Company Summary

| Longbridge Review Summary | |

| Founded | / |

| Registered Country/Region | Hong Kong |

| Regulation | SFC/FSPR (Unverified) |

| Market Instruments | Stocks, ETFs, Bonds, REITs, Options, Securities, DLCs, Funds |

| Trading Platform | Longbridge App |

| Customer Support | Email: service@longbridge.hk |

| Phone: +852 3851 1777 (HK); 400-071-2688 (Global) | |

| Social Media: Facebook, Instagram, Twitter, LinkedIn, WhatsApp, GitHub | |

Longbridge Information

Longbridge was established in Hong Kong and offers a variety of global market trading products such as stocks, ETFs, bonds, REITs, options, securities, DLCs, and funds, supporting both long and short trading. Although it claims to be regulated by multiple regulatory agencies, its SFC and FSPR licenses are marked as “unverified”. Investors should exercise caution regarding its legitimacy and transparency.

Pros and Cons

| Pros | Cons |

| Multiple payment methods | Unverified licenses |

| Various trading products | Limited info on trading conditions |

| Promotions offered | |

| No deposit and withdrawal fee |

Is Longbridge Legit?

Although Longbridge claims on its official website that it is regulated by multiple regulatory agencies, the two licenses it currently holds, SFC and FSPR, are marked as unverified. This poses a certain risk to trading. Traders should exercise caution and use funds prudently when trading.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| China (Hong Kong) | Securities and Futures Commission of Hong Kong (SFC) | Unverified | Long Bridge HK Limited | Dealing in futures contracts | BPX066 |

| Australia | Financial Service Providers Register (FSPR) | Unverified | Long Bridge Securities Limited | Financial Service Corporate | 600050 |

What Can I Trade on Longbridge?

Longbridge offers a wide range of global market trading products, including stocks, ETFs, bonds, REITs, options, DLCs, and other products, as well as long and short stock trading. In addition, it supports over-the-counter (OTC) global securities market trading and other non-standard product trading, and provides trading services for public funds, private equity funds, and money market funds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| REITs | ✔ |

