Profil perusahaan

| Dragon Capital Ringkasan Ulasan | |

| Dibentuk | 2006 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | CySEC |

| Produk & Layanan | Layanan investasi, perdagangan, saran investasi, penjaminan, penitipan, forex, derivatif |

| Akun Demo | ❌ |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: +357 25 376 300 |

| Fax: +357 25 376 301 | |

| Email: svitlana.rusakova@dragon-capital.com | |

Informasi Dragon Capital

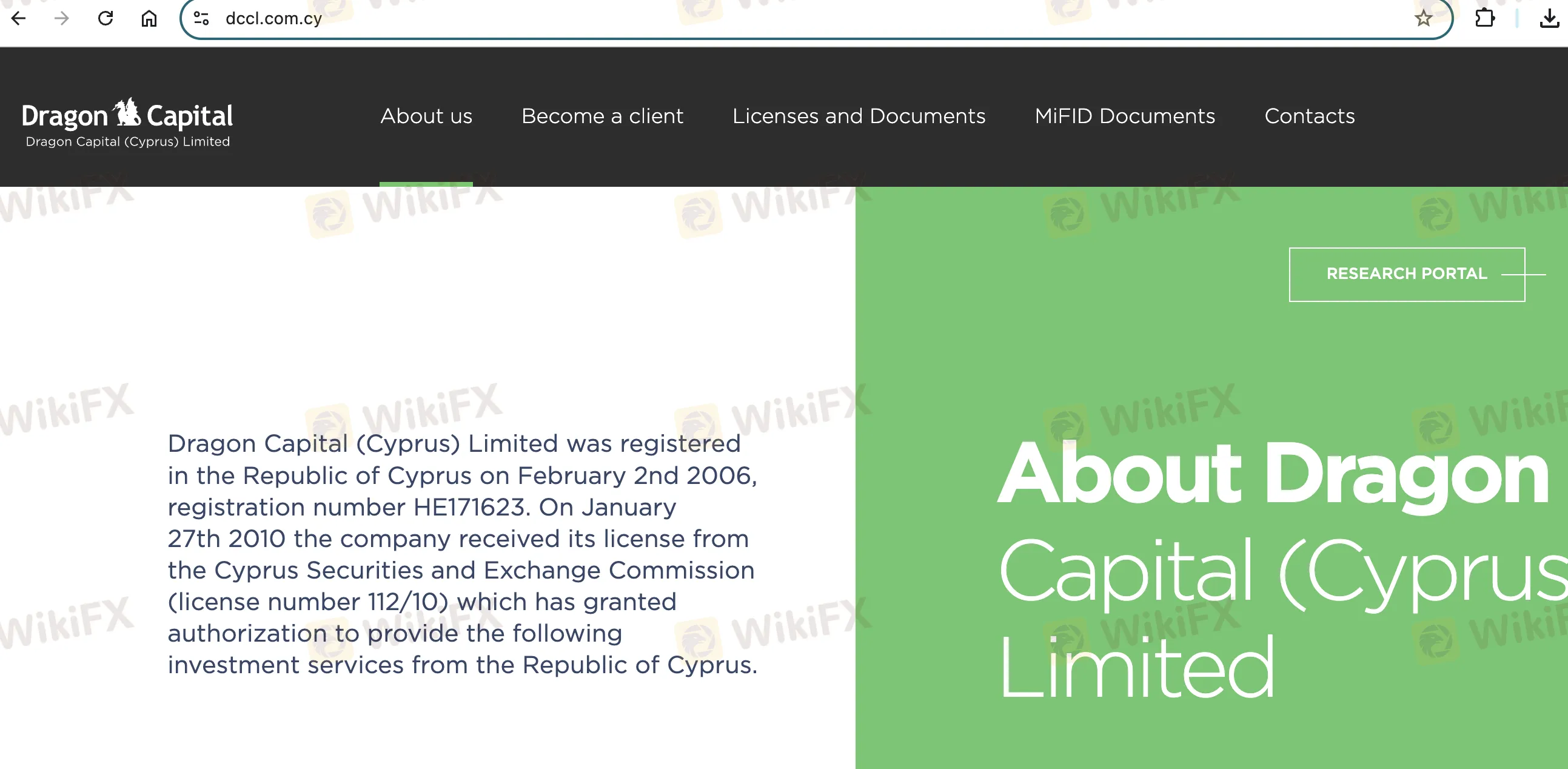

Dragon Capital (Cyprus) Ltd adalah perusahaan investasi berlisensi di Siprus yang didirikan pada tahun 2006 dan diatur oleh CySEC dengan nomor lisensi 112/10. Perusahaan ini menyediakan berbagai layanan investasi, termasuk eksekusi pesanan, perdagangan atas akun sendiri, penitipan, dan saran investasi, untuk berbagai instrumen keuangan.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh CySEC | Beberapa biaya (seperti layanan obligasi Ukraina) lebih tinggi daripada pesaing internasional |

| Menawarkan berbagai instrumen dan layanan keuangan | Tidak ada akun demo |

| Solusi investasi dan penitipan yang komprehensif | Tidak ada detail platform |

Apakah Dragon Capital Legal?

Dragon Capital (Cyprus) Ltd adalah entitas yang berlisensi dan diatur oleh Cyprus Securities and Exchange Commission (CySEC) dengan nomor lisensi 112/10, beroperasi sebagai Market Maker (MM).

Produk dan Layanan

Dragon Capital (Cyprus) Ltd menawarkan berbagai layanan investasi dan terkait, seperti mengeksekusi pesanan, perdagangan atas akun sendiri, memberikan saran investasi, penjaminan, dan layanan penitipan. Layanan-layanan ini mencakup berbagai instrumen keuangan, termasuk saham, derivatif, dan instrumen pasar uang.

