公司簡介

| KKR 檢討摘要 | |

| 成立年份 | 1976 |

| 註冊國家/地區 | 英國 |

| 監管 | 已撤銷 |

| 產品與服務 | 私募股權、基礎設施、房地產、信貸、資本市場、保險和戰略合作夥伴關係 |

| 客戶支援 | Client.Services@kkr.com |

| +1 (212) 230-9700 | |

KKR 資訊

KKR 成立於1976年,總部位於英國,提供多元化的產品和服務,涵蓋私募股權、基礎設施、房地產、信貸、資本市場、保險和戰略合作夥伴關係。儘管該平台曾持有FCA投資諮詢許可證,但現已被撤銷,他們管理著龐大的資產(截至2025年3月為2840億美元),服務廣泛的客戶,包括機構和個人投資者。

優點與缺點

| 優點 | 缺點 |

|

|

|

|

KKR 是否合法?

KKR 曾經在英國由金融行為監管局(FCA)監管,許可證號碼為471885。但現在已被撤銷。

| 監管狀態 | 已撤銷 |

| 監管機構 | 英國 |

| 許可機構 | 金融行為監管局(FCA) |

| 許可類型 | 投資諮詢許可證 |

| 許可號碼 | 471885 |

產品與服務

KKR 在全球提供資產管理、資本市場和保險解決方案。他們的主要領域包括私募股權、基礎設施、房地產、信貸、資本市場、保險和戰略合作夥伴關係。

公司統計數據

KKR 截至2025年3月31日的主要資產類別包括私募股權2090億美元、信貸2540億美元、基礎設施830億美元和房地產810億美元。他們的總管理資產(AUM),包括流動策略,達到2840億美元。

KKR 的客戶群

KKR 服務廣泛的客戶,包括機構投資者,通過其全球財富產品為合資格的個人提供量身定制的解決方案。該平台還為家庭、企業家和他們投資的公司提供服務,旨在實現增長和運營改善。

