公司简介

| 安聯投資 评论摘要 | |

| 成立时间 | 1998 |

| 注册国家/地区 | 香港 |

| 监管机构 | SFC |

| 金融服务 | 机构投资者、保险资产管理、零售基金、退休服务。 |

| 客户支持 | (852) 2238 8888, (852) 2238 8000 |

| hkenquiry@allianzgi.com | |

安聯投資 信息

安聯投資,成立于1998年,作为香港专业资产管理业务,并受SFC监管,提供多种金融服务,包括为机构投资者提供解决方案、为保险资产管理提供量身定制的策略、多样化的零售基金以及利用其全球专业知识的退休服务。

优点和缺点

| 优点 | 缺点 |

|

|

|

|

安聯投資 是否合法?

安聯投資在香港由证券及期货事务监察委员会(SFC)颁发“交易期货合同”许可证,许可证号为BFE699。

产品与服务

- 机构投资者:安聯投資为机构投资者提供包括国家/地区股票、全球股票、新兴市场股票、主题和行业策略以及总回报和多资产解决方案在内的集中和分离策略。他们的机构客户群包括主权基金、养老金计划、慈善机构等。

- 保险资产管理:安聯投資为全球保险公司提供量身定制的投资策略和解决方案,包括寿险、财产和意外险以及健康保险公司,以应对监管和低利率挑战。

- 零售基金:安聯投資为零售投资者提供不同投资策略的多样化基金,包括旨在在全球市场长期增值的股票基金、提供稳定收入的债券基金以及用于资本增长和多样化的多资产基金。这些基金可通过其世界一流的投资平台进行访问。

