Profil perusahaan

| KKR Ringkasan Ulasan | |

| Didirikan | 1976 |

| Negara/Daerah Terdaftar | Britania Raya |

| Regulasi | Ditarik |

| Produk dan Layanan | Ekuitas Swasta, Infrastruktur, Properti, Kredit, Pasar Modal, Asuransi, dan Kemitraan Strategis |

| Dukungan Pelanggan | Client.Services@kkr.com |

| +1 (212) 230-9700 | |

Informasi KKR

KKR, didirikan pada tahun 1976 di Inggris, menawarkan beragam produk dan layanan meliputi ekuitas swasta, infrastruktur, properti, kredit, pasar modal, asuransi, dan kemitraan strategis. Meskipun platform sebelumnya memiliki Lisensi Penasihat Investasi FCA, yang kini dicabut, mereka mengelola aset yang signifikan ($284M AUM per Maret 2025) dan melayani berbagai klien, termasuk investor institusi dan individu.

Pro dan Kontra

| Pro | Kontra |

|

|

|

|

Apakah KKR Legal?

KKR dulunya memiliki Lisensi Penasihat Investasi yang diatur oleh Otoritas Jasa Keuangan (FCA) di Britania Raya dengan nomor lisensi 471885. Namun sekarang sudah dicabut.

| Status Regulasi | Dicabut |

| Diatur oleh | Britania Raya |

| Badan Berlisensi | Otoritas Jasa Keuangan (FCA) |

| Tipe Lisensi | Lisensi Penasihat Investasi |

| Nomor Lisensi | 471885 |

Produk dan Layanan

KKR menyediakan solusi manajemen aset, pasar modal, dan asuransi secara global. Area utama mereka meliputi Ekuitas Swasta, Infrastruktur, Properti, Kredit, Pasar Modal, Asuransi, dan Kemitraan Strategis.

Statistik Perusahaan

Kelas aset utama KKR per 31 Maret 2025 mencakup $209M dalam Ekuitas Swasta, $254M dalam Kredit, $83M dalam Infrastruktur, dan $81M dalam Properti. Total Aset di Bawah Pengelolaan (AUM), termasuk strategi likuid, mencapai $284M.

Klien KKR

KKR melayani berbagai klien, termasuk investor institusi dengan solusi yang disesuaikan dan individu yang memenuhi syarat melalui penawaran kekayaan globalnya. Platform ini juga melayani keluarga, pengusaha, dan perusahaan yang mereka investasikan, bertujuan untuk pertumbuhan dan peningkatan operasional.

FX3862630966

Vietnam

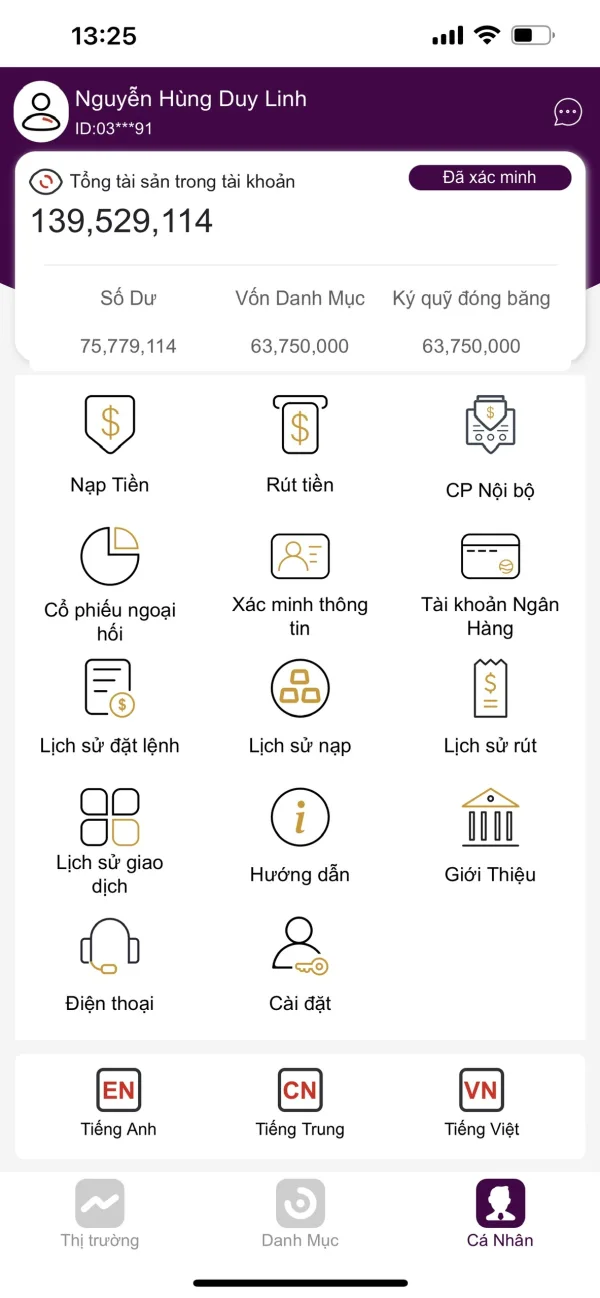

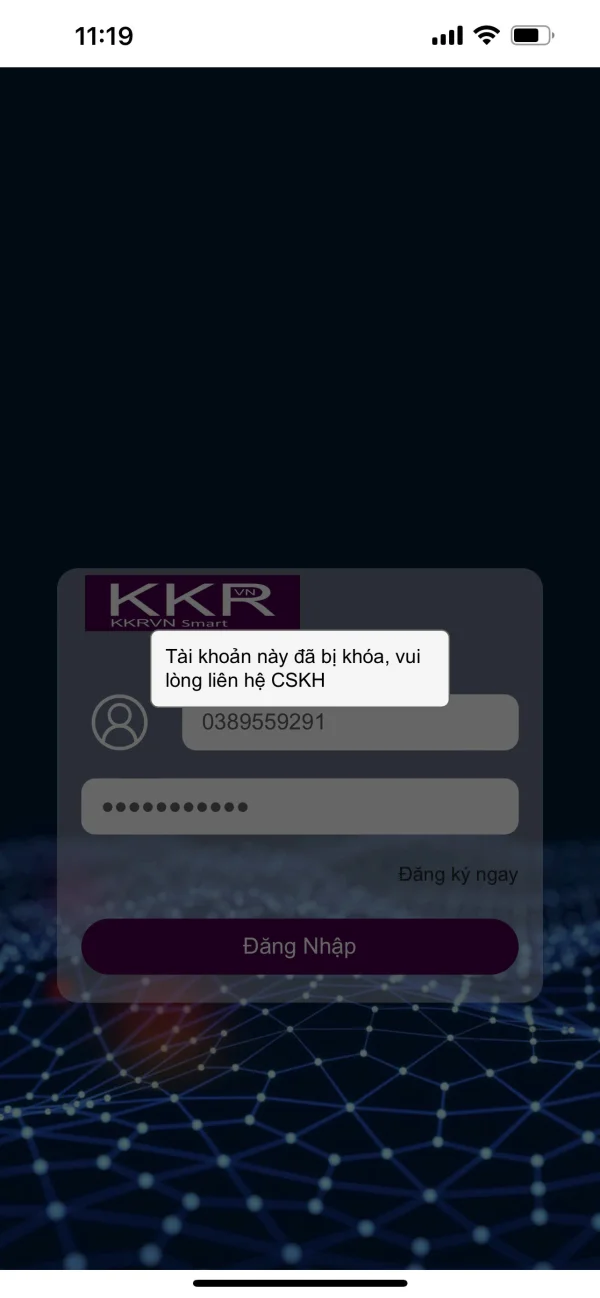

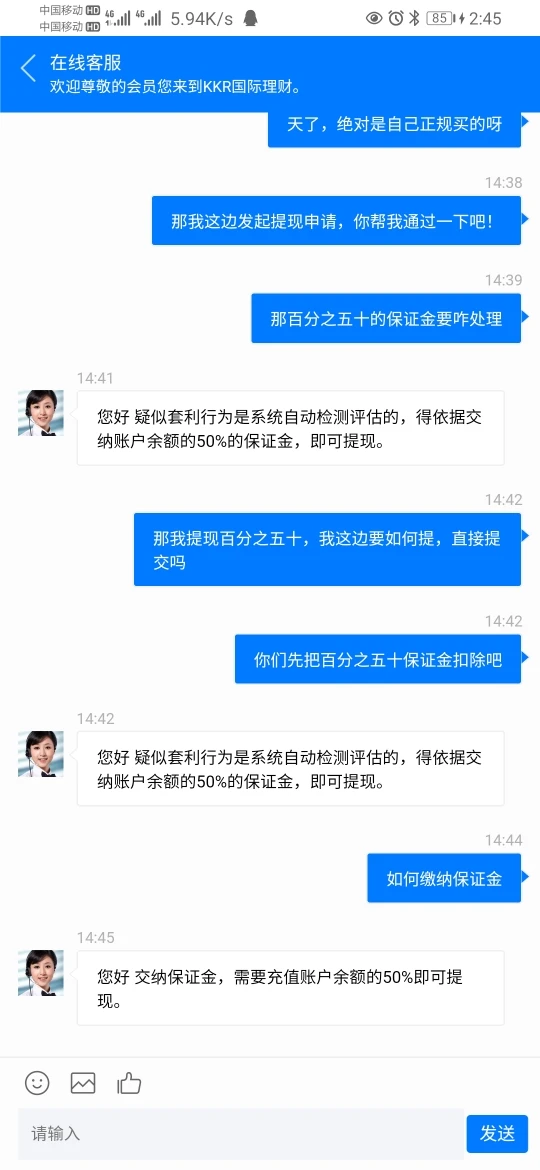

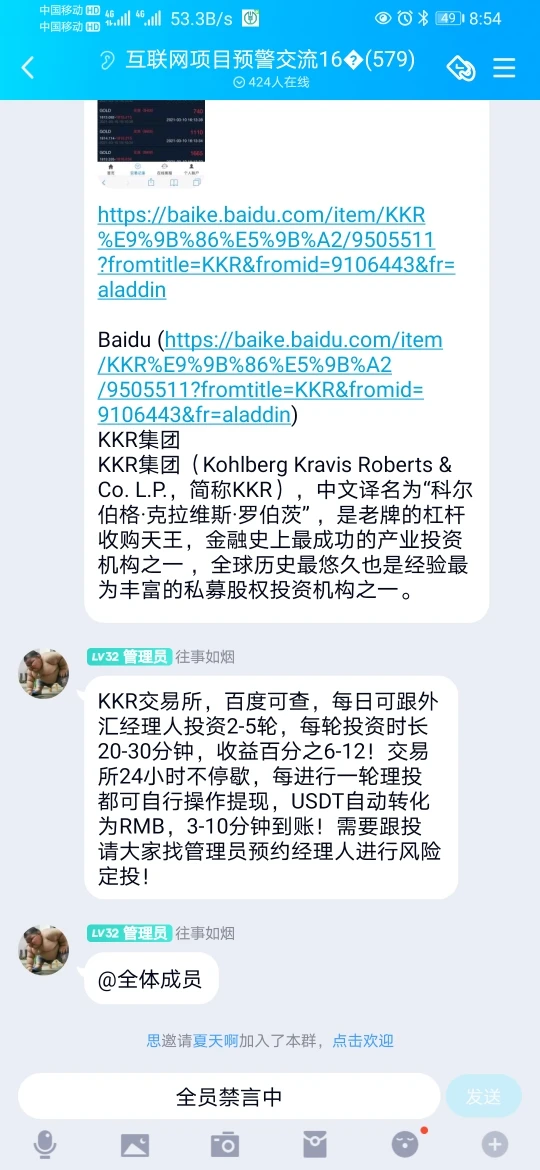

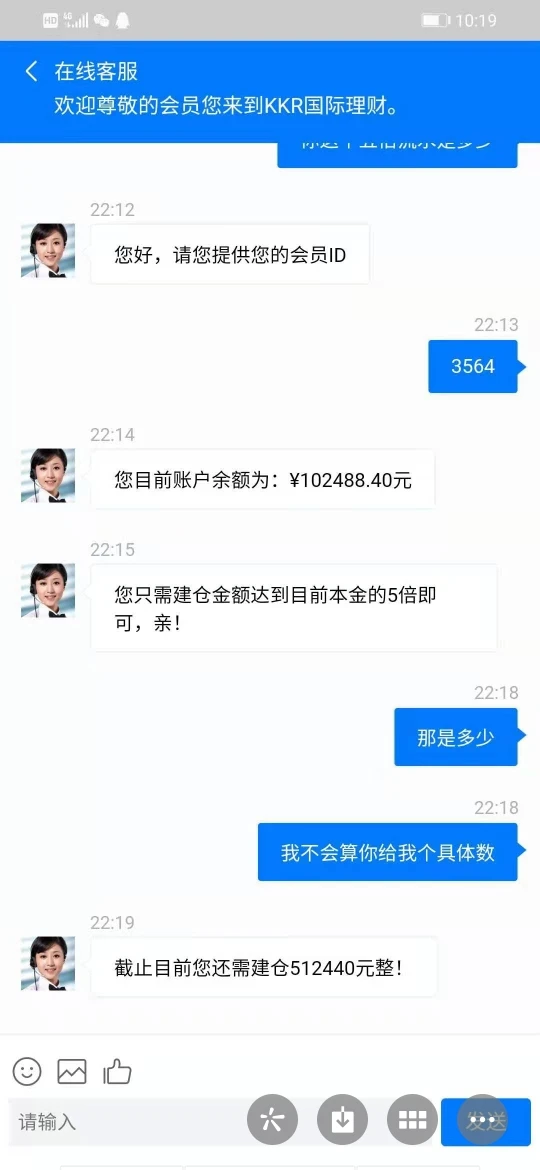

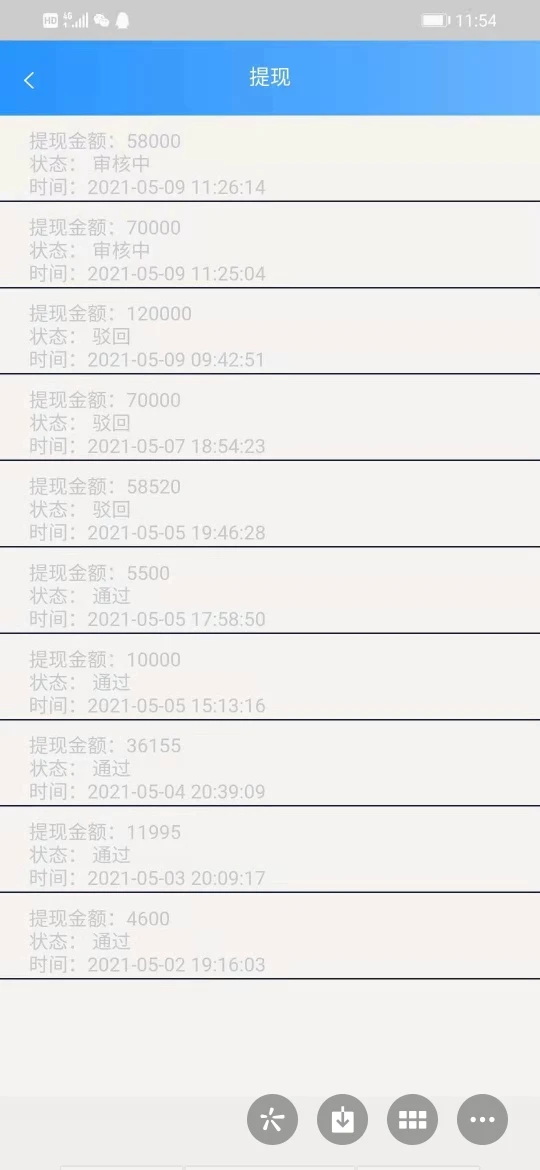

Semua orang di Vietnam, harap perhatikan bahwa Anda tidak boleh berinvestasi di KKR VN, mereka secara resmi 100% penipuan untuk mengambil uang dari investor. Mereka memiliki seluruh organisasi baik di dalam negeri maupun internasional untuk menipu dan memanipulasi investor kecil, menarik mereka, menciptakan kepercayaan, dan memanipulasi emosi mereka. Investor akan kehilangan semua uang mereka dan tidak akan dapat mengembalikannya. Biasanya, mereka menggunakan aplikasi mereka untuk investasi pasar saham. Awalnya, Anda dapat melakukan deposit, menghasilkan keuntungan, dan menarik. Tetapi kemudian mereka akan menggoda Anda untuk membeli saham diskon dan ketika Anda melakukan deposit untuk membeli jumlah sesuai dengan modal Anda, Anda tidak akan bisa melakukannya. Sistem mereka akan mendistribusikan sejumlah besar saham virtual untuk membuat saldo akun Anda menjadi negatif, dan pada saat ini, Anda akan tahu bahwa Anda telah ditipu. Mereka akan memberi tahu Anda untuk melakukan deposit uang untuk menghapus saldo negatif agar dapat melakukan pembelian, dan memaksa Anda untuk memutar modal Anda untuk membeli jumlah yang besar. Kemudian, ketika Anda menjual dan ingin menarik, Anda tidak akan dapat menarik seluruh jumlahnya, mereka hanya akan memperbolehkan Anda menarik 5% dari uang tersebut. Dan mereka akan terus mendorong Anda lebih dalam ke dalam perangkap untuk menguras uang Anda.

Paparan

123442698

Hong Kong

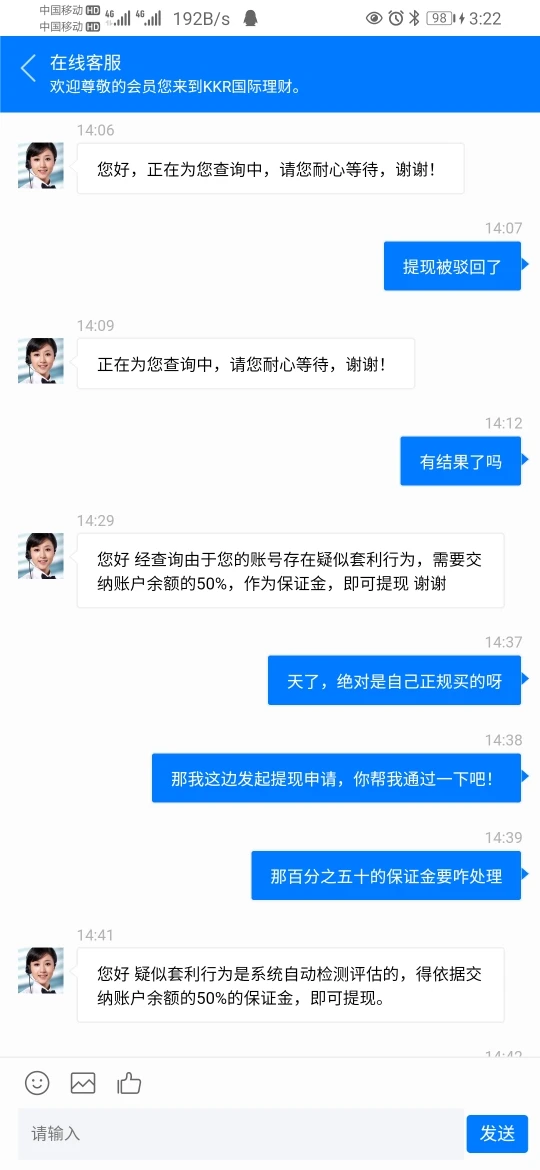

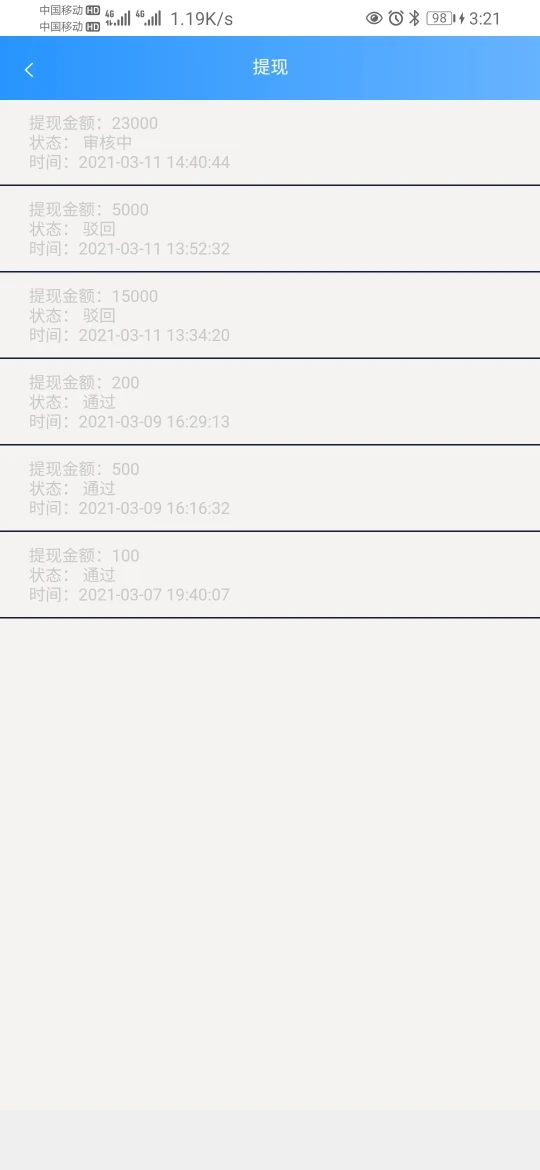

Tidak dapat menarik dana setelah mendapat untung dan margin diperlukan. Pria yang menginstruksikan Anda menghapus Anda dari obrolan grup tiba-tiba. Menjauh.

Paparan

FX4033457346

Hong Kong

Batasi penarikan. Pelanggan tipuan.

