Unternehmensprofil

| Tradition Überprüfungszusammenfassung | |

| Gegründet | 2004 |

| Registriertes Land/Region | Australien |

| Regulierung | SFC |

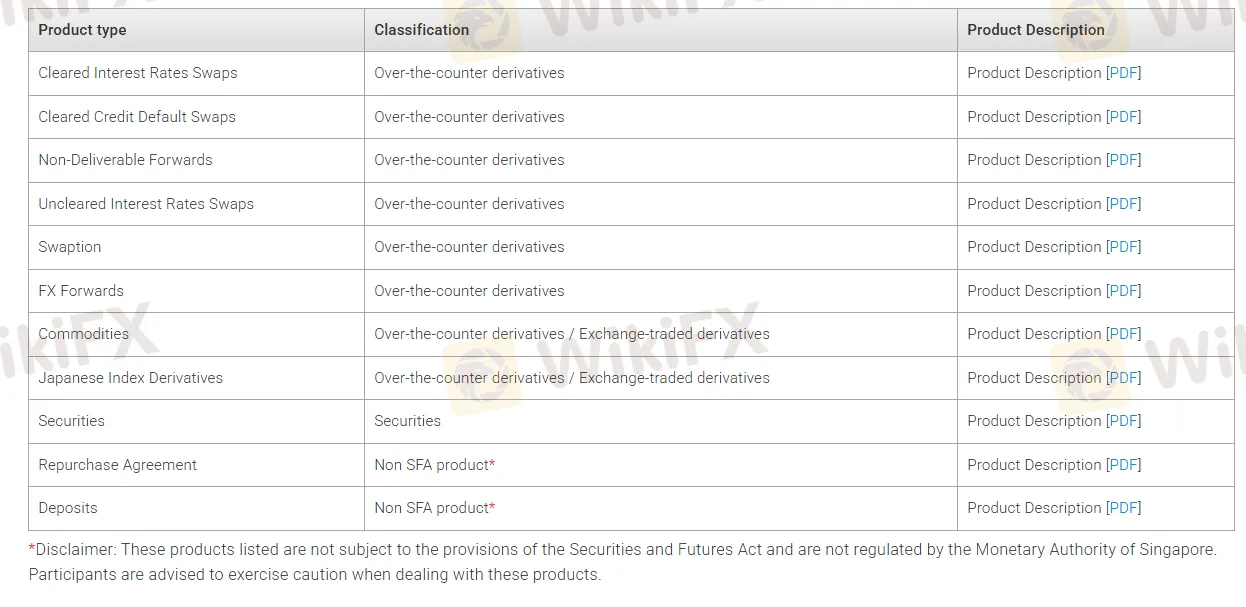

| Marktinstrumente | FX-Forwards, Rohstoffe, japanische Indexderivate, Wertpapiere, Swaption, nicht lieferbare Forwards usw. |

| Handelsplattform | TRADe-System |

| Kundenbetreuung | Tel: +61 2 9135 4931; +61 2 9135 4936; +61 2 9135 4933 |

| E-Mail: market.data.sales@traditionasia.com; trading.operations@traditionasia.com | |

Adresse:

| |

| Kontaktinformationen für andere Büros: https://www.traditionasia.com/contactUS | |

Tradition Informationen

Tradition ist die Interdealer-Brokerabteilung der Compagnie Financière Tradition, einem der weltweit größten Broker für außerbörsliche Finanz- und Warenprodukte wie FX-Forwards, Rohstoffe, japanische Indexderivate, Wertpapiere, Swaption usw. Der Broker ist jetzt in über 28 Ländern tätig, darunter China, Hongkong, Japan, Singapur usw.

Das Gute ist, dass das Unternehmen von der SFC reguliert wird, was bedeutet, dass seine finanziellen Aktivitäten streng von diesen Behörden überwacht werden, was in gewissem Maße einen bestimmten Grad an Kundenschutz garantiert.

Vor- und Nachteile

| Vorteile | Nachteile |

| SFC reguliert | Begrenzte Transparenz bei Handelsbedingungen |

| Weltweite Präsenz | |

| Verschiedene Handelsprodukte |

Ist Tradition legitim?

Tradition wird derzeit gut von der Securities and Futures Commission of Hong Kong (SFC) mit der Lizenznummer T2023364 reguliert.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| SFC | Reguliert | T.F.S. Derivatives HK Limited | Handel mit Futures-Kontrakten | ASE218 |

| Handelsinstrumente | Unterstützt |

| FX-Forwards | ✔ |

| Waren | ✔ |

| Japanische Indexderivate | ✔ |

| Wertpapiere | ✔ |

| Swaption | ✔ |

| Nicht lieferbare Forwards | ✔ |

| Indizes | ❌ |

| Aktien | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Handelsplattform

Tradition's TRADe-Plattform, betrieben von TFS Derivatives HK Ltd, ist ein reguliertes Auftragseingabesystem, das für den Handel mit Credit Default Swaps (CDS) und Anleihen entwickelt wurde. Es erleichtert die Auftragsverteilung und Ausführungsmeldungen durch Echtzeitbenachrichtigungen. Die Plattform unterstützt auch Festpreis-Matching-Sitzungen oder Auktionen, bei denen Teilnehmer Kauf- oder Verkaufsaufträge zu veröffentlichten Preisniveaus einreichen können.