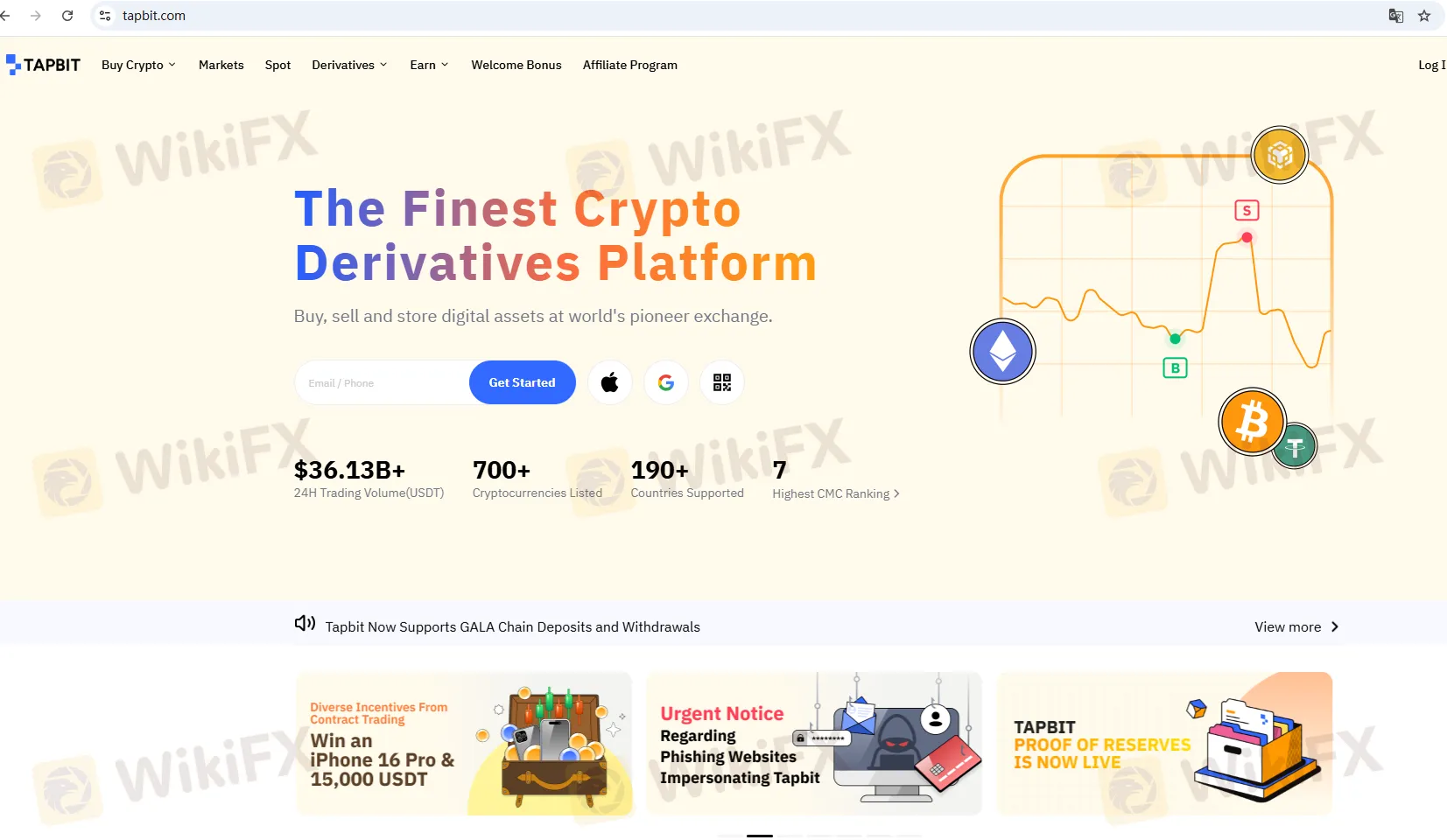

مقدمة عن الشركة

| Tapbit ملخص المراجعة | |

| تأسست | 2021 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | لا يوجد تنظيم |

| أدوات السوق | المشتقات، العملات الرقمية |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | تطبيق الجوال |

| الحد الأدنى للإيداع | / |

| دعم العملاء | دعم عملاء على مدار الساعة طوال أيام الأسبوع |

| دردشة مباشرة | |

| تليجرام، انستجرام، X، ميديوم، فيسبوك، يوتيوب، لينكد إن، ريديت | |

| البريد الإلكتروني: support@tapbit.com | |

Tapbit معلومات

تأسست Tapbit في عام 2021، مسجلة في الصين، وغير منظمة حاليًا، تقدم تداول العملات الرقمية والمشتقات.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| دعم تطبيق الجوال | لا يوجد تنظيم |

| نقص في الأدوات | |

| عدم توفر حساب تجريبي | |

| MT4/MT5 غير متوفرة | |

| نقص في معلومات الانتشار |

هل Tapbit شرعية؟

لا. Tapbit ليست موجودة تنظيميًا. يرجى أخذ الحيطة والحذر من المخاطر!