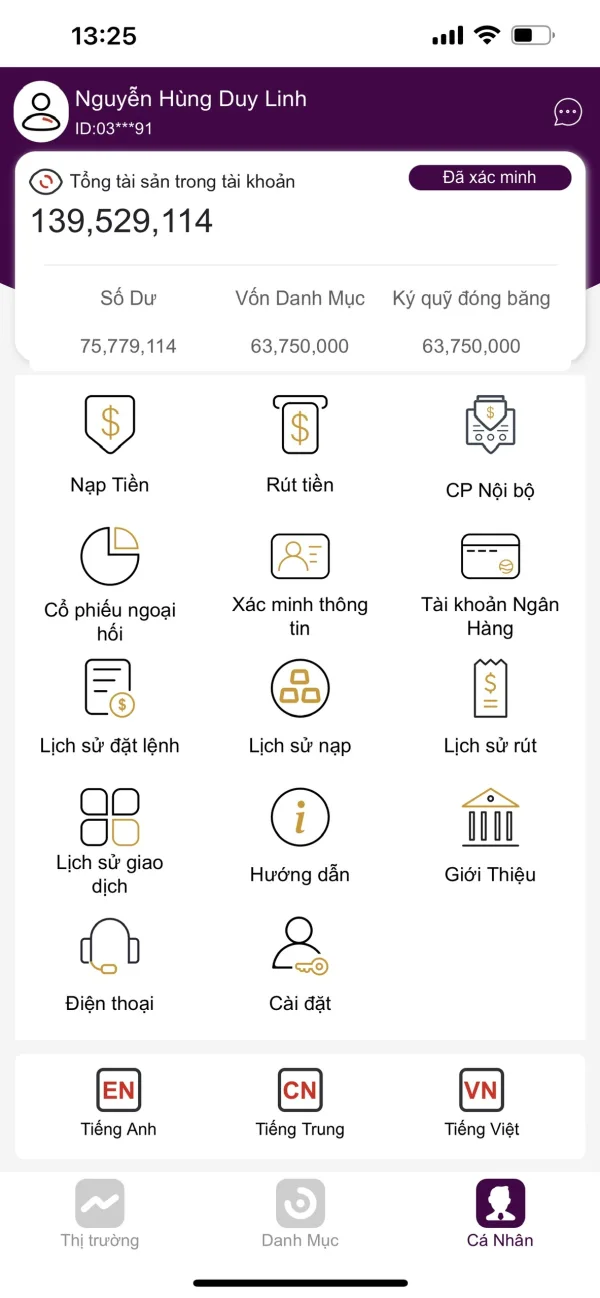

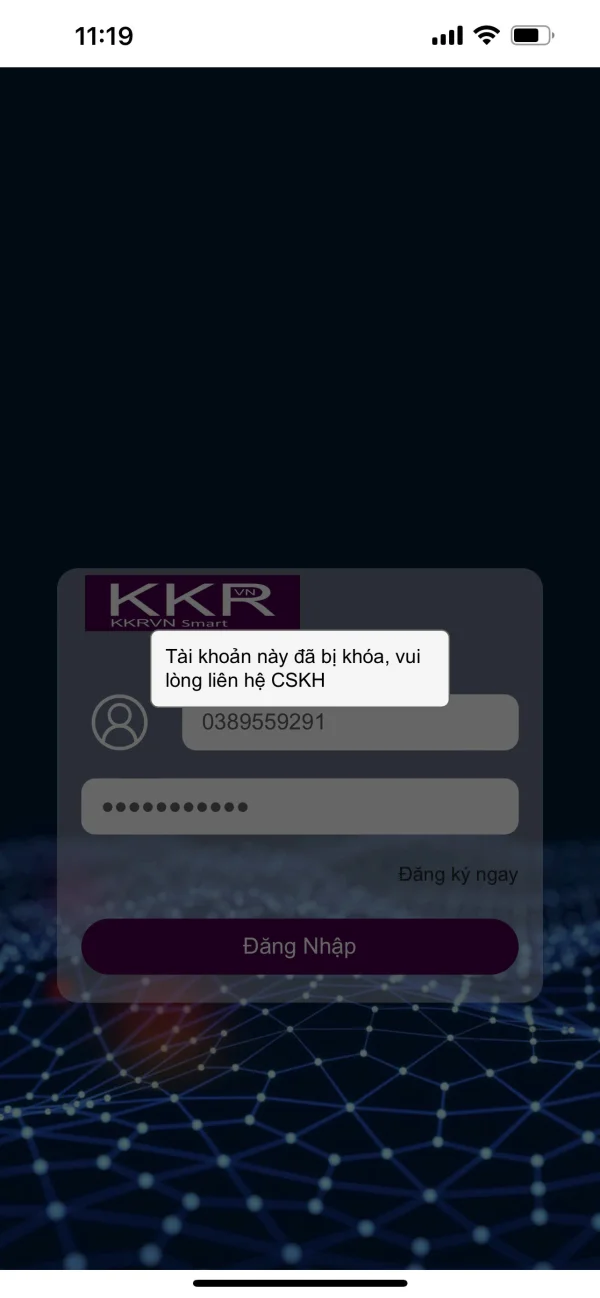

FX3862630966

越南

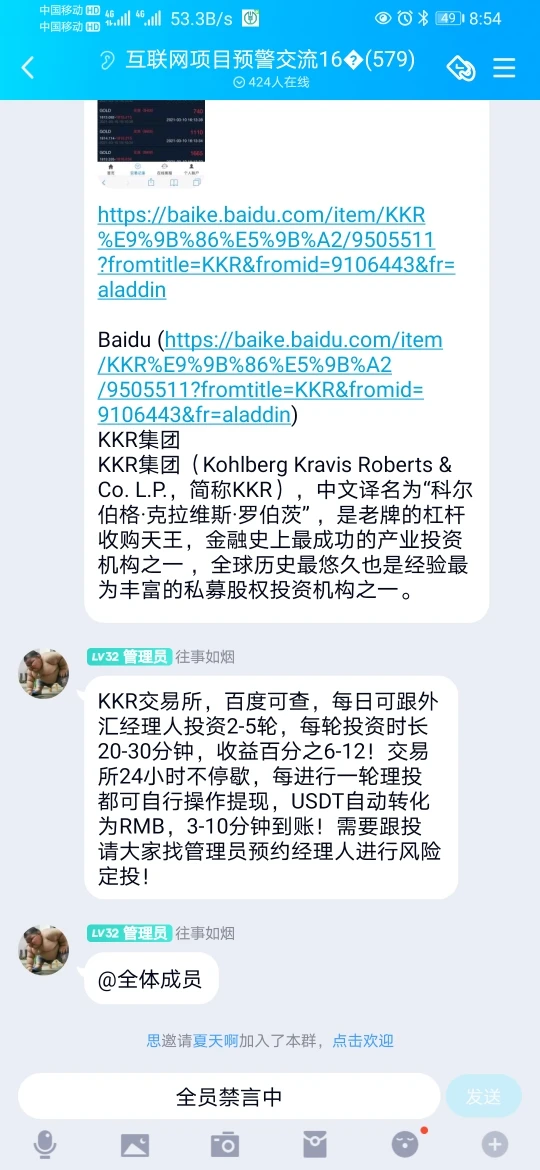

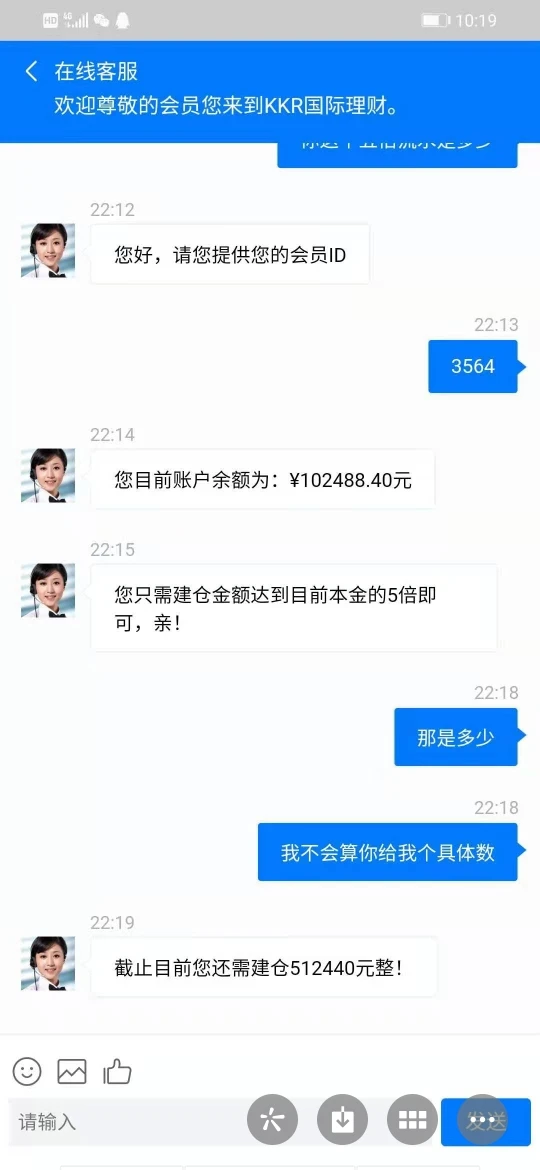

越南的朋友們,請注意不要投資KKR VN,他們是正式的100%騙局,旨在從投資者那裡奪取金錢。他們在國內外都有一整個組織來欺騙和操縱小投資者,誘使他們進入,建立信任,並操縱他們的情緒。投資者將損失所有資金,並無法恢復。通常,他們使用自己的應用程式進行股市投資。起初,您可以存款,獲利並提款。但是然後他們會引誘您購買折扣股票,當您存款以根據您的資本購買數量時,您將無法購買。他們的系統將分配大量虛擬股票,使您的帳戶餘額為負,此時您將知道自己被欺騙了。他們會告訴您存錢以清除負餘額以進行購買,並強迫您旋轉資本以購買大量股票。然後,當您賣出並想要提款時,您將無法提取全部金額,他們只允許您提取5%的金錢。他們將繼續將您推入陷阱,以耗盡您的資金。