- 退休服务:安聯投資提供退休服务,利用其全球投资和研究专业知识灵活管理财富,通过其退休产品方案帮助个人规划和确保其财务未来。

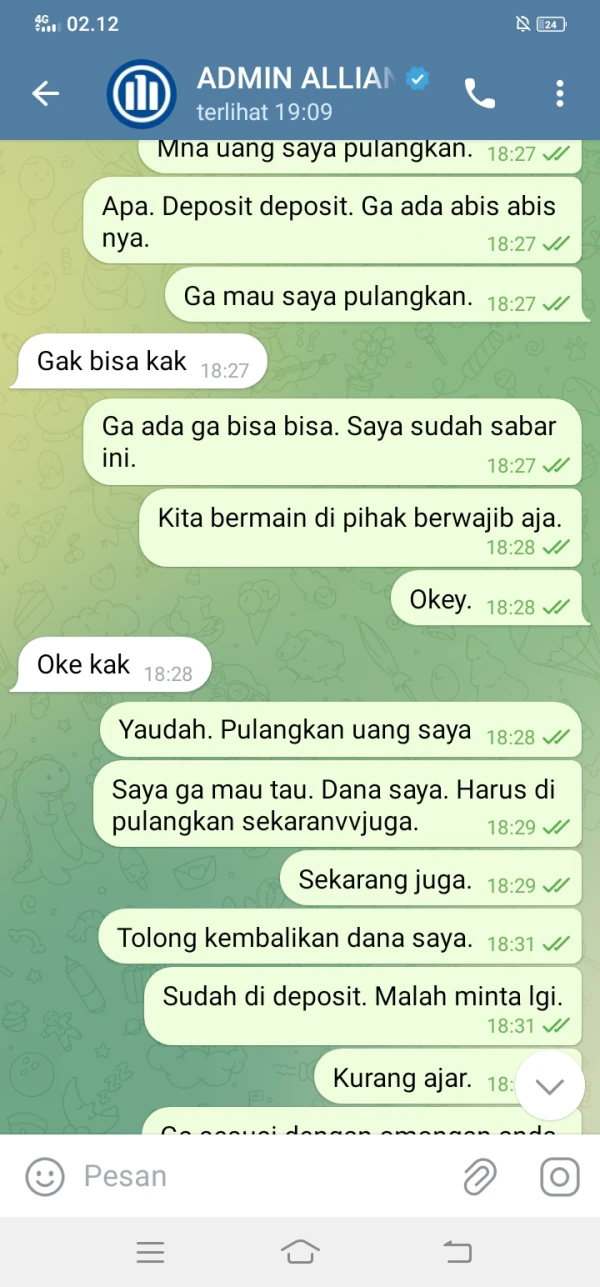

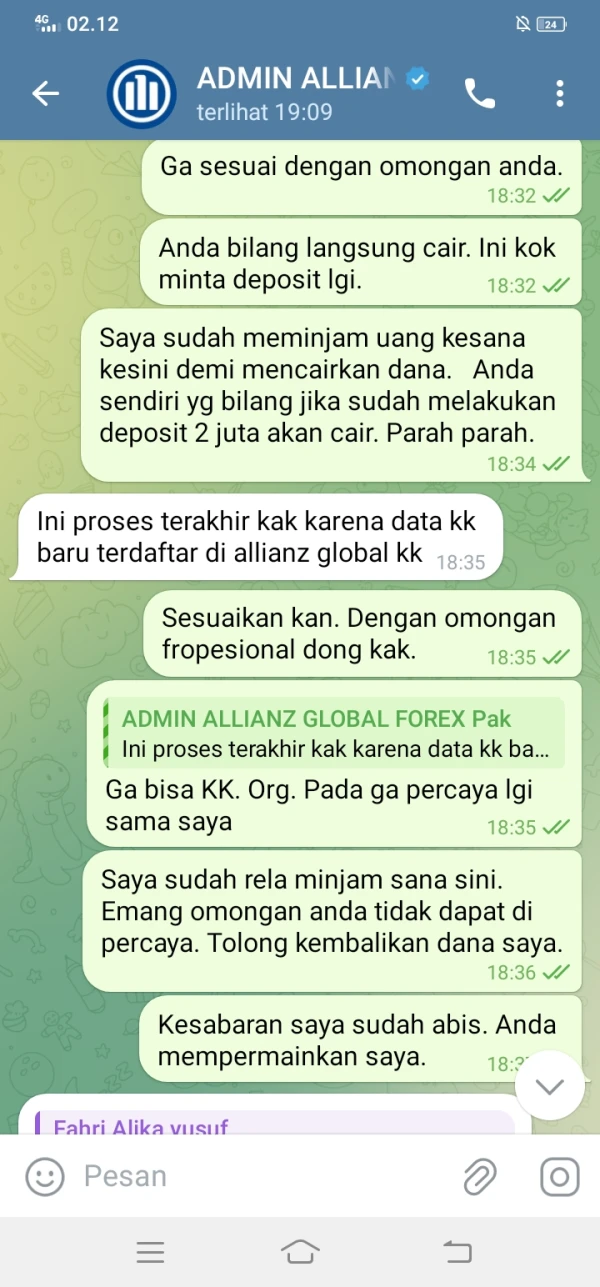

sunshine62137

韩国

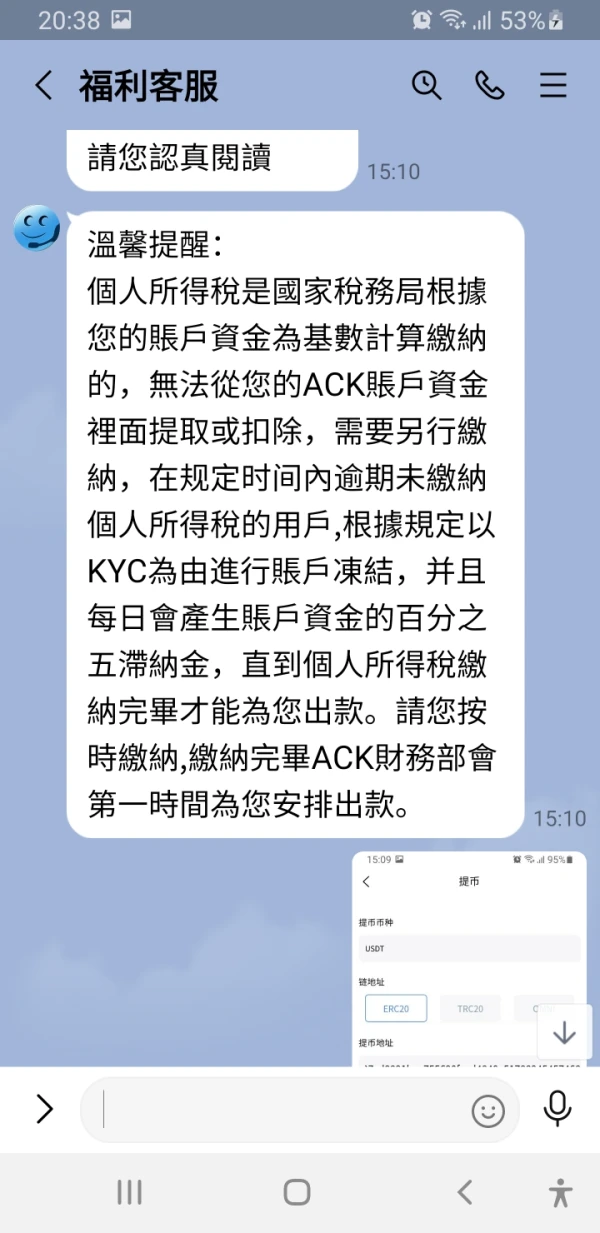

