Buod ng kumpanya

| KKR Buod ng Pagsusuri | |

| Itinatag | 1976 |

| Nakarehistrong Bansa/Rehiyon | United Kingdom |

| Regulasyon | Ibinasura |

| Mga Produkto at Serbisyo | Pribadong Ekweytibo, Infrastruktura, Real Estate, Credit, Capital Markets, Insurance, at Strategic Partnerships |

| Suporta sa Customer | Client.Services@kkr.com |

| +1 (212) 230-9700 | |

Impormasyon Tungkol sa KKR

KKR, itinatag noong 1976 sa UK, nag-aalok ng iba't ibang mga produkto at serbisyo na sumasaklaw sa pribadong ekweytibo, infrastruktura, real estate, credit, capital markets, insurance, at strategic partnerships. Bagaman noon ay mayroon silang Lisensiyang Pangpayo sa Pamumuhunan mula sa FCA, na ngayon ay ibinasura, pinamamahalaan nila ang malalaking ari-arian ($284B AUM hanggang Marso 2025) at naglilingkod sa malawak na mga kliyente, kabilang ang institusyonal at indibidwal na mga mamumuhunan.

Mga Benepisyo at Kadahilanan

| Mga Benepisyo | Kadahilanan |

|

|

|

|

Tunay ba ang KKR?

Ang KKR noon ay mayroong Lisensiyang Pangpayo sa Pamumuhunan na isinasaayos ng Financial Conduct Authority (FCA) sa United Kingdom na may numero ng lisensya na 471885. Ngunit ito ay ibinasura na ngayon.

| Status ng Regulasyon | Ibinasura |

| Isinasaklaw ng | United Kingdom |

| Lisensiyadong Institusyon | Ang Financial Conduct Authority (FCA) |

| Uri ng Lisensya | Lisensiyang Pangpayo sa Pamumuhunan |

| Numero ng Lisensya | 471885 |

Mga Produkto at Serbisyo

Ang KKR ay nagbibigay ng pamamahala ng ari-arian, mga merkado ng kapital, at mga solusyon sa seguro sa buong mundo. Ang kanilang pangunahing mga larangan ay kinabibilangan ng Pribadong Ekweytibo, Infrastruktura, Real Estate, Credit, Capital Markets, Insurance, at Strategic Partnerships.

Estadistika ng Kumpanya

Ang mga pangunahing uri ng ari-arian ng KKR hanggang Marso 31, 2025, ay kinabibilangan ng $209B sa Pribadong Ekweytibo, $254B sa Credit, $83B sa Infrastruktura, at $81B sa Real Estate. Ang kanilang kabuuang Assets Under Management (AUM), kasama ang mga liquid strategies, ay umabot sa $284B.

Kliyente ng KKR

KKR ay naglilingkod sa malawak na hanay ng mga kliyente, kabilang ang mga institusyonal na mamumuhunan na may mga solusyon na naayon at mga taong kwalipikado sa pamamagitan ng kanilang mga alok sa yaman sa buong mundo. Ang plataporma rin ay naglilingkod sa mga pamilya, mga negosyante, at sa mga kumpanyang kanilang pinag-iinvestan, na layuning makamit ang paglago at pagpapabuti sa operasyon.