爆料

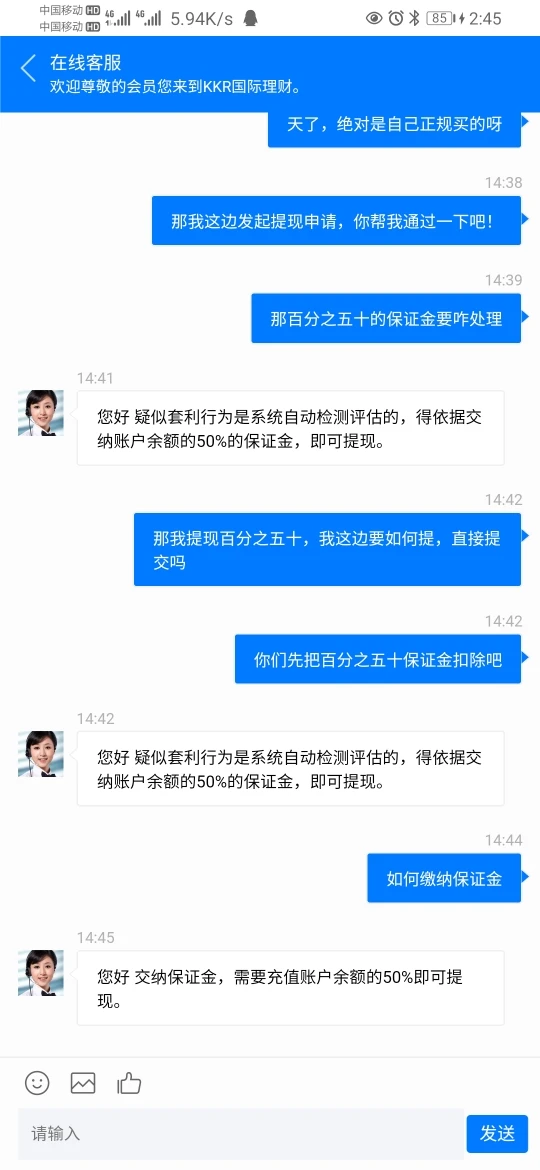

123442698

香港

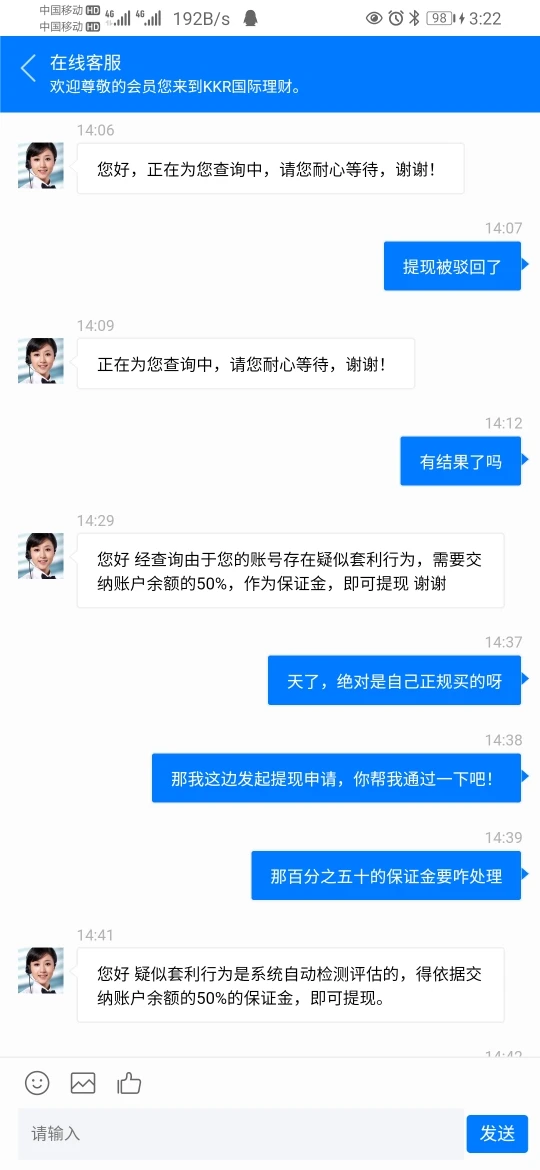

