Company Summary

| Aspect | Information |

| Registered Country/Region | Palo Alto, California, USA |

| Founded | 2018 |

| Regulation | MAS, NFA (Suspicious clone) |

| Tradable Assets | Stocks, options, funds, US treasury, cryptocurencies (coming soon) |

| Demo Account | Available ($1 million in virtual money for stocks or options, and $10 million for futures) |

| Minimum Deposit | No |

| Trading Platforms | MOOMOO trading platform (mobile app and desktop platform) |

| Customer Support | 24/7 online chat |

| Phone: +65 6321 8888 | |

| Email: clientservice@sg.moomoo.com | |

| Prromotion | Yes |

What is Moomoo?

Moomoo is a MAS-regulated trading platform that serves a broad spectrum of investors, offering tools and resources aimed at facilitating access to global financial markets. Established to support both novice and experienced traders, Moomoo provides functionalities that accommodate various trading styles and preferences. The platform features real-time data and multiple trading instruments, including stocks, options, and futures.

Pros & Cons

Moomoo, as a newer entrant in the U.S. discount brokerage industry, offers several advantages. It provides low commissions for stock and ETF trades for options trading. Traders benefit from quick screens, Level II data, and access to China A-shares and the Hong Kong stock market, which are uncommon features among American brokers. Additionally, moomoo offers better-than-average margin rates, making it attractive for traders who utilize margin loans.

However, there are some drawbacks to consider. Moomoo imposes significant transfer-out fees, which could discourage transferring large portfolios.

| Pros | Cons |

| Low commissions for stock and ETF trades | Whopping transfer-out fees |

| Better-than-average margin rates | |

| Quick screens and Level II data | |

| Access to China A-shares and Hong Kong markets |

Is Moomoo Legit?

Moomoo operates as a legitimate financial trading platform, adhering to regulations set by reputable authorities. It is regulated by the Monetary Authority of Singapore (MAS) under license number CMS101000 and by the National Futures Association (NFA) in the United States with license number 0523957. These regulatory bodies ensure that Moomoo maintains high standards of financial integrity and consumer protection.

Additionally, U.S. securities held in accounts through Moomoo are protected up to $500,000 by the Securities Investor Protection Corporation (SIPC), which adds an extra layer of security for investors' assets. This protection covers against the loss of cash and securities in case the broker fails financially. The availability of this information and adherence to regulatory guidelines helps establish Moomoo as a credible and reliable platform for trading and investment.

Market Instruments

Moomoo provides a diverse range of market instruments, catering to various investment preferences and strategies. The platform allows users to trade stocks, which includes a wide selection of public companies from different sectors and industries. Additionally, Moomoo offers options trading, giving traders the flexibility to speculate on future price movements or hedge existing positions. For those interested in a more diversified approach, Moomoo also provides access to various funds, including mutual funds and ETFs, as well as US Treasury securities, which are government debt instruments known for their safety and stability.

Moreover, Moomoo is planning to expand its offerings by introducing cryptocurrencies soon, which will allow users to engage with the dynamic and rapidly evolving digital asset market.

Features

Moomoo offers a robust suite of features designed to enhance the trading experience for both novice and experienced traders. The platform provides advanced charting capabilities, allowing users to choose from over 63 indicators and 38 advanced drawing tools, facilitating detailed technical analysis to inform trading decisions. Additionally, Moomoo's stock analysis tools are equipped with real-time data, providing traders with up-to-the-minute information to help them stay ahead in fast-moving markets.

For those looking to deepen their understanding of trading and investment strategies, Moomoo also offers “Learn Premium,” which includes 8 premium courses encompassing 120 lectures. These educational resources cover a broad range of topics, designed to enhance traders' knowledge and skills in a structured learning environment. Collectively, these features make Moomoo a comprehensive platform that supports effective trading and continuous learning.