Paparan

雨中飞燕

Hong Kong

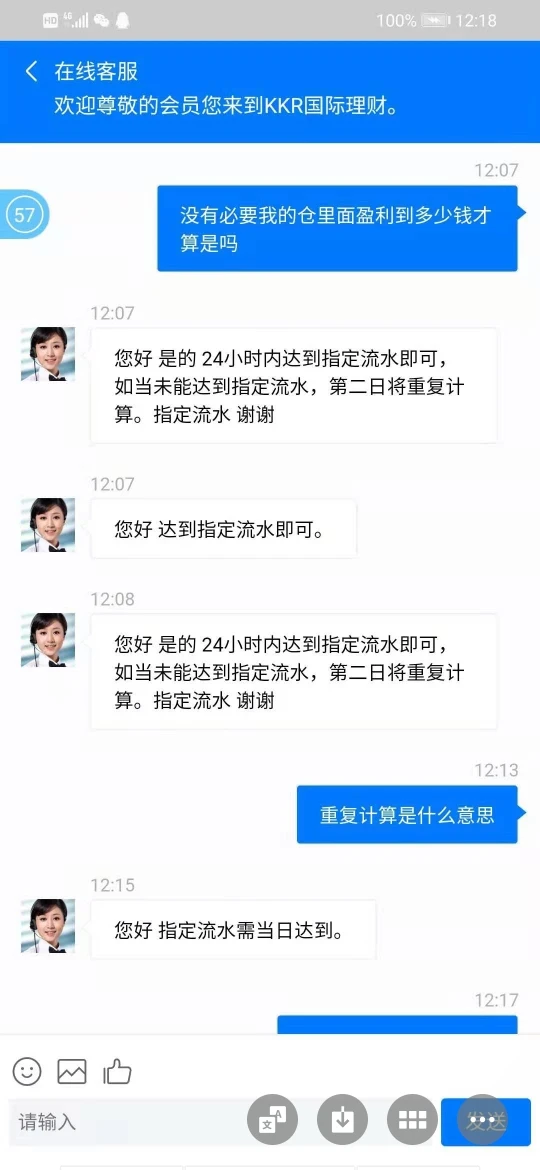

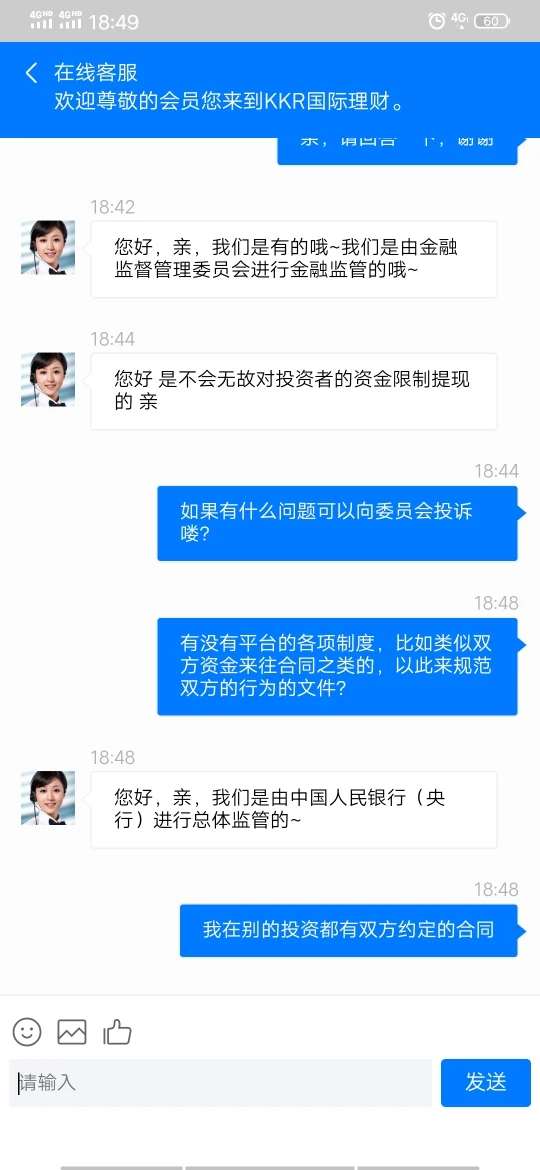

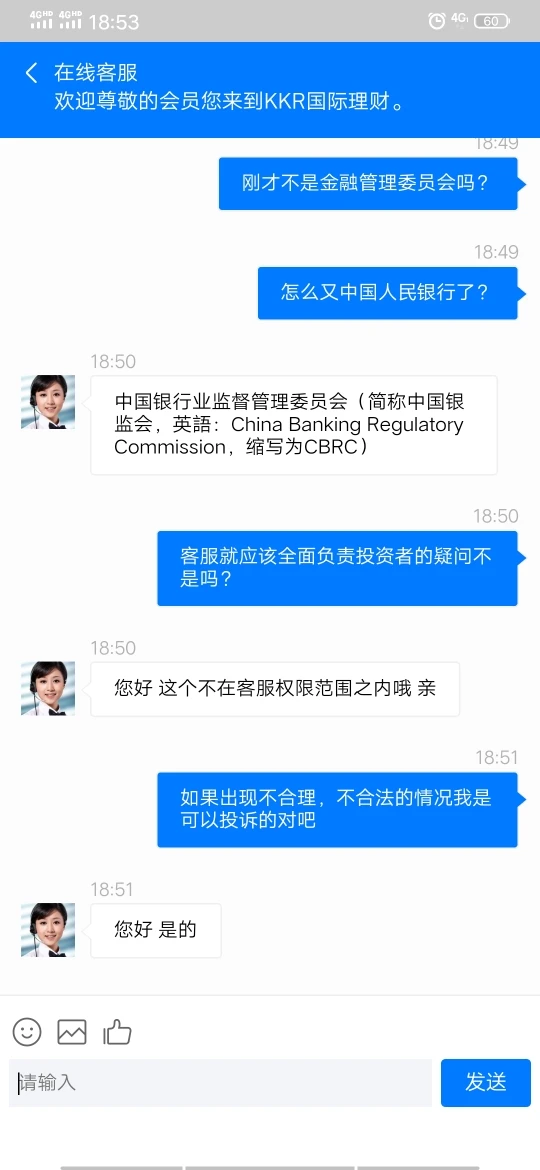

Platform penipuan. Layanan pelanggan mengatakan kebohongan demi kebohongan. Terkadang dikatakan bahwa mereka diatur oleh FSC. Terkadang mereka mengatakan bahwa mereka diatur oleh CBRC. Tapi hadiahnya ditampilkan di Wiki Global

Paparan