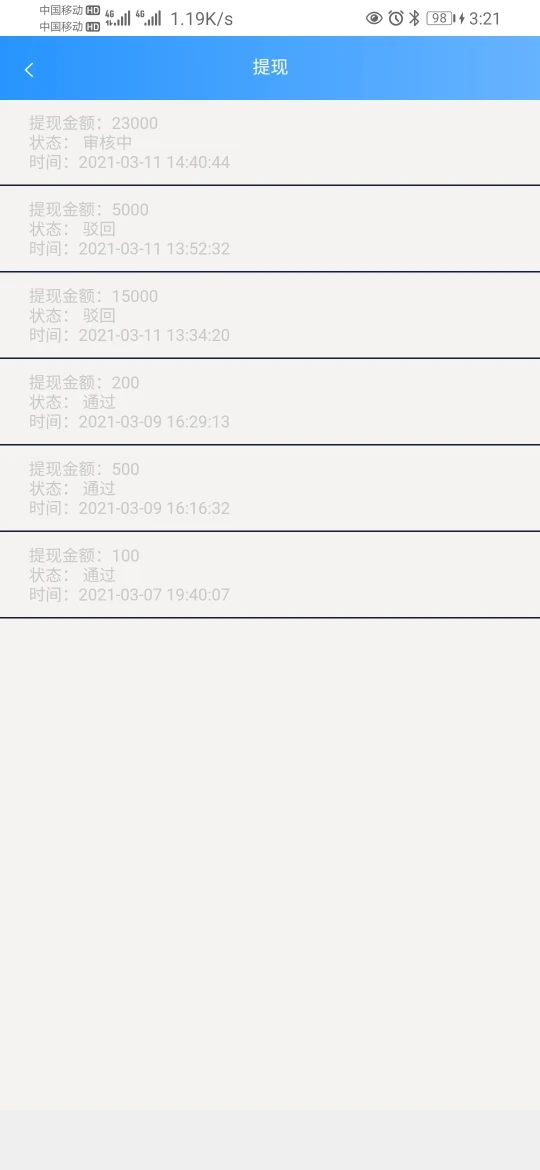

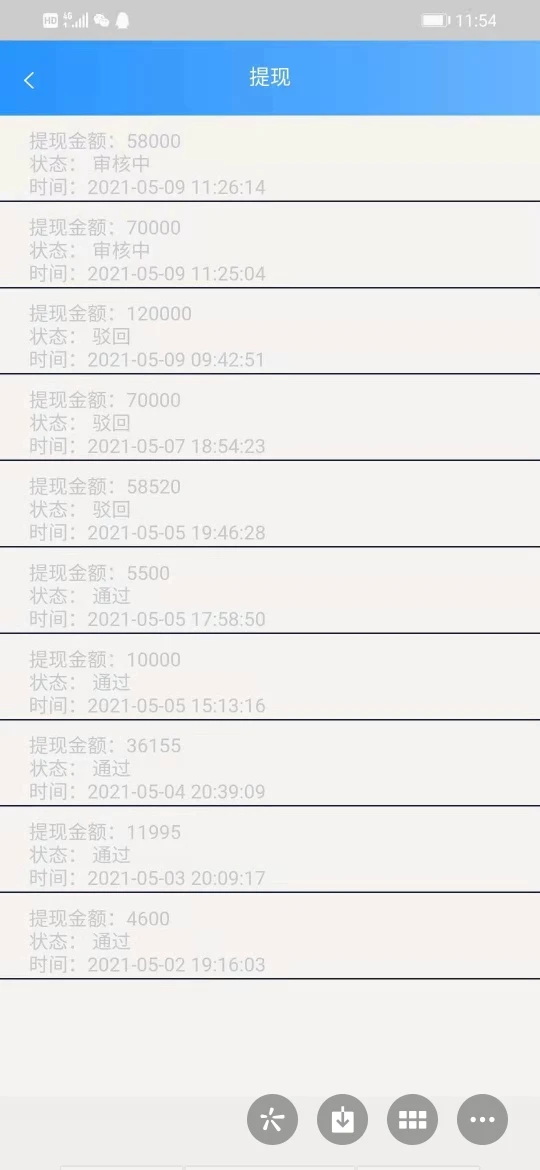

赚钱了不能出金,需要缴纳保证金,带玩的人突然把你踢群,远离。

爆料

FX4033457346

