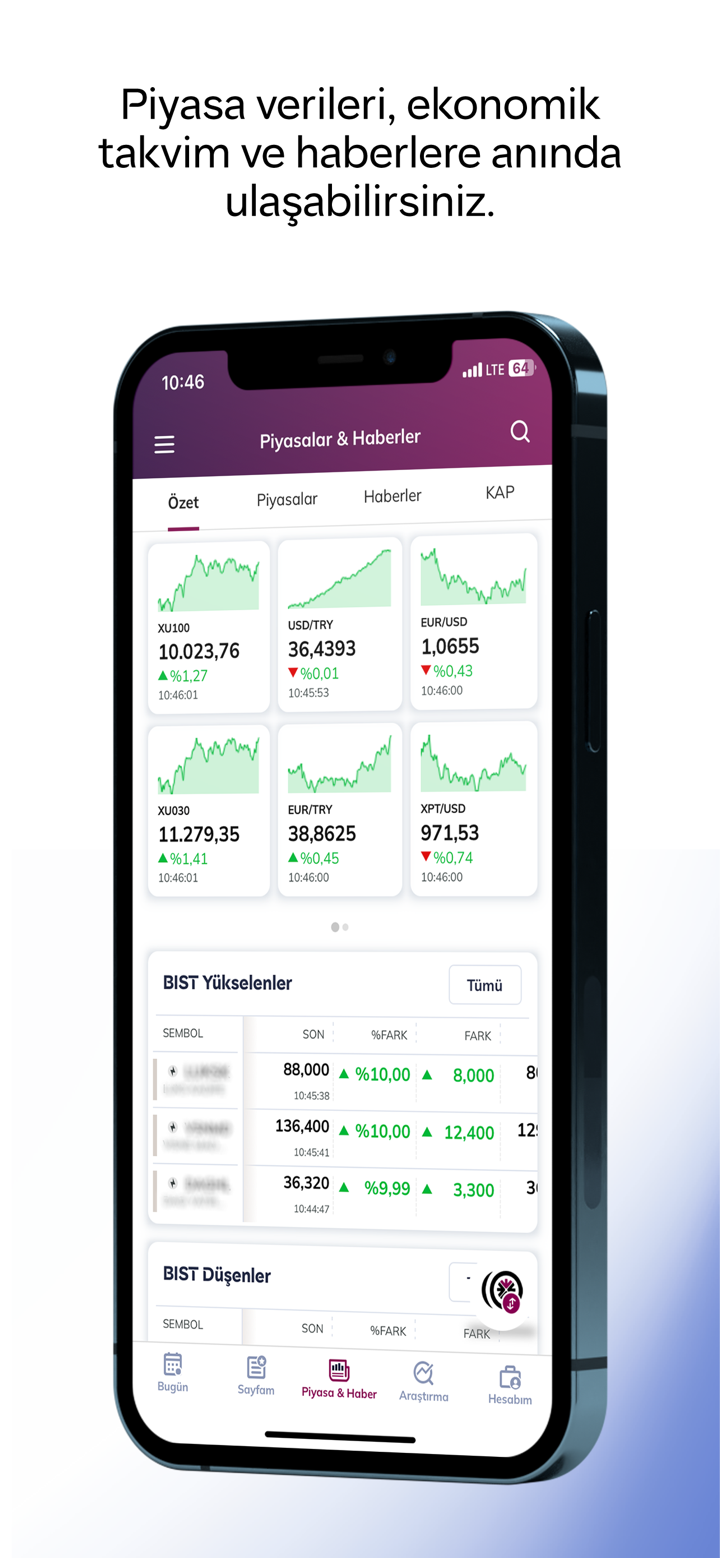

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| QNB Invest | ✔ | Web, Escritorio, tablets, Android, iOS | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |