مقدمة عن الشركة

| ACLEDA Bankملخص المراجعة | |

| تأسست | 2005 |

| البلد/المنطقة المسجلة | كمبوديا |

| التنظيم | لا يوجد تنظيم |

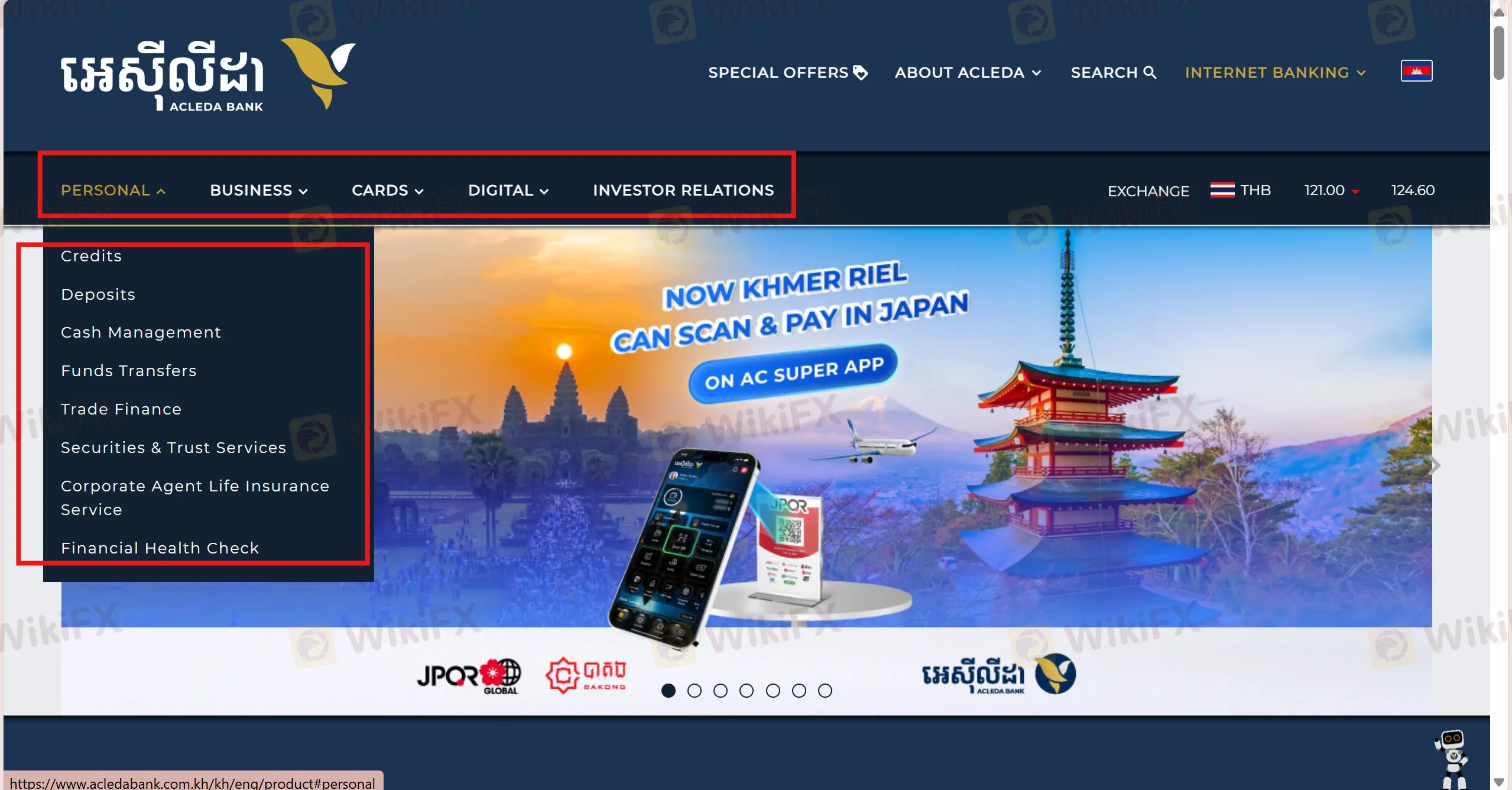

| المنتجات والخدمات | الائتمانات، الودائع، إدارة النقد، تحويل الأموال، تمويل التجارة، خدمات الأوراق المالية والثقة، خدمة التأمين على الحياة للوكلاء الشركات، فحص الصحة المالية |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | AC SUPER APP، ACLEDA INTERNET BANKING |

| الحد الأدنى للإيداع | / |

| دعم العملاء | الهاتف: 023 994 444، 015 999 233 |

| البريد الإلكتروني: acledabank@acledabank.com.kh | |

| الفاكس: 023 430 555 | |

| وسائل التواصل الاجتماعي: فيسبوك، تيليجرام، ماسنجر، تيك توك، يوتيوب، لينكد إن، لاين، وي شات، واتساب، X | |

| العنوان: مبنى رقم 61، شارع برياه منيفونج، سانجكات سراه شاك، خان دون بينه، بنوم بنه، كمبوديا. | |

معلومات ACLEDA Bank

ACLEDA Bank، تأسست في عام 2005، هي بنك مسجل في كمبوديا. يوفر مجموعة متنوعة من خدمات البنك مثل الائتمانات، الودائع، إدارة النقد، تحويل الأموال، تمويل التجارة، خدمات الأوراق المالية والثقة، خدمة التأمين على الحياة للوكلاء الشركات، وفحص الصحة المالية. ومع ذلك، ليس لديها أي ترخيص.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| مجموعة واسعة من خدمات البنك | لا يوجد تنظيم |

| خيارات دعم العملاء المتعددة |

هل ACLEDA Bank شرعي؟

ACLEDA Bank ليس لديها أي ترخيص، مما يعني أن عملائها يجب أن يكونوا أكثر حذرًا عند التعامل مع هذا البنك.

المنتجات والخدمات

مثل معظم البنوك، ACLEDA Bank تقدم العديد من خدمات البنكية، التي تشمل الائتمانات، الودائع، إدارة النقد، تحويل الأموال، تمويل التجارة، الأوراق المالية وخدمات الثقة، خدمات التأمين على الحياة للوكلاء الشركات، فحص الصحة المالية.

| المنتجات والخدمات | مدعوم |

| الائتمانات | ✔ |

| الودائع | ✔ |

| إدارة النقد | ✔ |

| تحويل الأموال | ✔ |

| تمويل التجارة | ✔ |

| الأوراق المالية وخدمات الثقة | ✔ |

| خدمات التأمين على الحياة للوكلاء الشركات | ✔ |

| فحص الصحة المالية | ✔ |

منصة التداول

منصات التداول لدى ACLEDA Bank هي تطبيق ACLEDA الرائع ومصرف ACLEDA عبر الإنترنت، التي تدعم التجار على أجهزة الكمبيوتر الشخصي، ماك، آيفون وأندرويد.

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

| تطبيق ACLEDA الرائع | ✔ | الجوال | / |

| مصرف ACLEDA عبر الإنترنت | ✔ | الكمبيوتر الشخصي، الجهاز اللوحي | / |