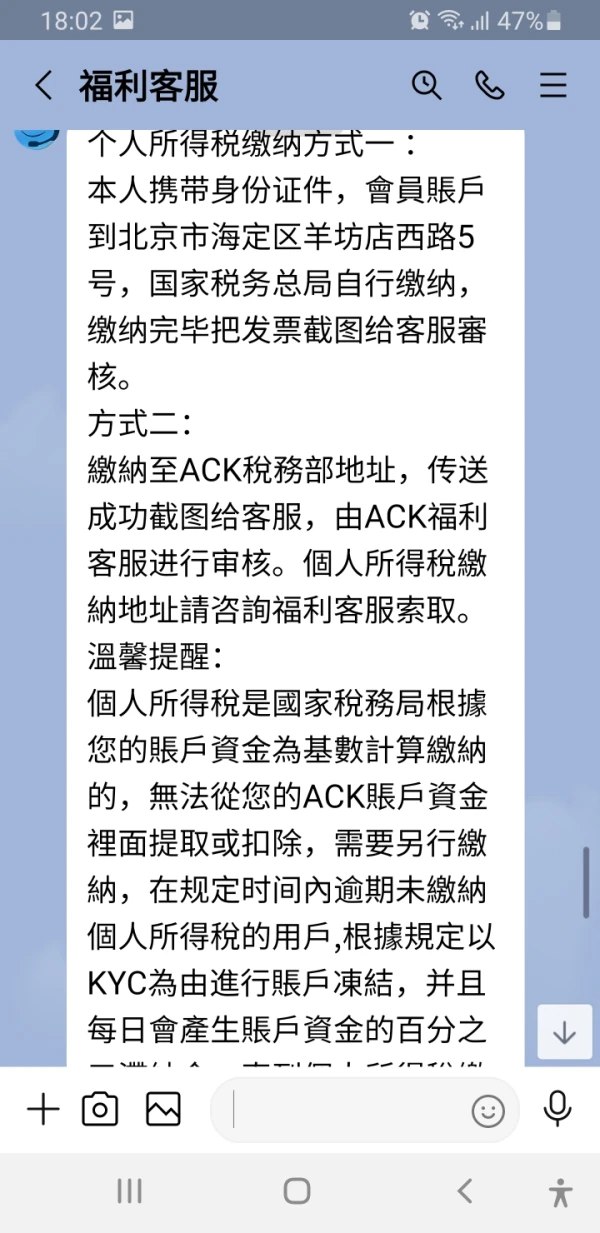

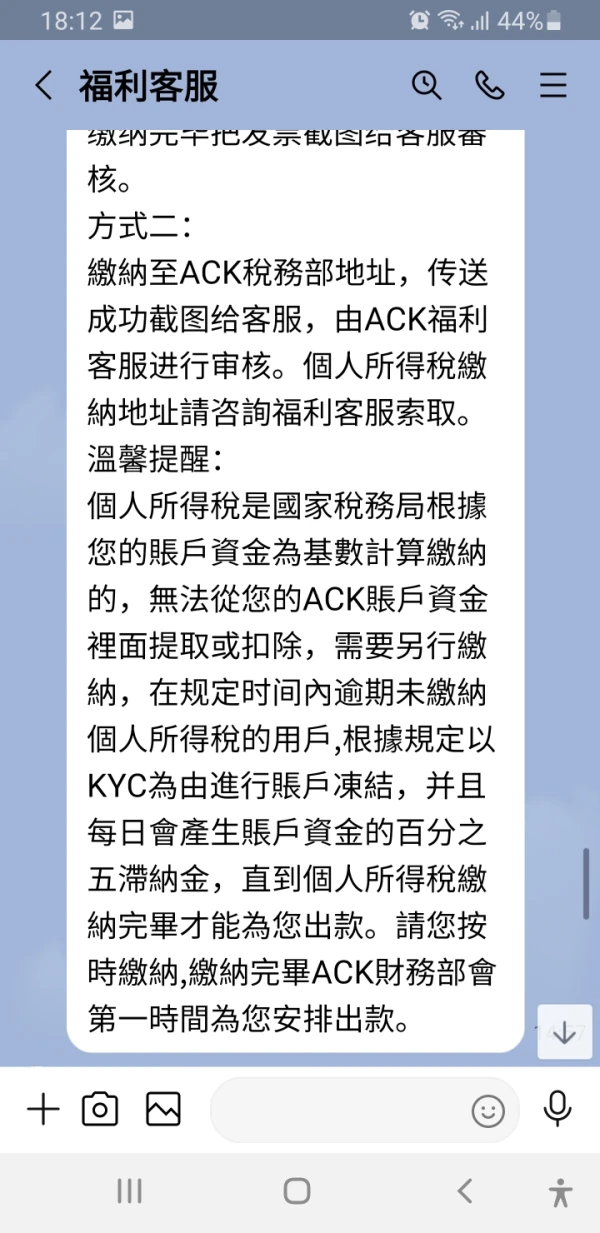

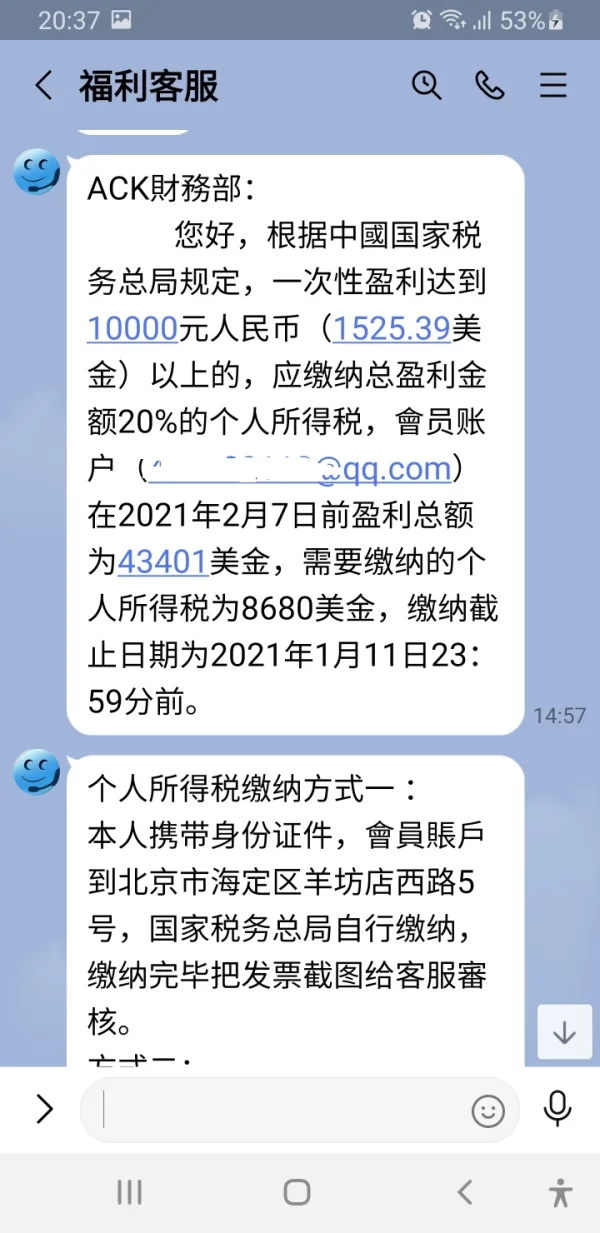

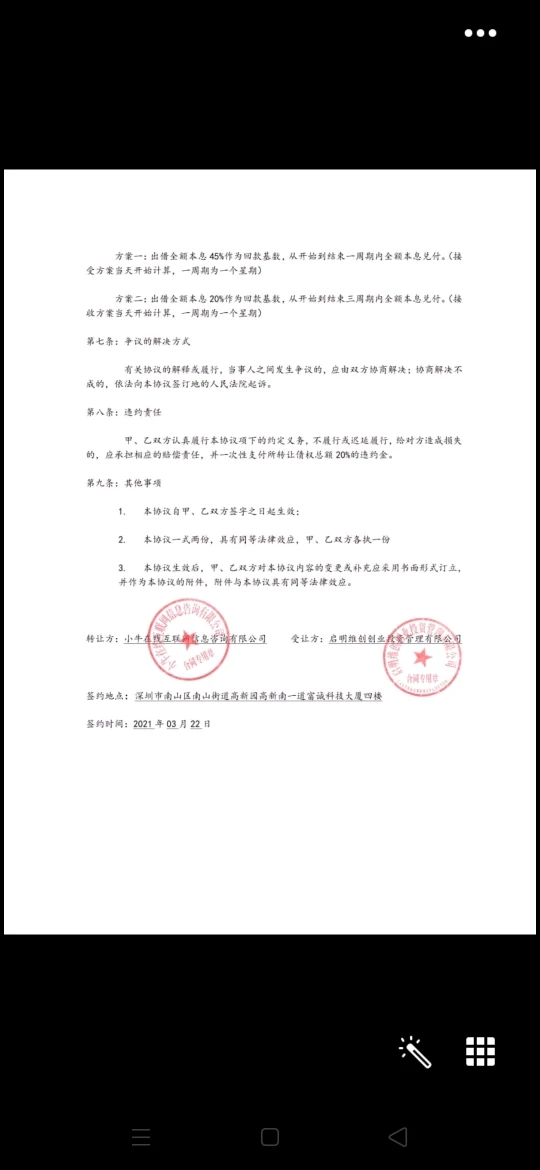