FX3862630966

Vietnam

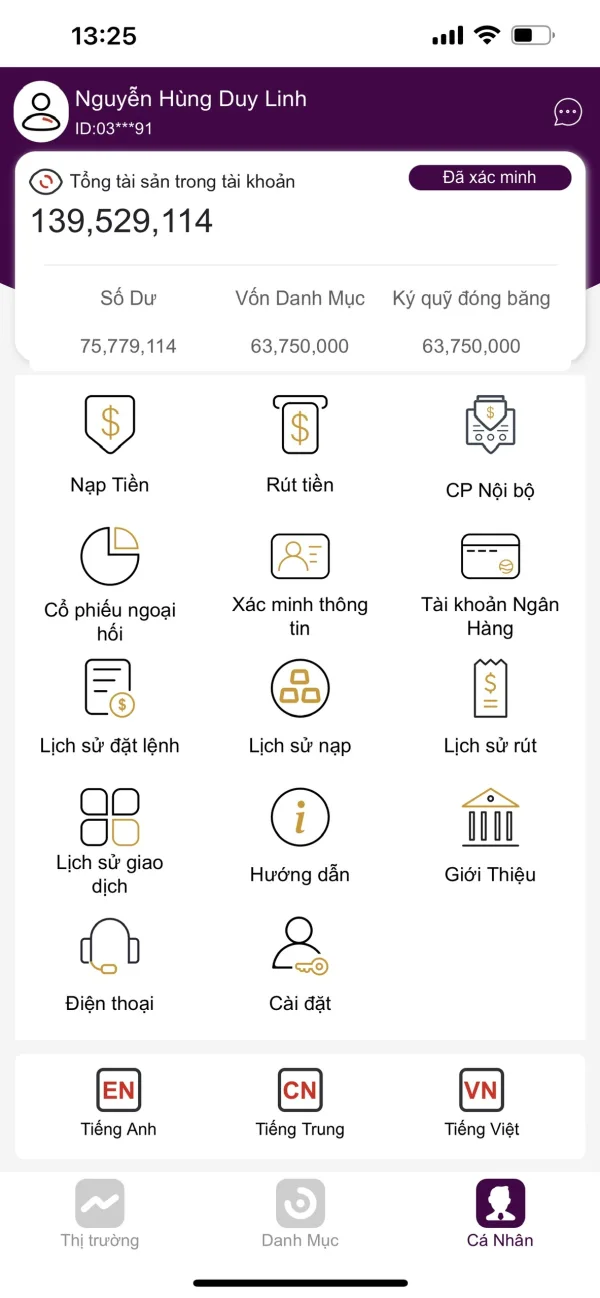

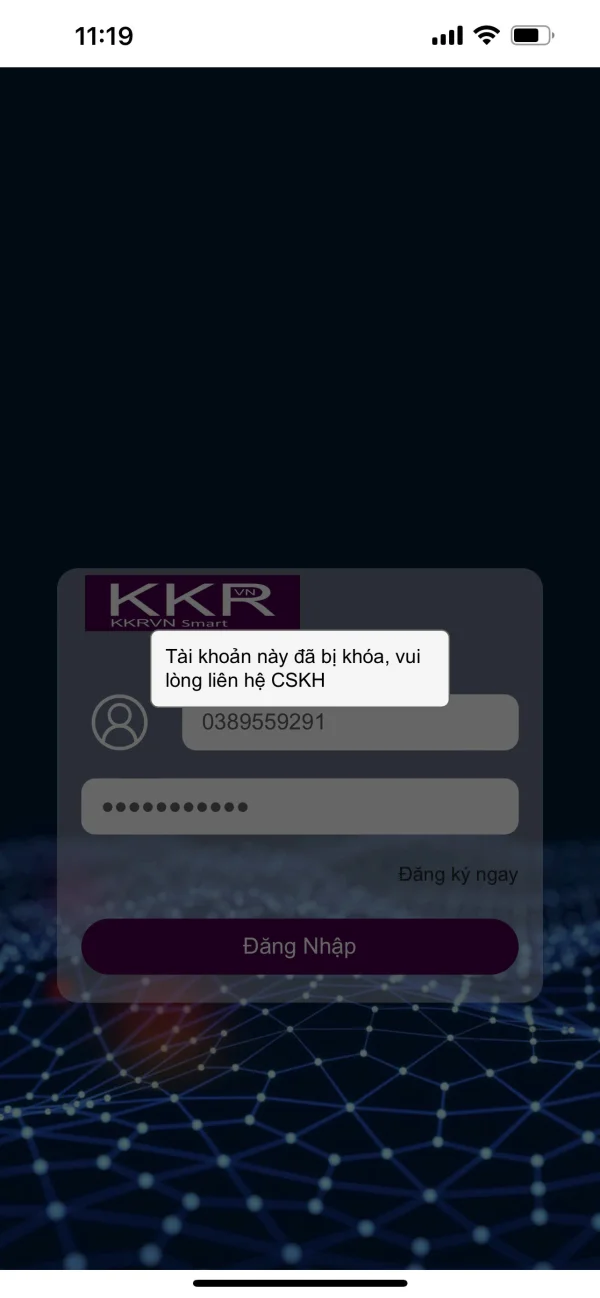

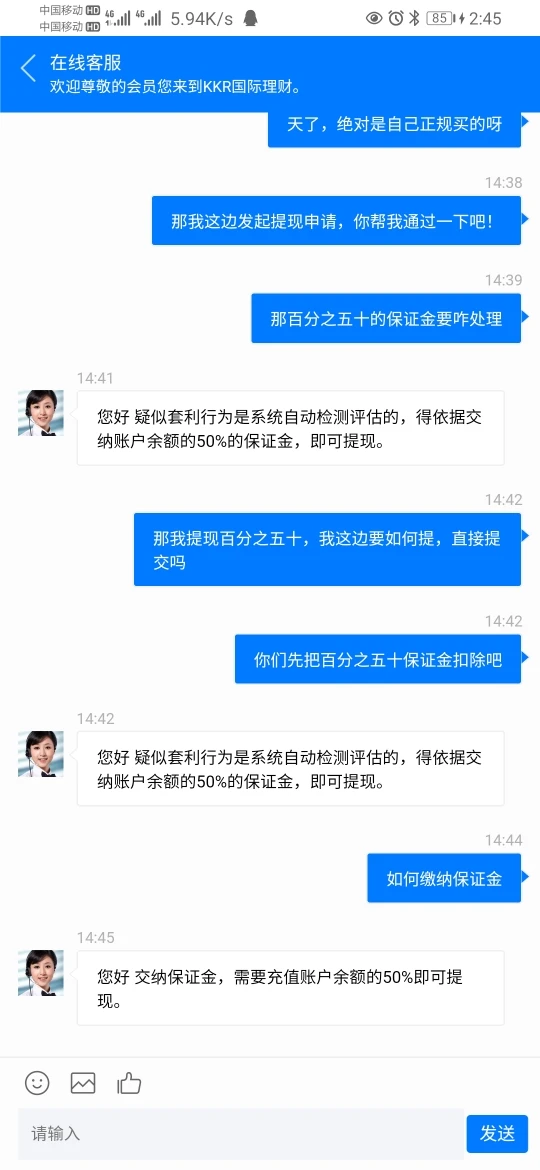

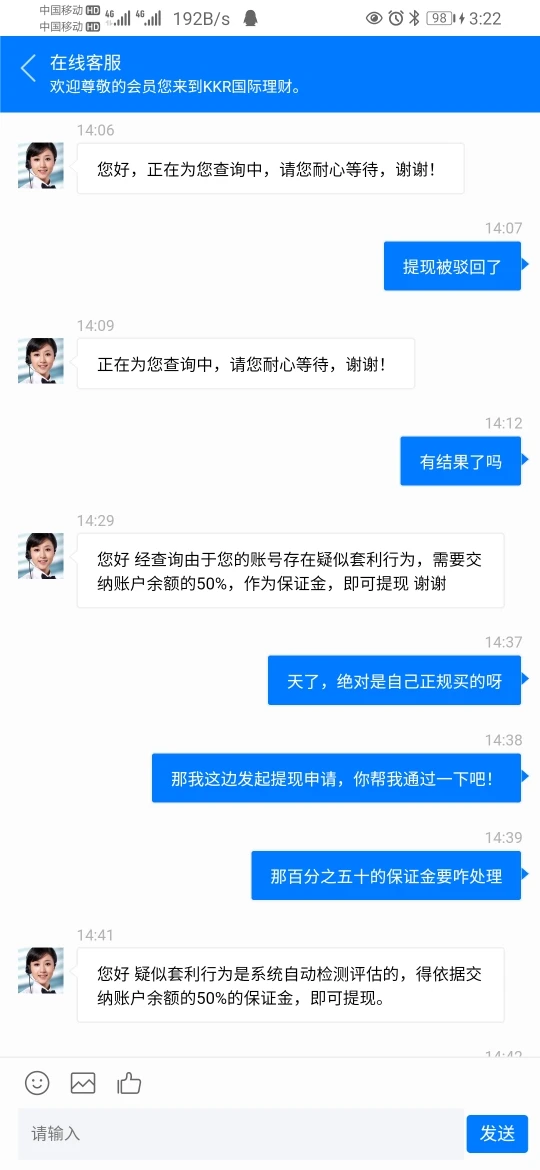

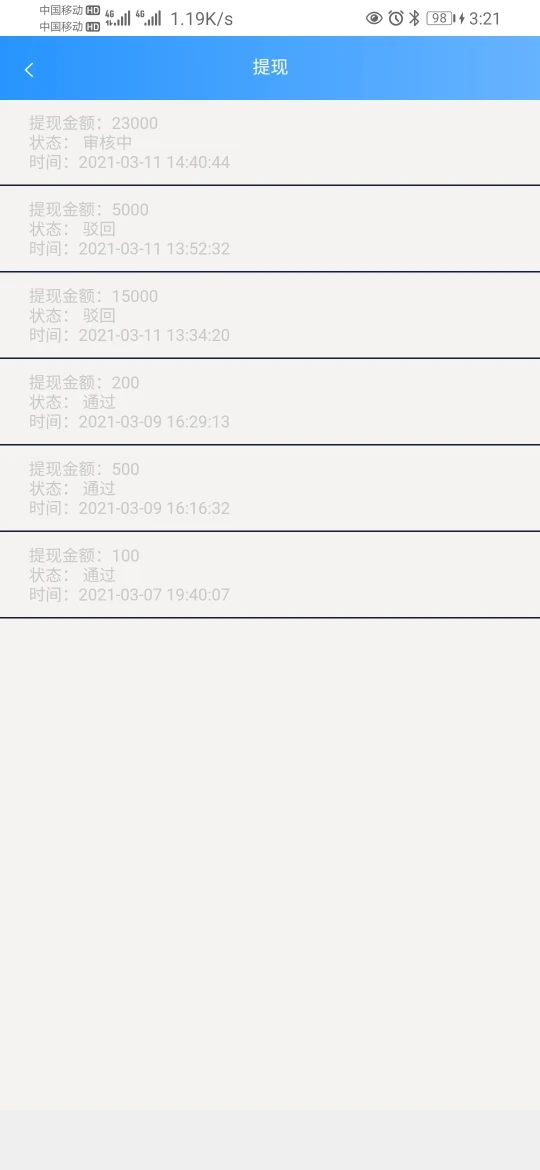

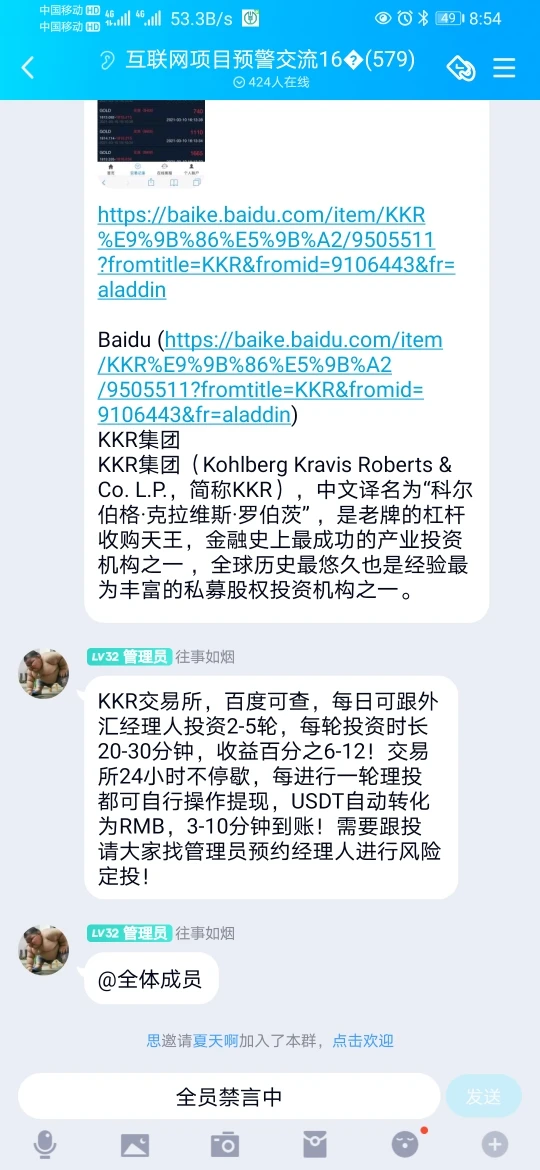

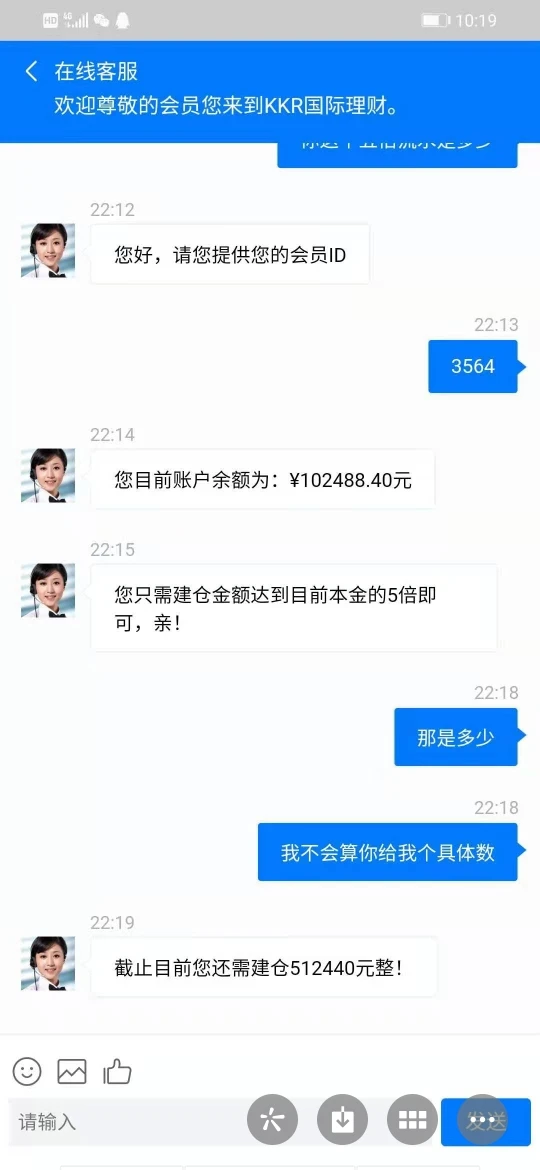

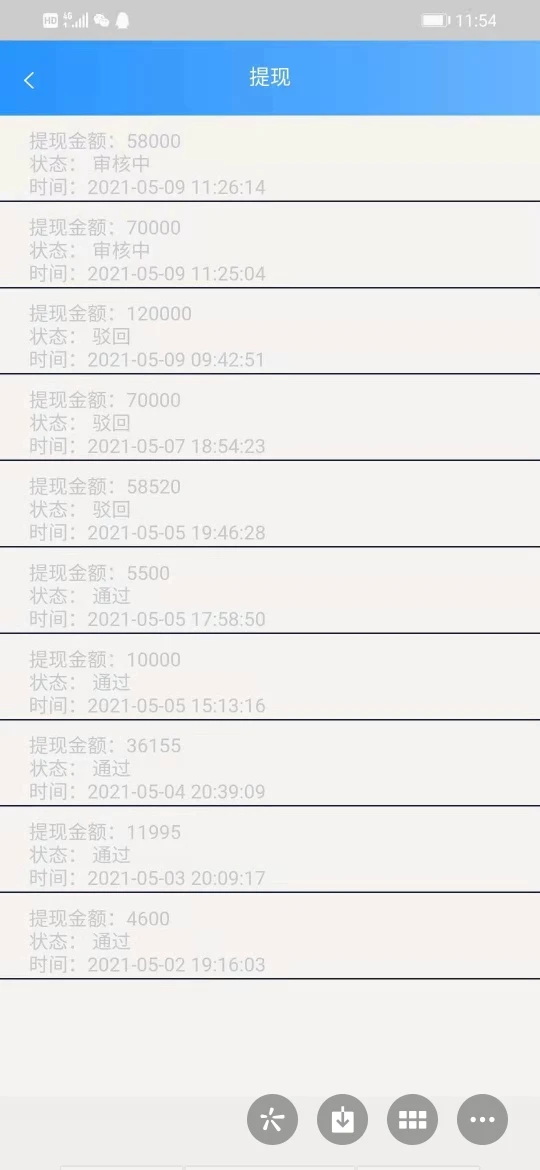

