Profil perusahaan

| Fubon SecuritiesRingkasan Ulasan | |

| Didirikan | 5-10 tahun |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | Tidak Diatur |

| Layanan | Perdagangan Efek dan Bisnis Berjangka |

| Akun Demo | Tidak disebutkan |

| Platform Perdagangan | Fubon Trading Treasure(iOS/Android/Windows/PC) |

| Dukungan Pelanggan | Tel: (852)28814500 |

| Email: hkeb.sec@fubon.com | |

| Fax: (852)28126269 | |

Informasi Fubon Securities

Fubon Securities adalah perusahaan efek yang diatur yang menyediakan analisis investasi efek dan layanan konsultasi.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur | Tidak tersedia MT4/MT5 |

| Layanan melibatkan berbagai aset | Tidak ada sumber daya pendidikan |

Apakah Fubon Securities Legal?

TPEx mengatur Fubon Securities, yang membuatnya lebih aman daripada broker yang tidak diatur. Namun, risiko perdagangan tidak dapat sepenuhnya dihindari.

Layanan

Fubon Securities menyediakan perdagangan efek dan bisnis berjangka untuk indeks, forex, komoditas, dan logam.

| Layanan | Didukung |

| Perdagangan Efek | ✔ |

| Bisnis Berjangka | ✔ |

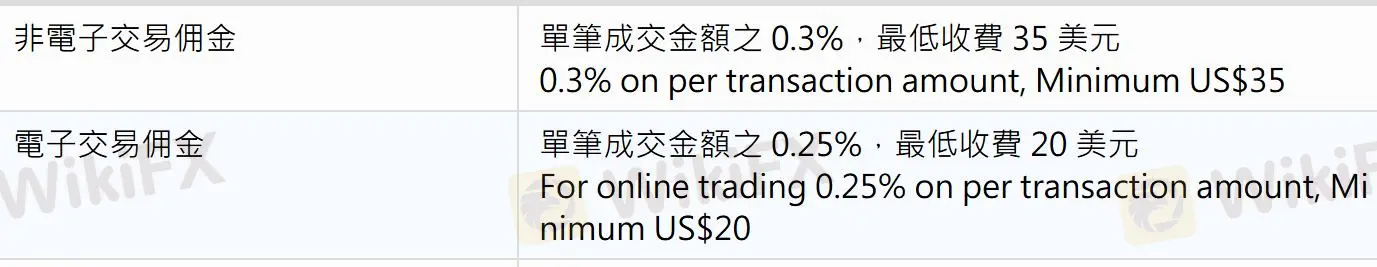

Biaya Fubon Securities

Komisi minimum adalah $20.

