مقدمة عن الشركة

| ABXملخص المراجعة | |

| مسجل في | 1999-02-26 |

| البلد/المنطقة المسجلة | أستراليا |

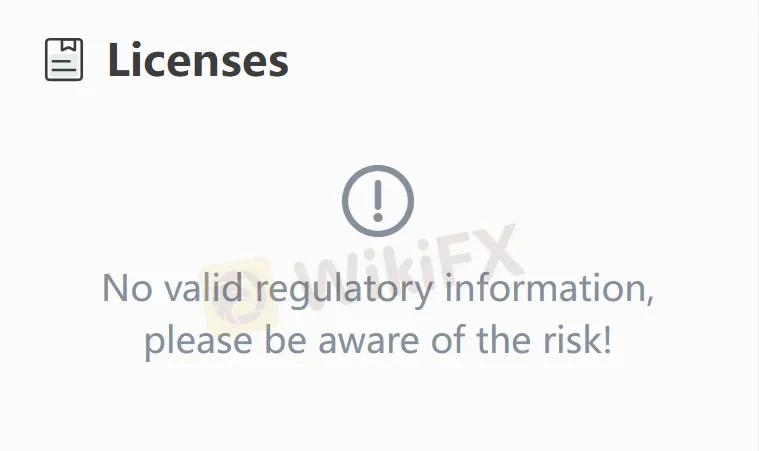

| التنظيم | غير منظم |

| أدوات السوق | الذهب، الفضة، والبلاتين |

| منصة التداول | MetalDesk |

| دعم العملاء | هاتف: +61 7 3211 5007 (أستراليا) |

| هاتف: +66 (0)2 231 8171 (تايلاند) | |

| هاتف: +852 3956 7193 (هونغ كونغ) | |

| هاتف: +357 25262656 (قبرص) | |

| فاكس: +61 7 3236 1106 (أستراليا) | |

| فاكس: +852 3956 7100 (هونغ كونغ) | |

| فاكس: +357 25560815 (قبرص) | |

| البريد الإلكتروني: info@abx.com | |

| LinkedIn، Facebook، Twitter | |

ABX معلومات

Allocated Bullion Exchange (ABX) هو بورصة إلكترونية عالمية للمعادن الثمينة الفعلية. من خلال منصتها الخاصة MetalDesk، تربط ABX سبعة مراكز تداول عالمية رئيسية لتوفير خدمات تداول المعادن الثمينة الفعلية المخصصة مثل الذهب والفضة والبلاتين. تقدم المنصة حلول تداول فعالة للمشاركين عبر سلسلة الصناعة بأكملها، من منقبين إلى مستثمرين.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تداول عالمي متنوع في الذهب والفضة والبلاتين | غير منظم فقط المعادن الثمينة |

| حواجز دخول عالية لبعض المنتجات (على سبيل المثال، الفضة بحد أدنى لوحدة تداول تبلغ 25،000 أوقية) |

هل ABX شرعي؟

تنظم ASIC ABX، ولكن في الواقع، ليست كذلك. يُنصح بأن يتحقق التجار من صحة هذه الادعاءات مع سلطة التنظيم ASIC.

ما الذي يمكنني تداوله على ABX؟

على منصة ABX، يمكن للمستثمرين تداول مجموعة متنوعة من منتجات المعادن الثمينة الفعلية، بما في ذلك الذهب والفضة والبلاتين.