公司簡介

| 東興期貨 評論摘要 | |

| 成立年份 | 2009 |

| 註冊國家/地區 | 中國 |

| 監管 | CFFE(受監管) |

| 市場工具 | 期貨、期權 |

| 模擬帳戶 | ❌ |

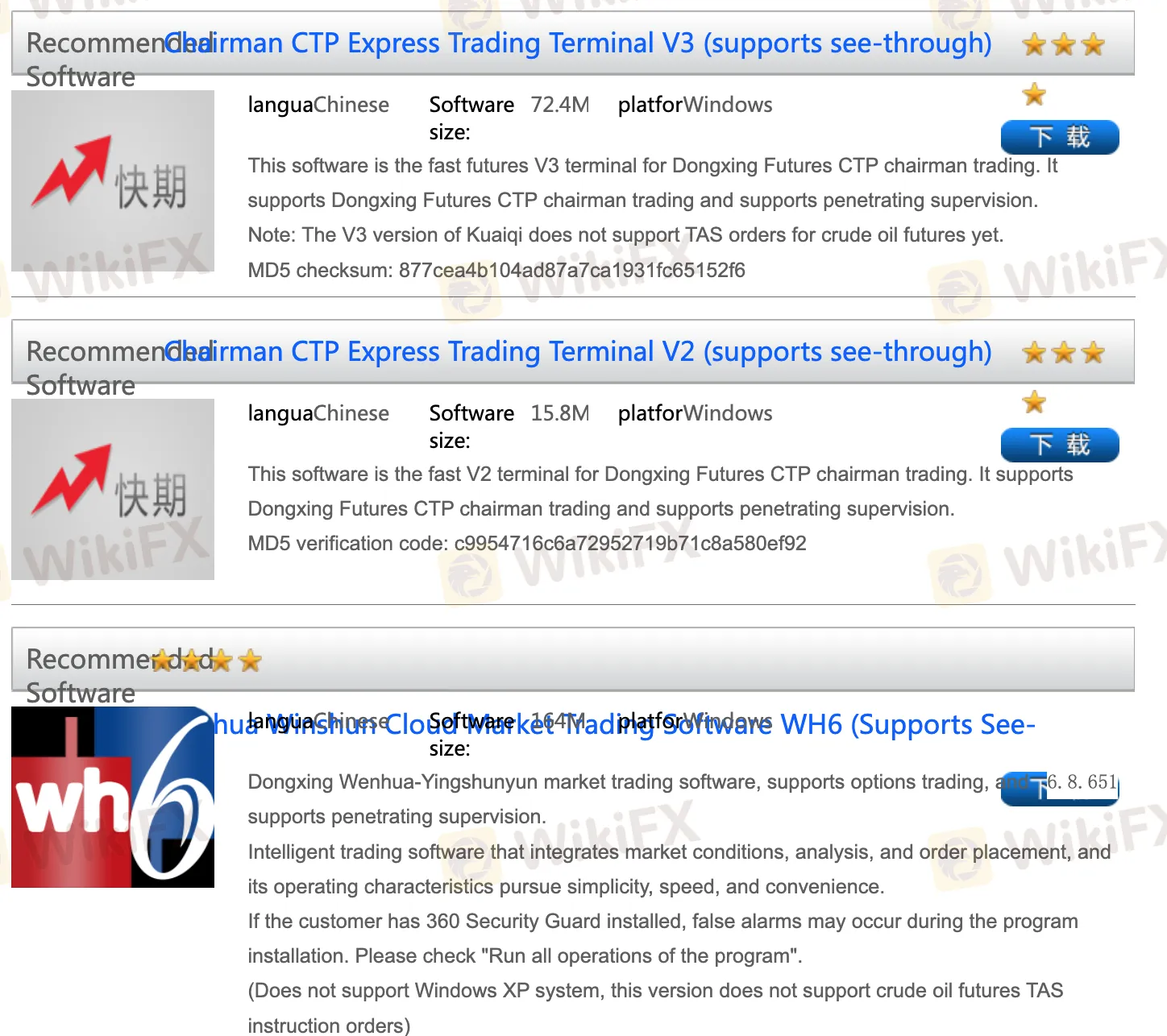

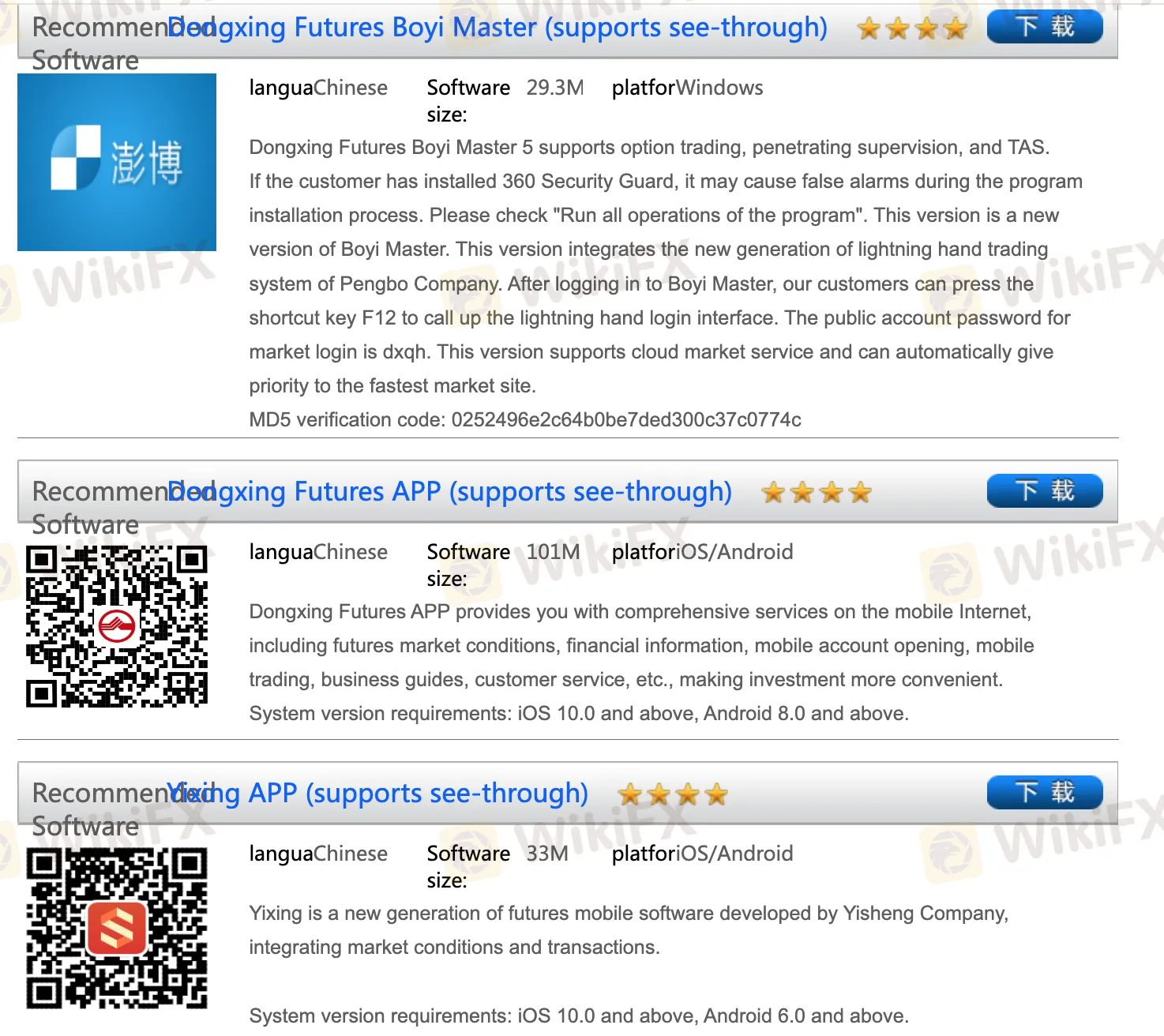

