Resumo da empresa

| ABXResumo da Revisão | |

| Registrado Em | 1999-02-26 |

| País/Região Registrada | Austrália |

| Regulação | Não Regulamentado |

| Instrumentos de Mercado | Ouro, Prata e Platina |

| Plataforma de Negociação | MetalDesk |

| Suporte ao Cliente | Telefone: +61 7 3211 5007 (Austrália) |

| Telefone: +66 (0)2 231 8171 (Tailândia) | |

| Telefone: +852 3956 7193 (Hong Kong) | |

| Telefone: +357 25262656 (Chipre) | |

| Fax: +61 7 3236 1106 (Austrália) | |

| Fax: +852 3956 7100 (Hong Kong) | |

| Fax: +357 25560815 (Chipre) | |

| Email: info@abx.com | |

| LinkedIn, Facebook, Twitter | |

ABX Informação

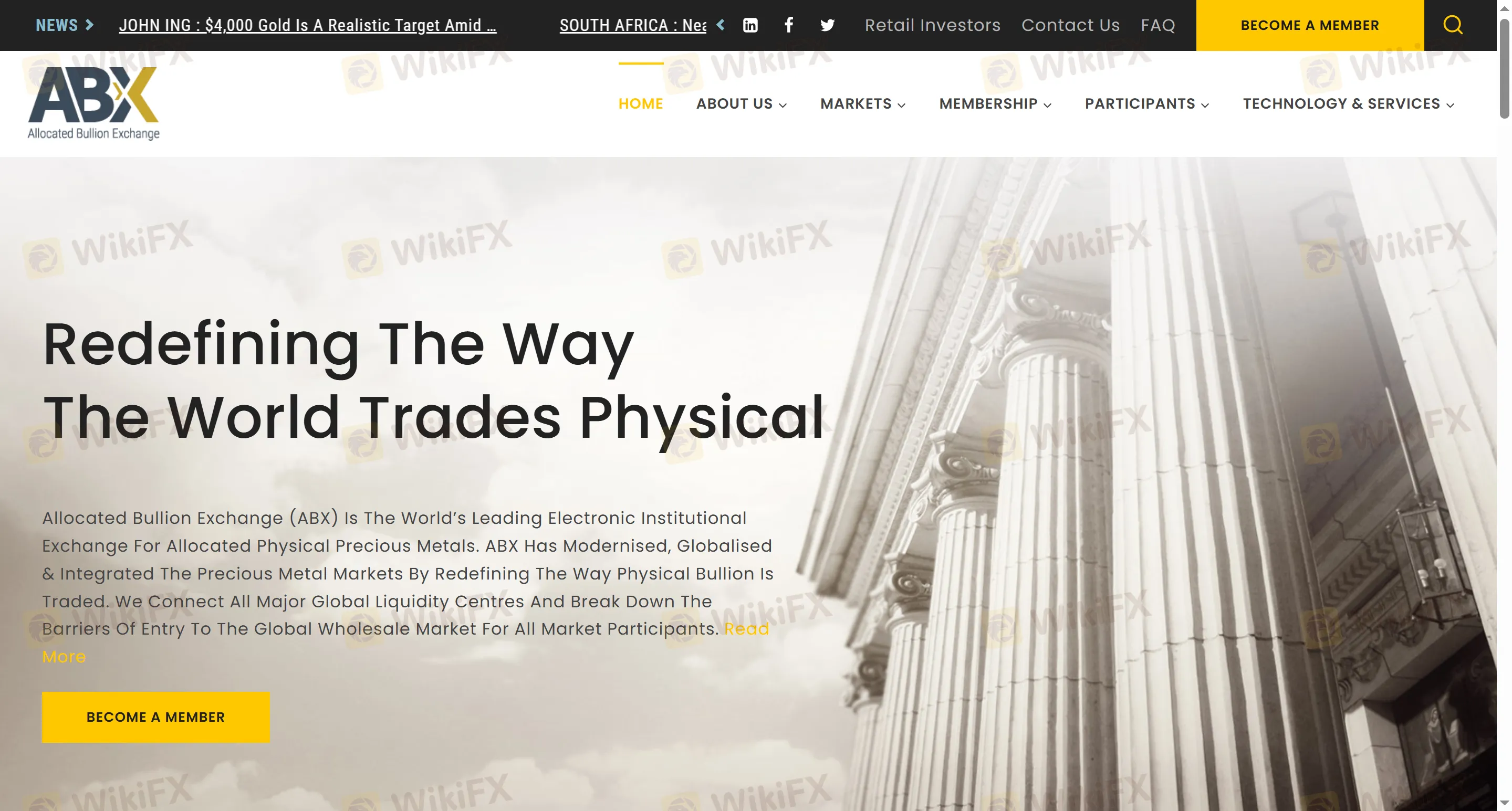

Allocated Bullion Exchange (ABX) é uma bolsa eletrônica global para metais preciosos físicos. Através de sua plataforma MetalDesk desenvolvida internamente, ABX conecta sete grandes centros de negociação globais para fornecer serviços de negociação de metais preciosos físicos alocados, como ouro, prata e platina. A plataforma oferece soluções de negociação eficientes para participantes em toda a cadeia da indústria, desde mineradores até investidores.

Prós e Contras

| Prós | Contras |

| Negociação GlobalOuro, prata e platina diversificados | Não RegulamentadoApenas metais preciosos |

| Altas barreiras de entrada para alguns produtos (por exemplo, prata com uma unidade mínima de negociação de 25.000 onças) |

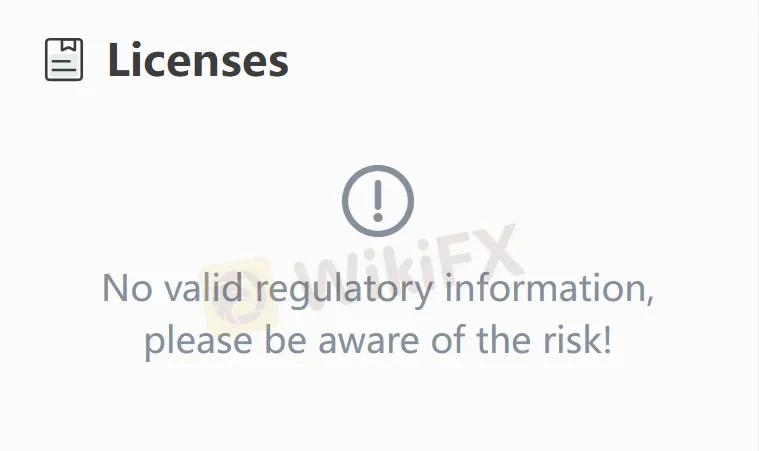

ABX é Legítimo?

A ASIC regula ABX, mas na realidade, não o faz. Os traders são aconselhados a verificar a autenticidade dessa afirmação com a autoridade reguladora ASIC.

O Que Posso Negociar na ABX?

Na plataforma ABX, os investidores podem negociar vários produtos físicos de metais preciosos, incluindo ouro, prata e platina.