회사 소개

| ABX리뷰 요약 | |

| 등록 날짜 | 1999-02-26 |

| 등록 국가/지역 | 호주 |

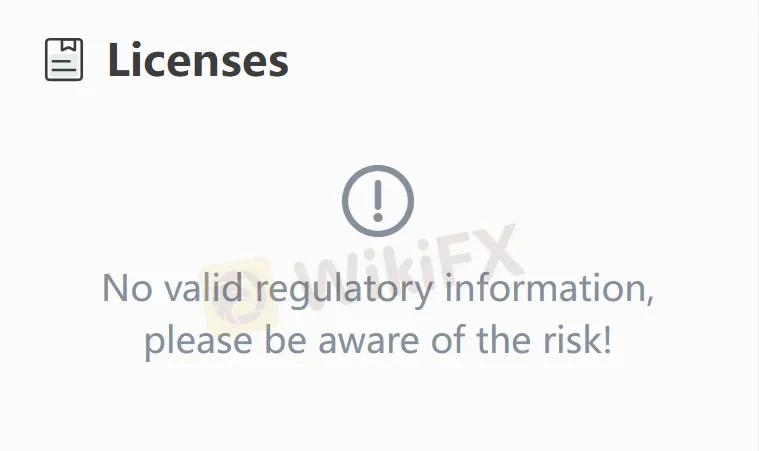

| 규제 | 규제되지 않음 |

| 시장 상품 | 금, 은, 및 백금 |

| 거래 플랫폼 | MetalDesk |

| 고객 지원 | 전화: +61 7 3211 5007 (호주) |

| 전화: +66 (0)2 231 8171 (태국) | |

| 전화: +852 3956 7193 (홍콩) | |

| 전화: +357 25262656 (키프로스) | |

| 팩스: +61 7 3236 1106 (호주) | |

| 팩스: +852 3956 7100 (홍콩) | |

| 팩스: +357 25560815 (키프로스) | |

| 이메일: info@abx.com | |

| LinkedIn, Facebook, Twitter | |

ABX 정보

Allocated Bullion Exchange (ABX)은 물리적인 귀금속을 위한 글로벌 전자 거래소입니다. 자체 개발한 MetalDesk 플랫폼을 통해 ABX은 금, 은, 및 백금과 같은 할당된 물리적 귀금속 거래 서비스를 제공하기 위해 전 세계 7대 주요 거래 허브를 연결합니다. 이 플랫폼은 광부부터 투자자까지 산업 전체 사슬에 걸친 참여자들을 위한 효율적인 거래 솔루션을 제공합니다.

장단점

| 장점 | 단점 |

| 글로벌 거래다양한 금, 은, 및 백금 | 규제되지 않음귀금속만 |

| 일부 제품에 대한 높은 진입 장벽 (예: 최소 거래 단위가 25,000 온스인 은) |

ABX이 신뢰할 만한가요?

ASIC는 ABX을 규제하지만 실제로는 그렇지 않습니다. 거래자들은 ASIC 규제 기관을 통해 이 주장의 진위를 확인하는 것이 좋습니다.

ABX에서 무엇을 거래할 수 있나요?

ABX 플랫폼에서 투자자들은 금, 은, 및 백금을 포함한 다양한 물리적 귀금속 제품을 거래할 수 있습니다.