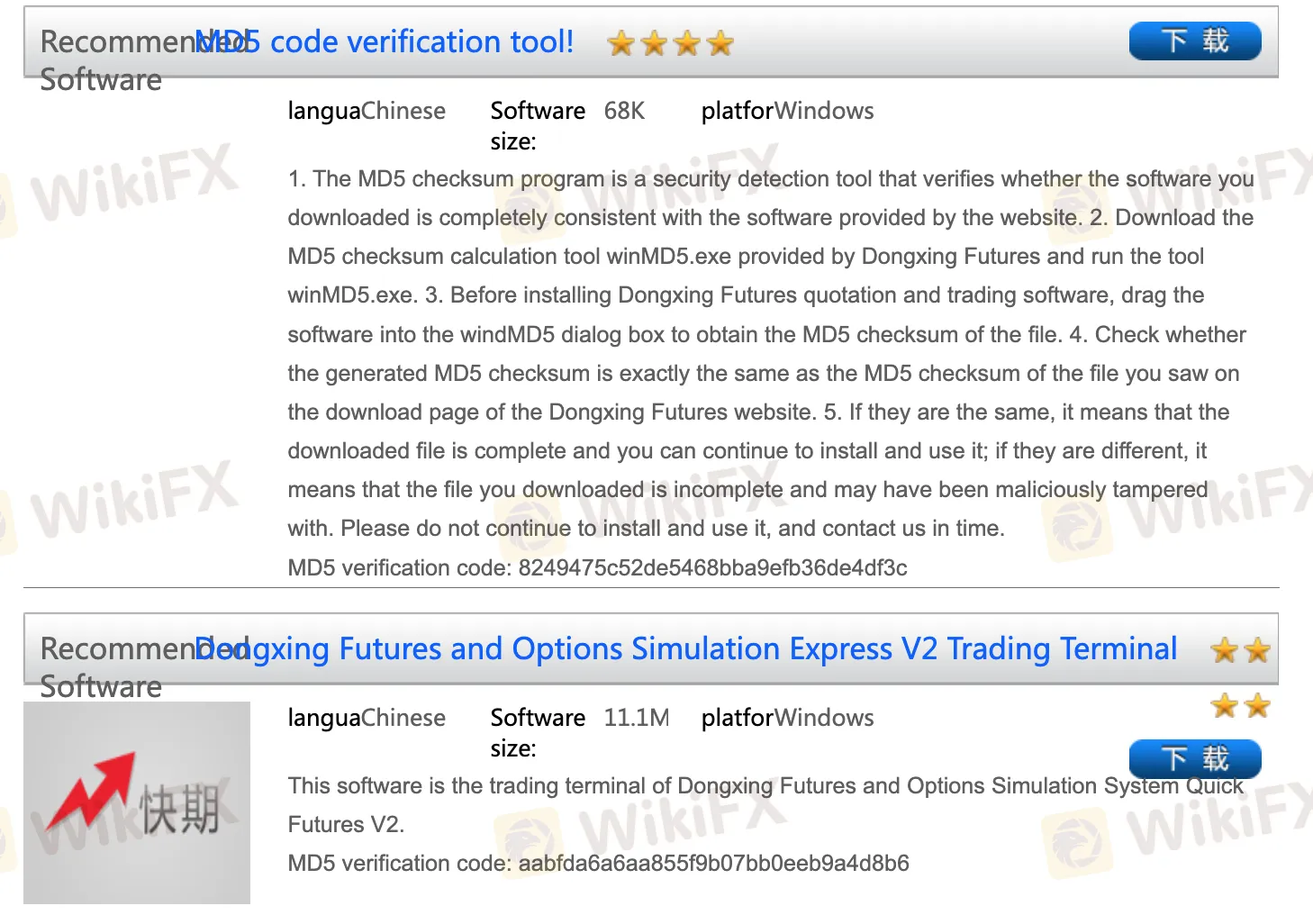

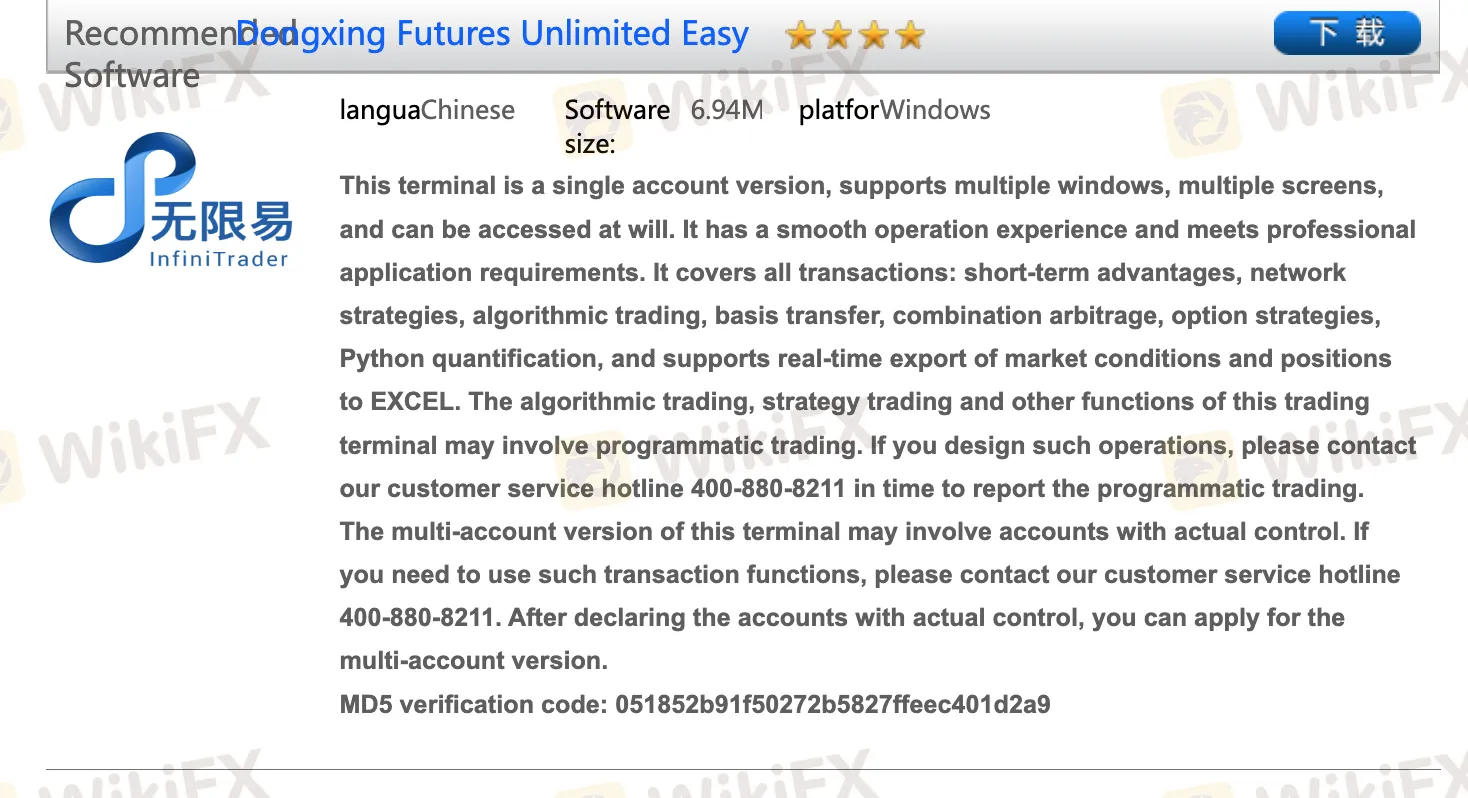

| 交易平台 | Chairman CTP Express Trading Terminal V3/V2、Dongxing Futures Boyi Master、Dongxing Futures APP、Yixing APP、MD5 code verification tool、Dongxing Futures and Options Simulation Express V2 Trading Terminal、Dongxing Futures Unlimited Easy 等 |

| 客戶支援 | 電話:400-880-8211 |

| 電郵:kfzx@dxqh.net | |

東興期貨 資訊

東興期貨 是一家受監管的經紀商,提供在各種交易平台上進行期貨和期權交易。該經紀商不提供模擬帳戶,並提供有限的有關交易條件的信息。

優缺點

| 優點 | 缺點 |

| 多種交易平台 | 不提供模擬帳戶 |

| 長時間運作 | 有關交易條件的信息有限 |

| 交易產品種類有限 | |

| 付款選項有限 |

東興期貨 是否合法?