Fees

Moomoo offers a competitive and transparent fee structure across various market instruments, making it an attractive option for investors looking for cost-effective trading.

| Investment Choice | Commission | Platform Fee |

| US Stocks, ETFs & Fractional Shares | $0 | $0.99 / Order |

| Singapore Stocks, ETFs and REITs | 1 Year Commission-Free* | 0.03% * Transaction amount, min 0.99 / Order |

| Hong Kong Stocks and ETFs | 0.03%* of the investment amount or HK$3 which ever is higher | 180 JPY/order |

| China A-shares | 0.03% * Transaction amount, min 3 CNH / Order | 15 CNH / Order |

| Japan Stocks and ETFs | 0.08%, min 80 JPY/order | 180 JPY/order |

For US stocks, ETFs, and fractional shares, Moomoo charges no commission and only a minimal platform fee of $0.99 per order. In Singapore, trading in stocks, ETFs, and REITs is commission-free for the first year, with a subsequent low transaction fee of 0.03%, and a minimum charge of $0.99 per order. Hong Kong stocks and ETFs incur a fee of 0.03% of the investment amount or HK$3, whichever is higher, along with a platform fee of 180 JPY per order. Trading China A-shares involves a commission of 0.03% with a minimum of 3 CNH per order and an additional platform fee of 15 CNH per order. For Japan stocks and ETFs, the fees are set at 0.08% with a minimum of 80 JPY per order plus a platform fee of 180 JPY per order.

This structured approach to fees ensures that traders can manage their trading costs effectively while accessing diverse global markets through Moomoo's platform. More detailed info on fees can be found on their website.