香港

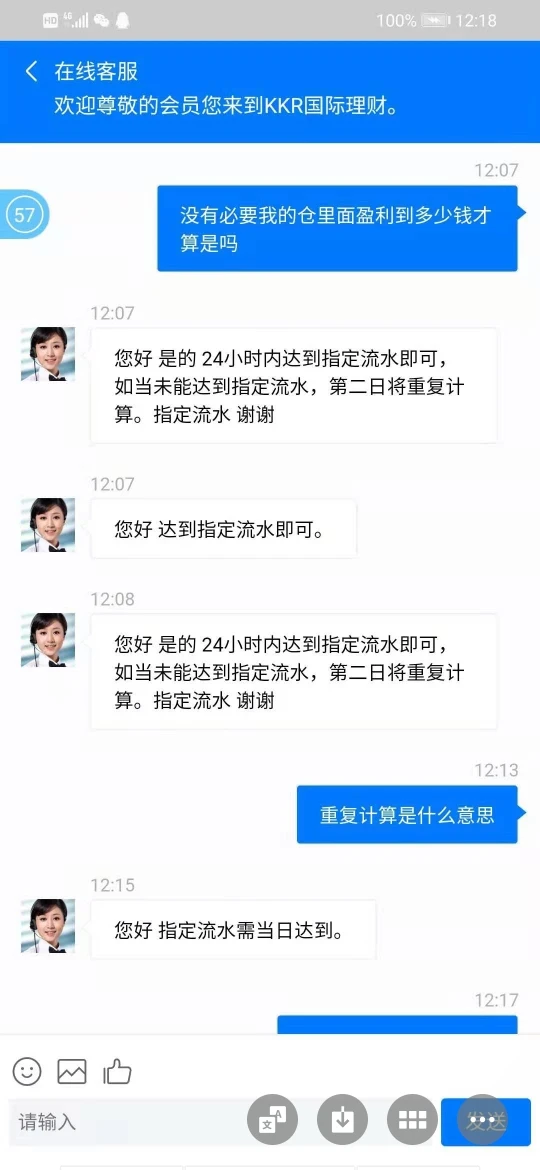

平台限制出金提现,引导客户一步步走进圈套,永各种理由拒绝出金

爆料

雨中飞燕

香港

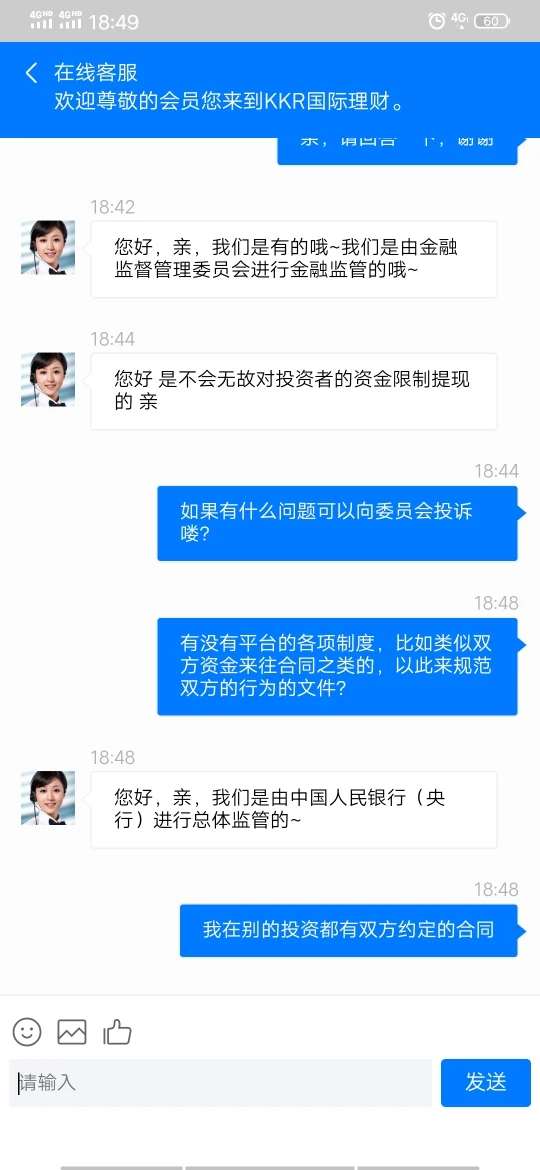