香港ACK外汇管理有限公司,一直让充值。要么就是缴纳税金,反正以各种理由不让提现

曝光

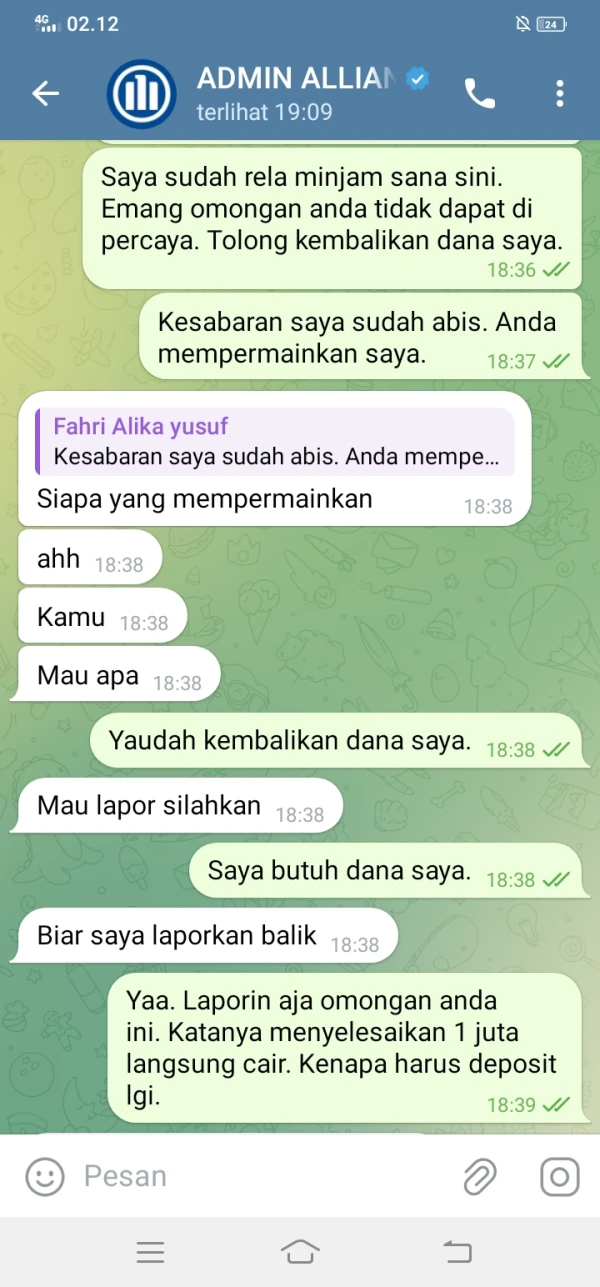

风之语8559

香港

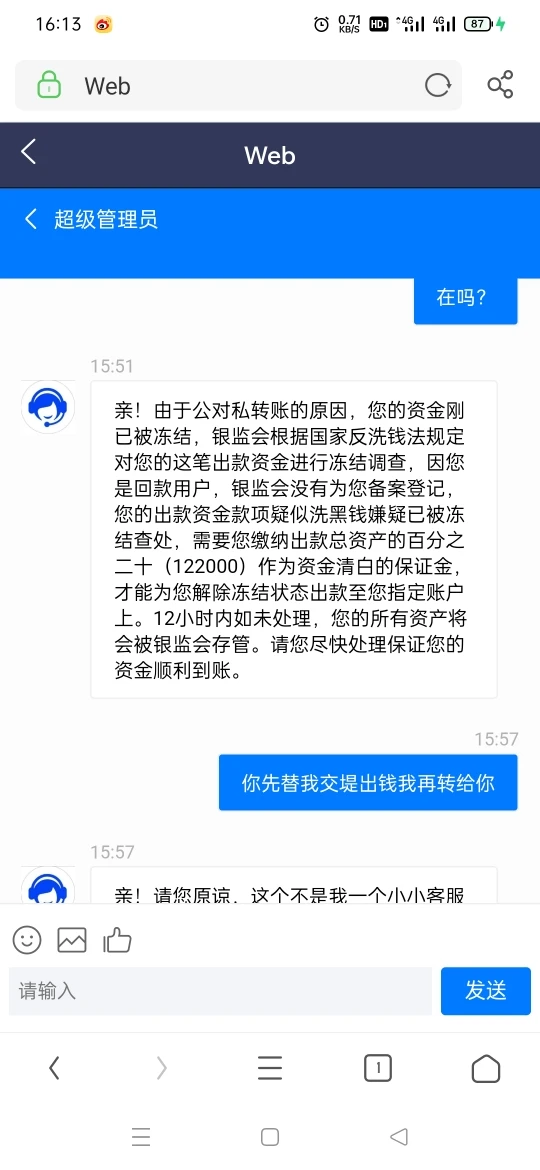

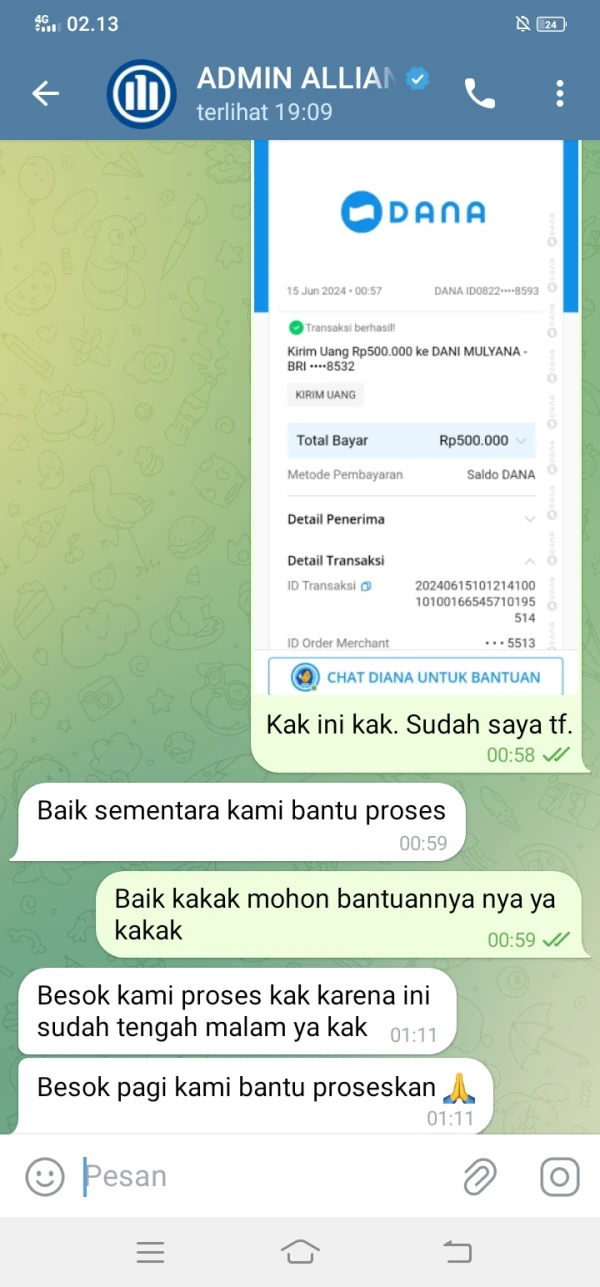