| Options | ✔ |

| Securities | ✔ |

| DLCs | ✔ |

| Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

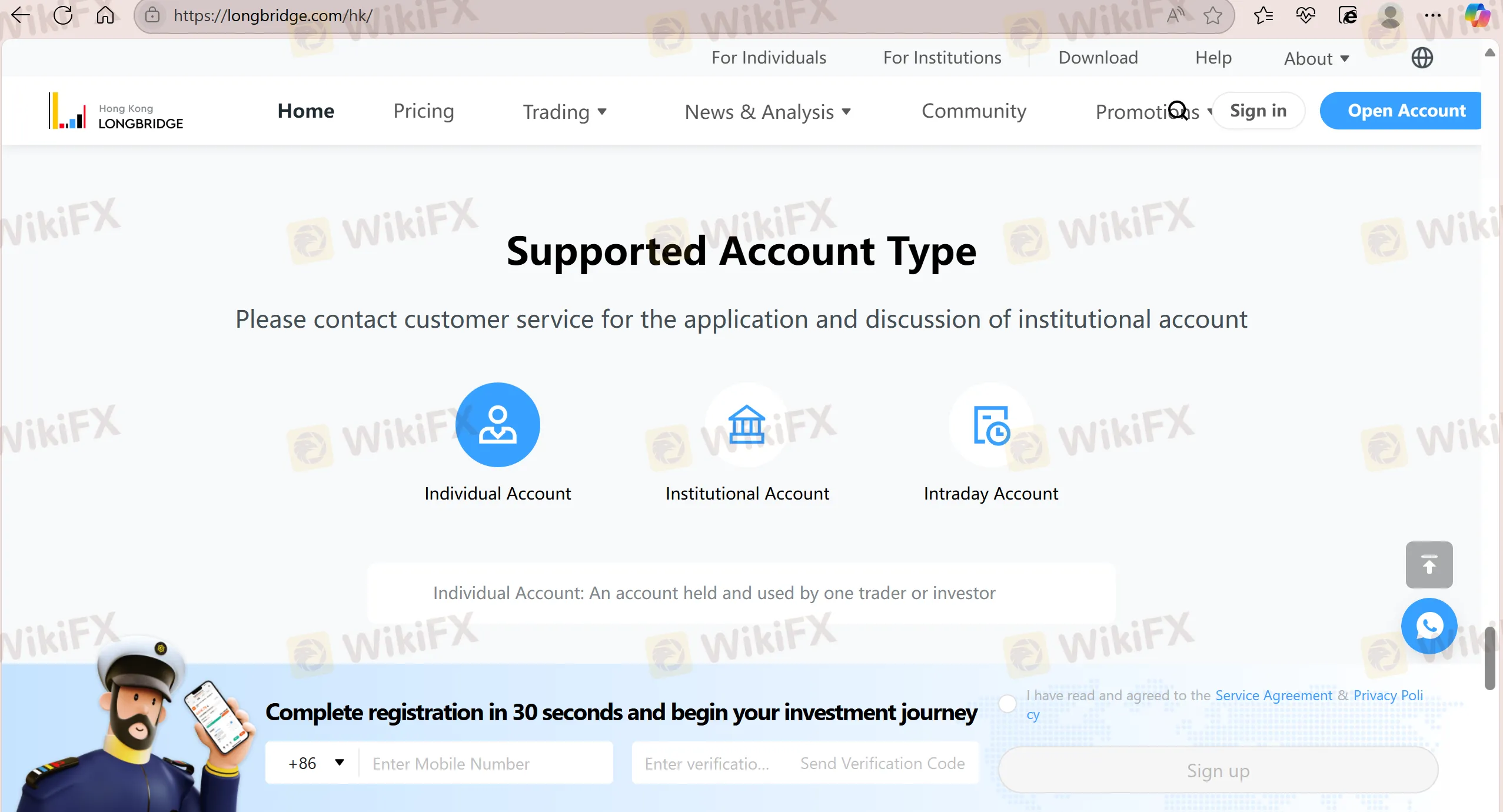

Account Types

Longbridge supports three types of accounts: Individual Account, Institutional Account, and Intraday Account.

Individual Account: Accounts held and used by personal traders or investors.

Institutional Account: Solutions that support multiple accounts, primarily for companies or institutions.

Intraday Account: Accounts specifically for day trading, where customers must complete and close their trades on the same trading day. Day trading is also known as T+0 trading.