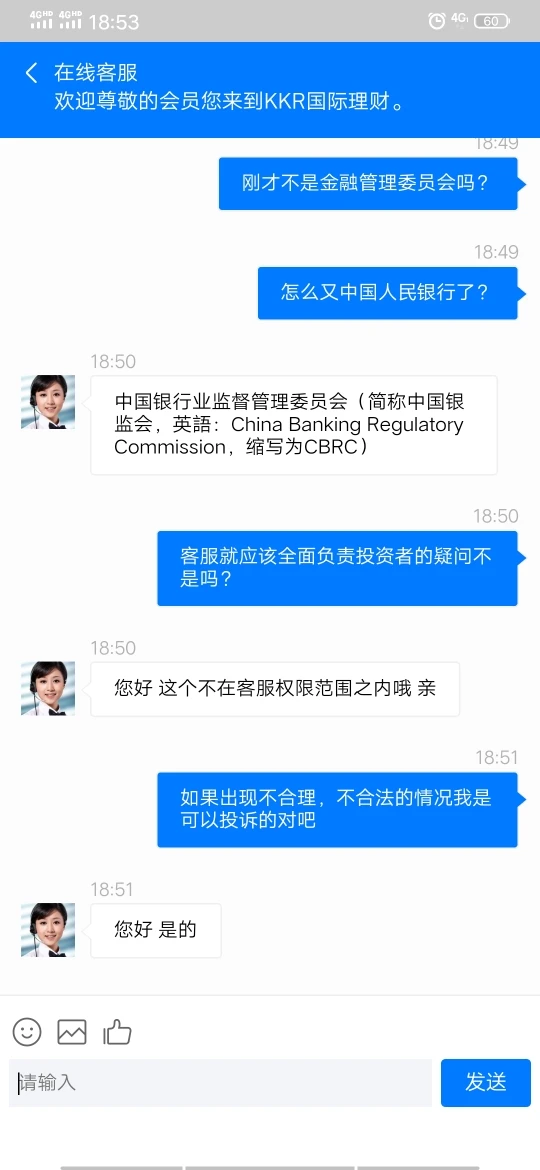

骗子平台,客服就谎话连篇,无法自圆,一会儿声称由金融监管委员会监管,一会儿又由中国银监会监管,天眼一查全露馅儿

爆料