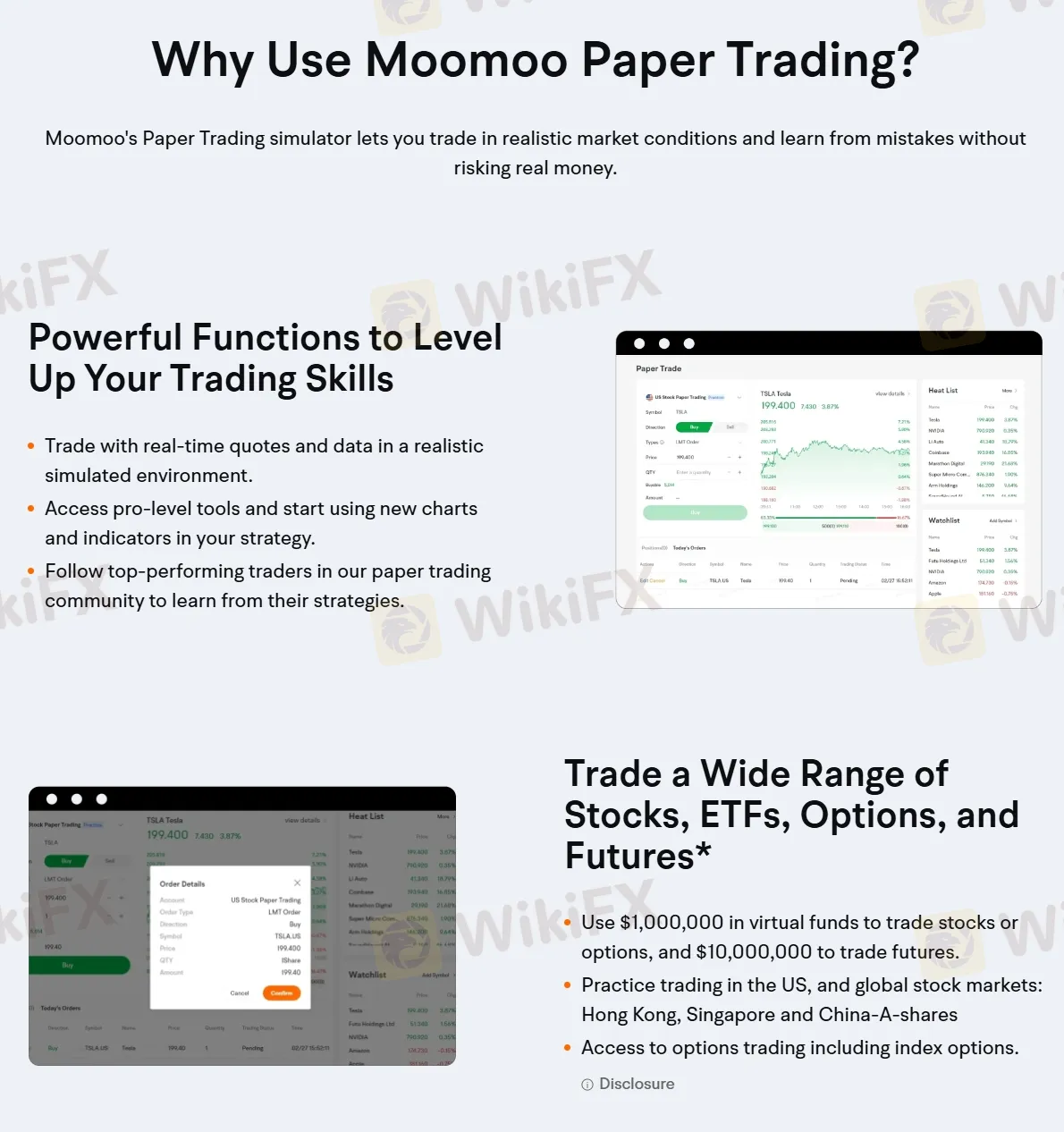

Paper Trading

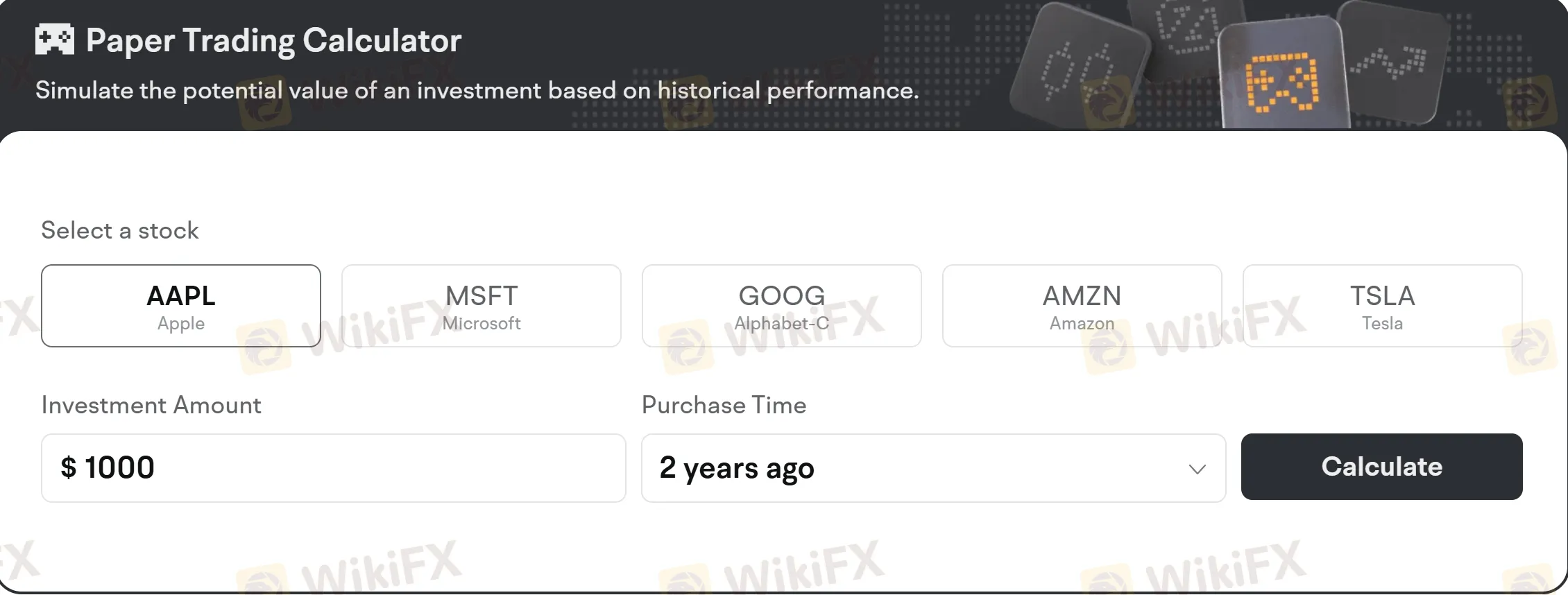

Moomoo provides an excellent opportunity for traders to hone their skills and test strategies through its paper trading feature. This simulation allows users to engage in trading with virtual money, mirroring the real market environment without any financial risk.

To further enhance this experience, Moomoo includes a Paper Trading Calculator, which aids traders in analyzing their trades, understanding potential profits and losses, and making informed adjustments to their strategies based on hypothetical outcomes. This tool is particularly valuable for beginners who are learning the ropes and seasoned traders testing new strategies.

