公司簡介

| Gleneagle 檢討摘要 | |

| 成立年份 | 2010 |

| 註冊國家/地區 | 澳洲 |

| 監管 | ASIC |

| 服務 | 物業貸款、資本籌集、管理基金、策略、收入支付、股權增長 |

| 交易平台 | GleneagleWeb |

| 客戶支援 | 聯絡表格 |

| 電話:1300 123 345 | |

| 電郵:members@gleneagle.com.au | |

| 地址:Level 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Gleneagle 資訊

Gleneagle 是一家受監管的頂級券商和金融服務提供商,於2010年在澳洲成立。它提供物業貸款、資本籌集、管理基金、策略、收入支付和股權增長等服務。

優缺點

| 優點 | 缺點 |

| 長時間運作 | 收取佣金費用 |

| 多種聯絡途徑 | |

| 提供多種金融服務 |

Gleneagle 是否合法?

Yes. Gleneagle 持有 ASIC 頒發的牌照,提供服務。其牌照號碼為 000337985。澳大利亞證券及投資委員會(ASIC)是澳大利亞政府的獨立機構,擔任澳大利亞的企業監管機構,於1998年7月1日成立,是根據 Wallis Inquiry 的建議成立的。

| 受監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 澳大利亞證券及投資委員會(ASIC) | 受監管 | GLENEAGLE SECURITIES (AUST) PTY LIMITED | 市場製造商(MM) | 000337985 |