| Produk & Layanan | Didukung |

| Efek (saham, obligasi) | ✔ |

| Derivatif & CFD | ✔ |

| Saran Investasi | ✔ |

| Penjaminan & Penempatan | ✔ |

| Layanan Penitipan | ✔ |

| Layanan Margin & Kredit | ✔ |

| Forex (terkait investasi) | ✔ |

| Penelitian Investasi | ✔ |

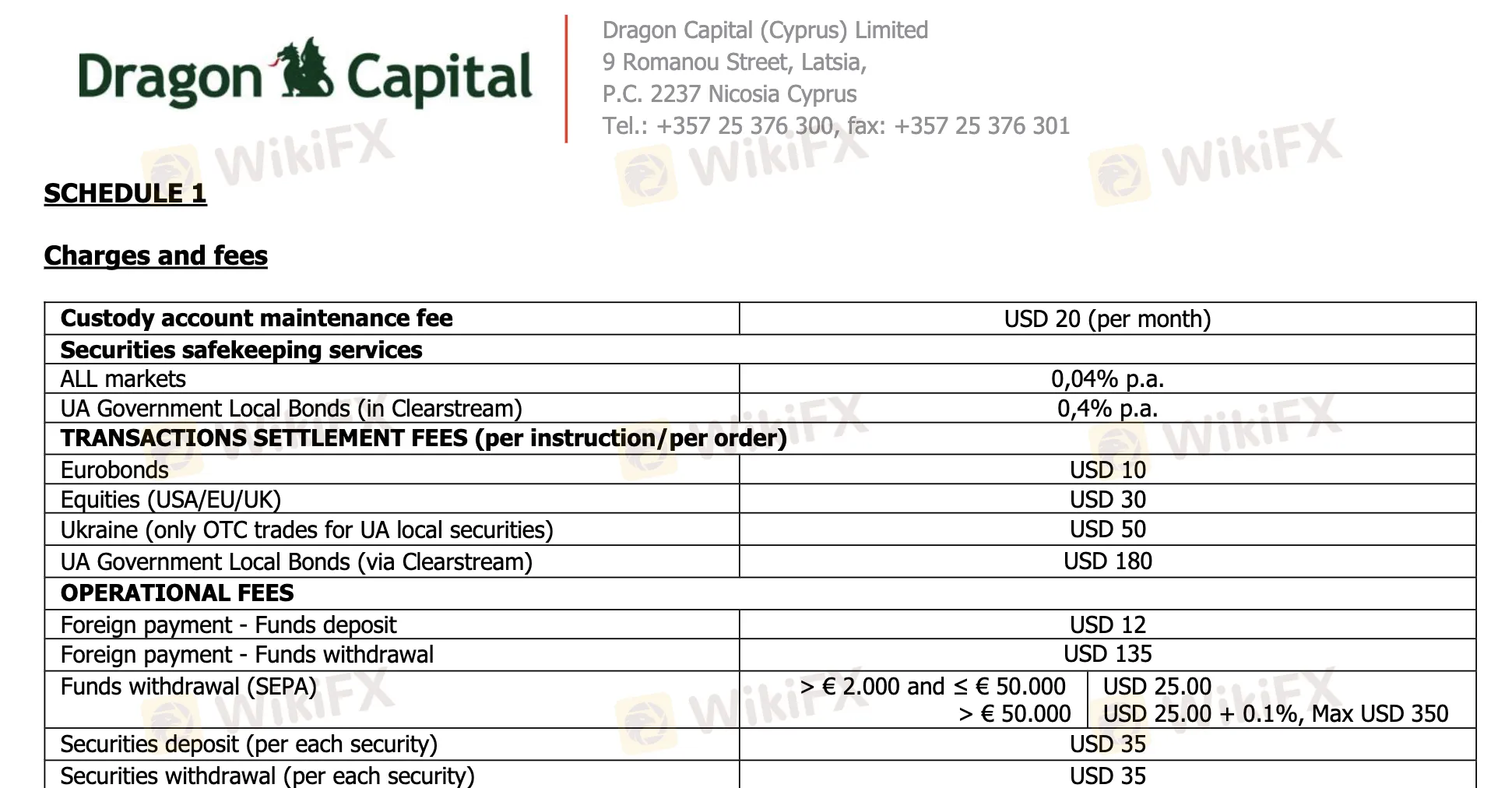

Biaya Dragon Capital

Biaya Dragon Capital sebagian besar sejalan dengan biaya perusahaan investasi internasional lainnya. Namun, ada biaya tambahan untuk beberapa layanan khusus, seperti obligasi lokal Ukraina, tindakan korporat, dan penarikan asing.

| Jenis Biaya | Jumlah |

| Pemeliharaan Akun Penitipan | USD 20 per bulan |

| Penyimpanan Efek (semua pasar) | 0.04% per tahun |

| Obligasi Lokal Pemerintah Ukraina (Clearstream) | 0.4% per tahun |

| Pelunasan Eurobond | USD 10 per pesanan |

| Pelunasan Saham (USA/UE/UK) | USD 30 per pesanan |

| Pelunasan Efek Lokal Ukraina (OTC) | USD 50 per pesanan |

| Pelunasan Obligasi Pemerintah Ukraina (Clearstream) | USD 180 per pesanan |

Biaya Non-Trading

| Biaya Non-Trading | Jumlah |

| Pembayaran Asing (Deposit) | USD 12 |

| Pembayaran Asing (Penarikan) | USD 135 |

| Penarikan SEPA > €2.000–50.000 | USD 25 |

| Penarikan SEPA > €50.000 | USD 25 + 0.1% (maks USD 350) |

| Penyetoran / Penarikan Efek | USD 35 per efek |

| Pengumpulan Pendapatan Dividen (hanya UA) | 0.2% (min USD 15, maks USD 300) |

| Kredit Pendapatan Dividen (hanya UA) | USD 20 |

| Pemungutan Suara Proksi Penuh | USD 100–200 + biaya eksternal |

| Pembelian Kembali (lokal UA) | USD 100 + biaya eksternal |

| Operasi FX Bank UE | 0.1% (min USD 20) |

| Operasi FX Bank UA | 0.2% (min USD 40) |

| Konversi DR, Permintaan Audit, dll. | USD 20–100 + biaya pihak ketiga |