Promotion

Moomoo offers a variety of enticing promotions designed to attract new users and reward existing ones. New traders can benefit from a generous welcome rewards program that provides a starter kit worth up to $970, making it an attractive incentive for those just beginning their trading journey. Additionally, Moomoo encourages its users to invite friends with a referral rewards program where both the referrer and the referred friend can share a total of $1,200.

For those looking to consolidate their investments, Moomoo offers a transfer-in promotion where clients can receive high-value items such as an iPhone 15 Pro Max as a reward for transferring their assets to Moomoo. Moreover, for traders aiming to enhance their investment skills, Moomoo's Learn Premium offers advanced courses designed to take investing knowledge to the next level.

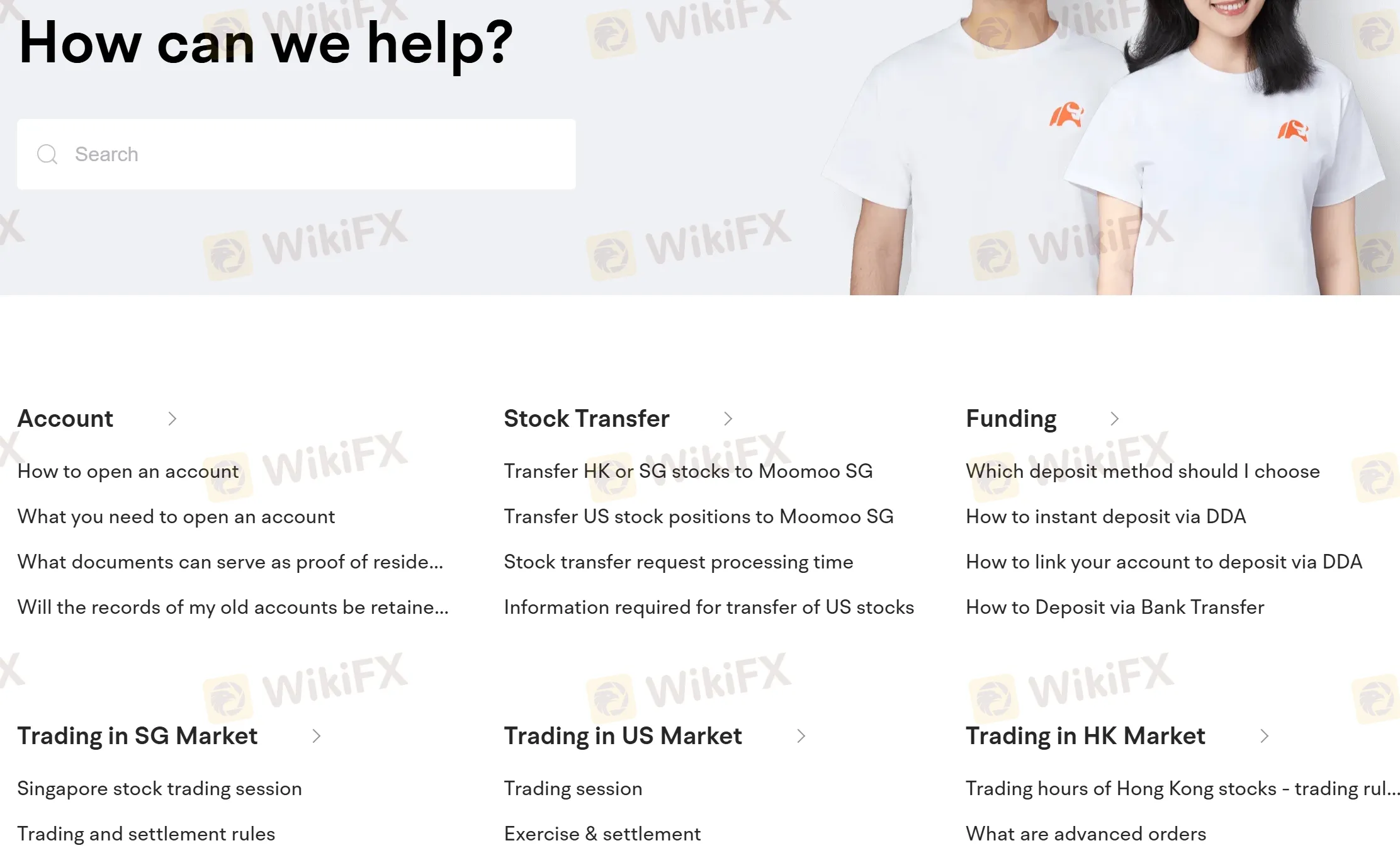

Customer Support

Moomoo is committed to providing exceptional customer service with several convenient options for support. They offer 24/7 online chat, allowing users to get immediate assistance at any time of the day. For more direct communication, customers can call their hotline at +65 6321 8888 or send an email to clientservice@sg.moomoo.com for queries that may require detailed responses.