Lahat ng tao sa Vietnam, pakitandaan na hindi dapat mag-invest sa KKR VN, sila ay opisyal na 100% na panloloko upang kunin ang pera mula sa mga mamumuhunan. Mayroon silang buong organisasyon sa loob at labas ng bansa upang dayain at manipulahin ang mga maliliit na mamumuhunan, sila ay maghikayat, lumikha ng tiwala, at manipulahin ang kanilang emosyon. Ang mga mamumuhunan ay mawawalan ng lahat ng kanilang pera at hindi nila ito mababawi. Karaniwan, ginagamit nila ang kanilang app para sa pamumuhunan sa stock market. Sa simula, maaari kang magdeposito, kumita ng tubo, at mag-withdraw. Ngunit pagkatapos ay tatakawin ka nila na bumili ng mga discounted na stocks at kapag nagdeposito ka para bumili ng kantidad ayon sa iyong kapital, hindi mo magagawa. Ang kanilang sistema ay magbibigay ng malaking halaga ng virtual na mga stocks upang gawing negatibo ang iyong account balance, at sa puntong ito, malalaman mo na niloko ka. Sasabihin nila sa iyo na magdeposito ng pera upang malinis ang negatibong balance upang makapagbili, at pilitin kang ikotin ang iyong kapital upang bumili ng malaking halaga. Pagkatapos, kapag ibinenta mo at gusto mong mag-withdraw, hindi mo magagawang i-withdraw ang buong halaga, papayagan ka lamang nilang mag-withdraw ng 5% ng pera. At patuloy nilang itutulak ka sa mas malalim na patibong upang ubusin ang iyong pera.

Paglalahad

123442698

Hong Kong

Hindi mag-withdraw ng mga pondo pagkatapos ng kita at kinakailangan ng margin. Ang lalaking nagtuturo sa iyo ay aalisin ka mula sa panggrupong chat nang bigla. Lumayo.

Paglalahad

FX4033457346

Hong Kong

Limitahan ang pag-atras. Linlangin ang customer.