骗子平台冒充客服让你入这个平台然后一步步骗你的保证金

曝光

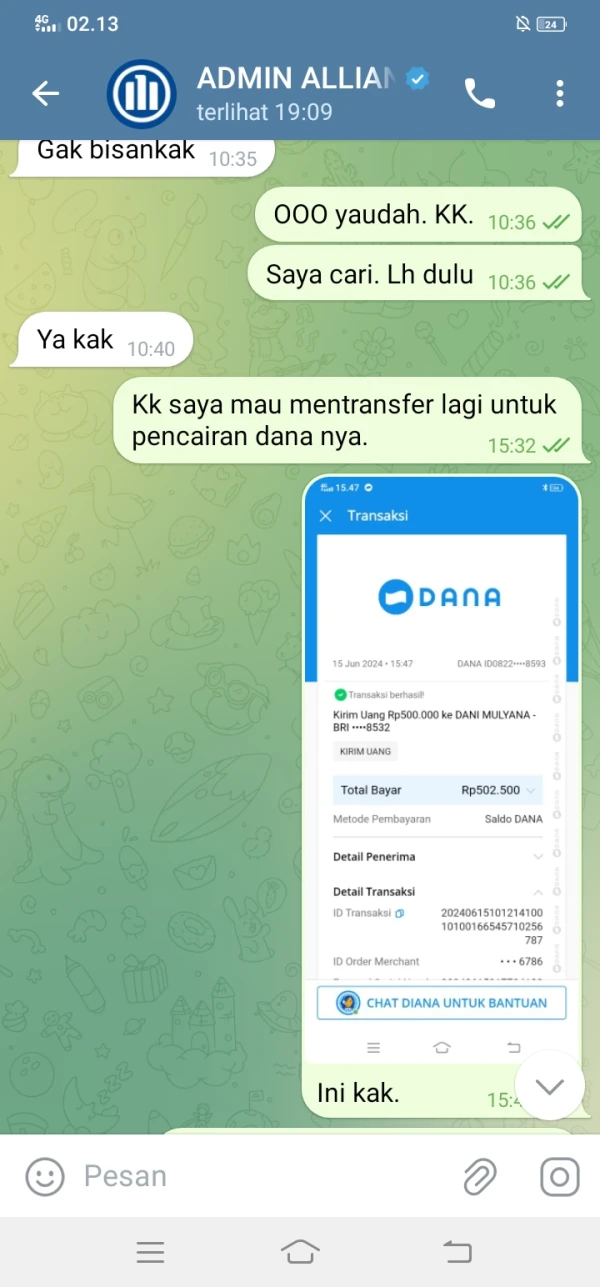

mabra1744

印尼

我的资金是1,000,000。请归还它们。

曝光

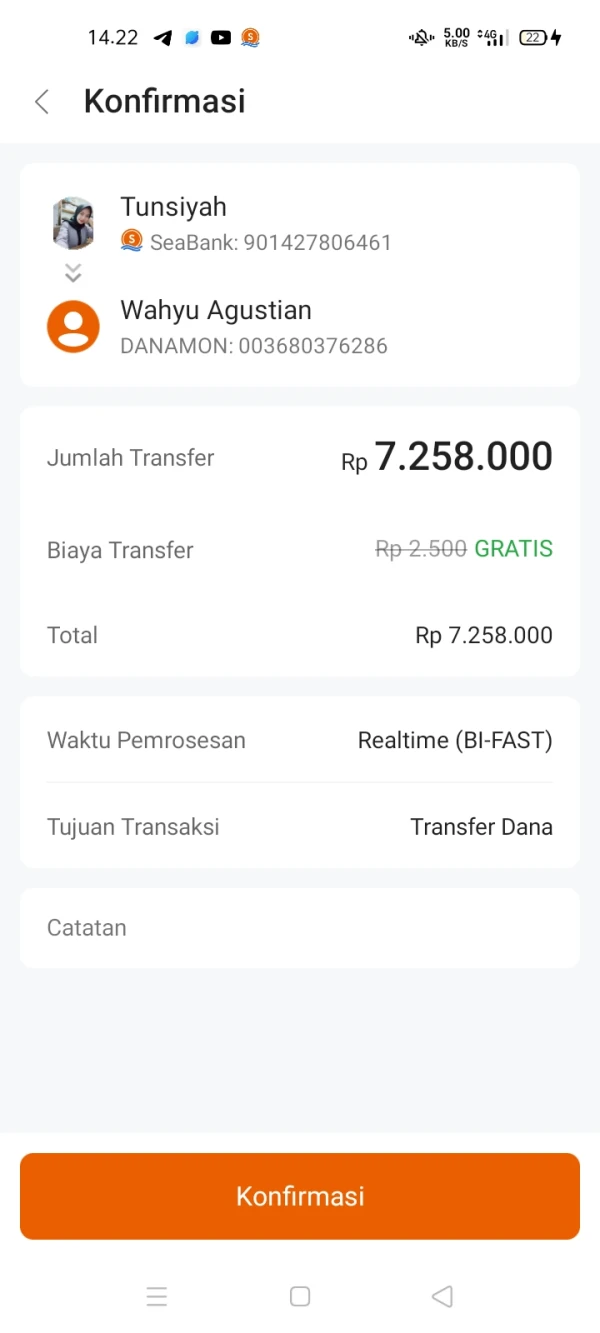

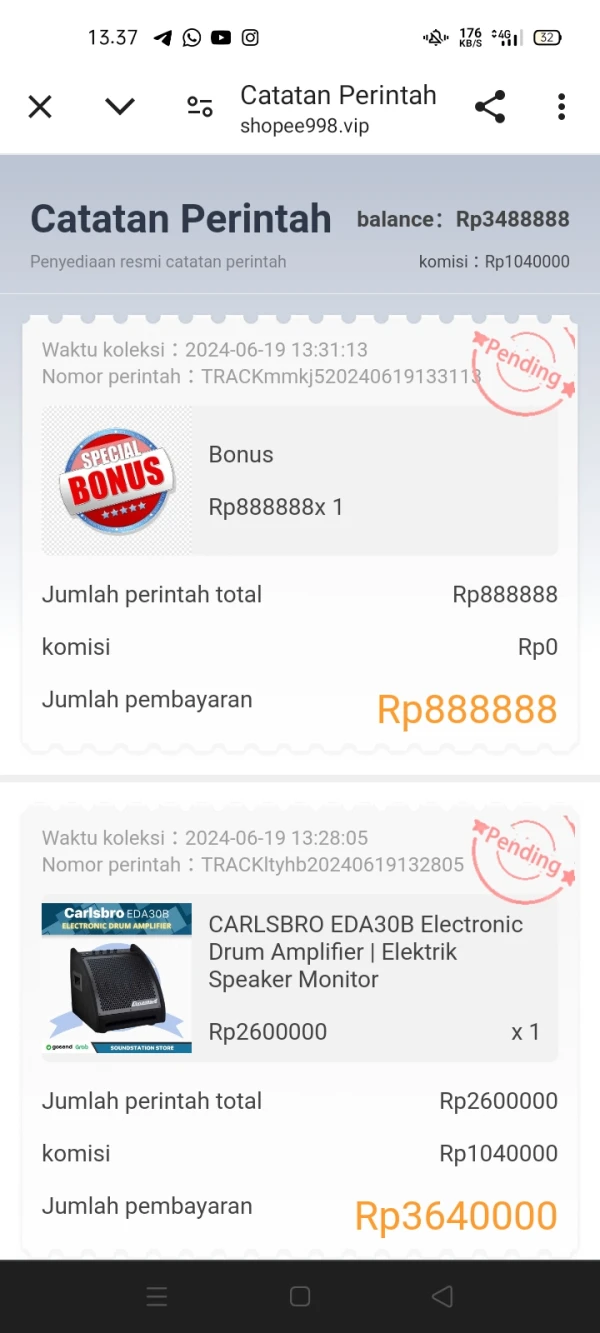