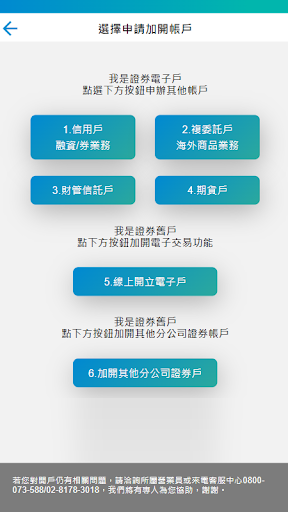

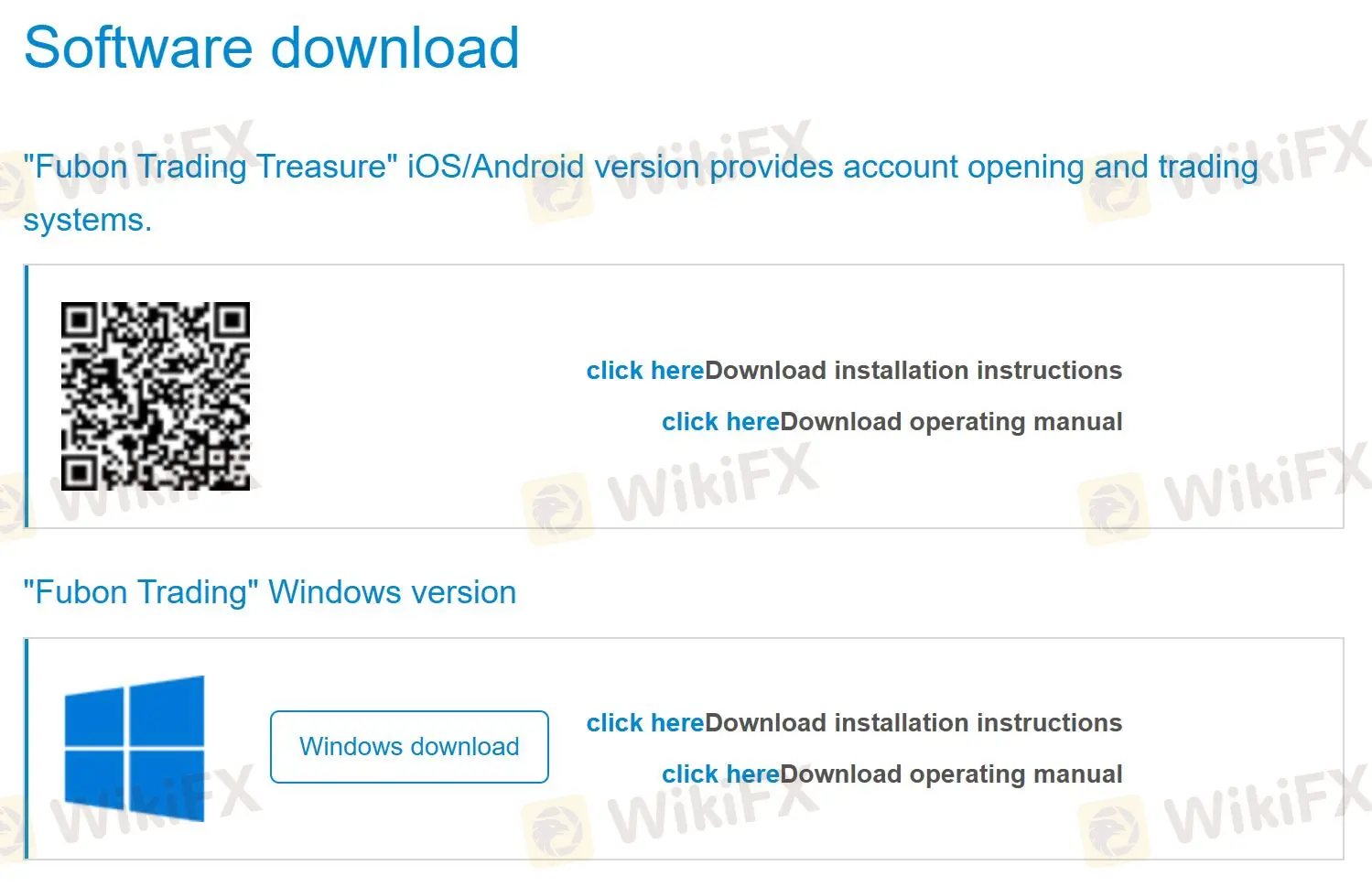

Platform Perdagangan

Fubon Securities menyediakan platform bawaan untuk versi iOS, Android, Windows, dan PC .

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Fubon Trading Treasure | ✔ | iOS/Android/Windows/PC |

Deposit dan Penarikan

Deposit minimum tidak spesifik. Fubon Securities menawarkan akun bank untuk deposit dan penarikan. Bank-bank kerjasama termasuk Hong Kong AndShanghaiBanking CorporationLimited (HSBCHKHHHKH), Standard Chartered Bank(Hong Kong) Limited(SCBLHKHHXXX), Fubon Bank (Hong Kong)Limited(IBALHKHHXXX), dan Taipei Fubon CommercialBank Co., Ltd., Hong KongBranch (TPBKHKHHXXX).

Opsi Dukungan Pelanggan

Trader dapat menghubungi Fubon Securities melalui Tel, email, dan fax.

| Opsi Kontak | Detail |

| Tel | (852)28814500 |

| hkeb.sec@fubon.com | |

| Fax | (852)28126269 |

| Bahasa yang Didukung | Cina sederhana, Cina tradisional |

| Bahasa Situs Web | Cina sederhana, Cina tradisional |

| Alamat Fisik | Ruang 1002, Lantai 10, Gedung Li-Ning, Hong Kong, 218 Electric Road, North Point, Hong Kong |