Additionally, Moomoo has a strong presence on social media platforms including Facebook, YouTube, Telegram, Instagram, and TikTok, enabling them to engage with customers and provide updates and support in a more informal manner. The Support Center on their website is another resourceful tool where users can find answers to frequently asked questions and troubleshoot common issues.

Conclusion

In conclusion, Moomoo presents itself as a versatile trading platform equipped with a range of features that cater to different investor requirements. With its array of analytical tools and educational resources, it supports informed trading decisions but maintains a straightforward approach without extensive customization options found in some competing platforms. As with any trading platform, every investor should consider the specific investment needs and preferences alongside Moomoos offerings to determine if it aligns well with their trading strategies.

FAQs

Which countries does Moomoo operate in?

Moomoo operates in several countries including the United States, Singapore, and Australia. However, it does not solicit investors or market its services in China and certain other jurisdictions.

What types of trading does Moomoo support?

Moomoo supports various types of trading including stocks, options, ETFs, and futures. It also plans to introduce cryptocurrency trading.

Is there a demo account option available on Moomoo?

Yes.

Does Moomo offer any promotions or bonuses for new traders?

Yes. More details can be found in the 'Promotion' part of this article.

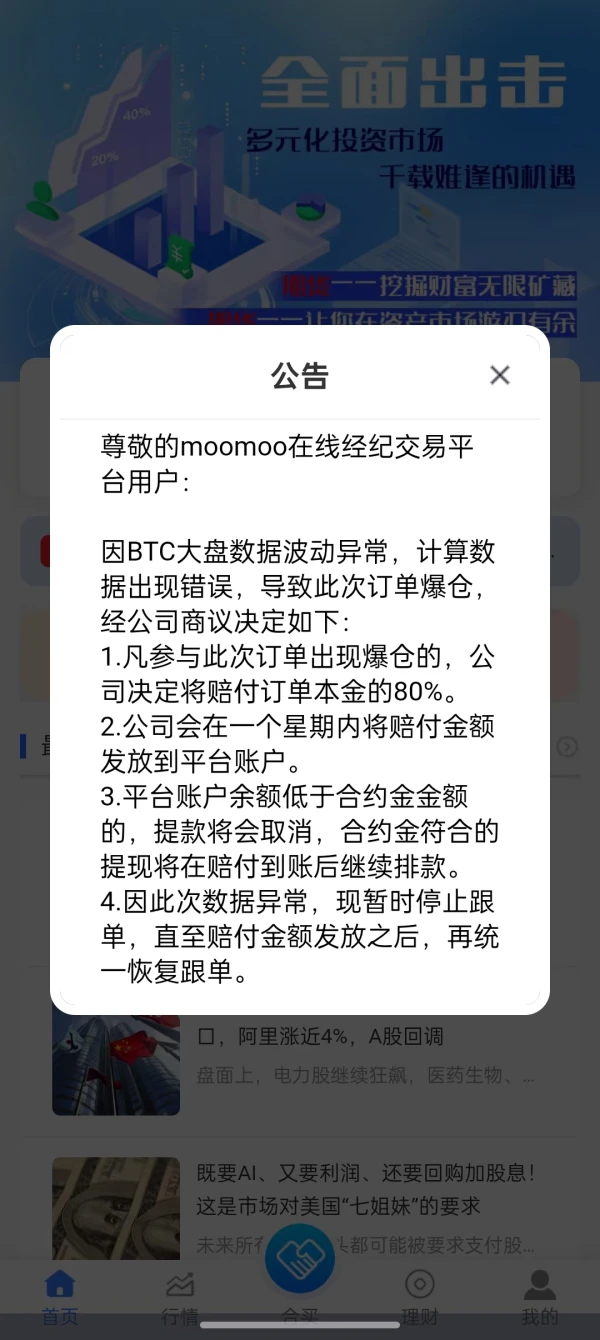

亿3122

Hong Kong

I couldn’t withdraw the money before, and now it has directly disconnected the network.