ما الذي يمكنني تداوله على Tapbit؟

Tapbit يوفر العقود المشتقة والعملات الرقمية.

| الأدوات التجارية | مدعوم |

| العملات الرقمية | ✔ |

| العقود المشتقة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

منصة التداول

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

| تطبيق الجوال | ✔ | / | المبتدئين والمتداولين العاديين الذين يبحثون عن البساطة والسرعة |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | المتداولين ذوي الخبرة |

الإيداع والسحب

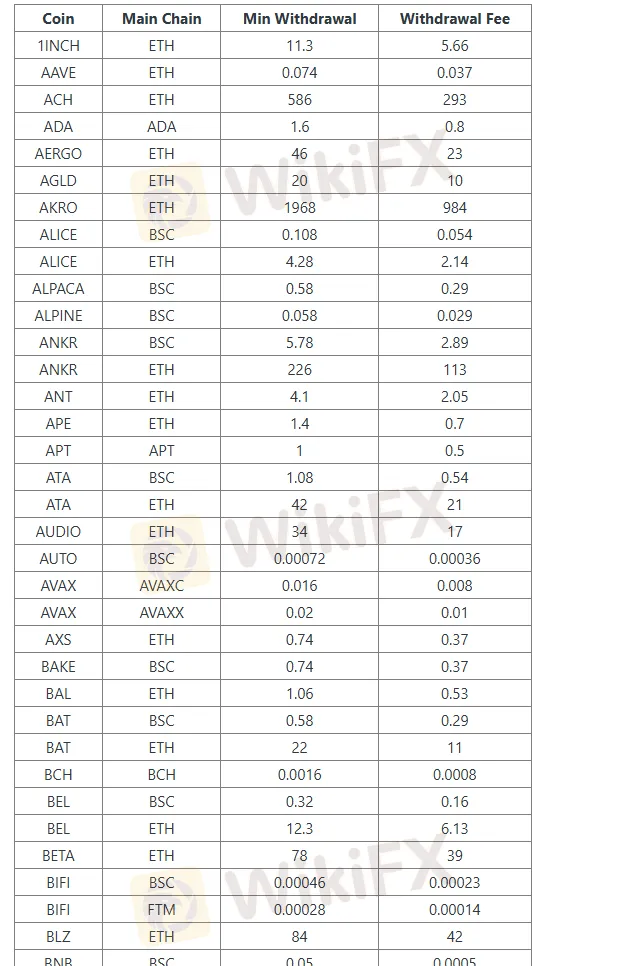

الإيداع مجاني على Tapbit، لمعرفة سعر الرسوم الخاص بكل عملة بشكل محدد، تحقق من الجدول أدناه:

إليك الجدول المنظم لتفاصيل سحب العملات الرقمية:

| العملة | السلسلة الرئيسية | الحد الأدنى للسحب | رسوم السحب |

| 1INCH | ETH | 11.3 | 5.66 |

| AAVE | ETH | 0.074 | 0.037 |

| ACH | ETH | 586 | 293 |

| ADA | ADA | 1.6 | 0.8 |

| AERGO | ETH | 46 | 23 |

| AGLD | ETH | 20 | 10 |

| AKRO | ETH | 1968 | 984 |

| ALICE | BSC | 0.108 | 0.054 |

| ALICE | ETH | 4.28 | 2.14 |

| ALPACA | BSC | 0.58 | 0.29 |

| ALPINE | BSC | 0.058 | 0.029 |

| ANKR | BSC | 5.78 | 2.89 |

| ANKR | ETH | 226 | 113 |

| ANT | ETH | 4.1 | 2.05 |

| APE | ETH | 1.4 | 0.7 |

| APT | APT | 1 | 0.5 |

| ATA | BSC | 1.08 | 0.54 |

| ATA | ETH | 42 | 21 |

| AUDIO | ETH | 34 | 17 |

| AUTO | BSC | 0.00072 | 0.00036 |

| AVAX | AVAXC | 0.016 | 0.008 |

| AVAX | AVAXX | 0.02 | 0.01 |

| AXS | ETH | 0.74 | 0.37 |

| BAKE | BSC | 0.74 | 0.37 |