Perfil de la compañía

| Commerzbank Resumen de la reseña | |

| Establecido | 1870 |

| País/Región Registrada | Alemania |

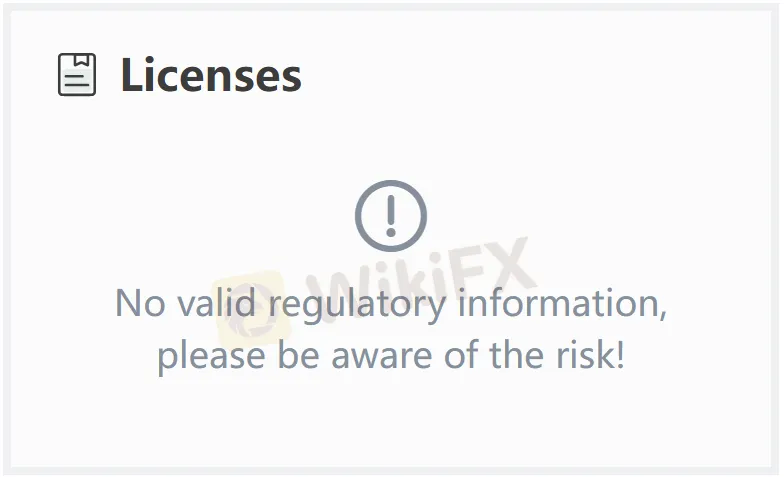

| Regulación | Sin regulación |

| Productos y Servicios | Servicios en efectivo, Servicios comerciales, Productos bancarios y Productos de mercado |

| Soporte al Cliente | Teléfono: +49 69 136-20, 0800 1010159 |

| Correo electrónico: info-recruiting@commerzbank.com, info@commerzbank.com | |

| Facebook, Instagram, LinkedIn, YouTube | |

Commerzbank es una institución financiera no regulada fundada en 1870 y registrada en Alemania. Ofrece una amplia gama de productos y servicios, incluidos Servicios en efectivo, Servicios comerciales, Productos bancarios y Productos de mercado. Además, Commerzbank también brinda servicios para clientes privados, clientes comerciales y clientes corporativos.

Pros y Contras

| Pros | Contras |

| Larga historia | Sin regulación |

| Amplia gama de productos y servicios | Estructura de tarifas poco clara |

¿Es Commerzbank legítimo?

En la actualidad, Commerzbank carece de regulación válida. ¡Por favor, tenga en cuenta el riesgo!

Productos y Servicios

Commerzbank ofrece a los clientes Servicios en efectivo, Servicios comerciales, Productos bancarios y Productos de mercado.