Fees

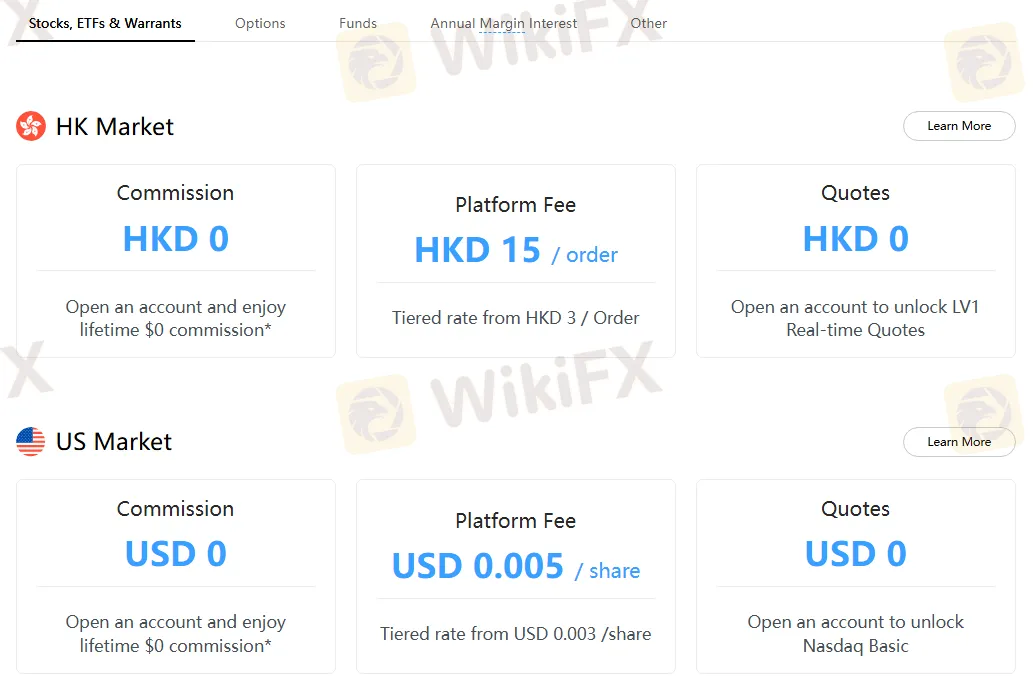

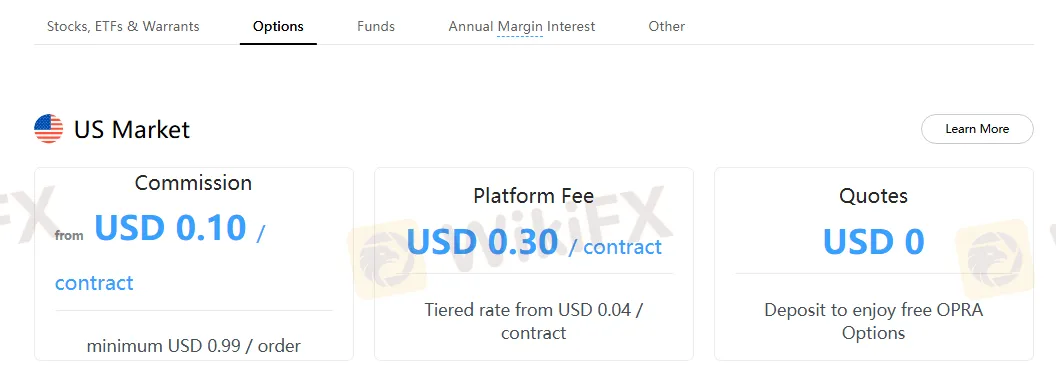

Commissions vary depending on the asset, such as Stocks, ETFs, & Warrants, which are commission-free for life after opening an account. Options are charged a commission of USD 0.10 per contract, with a minimum of USD 0.99 per trade.

| Category | HK Market | US Market | |

| Stocks, ETFs & Warrants | Commission | HKD 0 (lifetime $0 commission*) | USD 0 (lifetime $0 commission*) |

| Platform Fee | HKD 15 / order (tiered rate from HKD 3 / order) | USD 0.005 / share (tiered rate from USD 0.003 / share) | |

| Quotes | HKD 0 (real-time quotes with account) | USD 0 (Nasdaq Basic with account) | |

| Options | Commission | / | USD 0.10 / contract (minimum USD 0.99 / order) |

| Platform Fee | / | USD 0.30 / contract (tiered rate from USD 0.04 / contract) | |

| Quotes | / | USD 0 (free OPRA Options with deposit) | |

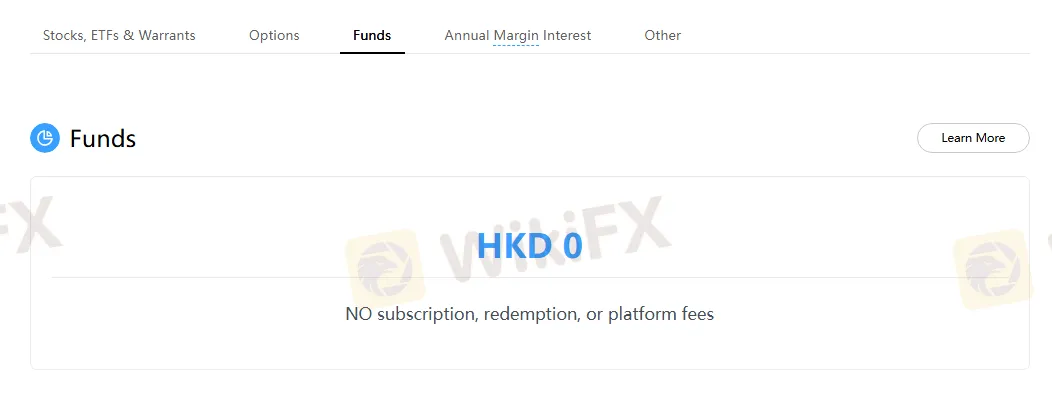

| Funds | Fees | HKD 0 (no subscription, redemption, or platform fees) | / |

| Annual Margin Interest | Funding Rate | 5.75% (HK Stock Annual Interest Rate) | 5.75% (US Stock Annual Interest Rate) |

| Other | IPO Subscription Fee | HKD 49 (Ordinary), HKD 99 (Margin) | / |

| Pre-IPO Market Pricing | Commission: 0.03% × total trading amount (minimum HKD 3 per trade) | / | |

| US Fractional Shares | / | Commission: USD 0 (<1 share/order, free; ≥1 share/order, standard fees apply) | |

| Platform Fee: 0.99% × trade amount (up to USD 0.99/order) | |||

| Deposit & Withdrawal | HKD 0 (free deposits, withdrawals, and stock transfer-ins) | / | |