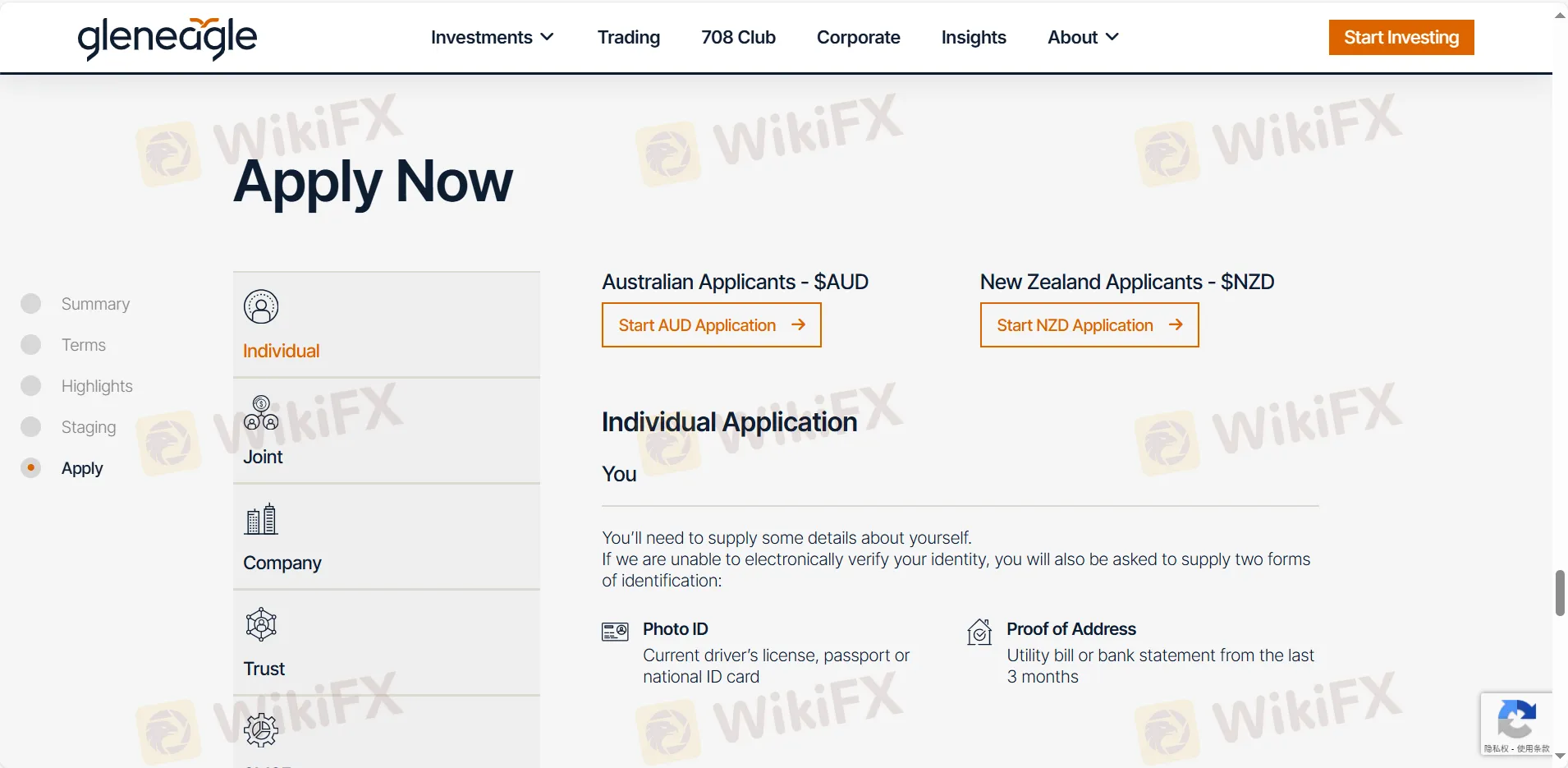

Gleneagle 服務

| 服務 | 支援 |

| 物業貸款 | ✔ |

| 資本籌集 | ✔ |

| 管理基金 | ✔ |

| 策略 | ✔ |

| 收入支付 | ✔ |

| 股本增長 | ✔ |

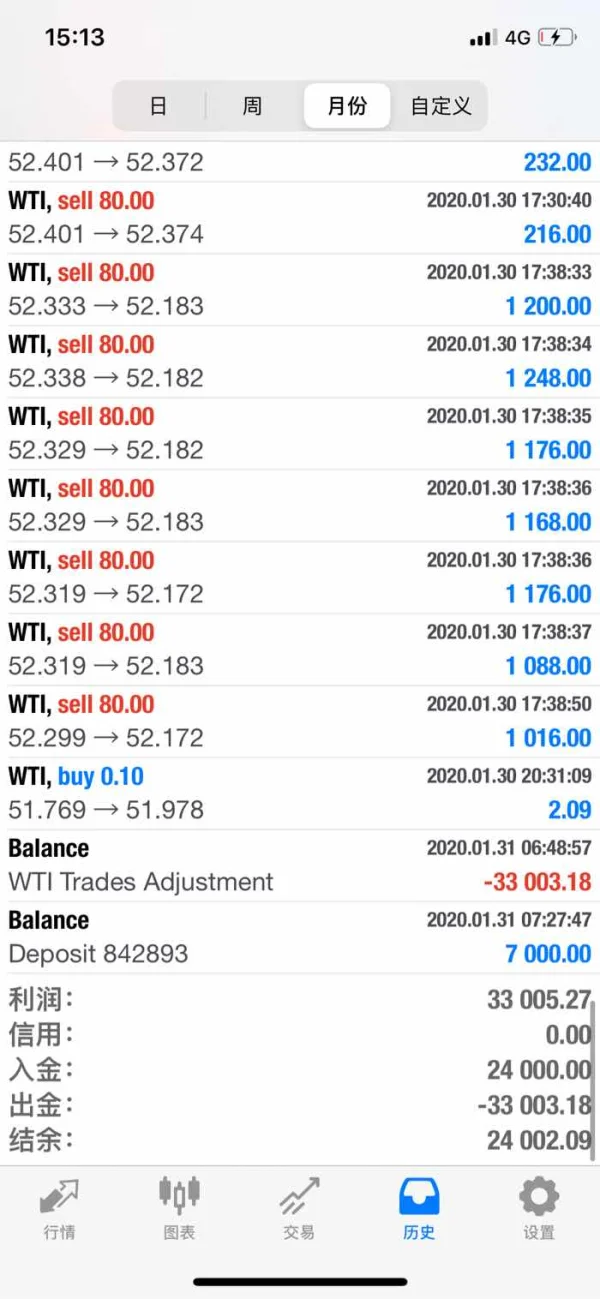

Gleneagle 費用

股票費用和費率

您通常將被收取的 ASX 交易股票交易費用為交易金額的1.1%(包括 GST),最低為 $82.50,但最高為 1.65% 和 $150(包括 GST)。

ASX 衍生品費用

您通常將被收取的交易所交易衍生品費用為保費金額的1.1%(包括 GST),最低為 $82.50,但最高為 1.65% 和 $150(包括 GST)。

OTC 交易費用

OTC 交易的費用、成本和收費在該產品的 PDS 中披露。

| 費用詳情 | 金額 |

| 銀行拒付費 | $82.50 |

| 手動預訂費 | $33.00 |

| 重新預訂費 | $33.00 |

| 客戶追踪費 | $30 |

| 即時毛額結算(國內) | $55 |

| 場外市場轉移 | $55 每股 |

| SRN 要求股份登記處 | $27.50 每持有 |

| 股票借貸費 | $110 |

| 郵寄交易確認 | $3.30 每次確認 |

交易平台

| 交易平台 | 支援 | 可用設備 |

| Gleneagle 網頁 | ✔ | PC、筆記本電腦、平板電腦 |