tunsiyah

印尼

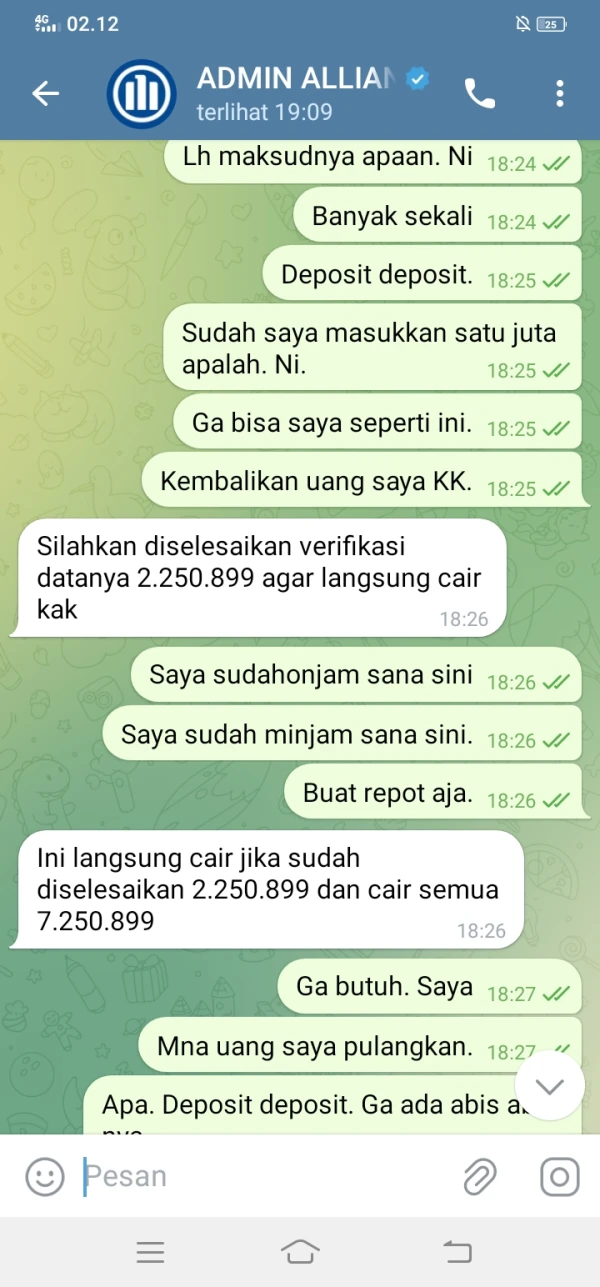

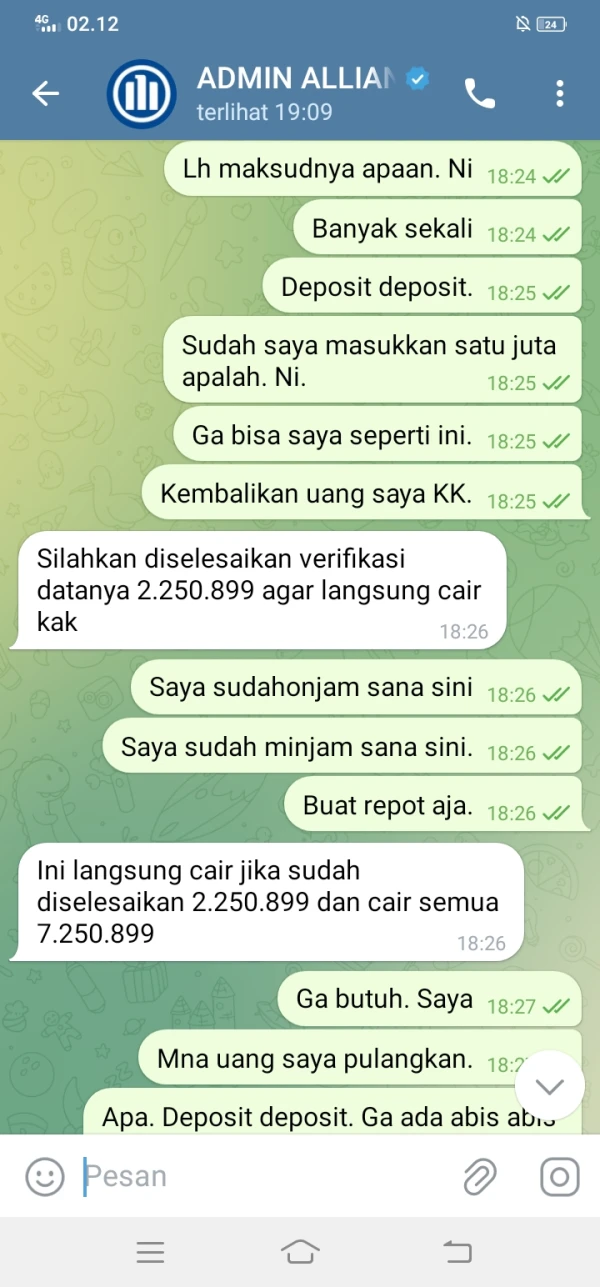

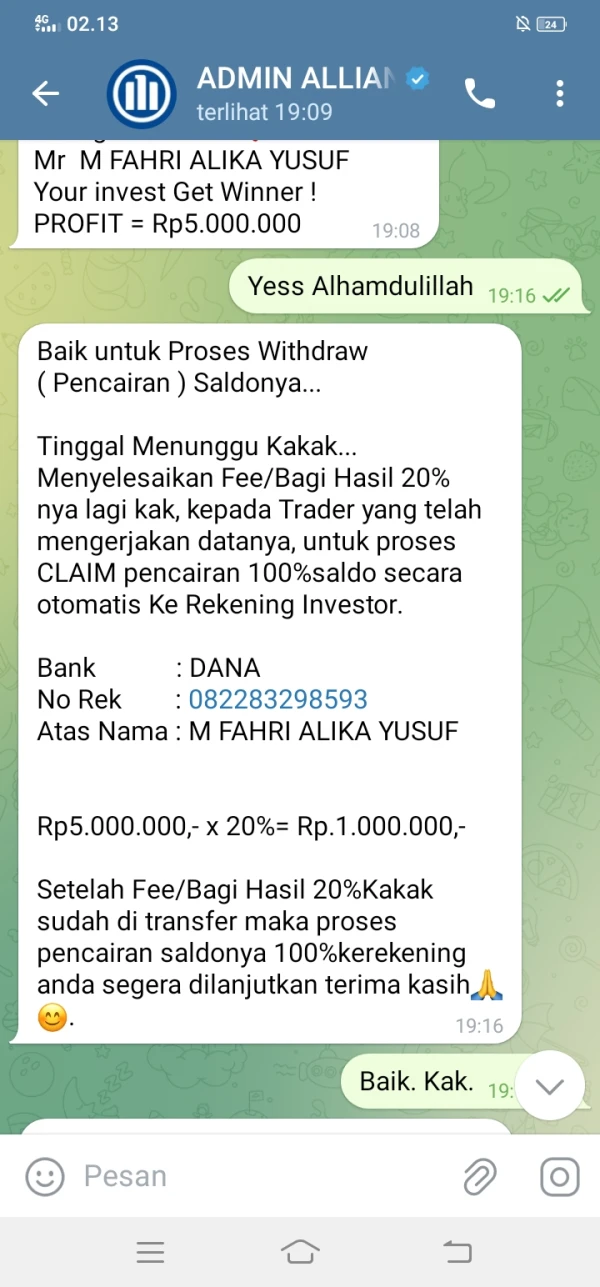

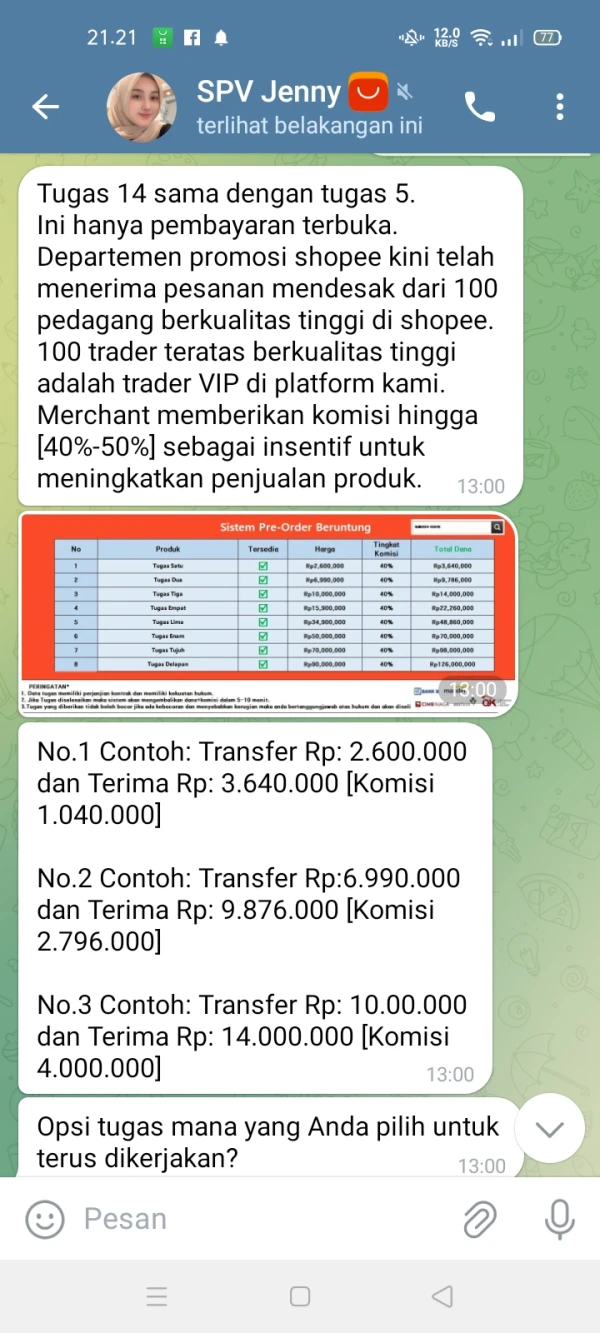