是的。東興期貨 獲得 CFFEX 頒發牌照以提供服務。

| 受監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 中國金融期貨交易所(CFFE) | 受監管 | 东兴期货有限责任公司 | 期貨牌照 | 0186 |

我可以在 東興期貨 上交易什麼?

東興期貨 提供期貨和期權交易。

| 可交易工具 | 支援 |

| 期貨 | ✔ |

| 期權 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 交易所交易基金 (ETFs) | ❌ |

交易平台

東興期貨 提供多種交易平台,包括主席CTP Express交易終端V3/V2、東興期貨博易大師、東興期貨APP、易行APP、MD5代碼驗證工具、東興期權模擬快速交易終端V2和東興期貨無限輕鬆。

可用設備:桌面和移動設備。

存款和提款

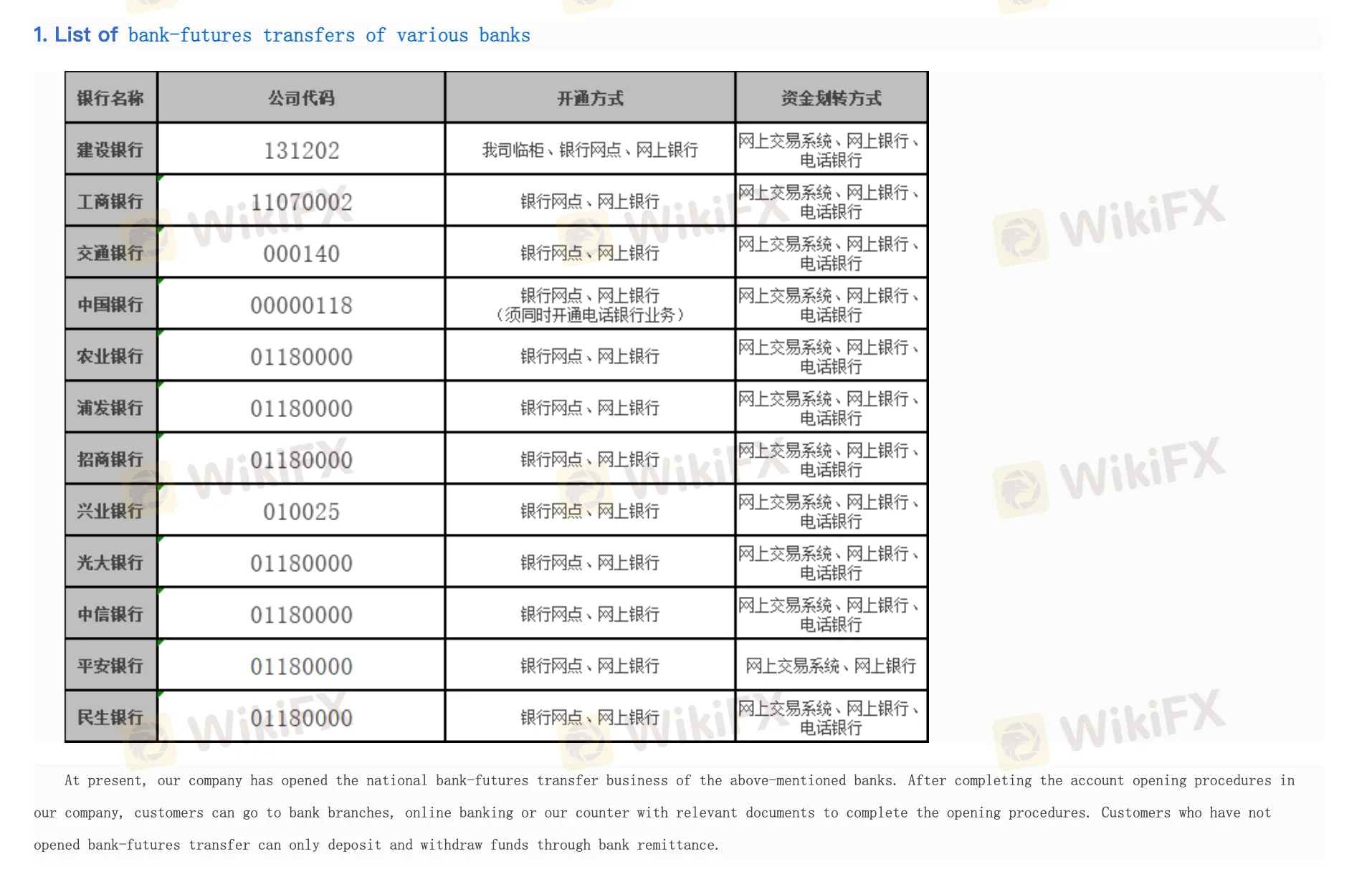

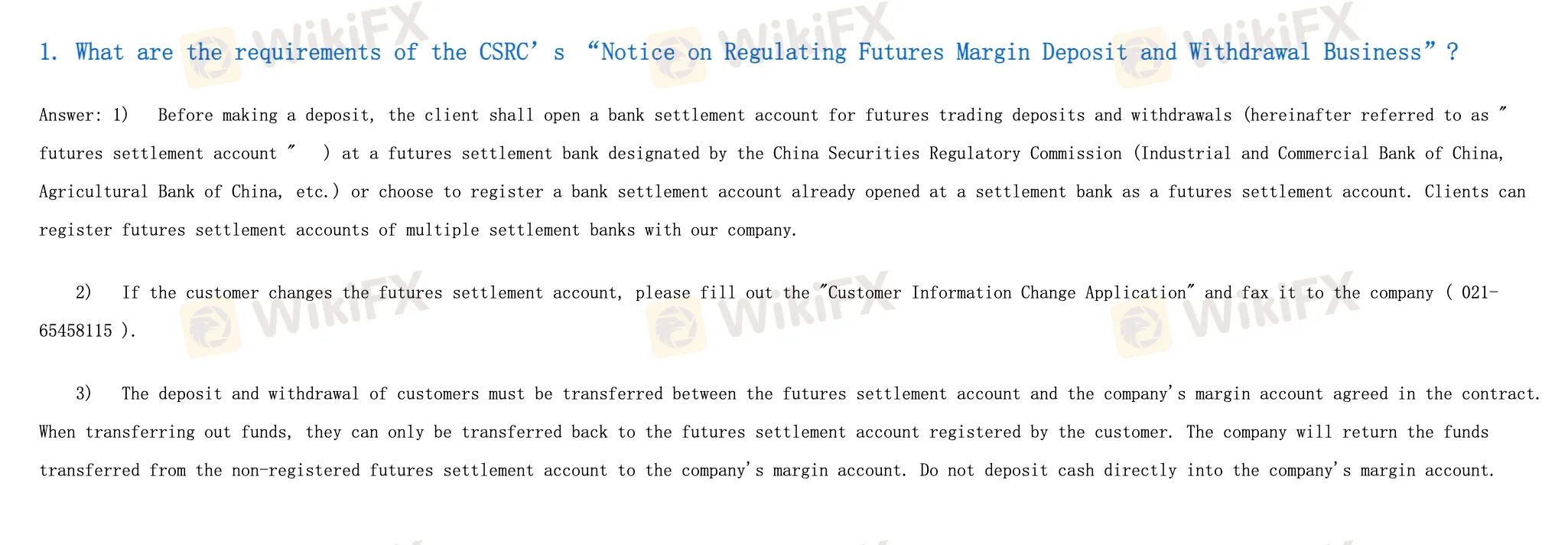

東興期貨 接受銀行電匯付款。

有關提款,交易系統將在當天結算前凍結手續費和其他費用,只有可用資金的90%可以轉出。餘下的資金可以在第二天全部轉出。