Exposure

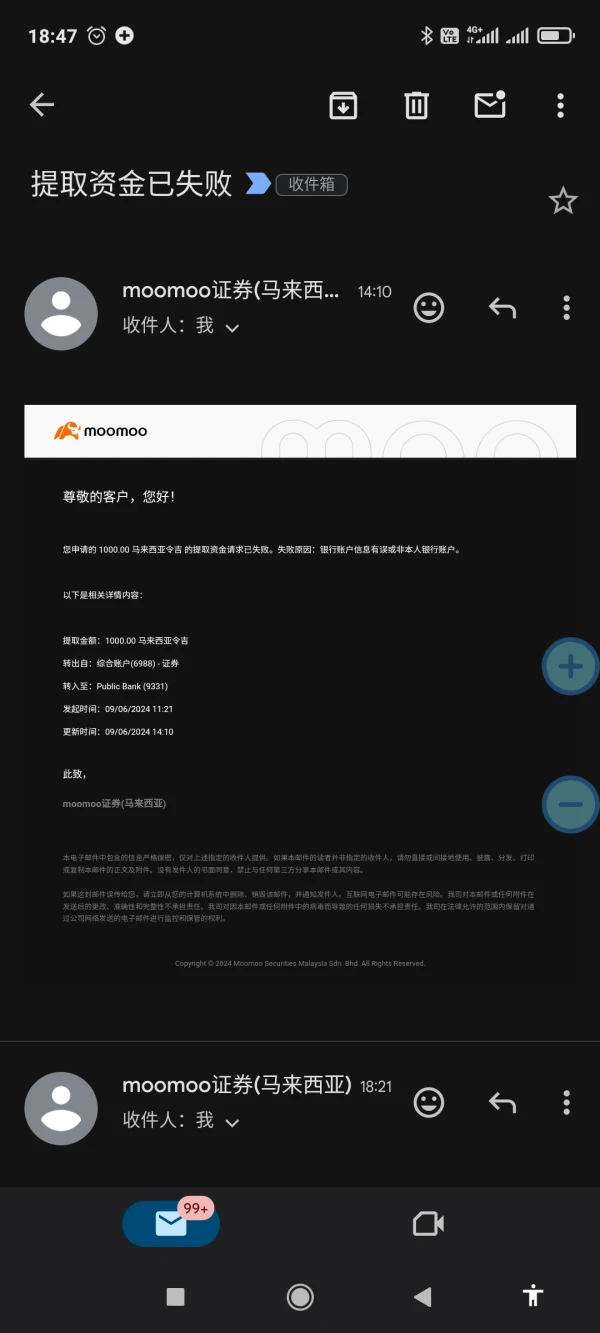

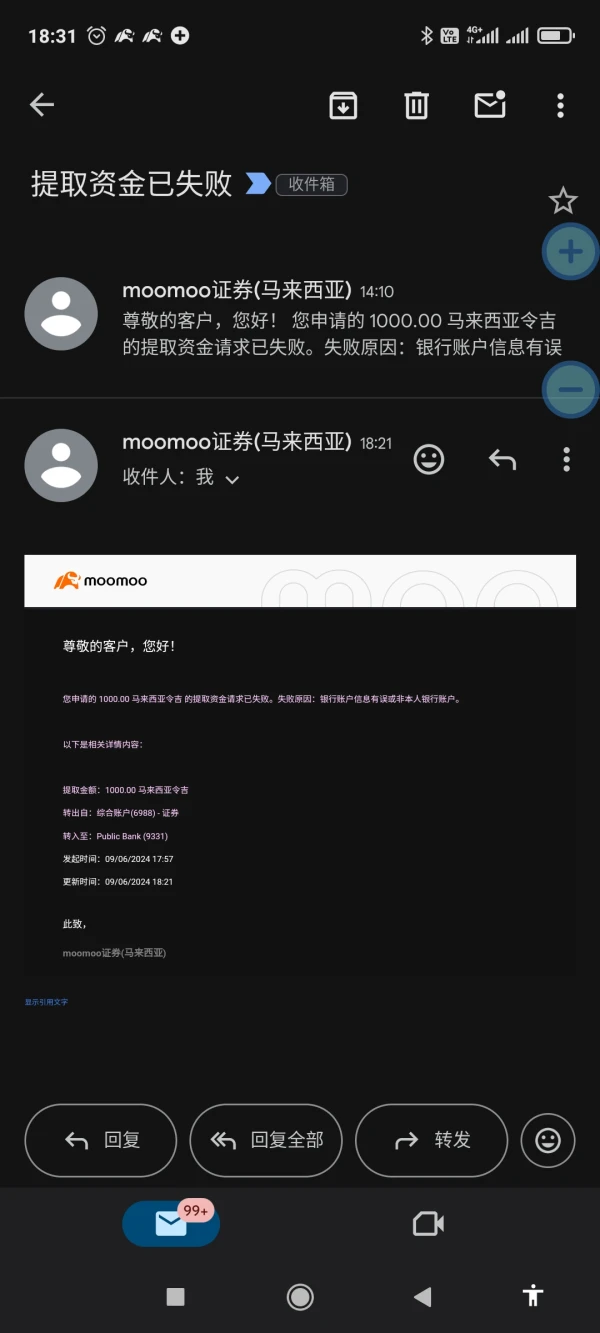

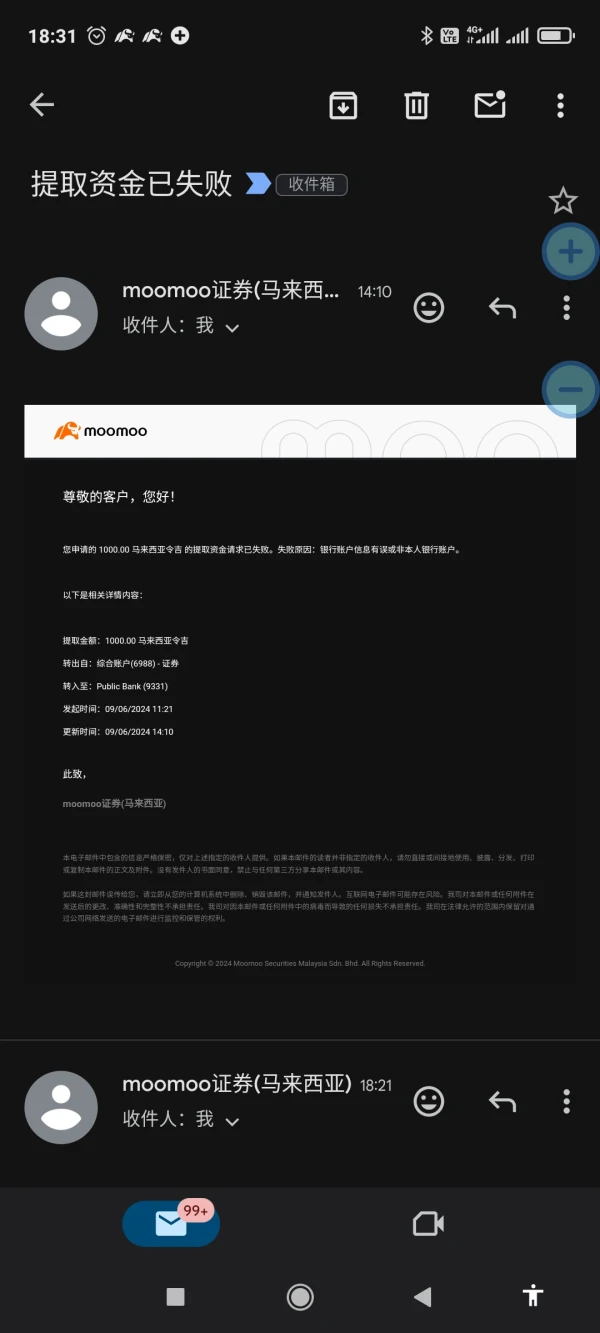

白一喜

Malaysia

Withdrawal authentication has been rejected many times, saying that it is not my bank account. Why don’t I need authentication when I deposit? ?

Exposure

annlim831

Malaysia

The operation interface is complex, making it difficult for beginners to get started, and it requires time to learn how to operate.

Neutral

FX2898763245

Malaysia

Currently using this platform, but the specialist keeps contacting me, very annoying.

Neutral

Gavinn

Singapore

Awesome! The app is super easy to use, packed with all the tools you need to trade like a pro. Love the real-time data and AI alerts that really help in making smart decisions.

Positive