Paglalahad

雨中飞燕

Hong Kong

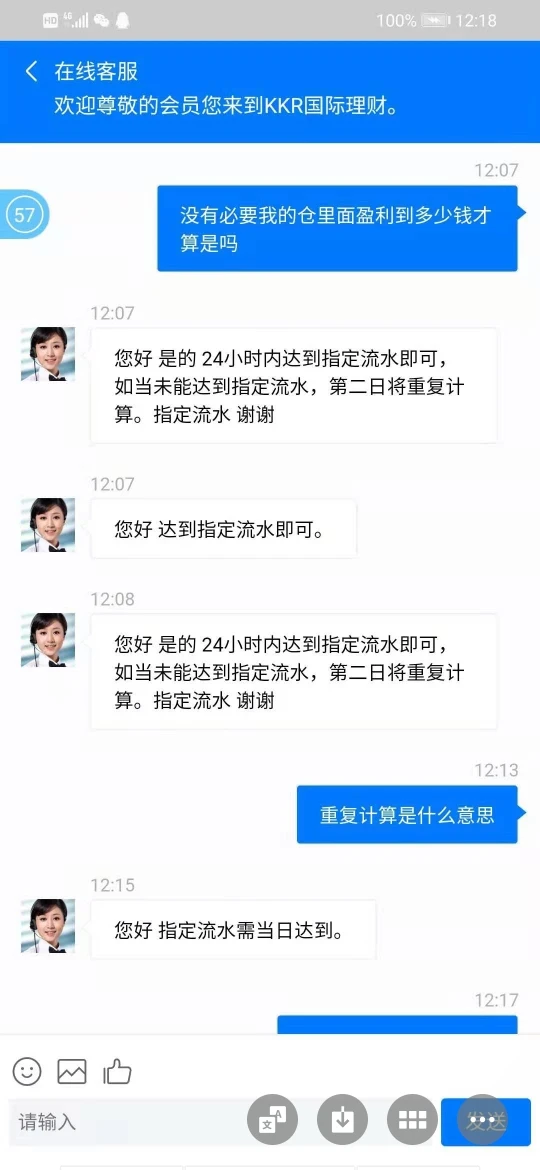

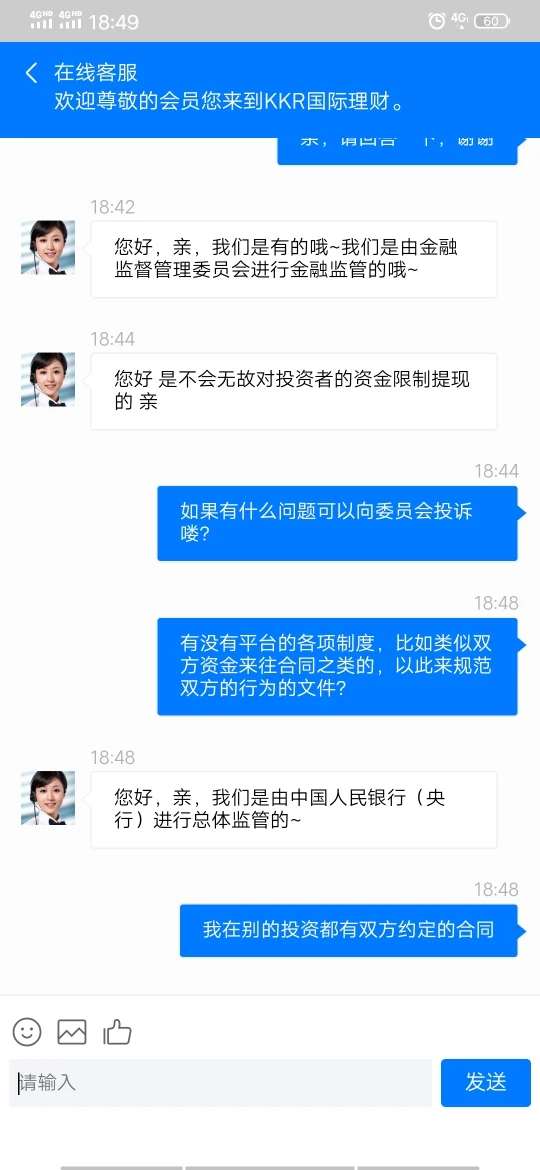

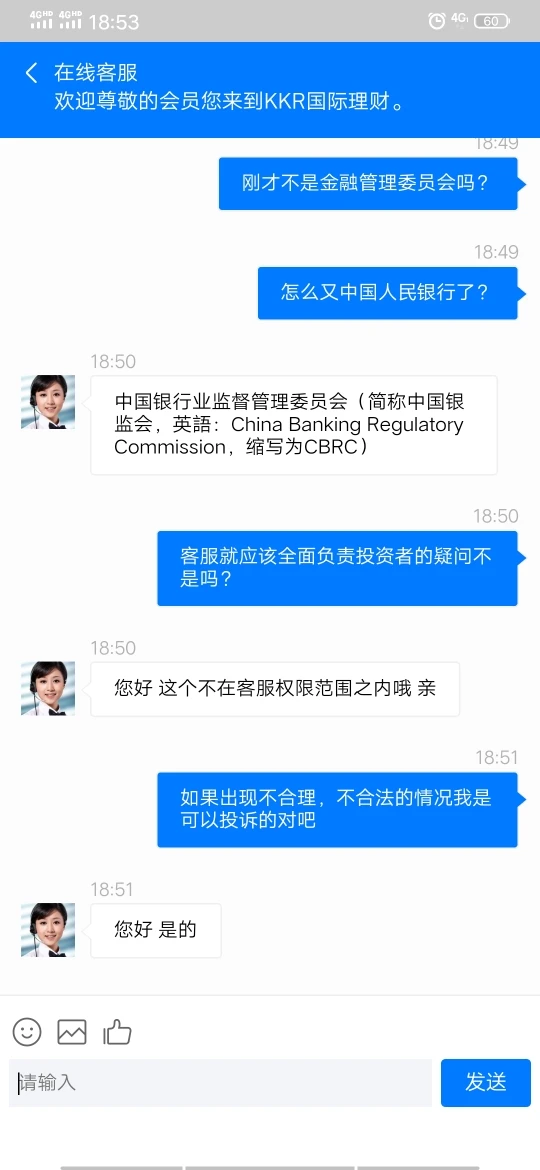

Platform ng pandaraya. Sinasabi ng serbisyo sa customer ang kasinungalingan pagkatapos ng kasinungalingan. Minsan sabihin na sila ay kinokontrol ng FSC. Minsan sinasabi nila na kinokontrol sila ng CBRC. Ngunit ang giveaway ay ipinakita sa Wiki Global

Paglalahad