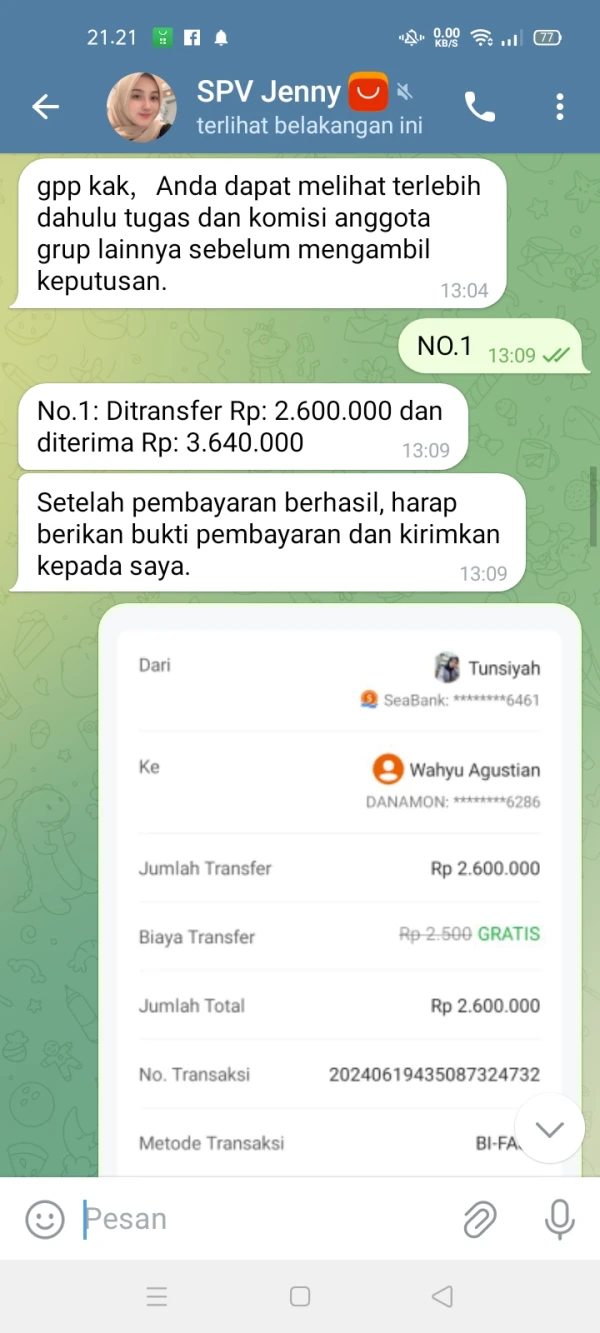

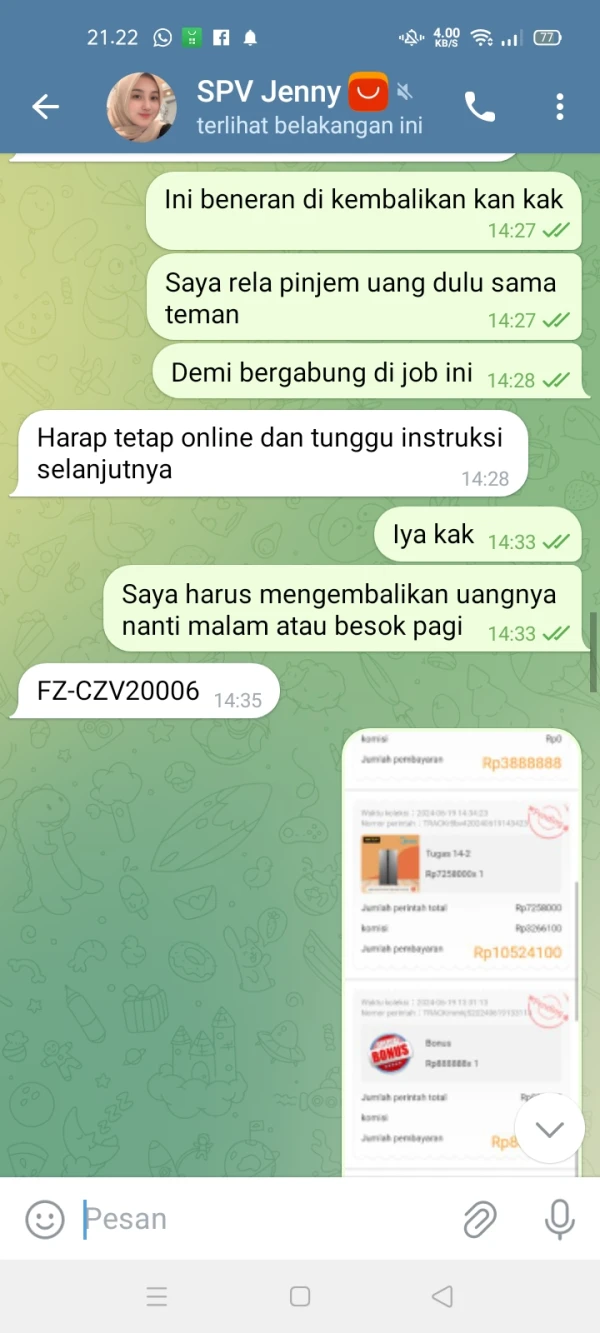

请帮帮我。我损失了9,858,000印尼盾,接近1000万印尼盾。我是兼职工作欺诈的受害者。最初,我被分配了一个低金额的购买任务,我的钱和奖金一起退还了。然后,我又被分配了3个任务,理由是必须完成这三个任务后,钱才会连同佣金一起退还。我为第一个任务转账了2,600,000印尼盾,为第二个任务转账了7,258,000印尼盾。当我得到第三个任务时,我才意识到自己是受骗的受害者。请帮帮我。我用的钱是借来的。请归还它。😭

曝光

林婷

美国

我不愿意与 Allianz 进行交易,因为他们没有任何监管许可。知道我的投资受到知名机构的保护和监督对我来说很重要。没有执照,我不能确定安联是否值得信赖。所以,再见了,安联!

好评