Trading Platform

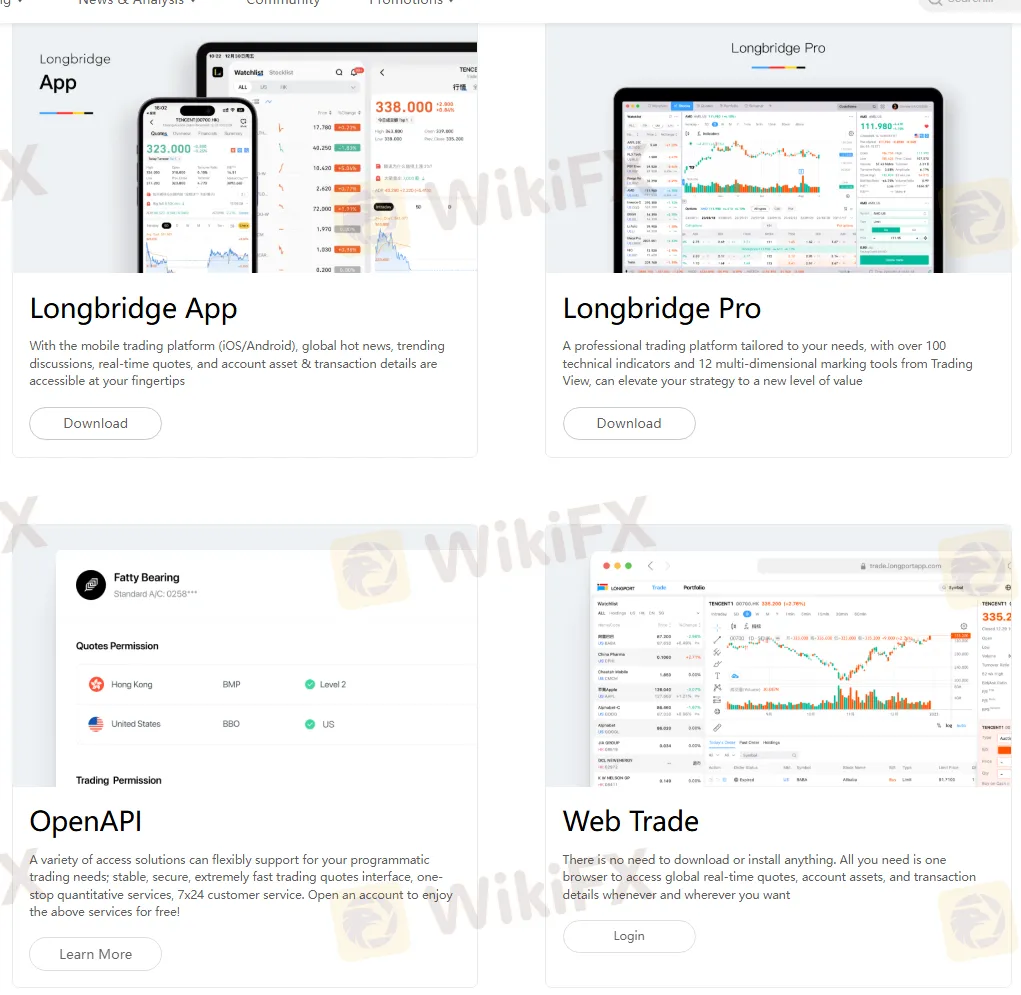

Longbridge supports trading through its proprietary Longbridge App, which can be used on desktop, mobile, and web platforms.

| Trading Platform | Supported | Available Devices |

| Longbridge App | ✔ | Desktop, Mobile, Web |

Deposit and Withdrawal

Longbridge supports deposits and withdrawals through major banks in Hong Kong, offering a variety of convenient deposit and withdrawal methods, including FPS, eDDA, bank securities transfers, online banking transfers, checks, counter transactions, telegraphic transfers (Telegraphic Transfer), SWIFT, CHATS, intra-bank transfers, online banking transfers, and PAYNOW.

Additionally, funds are credited quickly, and account assets are updated in real time, ensuring that transactions are not hindered.

No fees for deposits and withdrawals.